MY-ASSIGNMENTEXPERT™可以为您提供web.mst.edu Math 5737 Financial Mathematics金融数学课程的代写代考和辅导服务!

Math 5737课程简介

Lecture: Monday, Wednesday, and Friday online synchronous (zoom) or Fulton 220 from 1 to 1:50 in the afternoon. The web site for this class is

$$

\text { http://web.mst. edu/ } \text { bohner/math } 5737-22 / \text { math5737.html. }

$$

Office Hours: Monday, Wednesday, and Friday from 3 to $3: 50$ in the afternoon (zoom), if requested by e-mail. Also by appointment.

Prerequisites

Text: “Options, Futures, and other Derivatives” by John C. Hull, 11th edition (students are not required to buy this book, power point presentation is available).

Description: Risk-free assets, interest rates, risky assets, discrete time market models, portfolio management, forward and futures contracts, interest rate futures, swaps, options, options pricing, binomial trees, Cox-Ross-Rubinstein analysis, Black-Scholes-Merton model, Wiener processes, Itô’s lemma, financial engineering, options on stock indices, options on currencies, options on futures, the Greek letters, volatility smiles, basic numerical procedures, exotic options.

Math 5737 Financial Mathematics HELP(EXAM HELP, ONLINE TUTOR)

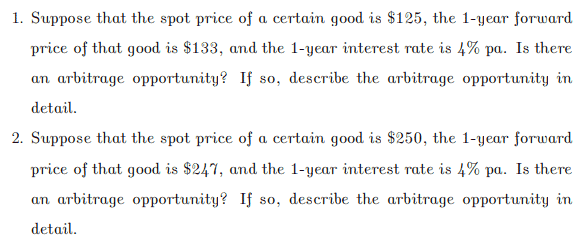

Suppose that the spot price of a certain good is $\$ 125$, the 1-year forward price of that good is $\$ 133$, and the 1-year interest rate is $4 \%$ pa. Is there an arbitrage opportunity? If so, describe the arbitrage opportunity in detail.

To determine if there is an arbitrage opportunity, we need to compare the cost of buying the asset now with the cost of buying it in the future. If the cost is higher now than it is in the future, then there is a potential arbitrage opportunity.

Let’s assume that we want to buy one unit of the asset. If we buy it now, it will cost us $$125$. Alternatively, we could buy a 1-year forward contract on the asset for $$133$. In this case, we would agree to buy the asset in one year at the price of $$133$.

If we buy the asset now, we could invest the cost at the 1-year interest rate of $4%$ and have:

$$125 \times (1 + 0.04) = 130 \text{ dollars after one year.}$$

If we buy the forward contract, we do not need to pay for the asset until one year from now, so we can invest the cost of the forward contract at the same interest rate and have:

$$133 \times (1 + 0.04) = 138.32 \text{ dollars after one year.}$$

If we exercise the forward contract at the end of the year, we would pay $$133$ and receive the asset, which would be worth $$138.32$. So, we would make a profit of $$5.32$.

Since we can make a profit by buying the forward contract and investing the cost at the interest rate, there is an arbitrage opportunity. Here is how we can take advantage of it:

- Borrow $$125$ at the 1-year interest rate of $4%$, which gives us $$130$ after one year.

- Buy the forward contract for $$133$ and invest the remaining $$130 – $133 = -$3$ at the same interest rate. This will give us $$135.52$ after one year.

- At the end of the year, exercise the forward contract and receive the asset, which is worth $$138.32$.

- Sell the asset for $$138.32$ and use the $$135.52$ we have to pay back the loan with interest, which leaves us with a profit of $$2.80$.

Therefore, we can make a riskless profit of $$2.80$ by borrowing at the interest rate, buying the forward contract, and exercising it at the end of the year. This is an arbitrage opportunity.

Suppose that the spot price of a certain good is $\$ 250$, the 1-year forward price of that good is $\$ 24 \%$, and the 1-year interest rate is $4 \%$ pa. Is there an arbitrage opportunity? If so, describe the arbitrage opportunity in detail.

To determine if there is an arbitrage opportunity, we need to compare the cost of buying the asset now with the cost of buying it in the future. If the cost is higher now than it is in the future, then there is a potential arbitrage opportunity.

Let’s assume that we want to buy one unit of the asset. If we buy it now, it will cost us $$250$. Alternatively, we could buy a 1-year forward contract on the asset for $$250 \times (1 + 0.24) = $310$. In this case, we would agree to buy the asset in one year at the price of $$310$.

If we buy the asset now, we could invest the cost at the 1-year interest rate of $4%$ and have:

$$250 \times (1 + 0.04) = 260 \text{ dollars after one year.}$$

If we buy the forward contract, we do not need to pay for the asset until one year from now, so we can invest the cost of the forward contract at the same interest rate and have:

$$310 \times (1 + 0.04) = 322.40 \text{ dollars after one year.}$$

If we exercise the forward contract at the end of the year, we would pay $$310$ and receive the asset, which would be worth $$250$. So, we would lose $$60$.

Since we would lose money by buying the forward contract and exercising it at the end of the year, there is no arbitrage opportunity.

Therefore, there is no arbitrage opportunity in this case, and the market is pricing the asset correctly. The higher forward price reflects the expected increase in the spot price over the next year, and the interest rate is taken into account in the forward price calculation.

MY-ASSIGNMENTEXPERT™可以为您提供UNIVERSITY OF ILLINOIS URBANA-CHAMPAIGN MATH2940 linear algebra线性代数课程的代写代考和辅导服务! 请认准MY-ASSIGNMENTEXPERT™. MY-ASSIGNMENTEXPERT™为您的留学生涯保驾护航。