MY-ASSIGNMENTEXPERT™可以为您提供 sydney ECOS2002 Macroeconomics宏观经济学的代写代考和辅导服务!

这是悉尼大学宏观经济学课程的代写成功案例。

ECOS2002课程简介

This unit of study develops models of the goods, money and labour markets, and examines issues in macroeconomic policy. Macroeconomic relationships, covering consumption, investment, money and employment, are explored in detail. Macro-dynamic relationships, especially those linking inflation and unemployment, are also considered. Exchange rates and open economy macroeconomics are also addressed. In the last part of the unit, topics include the determinants and theories of economic growth, productivity and technology, the dynamics of the business cycle, counter-cyclical policy and the relationship between micro and macro policy in the context of recent Australian experience.

Prerequisites

At the completion of this unit, you should be able to:

- LO1. understand theoretical models that form the body of contemporary macroeconomics

- LO2. understand and apply macroeconomic models to various economic problems and policy issues

- LO3. understand the associated empirical implications of policy issues

- LO4. apply new ways of thinking and appreciate the importance of intellectual curiosity and reflection as foundation for continuous learning

- LO5. identify, define and analyse problems and recommend creative solutions within real-world constraints

- LO6. demonstrate a capacity to work independently including the ability to plan and achieve goals

- LO7. critically evaluate underlying theories, concepts, assumptions, limitations and arguments in disciplinary and cross-disciplinary fields of study

- LO8. intellectually participate in public policy discussions arising in business and government environments

- LO9. manage, analyse, evaluate and use information efficiently and effectively.

ECOS2002 Macroeconomics(EXAM HELP, ONLINE TUTOR)

This question asks you to analyze in more detail the two-sector endogenous growth model presented in the text.

a. Rewrite the production function for manufactured goods in terms of output per effective worker and capital per effective worker.

b. In this economy, what is break-even investment (the amount of investment needed to keep capital per effective worker constant)?

c. Write down the equation of motion for $k$, which shows $\Delta k$ as saving minus break-even investment. Use this equation to draw a graph showing the determination of steady-state k. (Hint: This graph will look much like those we used to analyze the Solow model.) d. In this economy, what is the steady-state growth rate of output per worker $Y / L$ ? How do the saving rate $s$ and the fraction of the labor force in universities $u$ affect this steadystate growth rate?

e. Using your graph, show the impact of an increase in $u$. (Hint: This change affects both curves.) Describe both the immediate and the steady-state effects.

f. Based on your analysis, is an increase in $u$ an unambiguously good thing for the economy? Explain.

Answer:

a). In the two-sector growth model, the production function takes this form:

$$

\mathrm{Y}=\mathrm{F}(\mathrm{K},(1-\mathrm{u}) \mathrm{EL})

$$

Let $\mathrm{y}=\frac{\mathrm{Y}}{\mathrm{EL}}$ and $\mathrm{k}=\frac{\mathrm{K}}{\mathrm{EL}}$, we have

$$

\mathrm{y}=\mathrm{f}(\mathrm{k})=\mathrm{F}[\mathrm{k},(1-\mathrm{u})]

$$

b). In order to keep capital per effective worker $(K / E L)$ constant, break-even investment includes three terms: $\delta k$ is needed to replace depreciating capital, $n k$ is needed to provide capital for new workers, and $g(u)$ is needed to provide capital for the greater stock of knowledge $E$ created by research universities. That is, break-even investment is $(\delta+n+$ $g(u)) k$.

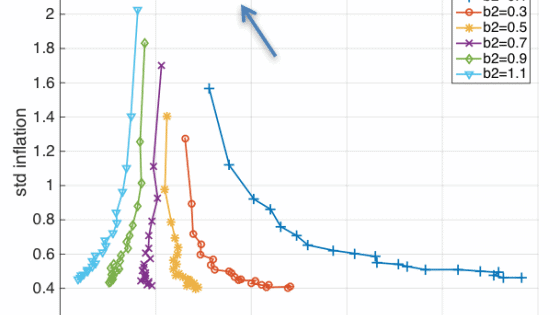

c) The motion for $k$ is $\Delta \mathrm{k}=\mathrm{sf}(\mathrm{k})-(\delta+\mathrm{n}+\mathrm{g}(\mathrm{u})) \mathrm{k}$, and in the steady state we have $\Delta \mathrm{k}^=\mathrm{sf}\left(\mathrm{k}^\right)-(\delta+\mathrm{n}+\mathrm{g}(\mathrm{u})) \mathrm{k}^*=0$. The corresponding graph should look like the one below:

d). The steady state has constant capital per effective worker $k$. We also assume that in the steady state, there is a constant share of time spent in research universities, so $u$ is constant. (After all, if $u$ were not constant, it wouldn’t be a “steady” statel). Hence, output per effective worker $y$ is also constant. Output per worker equals $y E$, and $E$ grows at rate $g(t)$. Therefore, output per worker grows at rate $g(u)$. The saving rate does not affect this growth rate. However, the amount of time spent in research universities does affect this rate: as more time is spent in research universities, the steady-state growth rate rises.

e). An increase in $u$ shifts both lines in our figure. Output per effective worker falls for any given level of capital per effective worker, since less of each worker’s time is spent producing manufactured goods. This is the immediate effect of the change, since at the time $u$ rises, the capital stock $K$ and the efficiency of each worker $E$ are constant. Since output per effective worker falls, the curve showing saving per effective worker shifts down. At the same time, the increase in time spent in research universities increases the growth rate of labor efficiency $g(u)$. Hence, break-even investment [which we found above in part (b)] rises at any given level of $k$, so the line showing breakeven investment also shifts up.

f). In the short run, the increase in $u$ unambiguously decreases consumption. After all, we argued in part (e) that the immediate effect is to decrease output, since workers spend less time producing manufacturing goods and more time in research universities expanding the stock of knowledge. For a given saving rate, the decrease in output implies a decrease in consumption. The long-run steady-state effect is more subtle. We found in part (e) that output per effective worker falls in the steady state. But welfare depends on output (and consumption) per norker, not per effective worker. The increase in time spent in research universities implies that $E$ grows faster. That is, output per worker equals $y$ E. Although steady-state $y$ falls, in the long run the faster growth rate of Enecessarily dominates. That is, in the long run, consumption unambiguously rises. Nevertheless, because of the initial decline in consumption, the increase in $u$ is not unambiguously a good thing. That is, a policymaker who cares more about current generations than about future generations may decide not to pursue a policy of increasing $u$. (This is analogous to the question considered in Chapter 7 of whether a policymaker should try to reach the Golden Rule level of capital per effective worker if $k$ is currently below the Golden Rule level.)

An economy begins in long-run equilibrium, and then a change in government regulations allows banks to start paying interest on checking accounts. Recall that the money stock is the sum of currency and demand deposits, including checking accounts, so this regulatory change makes holding money more attractive.

a. How does this change affect the demand for money?

b. What happens to the velocity of money?

c. If the Fed keeps the money supply constant, what will happen to output and prices in the short run and in the long run?

d. If the goal of the Fed is to stabilize the price level, should the Fed keep the money supply constant in response to this regulatory change? If not, what should it do? Why? e. If the goal of the Fed is to stabilize output, how would your answer to part (d) change?

Answer:

a). This will increase the demand for money as holding money (checking deposit) becomes more rewarding.

b). The velocity of money will be reduced as more people are willing to hold money in the form of checking deposit instead of using it for purchasing goods or services. (Recall that we talked about introducing credit card increases the velocity of money. The logic is very similar here. Someone may use the argument that to maintain the quantity equation given output and price being fixed, the velocity of money has to decrease when money demand increases. This is INCORRECT as output is not fixed in the short run and price is not fixed in the long run.

c) The reduced velocity of money is a negative demand shock that shifts the demand curve to the left, which reduces output in the short run and reduces price in the long run.

d) If FED only wants to stabilize the price level, then it should increase money supply in the long run while leaving money supply unchanged in the short run. The specific approach to conduct this policy is out of the scope of this chapter.

e) If FED only wants to stabilize the output level, then it should increase money supply in the short run while leaving money supply unchanged in the long run.

MY-ASSIGNMENTEXPERT™可以为您提供 SYDNEY ECOS2002 MACROECONOMICS宏观经济学的代写代考和辅导服务!