如果你也在 怎样代写微观经济学Microeconomics ECON310这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。微观经济学Microeconomics是主流经济学的一个分支,研究个人和公司在做出有关稀缺资源分配的决策时的行为以及这些个人和公司之间的互动。微观经济学侧重于研究单个市场、部门或行业,而不是宏观经济学所研究的整个国民经济。

微观经济学Microeconomic的一个目标是分析在商品和服务之间建立相对价格的市场机制,并在各种用途之间分配有限资源。微观经济学显示了自由市场导致理想分配的条件。它还分析了市场失灵,即市场未能产生有效的结果。微观经济学关注公司和个人,而宏观经济学则关注经济活动的总和,处理增长、通货膨胀和失业问题以及与这些问题有关的国家政策。微观经济学还处理经济政策(如改变税收水平)对微观经济行为的影响,从而对经济的上述方面产生影响。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

我们在经济Economy代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的经济Economy代写服务。我们的专家在微观经济学Microeconomics代写方面经验极为丰富,各种微观经济学Microeconomics相关的作业也就用不着 说。

经济代写|微观经济学代考Microeconomics代写|HOW TAXES ON BUYERS AFFECT MARKET OUTCOMES

We first consider a tax levied on buyers of a good. Suppose, for instance, that our local government passes a law requiring buyers of ice-cream cones to send $\$ 0.50$ to the government for each ice-cream cone they buy. How does this law affect the buyers and sellers of ice cream? To answer this question, we can follow the three steps in Chapter 4 for analyzing supply and demand: (1) We decide whether the law affects the supply curve or demand curve. (2) We decide which way the curve shifts. (3) We examine how the shift affects the equilibrium.

The initial impact of the tax is on the demand for ice cream. The supply curve is not affected because, for any given price of ice cream, sellers have the same incentive to provide ice cream to the market. By contrast, buyers now have to pay a tax to the government (as well as the price to the sellers) whenever they buy ice cream. Thus, the tax shifts the demand curve for ice cream.

The direction of the shift is easy to determine. Because the tax on buyers makes buying ice cream less attractive, buyers demand a smaller quantity of ice cream at every price. As a result, the demand curve shifts to the left (or, equivalently, downward), as shown in Figure 6-6.

We can, in this case, be precise about how much the curve shifts. Because of the $\$ 0.50$ tax levied on buyers, the effective price to buyers is now $\$ 0.50$ higher than the market price. For example, if the market price of a cone happened to be $\$ 2.00$, the effective price to buyers would be $\$ 2.50$. Because buyers look at their total cost including the tax, they demand a quantity of ice cream as if the market price were $\$ 0.50$ higher than it actually is. In other words, to induce buyers to demand any given quantity, the market price must now be $\$ 0.50$ lower to make up for the effect of the tax. Thus, the tax shifts the demand curve downward from $D_1$ to $D_2$ by exactly the size of the tax $(\$ 0.50)$.

To see the effect of the tax, we compare the old equilibrium and the new equilibrium. You can see in the figure that the equilibrium price of ice cream falls from $\$ 3.00$ to $\$ 2.80$ and the equilibrium quantity falls from 100 to 90 cones. Because sellers sell less and buyers buy less in the new equilibrium, the tax on ice cream reduces the size of the ice-cream market.

Now let’s return to the question of tax incidence: Who pays the tax? Although buyers send the entire tax to the government, buyers and sellers share the burden. Because the market price falls from $\$ 3.00$ to $\$ 2.80$ when the tax is introduced, sellers receive $\$ 0.20$ less for each ice-cream cone than they did without the tax. Thus, the tax makes sellers worse off. Buyers pay sellers a lower price (\$2.80), but the effective price including the tax rises from $\$ 3.00$ before the tax to $\$ 3.30$ with the tax $(\$ 2.80+$ $\$ 0.50=\$ 3.30)$. Thus, the tax also makes buyers worse off.

To sum up, the analysis yields two general lessons:

Taxes discourage market activity. When a good is taxed, the quantity of the good sold is smaller in the new equilibrium.

- Buyers and sellers share the burden of taxes. In the new equilibrium, buyers pay more for the good, and sellers receive less.

经济代写|微观经济学代考Microeconomics代写|HOW TAXES ON SELLERS AFFECT MARKET OUTCOMES

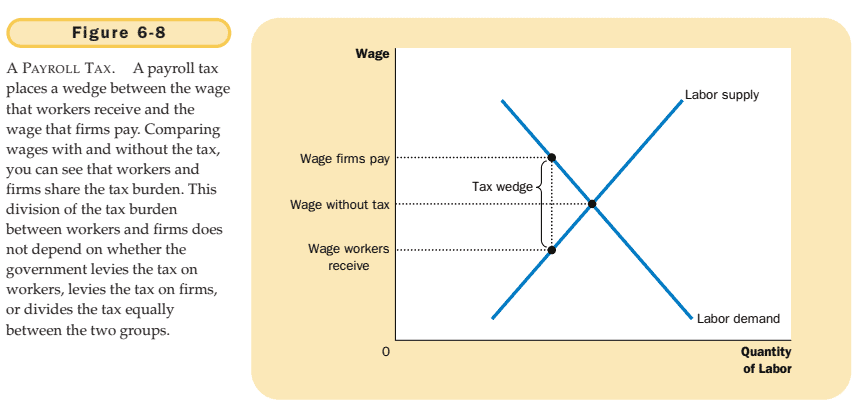

Now consider a tax levied on sellers of a good. Suppose the local government passes a law requiring sellers of ice-cream cones to send $\$ 0.50$ to the government for each cone they sell. What are the effects of this law?

In this case, the initial impact of the tax is on the supply of ice cream. Because the tax is not levied on buyers, the quantity of ice cream demanded at any given price is the same, so the demand curve does not change. By contrast, the tax on sellers raises the cost of selling ice cream, and leads sellers to supply a smaller quantity at every price. The supply curve shifts to the left (or, equivalently, upward).

Once again, we can be precise about the magnitude of the shift. For any market price of ice cream, the effective price to sellers-the amount they get to keep after paying the tax-is $\$ 0.50$ lower. For example, if the market price of a cone happened to be $\$ 2.00$, the effective price received by sellers would be $\$ 1.50$. Whatever the market price, sellers will supply a quantity of ice cream as if the price were $\$ 0.50$ lower than it is. Put differently, to induce sellers to supply any given quantity, the market price must now be $\$ 0.50$ higher to compensate for the effect of the tax. Thus, as shown in Figure 6-7, the supply curve shifts upward from $S_1$ to $S_2$ by exactly the size of the tax $(\$ 0.50)$.

When the market moves from the old to the new equilibrium, the equilibrium price of ice cream rises from $\$ 3.00$ to $\$ 3.30$, and the equilibrium quantity falls from 100 to 90 cones. Once again, the tax reduces the size of the ice-cream market. And once again, buyers and sellers share the burden of the tax. Because the market price rises, buyers pay $\$ 0.30$ more for each cone than they did before the tax was enacted. Sellers receive a higher price than they did without the tax, but the effective price (after paying the tax) falls from $\$ 3.00$ to $\$ 2.80$.

Comparing Figures 6-6 and 6-7 leads to a surprising conclusion: Taxes on buyers and taxes on sellers are equivalent. In both cases, the tax places a wedge between the price that buyers pay and the price that sellers receive. The wedge between the buyers’ price and the sellers’ price is the same, regardless of whether the tax is levied on buyers or sellers. In either case, the wedge shifts the relative position of the supply and demand curves. In the new equilibrium, buyers and sellers share the burden of the tax. The only difference between taxes on buyers and taxes on sellers is who sends the money to the government.

微观经济学代写

经济代写|微观经济学代考MICROECONOMICS代写|HOW TAXES ON BUYERS AFFECT MARKET OUTCOMES

我们首先考虑对商品购买者征收的税。例如,假设我们当地政府通过了一项法律,要求冰淇淋甜筒的购买者将 $\$ 0.50$ 他们购买的每一个冰淇淋甜筒 都交给政府。这条法律对冰淇淋的买卖双方有何影响? 要回答这个问题,我们可以按照第四章供需分析的三个步㡜: 1 我们決定法律是影响供给曲 线还是需求曲线。2我们决定曲线移动的方式。 3 我们检查这种转变如何影响均衡。

税收的最初影响是对冰淇淋的需求。供给曲线不受影响,因为对于任何给定的冰淇淋价格,卖家都有相同的动机向市场提供冰淇淋。相比之下, 买家现在必须向政府缴税aswellasthepricetothesellers每当他们买冰淇淋时。因此,税收使冰淇淋的需求曲线移动。

移动的方向很容易确定。因为对购买者征税使得购买冰淇淋的吸引力降低,所以购买者在每个价格下都需要较少数量的冰淇淋。因此,需求曲线 向左移动or, equivalently, downward,如图6-6所示。

在这种情况下,我们可以精确地知道曲线移动了多少。因为 $\$ 0.50$ 向买家征税,买家的有效价格是现在 $\$ 0.50$ 高于市场价。例如,如果雉体的市场 价格恰好是 $\$ 2.00$ ,买家的有效价格将是 $\$ 2.50$. 因为买家会考虑包括税在内的总成本,所以他们需要一定数量的冰淇淋,就好像市场价格是 $\$ 0.50$ 比实际高。换句话说,为了诱导买家需求任何给定的数量,现在的市场价格必须是 $\$ 0.50$ 降低以弥补税收的影响。因此,税收使需求曲线从 $D_1$ 到 $D_2$ 按税额大小 $(\$ 0.50)$

为了了解税收的影响,我们比较了旧均衡和新均衡。你可以在图中看到冰淇淋的均衡价格从 $\$ 3.00$ 到 $\$ 2.80$ 均衡数量从 100 个下降到 90 个。因为在 新的均衡中卖家卖得少,买家买得少,所以对冰淇淋征税会缩小冰淇淋市场的规模。

现在让我们回到税收归宿的问题: 谁来纳税? 尽管买家将全部税款交给政府,但买家和卖家分担了负担。因为市场价格从 $\$ 3.00$ 到 $\$ 2.80$ 当引入税 收时,卖家收到 $\$ 0.20$ 每个冰淇淋甜筒的收入都低于他们没有征税时的收入。因此,税收使卖家的状况更糟。买家付给卖家一个较低的价格 $\$ 2.80$, 但含税的有效价格从 $\$ 3.00$ 税前至 $\$ 3.30$ 与税 $\$ 2.80+\$ 0.50=\$ 3.30)$. 因此,税收也使买家的境况更糟。

总而言之,该分析得出了两个一般性教训:

税收阻碍了市场活动。当一种商品被征税时,新均衡中商品的销售量会减少。

- 买卖双方分担税收负担。在新的均衡中,买者为商品支付更多,而卖者得到更少。

经济代写|微观经济学代考MICROECONOMICS代写|HOW TAXES ON SELLERS AFFECT MARKET OUTCOMES

现在考虑对商品的销售者征税。假设当地政府通过了一项法律,要求冰淇淋甜筒的销售商将 $\$ 0.50$ 他们出售的每个甜筒都交给政府。这条法律有什 从影吅向?

在这种情况下,税收的最初影响是对冰淇淋的供应。因为不向买者征税,所以在任何给定价格下冰淇淋的需求量都是相同的,所以需求曲线不 变。相比之下,对卖家征税提高了销售冰淇淋的成本,并导致卖家在每个价格下都供应较少的数量。供给曲线向左移动 or, equivalently, upward.

再一次,我们可以准确地知道转变的幅度。对于冰淇淋的任何市场价格,卖家的有效价格一一他们在缴税后得到的金额一一是 $\$ 0.50$ 降低。例如,如 果锥体的市场价格恰好是 $\$ 2.00$, 卖方收到的有效价格为 $\$ 1.50$. 无论市场价格如何,卖家都会提供一定数量的㳮淇淋,就好像价格是 $\$ 0.50$ 比它低。 换句话说,为了诱使卖家供应任何给定的数量,现在的市场价格必须是 $\$ 0.50$ 更高以补偿税收的影响。因此,如图 6-7 所示,供给曲线从 $S_1$ 到 $S_2$ 按 税额大 $(\$ 0.50)$.

当市场从旧均衡移动到新均衡时,冰淇淋的均衡价格从 $\$ 3.00$ 到 $\$ 3.30$ ,均衡数量从 100 下降到 90 。税收再次缩小了冰淇淋市场的规模。买卖双方 再一次分担税收负担。因为市场价格上涨,买家买单 $\$ 0.30$ 每个圆锥体的收入都比税收颁布前多。卖家收到的价格高于末缴税时的价格,但有效价 格afterpayingthetax从 $\$ 3.00$ 到 $\$ 2.80$.

比较图 6-6和图 6-7 得出一个惊人的结论:对买者征税和对卖者征税是等价的。在这两种情况下,税收都会在买家支付的价格和卖家收到的价格之 间设置一个楔子。无论是对买家还是卖家征税,买家价格和卖家价格之间的差距都是一样的。在任何一种情况下,楔形都会移动供需曲线的相对 位置。在新的均衡中,买卖双方分担税收负担。对买家征税和对卖家征税之间的唯一区别在于谁将钱汇给了政府。

经济代写|微观经济学代考Microeconomics代写 请认准exambang™. exambang™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。