如果你也在 怎样代写财报分析Financial Statement Analysis GSBS6506这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。财报分析Financial Statement Analysis常见的财务报表分析方法包括基本分析、杜邦分析、横向和纵向分析以及财务比率的使用。历史信息与一系列的假设和对财务信息的调整相结合,可用于预测未来的业绩。专业金融分析师可以获得特许金融分析师的称号。

财报分析Financial Statement Analysis FIL246是审查和分析公司财务报表的过程,以做出更好的经济决策,在未来获得收入。这些报表包括利润表、资产负债表、现金流量表、账目说明和权益变动表(如果适用)。财务报表分析是一种方法或过程,涉及评估一个组织的风险、业绩、财务健康和未来前景的特定技术。它被各种利益相关者所使用,如信贷和股权投资者、政府、公众和组织内部的决策者。这些利益相关者有不同的利益,并运用各种不同的技术来满足他们的需求。例如,股权投资者对组织的长期收益能力感兴趣,也许对股息支付的可持续性和增长感兴趣。债权人希望确保组织的债务证券(如债券)的利息和本金在到期时得到支付。

财报分析Financial Statement Analysis代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。最高质量的财报分析Financial Statement Analysis作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此财报分析Financial Statement Analysis作业代写的价格不固定。通常在各个科目专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

我们在会计Accounting代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的会计Accounting代写服务。我们的专家在财报分析Financial Statement Analysis代写方面经验极为丰富,各种财报分析Financial Statement Analysis相关的作业也就用不着 说。

会计代写|财报分析代写Financial Statement Analysis代考|METHOD OF ACCOUNTING

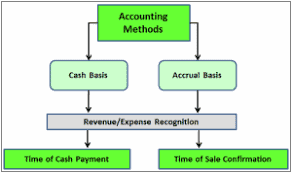

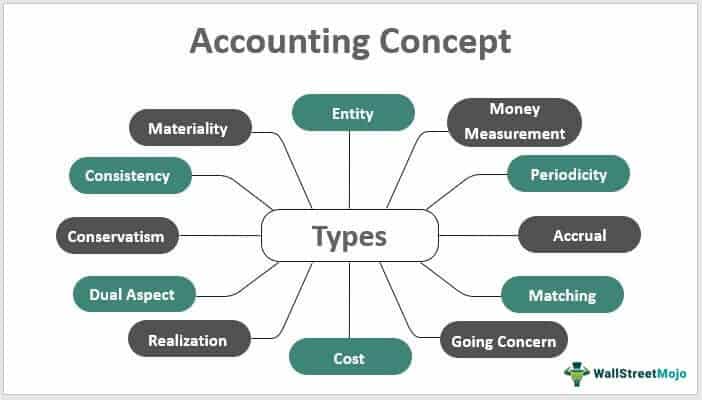

There are three cardinal assumptions under financial accounting : going concern, consistency and accrual. There are, however, three systems of accounting : (a) cash (b) accrual, and (c) hybrid. Under the cash system of accounting all expenses paid in cash and all incomes received in cash during the financial period, are recognised in the accounts. As a result, any expense not paid on income non received is left out of the accounting record. This state of affairs impede the process of measurement of business income and attribution of income to the period to which it belongs.

As contrary to this there has been another system of accounting known as the accrual or mercantile system. Under this, all expenses pertaining to the current period whether paid or not-that is accrued are recognised in accounts for that period. Similar, is the case with regard to income pertaining to the current period, no matter whether received or accrued, is recognised in accounts for the purposes of computation and measurement of business income. The system has been accorded legal recognition in India in the recent past. The Companies Amendment Act, 1988, vide an amendment to Section 209, with effect from 15 th June 1988, made it obligatory for all companies to maintain their accounts on accrued basis and according to the double entry accounting system. In Accounting Standard No. 1 (AS 1) issued by the Institute of Chartered Accountants of India (ICA), it has been stipulated that if the Generally Accepted Accounting. Principles (GAAP) and underlying assumption, such as going concern, eonsistency and accrual are not followed, the fact should be disclosed in the corporate financial statement. The term ‘accrual’ has been explained by the Accounting Standard No. 1.on Disclosure of Accounting Policies as :

“Revenues and costs and accrued, that is, recognised as they are earned or incurred (and not as money is received or paid) and recorded in the financial statements of the periods to which they relate”. The Guidance Note issued by the Accounting Standards Board of the ICAI explains accrual basis of accounting as “The method of recording transactions by which revenues, costs, assets and liabilities are reflected in the accounts in the period in which they accrue. The accrual basis of accounting includes considerations relating to deferrals, allocations, depreciation and amortisation. This basis is also called called mercantile basis of accounting”‘. Accrual basis of accounting thus recognises the financial effects of the transactions, events and circumstances of an entity in the period in which they occur, rather than recording them in the period in which cash is received or paid. The accomplishments measured in terms of revenue and the efforts expressed in the form of cost may not be in consonance with cash receipts and cash payments for the same. This is rational for measurement of performance and corporate income during a period instead of merely recording cash receipts and payments. The major difference between the cash system and the accural system of accounting lies in the timing of recognition of revenues, expenses, gains and losses. The essential features of accrual basis of accounting are :

(a) revenue is recognised as it is earned,

(b) costs are matched either against revenues, so recognised or against the relevant time period to determine periodic income, and

(c) costs which are not charged to income are carried forward are kept under continuous review. AS 9 issued by ICAI explains that recognition of revenue requires that revenue against sale, or service or use of resources is measu:able and are expected of collection.

会计代写|财报分析代写Financial Statement Analysis代考|Recognition of Assets and Liabilities

The way expenses and revenues are recognised under the accrual system in the same manner, the transactions pertaining to assets and liabilities are recognised as they occur irrespective of the actual receipt of payment. The accrual concept has to be supplemented by the concept of materiality. Section 209 (3) of the Companies Act, 1956, requires that every company has to keep the books of account in such a manner that they give a true and fair view of its state of affairs and that the books are maintained on the accrual basis of accounting. The Accounting Standard (AS 1) ‘Disclosure the Accounting Policies’ stipulates that financial statements should disclose all material items, i.e., items the knowledge of which might influence the decisions of the user of financial statement.

Accrual basis of accounting imbibes a problem as regards reporting of accrual of expense and liability. For instance, Coal India, Indian Airlines are sure of the occurrence of certain events but they are not sure of the liability that may accrue to the company. The accrual basis of reporting is based on matching, materialty and realisability concepts. Accrual of expense and eventual liability has to be quantified and reported even if no payment is made or expected to be made during the period. In the recent period a shift has taken place from accrual basis to cash flow implication of the transactions. Cash flow generated out of business transactions is a more pragmatic indicator of real change in value over the accounting period. This is why accrual cash flow accounting has been envisaged for peripheral users of financial information. This would provide workable evaluation of real purchasing power of the assets of the entity. Full-fledged cash flow accounting has been emphasised over the recent years and not a cash flow statement alone. Reporting of income and expense under accrual basis should stand the test of verifiability, objectivity and comparability. The International Accounting Standard (IAS) No. 18 stipulates that revenue should be recognised in accounts when there is no uncertainty about measurability and collectability. It implies that when revenue is not determinable within reasonable limits, the recognition of revenue should be postponed. In addition to disclosure requirement of IAS 1 and 5 , the circumstances in which revenue has been postponed should be disclosed and reported in the financial.statement.

The problem that emerges is with the recognition, allocation of receipts and expenditures to a particular period as revenue and expense. When goods are sold, when is the revenue earned? When the order is placed by the customer, or when goods are shipped, or when the invoice is mailed or when the customer’s cheque is received ? Under accrual system of accounting the firms recognise the sale as a transaction and record the revenue as having been earned in accounts during the period when goods are shipped. Likewise, in respect of purchase, when is expense recognised? When the goods are ordered, or received, or consumed or paid for ? It would depend upon how the aceounts are maintained, whether under accrual or cash basis.

财务分析代写

会计代写|财报分析代写FINANCIAL STATEMENT ANALYSIS代考|METHOD OF ACCOUNTING

财务会计的三个基本假设是:持续经营、一致性和权责发生制。但是,存在三种会计系统: $a$ 现金 $b$ 权责发生制,以及 $c$ 杂交种。在现金会计制度 下,财务期间以现金支付的所有费用和以现金收到的所有收入均在账目中确认。结果,末收到的收入末支付的任何费用都被排除在会计记录之 外。这种事态阻碍了业务收入的计量和收入归属到其所属时期的过程。

与此相反,还有另一种会计系统,称为权责发生制或商业系统。在这种情况下,与当期有关的所有费用,无论是否已支付,都应计入该期间的账 户。与当期有关的收入也是如此,无论是收到的还是应计的,都在计算和计量业务收入的账户中确认。该系统最近在印度获得了法律认可。1988 年《公司修正法》对第 209 条进行了修正,自 1988 年 6 月 15 日起生效,规定所有公司有义务根据应计制和复式记账系统维护其账目。在会计准则 第 1 号 $A S 1$ 由印度特许会计师协会颁发 $I C A$,已经规定如果公认会计。原则 $G A A P$ 末遵循持续经营、持续性、权责发生制等基本假设的,应当在 公司财务报表中予以披露。会计准则第 1 号关于会计政策披露对“应计”一词的解释如下:

“收入和成本并应计,即在赚取或发生时确认andnotasmoneyisreceivedorpaid并记录在相关期间的财务报表中”。ICAI 会计准则委员会发布的 指导说明将权责发生制解释为“收入、成本、资产和负债反映在应计期间的账户中的交易记录方法。会计的权责发生制包括与递延、分配、折旧和 婎销相关的考虑因素。这种基础也称为“商业会计基础”。因此,权责发生制会计在一个实体的交易、事件和情况发生的期间确认其财务影响,而 不是在收到或支付现金的期间记录它们。以收入衡量的成就和以成本形式表达的努力可能与现金收入和现金支付不一致。这对于衡量一段时间内 的绩效和企业收入是合理的,而不仅仅是记录现金收支。收付实现制与权责发生制的主要区别在于收入、费用、损益的确认时间。权责发生制会 计的基本特征是: 收付实现制与权责发生制的主要区别在于收入、费用、损益的确认时间。权责发生制会计的基本特征是:收付实现制与权责发 生制的主要区别在于收入、费用、损益的确认时间。权责发生制会计的基本特征是: a收入在获得时确认,

$b$ 成本与如此确认的收入相匹配,或与相关时间段相匹配以确定定期收入,并且

$c$ 末记入收入的成本结转,并不断审查。ICAI 发布的AS 9 解释说,收入的确认要求销售收入、服务收入或资源使用收入是可衡量的,并且预计会收取。

会计代写|财报分析代写FINANCIAL STATEMENT ANALYSIS代考|RECOGNITION OF ASSETS AND LIABILITIES

费用和收入在权责发生制下的确认方式相同,与资产和负债相关的交易在发生时确认,与实际收到付款无关。权责发生制的概念必须由重要性的 概念来补充。第209节 31956 年 《公司法》要求每家公司都必须以真实和公正地反映其事务状况的方式保存账䈻,并且账䈻在会计权责发生制基础 上进行维护。会计准则 $A S 1$ 《会计政策披露》规定财务报表应当披露所有重大项目,即知怱可能影响财务报表使用者决策的项目。

会计权责发生制吸收了关于费用和负债应计费用报告的问题。例如,印度煤炭公司、印度航空公司确定某些事件的发生,但不确定公司可能承担 的责任。报告的权责发生制基于匹配、重要性和可实现性概念。应计费用和最终负债必须量化和报告,即使在此期间没有付款或预计不会付款。 在最近一段时间内,交易的影响从权责发生制转变为现金流量影响。业务交易产生的现金流量是会计期间价值实际变化的更实用的指标。这就是 为什么权责发生制现金流量会计已被设想用于财务信息的外围用户。这将为实体资产的实际购买力提供可行的评估。近年来一直强调全面的现金 流量会计,而不仅仅是现金流量表。权责发生制下的收入和费用报告应经得起可验证性、客观性和可比性的检验。国际会计准则 $I A S 18$ 号文规定 收入在可计量性和可收回性不存在不确定性的情况下入账确认。这意味着当收入在合理范围内不能确定时,应当推迟确认收入。除 IAS 1 和 5 的披 露要求外,收入被推迟的情况应在财务报表中披露和报告。

出现的问题是将收入和支出确认、分配到特定时期作为收入和支出。商品卖出去,收入什么时候赚到? 客户什么时候下订单,什么时候发货,什 么时候邮奇发票,什么时候收到客户的支票? 在权责发生制会计制度下,公司将销售确认为一项交易,并将收入记录为货物装运期间在账户中赚 取的收入。同样,就采购而言,何时确认费用? 何时订购、接收、消费或付款? 这将取决于帐户的维护方式,是权责发生制还是收付实现制。

会计代写|财报分析代写Financial Statement Analysis代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。