如果你也在 怎样代写金融工程Financial Engineering CMSE11471这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。金融工程Financial Engineering是一个涉及金融理论、工程方法、数学工具和编程实践的多学科领域。它也被定义为技术方法的应用,特别是数学金融和计算金融在金融实践中的应用。

金融工程Financial Engineering借鉴了应用数学、计算机科学、统计学和经济理论的工具。在最广泛的意义上,任何在金融领域使用技术工具的人都可以被称为金融工程师,例如银行的任何计算机程序员或政府经济局的任何统计员。然而,大多数从业者将这一术语限制为接受过现代金融的全部工具的教育,其工作以金融理论为依据。

金融工程Financial Engineering代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。 最高质量的金融数学Financial Mathematics作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此金融数学Financial Mathematics作业代写的价格不固定。通常在专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

我们在金融 Finaunce代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的金融 Finaunce代写服务。我们的专家在金融工程Financial Engineering代写方面经验极为丰富,各种金融工程Financial Engineering相关的作业也就用不着 说。

金融代写|金融工程代考Financial Engineering代写|INTEREST RATE PARITY

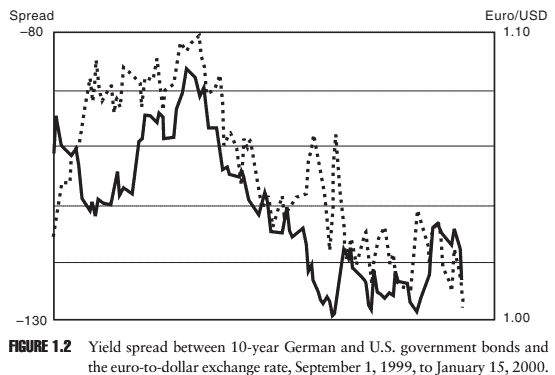

Assume that the annual rate of interest in country $\mathrm{X}$ is 5 percent and that the annual rate of interest in country $\mathrm{Y}$ is 10 percent. Clearly, all else being equal, investors in country $\mathrm{X}$ would rather have money in country $\mathrm{Y}$ since they are able to earn more basis points, or bps ( $1 \%$ is equal to $100 \mathrm{bps})$, in country Y relative to what they are able to earn at home. Specifically, the interest rate differential (the difference between two yields, expressed in basis points) is such that investors are picking up an additional 500 basis points of yield. However, by investing money outside of their home country, investors are taking on exchange rate risk. To earn the rate of interest being offered in country Y, investors first have to convert their country X currency into country Y currency. At the end of the investment horizon (e.g., one year), international investors may well have earned more money via a rate of interest higher than what was available at home, but those gains might be greatly affected (perhaps even entirely eliminated) by swings in the value of respective currencies. The value of currency $\mathrm{Y}$ could fall by a large amount rela- tive to currency $\mathrm{X}$ over one year, and this means that less of currency $\mathrm{X}$ is recovered.

Indeed, the theory of interest rate parity essentially argues that on a fully hedged basis, any differential that exists between the interest rates of two countries will be eliminated by the differential in exchange rates between those two countries. Continuing with the preceding example, if a forward contract is purchased to exchange currency $\mathrm{Y}$ for currency $\mathrm{X}$ at the end of the investment horizon, the pricing embedded in the forward arrangement will be such that the currency loss on the trade will exactly offset the gain generated by the interest rate differential. That is, currency $\mathrm{Y}$ will be priced so as to depreciate relative to currency $\mathrm{X}$, and by an equivalent magnitude of 500 bps. In short, whatever interest rate advantage investors might enjoy initially will be eliminated by currency depreciation when a strategy is executed on a hedged basis.

金融代写|金融工程代考Financial Engineering代写|PURCHASING POWER PARITY

Another popular theory to explain exchange rate valuation goes by the name of purchasing power parity (PPP).

The idea behind PPP is that, over time (and the question of what period of time is indeed a relevant and oft-debated question), the purchasing ability of one currency ought to adjust itself to be more in line with the purchasing power of another currency. Broadly speaking, in a world where exchange rates are left free to adjust to market imbalances and disequilibria in a price context, exchange rates can serve as powerful equalizers. For example, if the currency of country $\mathrm{X}$ was quite strong relative to country $\mathrm{Y}$, then this would suggest that on a relative basis, the prices within country $\mathrm{Y}$ are perceived to be lower to consumers in country X. Accordingly, as the theory goes, since consumers in country $X$ buy more of the goods in country $Y$ (because they are cheaper) and eventually bid those prices higher (due to greater demand), an equalization eventually will materialize whereby relative prices of goods in countries $\mathrm{X}$ and $\mathrm{Y}$ become more aligned on an exchange rate-adjusted basis.

Although certainly to be taken with a grain of salt, Economist magazine occasionally updates a survey whereby it considers the price of a McDonald’s Big Mac on a global basis. Specifically, a Big Mac price in local currency (as in yen for Japan) is divided by the price for a Big Mac in the United States (upon conversion of yen into dollars). This result is termed “purchasing power parity,” and when compared to respective actual dollar exchange rates, an over- or undervaluation of a currency versus the dollar is obtained. The presumption is that a Big Mac is a relatively homogeneous product type and accordingly represents a meaningful point of reference. A rather essential (and perhaps heroic) assumption to this (or any other comparable PPP exercise) is that all of the ingredients that go into making a Big Mac are accessible in each of the countries where the currencies are being compared. Note that “equal” in this scenario does not necessarily have to mean that access to goods (inputs) is 100 percent free of tariffs or any type of trade barrier. If trade were indeed completely unfettered then this would certainly satisfy the notion of equally accessible. But if all goods were also subject to the same barriers to access, this would be equal too, at least in the sense that equal in this instance means equal barriers. Yet the vast number of trade agreements that exist globally highlights just how bureaucratic the ideal of free trade can become even if perceptions (and realities) are such that trade today is generally at the most free it has ever been. Another important and obvious consideration is that certain inputs might enjoy advantages of proximity. Beef may be more plentiful in the United States relative to Japan, for example.

金融工程代写

金融代写|金融工程代考FINANCIAL ENGINEERING代 写|INTEREST RATE PARITY

假设国家的年利率 $X$ 是 $5 \%$ 并且国家的年利率 $Y$ 是百分之十。显然,在其他条件相同的情况下,国家的投资者 $X$ 宁愿在国内有钱 $Y$ 因为他们能够赚 取更多基点或 bps $\$ 1 \% \$$ isequalto $\$ 100 \mathrm{bps}$

, incountryY relativetowhattheyareabletoearnathome. Speci fically, theinterestratedif ferential (thedif ferencebetweentwoyields,

复。

事实上,利率平价理论本质上认为,在完全对冲的基础上,两国利率之间存在的任何差异都将被两国之间的汇率差异所诮除。继续前面的例子,

如果购买远期合约来兄换货币

贬值而消失

金融代写|金融工程代考FINANCIAL ENGINEERING代 写|PURCHASING POWER PARITY

另一种解释汇率估值的流行理论称为购买力平价 $P P P$.

PPP 背后的想法是,随着时间的推移andthequestionofwhatperiodoftimeisindeedarelevantandoft-debatedquestion,一种货市的购买 力应该自我调整以更符合另一种货币的购买力。从广义上讲,在一个汇率可以自由调整以适应价格环境中的市场失衡和不均衡的世界中,汇率可 以充当强大的均衡器。例如,如果国家/地区的货币 $X$ 相对于国家来说相当强大Y,那么这将表明,在相对基础上,国内价格Y被 X国的消费者认为 较低。因此,正如理论所言,由于国家的消费者 $X$ 在国内购买更多商品 $Y$ becausetheyarecheaper 并最终出价更高duetogreaterdemand, 最终 将实现均衡,从而使各国商品的相对价格X和Y在汇率调整的基础上变得更加一致。

《经济学人》杂志偶尔会更新一项调查,其中考虑了麦当劳巨无霸在全球范围内的价格,尽管肯定会有所保留。具体来说,以当地货币计算的巨 无霸价格asinyen for Japan除以美国巨无霸的价格uponconversionofyenintodollars. 这一结果被称为“购买力平价”,当与各自的实际美元汇 率进行比较时,就会得出一种货币对美元的高估或低估。假设巨无霸是一种相对同质的产品类型,因此代表了一个有意义的参考点。一个相当重 要的andperhapsheroic对此的假设oranyothercomparablePPPexercise 是制作巨无霸的所有成分在每个进行货币比较的国家/地区都可以使 用。请注意,这种情况下的“平等”并不一定意味着获得商品inputs $100 \%$ 免关税或任何类型的贸易壁垒。如果贸易确实完全不受约束,那么这肯定 会满足平等可及性的概念。但是,如果所有商品也受到相同的准入壁垒,那么这也将是平等的,至少在这种情况下平等意味着平等壁垒。然而, 全球存在的大量贸易协定凸显了自由贸易的理想会变得多么官僚主义,即使人们的看法andrealities 是这样的,今天的贸易通常是有史以来最自 由的。另一个重要且明显的考虑因素是某些输入可能享有邻近优势。例如,美国的牛肉可能比日本更丰富。

金融代写|金融工程代写Financial Engineering代写 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。