这个作业是完成股票利率收益相关的数学金融问题

MATH3075 Financial Derivatives (Mainstream)

Brownian motion

Real gas molecules can move in all directions, not just to neighbors on a chessboard. We would therefore like to be able to describe a motion similar to the random walk above, but where the molecule can move in all directions. A realistic description of this is Brownian motion – it is similar to the random walk (and in fact, can be made to become equal to it. See the fact box below.), but is more realistic. In the beginning of the twentieth century, many physicists and mathematicians worked on trying to define and make sense of Brownian motion – even Einstein was interested in it!

$$

\frac{\partial \rho}{\partial t}=D \frac{\partial^{2} \rho}{\partial x^{2}}

$$

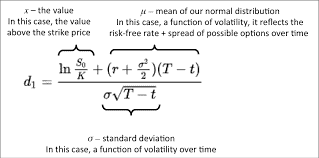

Black-Scholes-Merton Equation

We derive the BlackScholes-Merton PDE satisfied by the price of the option with the underlying asset modeled by a geometric Brownian motion. The idea is the same as the multi-period binomial model in Multi-Period Asset Pricing, and we want to determine the initial capital required to perfectly hedge a short position in the option. In the discrete setting, perfect hedging refers to a strategy that works for all possible outcomes of the coin tosses. In the continuous setting here, as the uncertainties of the asset price come from the Brownian motion, perfect hedging means that we can replicate the payoff of the option no matter which Brownian path is revealed. In the follow- ing discussion, we will try to make the comparison between the continuous and the discrete settings whenever possible, and one should first recall that , it was already shown that, in certain asymptotic regime where the time between different trades approaches to zero, the binomial model is close to the model of geometric Brownian motion. On the intuitive level, one should imagine those bi- nomial trees approximates (or are being approximated by) the trajectories of the geometric Brownian motion.

Evolution of Portfolio Value.

Consider the model from Example , assume $\sigma, \alpha>0$ are constants and the interest rate $r>0$ is also constant, so the stock price satisfies the SDE

$$d S(t)=\alpha S(t) d t+\sigma S(t) d W(t)$$

The value of the portfolio at time $t$ is $X(t),$ and the agent continuously trades between the stock account and the money market account. The (continuous) trading strategy is modeled by an adapted process $\Delta(t), t \geq 0 . \Delta(t)$

could be random but it must be adapted to $\mathcal{F}(t)$. One can write down the differential $d X(t)$.

$$

\quad d X(t)=\Delta(t) d S(t)+r[X(t)-\Delta(t) S(t)] d t

$$

which corresponds to the wealth equation in the binomial model (see e.g. Remark 2.1 and (2.3)$)$

$$

X_{j+1}-X_{j}=\Delta_{j}\left(S_{j+1}-S_{j}\right)+r\left(X_{j}-\Delta_{j} S_{j}\right)

$$

The r.h.s. of an be divided into three terms

$$

\begin{aligned}

d X(t) &=\Delta(t) d S(t)+r[X(t)-\Delta(t) S(t)] d t \

&=r X(t) d t+\Delta(t)(\alpha-r) S(t) d t+\Delta(t) \sigma S(t) d W(t)

\end{aligned}

$$

(ii) a risk which correspond to (i) an average rate of return $r$ on the portfolio, premium $\alpha-r$ for investing in the stock, (iii) a volatility term proportional to the

size of the stock investment. If we consider the discounted portfolio $e^{-r t} X(t),$ by Ito formula,$$

\begin{aligned}

d\left(e^{-r t} X(t)\right) &=-r e^{-r t} X(t) d t+e^{-r t} d X(t) \

&=e^{-r t}[\Delta(t)(\alpha-r) S(t) d t+\Delta(t) \sigma S(t) d W(t)]

\end{aligned}

$$

$$

=\Delta(t) d\left(e^{-r t} S(t)\right)

$$

In other words, the change of the discounted portfolio only comes from the change

of the discounted stock price.

Evolution of Option Value.

Consider $T$ and maturity $T$, so its payoff at $T$ is $(S(T)-K)^{+}$.

Assume that at strike $K$ and time $t \leq T$, the price of the option only depends on $t$ (more precisely time to maturity $T-t$ ) and the price of the underlying stock $S(t)$ (which is a random variable),

i.e., it is a two-variable function we write as $c(t, x)$, and the option price at $t$ is $c(t, S(t))$

. In the N-period binomial model, the counterpart is denoted by

$V{n}\left(\omega_{1} \ldots \omega_{n}\right),$

i.e., it is the price of the option at time $n$ if the outcomes of the first

$n$ coin tosses are $\omega_{1} \ldots \omega_{n}$.

1

Note that this is the general case when the payoff at maturity $N$ is $V_{N}\left(\omega_{1} \ldots \omega_{N}\right)$ which depends on the whole sequence of coin tosses $\omega_{1}, \ldots, \omega_{N}$. This is why the price at time $n$ also depends on the whole sequence up to $n$, rather than the price of the underlying which is $S_{0} u^{# H} d^{# T}$ in this case. In our continuous setting, as the option is an European call, whose payoff only depends on the underlying at maturity (rather than the whole path), one can assume the

price at $t$ is $c(t, S(t))$ Assume the function $c$ is smooth, by Itô formula we have

$$

\begin{aligned}

d c(t, S(t))=& \partial_{t} c(t, S(t)) d t+\partial_{x} c(t, S(t)) d S(t)+\frac{1}{2} \partial_{x x} c(t, S(t)) d S(t) d S(t) \

=&\left[\partial_{t} c(t, S(t))+\alpha S(t) \partial_{x} c(t, S(t))+\frac{1}{2} \sigma^{2} S(t)^{2} \partial_{x x} c(t, S(t))\right] d t \

&+\sigma S(t) \partial_{x} c(t, S(t)) d W(t)

\end{aligned}

$$

Similarly for the discounted option price we have (2.35)

$d\left[e^{-r t} c(t, S(t))\right]=-r e^{-r t} c(t, S(t)) d t+e^{-r t} d c(t, S(t))$

$$

\begin{aligned}

& e^{r t}\left[\partial_{t} c(t, S(t))-r c(t, S(t))+\alpha S(t) \partial_{x} c(t, S(t))+\frac{1}{2} \sigma^{2} S(t)^{2} \partial_{x x} c(t, S(t))\right] \

&+e^{-r t} \sigma S(t) \partial_{x} c(t, S(t)) d W(t)

\end{aligned}

$$

Dancing together.

Suppose we have initial capital $X(0)$ and trading strategy $\Delta(t), t \geq 0,$ then the evolution of the discounted portfolio value is given by $(2.34) .$ On the other hand, assuming the option price at time $t$ is given by $c(t, S(t))$ for some deterministic smooth function $c,$ the evolution of the discounted option price is given by $(2.35) .$ To replicate the payoff of the option at any time, we need

$$

X(t)=c(t, S(t)), \quad \text { for any } t \in[0, T]

$$

holds with probability one, i.e., independent of the realization of the Brownian motion which drives the change of $S$. Then we must have the differential forms equal. Comparing the coefficients of the $d W(t)$ term in (2.34) and $(2.35),$ we obtain

(2.36)

$$

\sigma \Delta(t) S(t)=\sigma S(t) \partial_{x} c(t, S(t))

$$

i.e., the position at time $t$ is given by

(2.37)

$$

\Delta(t)=\partial_{x} c(t, S(t))

$$

Comparing the coefficients of the $d t$ term,

(2.38)

$\Delta(t)(\alpha-r) S(t)$

$$

=\partial_{t} c(t, S(t))-r c(t, S(t))+\alpha S(t) \partial_{x} c(t, S(t))+\frac{1}{2} \sigma^{2} S(t)^{2} \partial_{x x} c(t, S(t))

$$

After cancelling the term $\Delta(t) \alpha S(t)$ on both sides using (2.37) , we have

$$

(2.39) \quad-r S(t) \partial_{x} c(t, S(t))=\partial_{t} c(t, S(t))-r c(t, S(t))+\frac{1}{2} \sigma^{2} S(t)^{2} \partial_{x x} c(t, S(t))

$$

理科代写答疑辅导,请认准UpriviateTA

经济金融答疑代写Financial Derivatives代写Black-Scholes 期权定价代写请认准UpriviateTA. UpriviateTA为您的留学生涯保驾护航。

更多内容请参阅另外一份实分析代写.