经济代写| Wrong theories result in bad policie 宏观经济学代写

经济代写

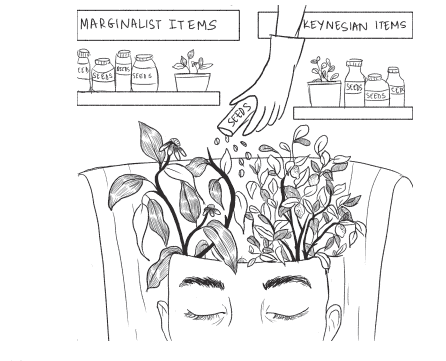

Given the existence of different contending theories in economics (briefly outlined in Section 1.2), characterising a theory as wrong depends, to an extent, on one’s own standpoint. And this standpoint partly (or mostly) depends on the economics education that one has received via school and college textbooks. So far, in this textbook, two distinct approaches to understanding money, output levels and output growth have been provided. In this section, we shall critically engage with some of these theories.

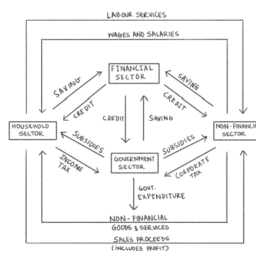

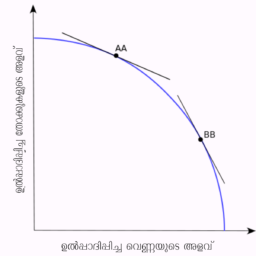

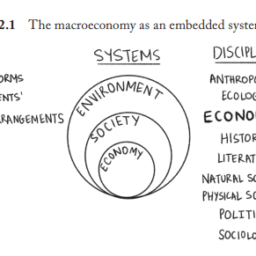

The theories of money, output and economic growth, arising from the conceptual hub of marginalist economics, are based on the following four ‘wrong’ principles and theories: $(a)$ what is true for an individual is true for the economy as a whole, $(b)$ the rate of interest is a ‘real’ phenomenon, $(c)$ planned saving determines planned investment and $(d)$ the marginal productivity theory of these theories results in bad policies-bad in terms of the economic effects it has on people’s lives.

Mainstream macroeconomics is built on the idea that what is true for an individual must be true for the macroeconomy as well-via a simple aggregation of individual actions. Prima facie, there is no reason to think that this approach is wrong. This approach has led economists, both past and present, to argue that saving is good not only for an individual but also for the entire economy. The logic is simply this: since it is good for an individual household to accumulate there an issue with this argument from an economics perspective? Yes, most there an issue with this argument from an economics perspective? Yes, most a household because of their respective constitutional standing, legal aspects, ability to borrow funds, social roles and public accountability. (As an exercise, make a note of the socio-political differences between a household and a 120

WHY ECONOMIC THEORY MATTERS

firm.) The government, very often, performs the function of the ‘provider of last resort’, much like the central bank is the ‘lender of last resort’. In many countries, the government pays an allowance if an individual is unable to find employment; in India, the government provides employment through the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), thereby underscoring the right of every individual to work. Such social functions are not performed by private households or firms. This is because by considering it as an extension of a rational economic individual nor as a sum of rational economic individual decisions.

As already divulged in Chapter 4, I have had students tell me that they find microeconomics to be more intuitive than macroeconomics. In a way, this is because marginalist microeconomics asks its student to place herself within the rational utility calculus, and subsequently various thought (or perhaps, more accurately, pedagogic) experiments are carried out in support of the marginalist constraints. On the other hand, since macroeconomics deals with the economy as a whole, it is not possible to employ such individual thought experiments to provide a basis for macroeconomic understanding. The logic and behaviour of an economic system is different from the logic and behaviour of an individual economic agent. However, marginalist macroeconomics tries to reduce macro behaviour to micro behaviour-as clearly visible in the ‘microfoundations’ approach to macroeconomics (see later). Hence, the marginalist standpoint methodological holism.

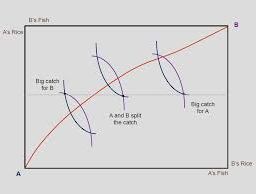

In 1936, Keynes demonstrated that the use of methodological individualism to understand macroeconomics – the theory of output, employment and money-is logically flawed. Let us suppose that all households decide to save more with a view to increasing aggregate (national) savings. Given current happens in the macroeconomy? Owing to reduced household consumption, firms will be unable to sell their planned output, leading to a reduction in firms’ incomes, which may result in a reduction in labour employed and, consequently, to a reduction in households’ incomes and, therefore, of household savings. This is called the paradox of thrift because the attempt to increase aggregate savings by increasing individual savings has a paradoxical (or counter-intuitive) effect. However, recognise that this is a paradox only from the standpoint of

鉴于经济学中存在不同的相互竞争的理论(在第 1.2 节中简要概述),将一个理论定性为错误的理论在一定程度上取决于一个人自己的立场。这种观点部分(或大部分)取决于一个人通过学校和大学教科书接受的经济学教育。到目前为止,在这本教科书中,已经提供了两种不同的方法来理解货币、产出水平和产出增长。在本节中,我们将批判性地讨论其中的一些理论。

货币、产出和经济增长理论源自边际经济学的概念中心,基于以下四个“错误”原则和理论:整体而言,$(b)$ 利率是一个“真实的”现象,$(c)$ 计划储蓄决定计划投资,而 $(d)$ 这些理论的边际生产力理论导致了糟糕的政策——就以下方面而言是糟糕的它对人们生活的经济影响。

主流宏观经济学建立在这样一种理念之上,即对个人正确的事情对宏观经济也必须是正确的——通过个人行为的简单聚合。从表面上看,没有理由认为这种方法是错误的。这种方法使过去和现在的经济学家都认为储蓄不仅对个人有益,而且对整个经济都有好处。逻辑很简单:既然个人家庭积累有好处,那么从经济学的角度来看,这个论点有问题吗?是的,从经济学的角度来看,这个论点最有问题吗?是的,由于各自的宪法地位、法律方面、借贷能力、社会角色和公共责任,大多数家庭都是如此。 (作为练习,记下家庭和 120

为什么经济理论很重要

公司。)政府经常扮演“最后的提供者”的职能,就像中央银行是“最后的贷款人”一样。在许多国家,如果个人找不到工作,政府会支付津贴;在印度,政府通过《圣雄甘地国家农村就业保障法》(MGNREGA)提供就业机会,从而强调每个人都有工作的权利。这种社会功能不是由私人家庭或公司来执行的。这是因为将其视为理性经济个体的延伸,而不是理性经济个体决策的总和。

正如第 4 章所述,我有学生告诉我,他们发现微观经济学比宏观经济学更直观。在某种程度上,这是因为边际主义微观经济学要求其学生将自己置于理性效用计算中,随后进行了各种思想(或者更准确地说,是教学法)实验来支持边际主义约束。另一方面,由于宏观经济学将经济作为一个整体来处理,因此不可能采用这种个人思想实验来为宏观经济学的理解提供基础。一个经济系统的逻辑和行为不同于个体经济主体的逻辑和行为。然而,边际主义宏观经济学试图将宏观行为简化为微观行为——这在宏观经济学的“微观基础”方法中清晰可见(见下文)。因此,边际主义立场的方法论整体论。

1936 年,凯恩斯证明使用方法论的个人主义来理解宏观经济学——产出、就业和货币理论——在逻辑上是有缺陷的。让我们假设所有家庭决定增加储蓄以增加总(国家)储蓄。鉴于当前宏观经济中发生的情况?由于家庭消费减少,企业将无法出售其计划产出,从而导致企业收入减少,这可能导致就业劳动力减少,从而导致家庭收入减少,因此,家庭储蓄。这被称为节俭悖论,因为通过增加个人储蓄来增加总储蓄的尝试具有矛盾(或违反直觉)的效果。但是,请认识到这只是从以下角度来看的一个悖论

经济代考

宏观经济学,是以国民经济总过程的活动为研究对象,主要考察就业总水平、国民总收入等经济总量,因此,宏观经济学也被称做就业理论或收入理论。 宏观经济学研究的是经济资源的利用问题,包括国民收入决定理论、就业理论、通货膨胀理论、经济周期理论、经济增长理论、财政与货币政策。

其他相关科目课程代写:组合学Combinatorics集合论Set Theory概率论Probability组合生物学Combinatorial Biology组合化学Combinatorial Chemistry组合数据分析Combinatorial Data Analysis

my-assignmentexpert愿做同学们坚强的后盾,助同学们顺利完成学业,同学们如果在学业上遇到任何问题,请联系my-assignmentexpert™,我们随时为您服务!

宏观经济学是经济学的一个分支,它研究的是一个整体经济,即市场或其他大规模运作的系统是如何运作的。宏观经济学研究经济范围内的现象,如通货膨胀价格水平经济增长,国民收入,国内生产总值,以及失业 .

计量经济学代考

计量经济学是以一定的经济理论和统计资料为基础,运用数学、统计学方法与电脑技术,以建立经济计量模型为主要手段,定量分析研究具有随机性特性的经济变量关系的一门经济学学科。 主要内容包括理论计量经济学和应用经济计量学。 理论经济计量学主要研究如何运用、改造和发展数理统计的方法,使之成为经济关系测定的特殊方法。

相对论代考

相对论(英語:Theory of relativity)是关于时空和引力的理论,主要由愛因斯坦创立,依其研究对象的不同可分为狭义相对论和广义相对论。 相对论和量子力学的提出给物理学带来了革命性的变化,它们共同奠定了现代物理学的基础。

编码理论代写

编码理论(英语:Coding theory)是研究编码的性质以及它们在具体应用中的性能的理论。编码用于数据压缩、加密、纠错,最近也用于网络编码中。不同学科(如信息论、电机工程学、数学、语言学以及计算机科学)都研究编码是为了设计出高效、可靠的数据传输方法。这通常需要去除冗余并校正(或检测)数据传输中的错误。

编码共分四类:[1]

数据压缩和前向错误更正可以一起考虑。

复分析代考

学习易分析也已经很冬年了,七七八人的也续了圧少的书籍和论文。略作总结工作,方便后来人学 Đ参考。

复分析是一门历史悠久的学科,主要是研究解析函数,亚纯函数在复球面的性质。下面一昭这 些基本内容。

(1) 提到复变函数 ,首先需要了解复数的基本性左和四则运算规则。怎么样计算复数的平方根, 极坐标与 $x y$ 坐标的转换,复数的模之类的。这些在高中的时候囸本上都会学过。

(2) 复变函数自然是在复平面上来研究问题,此时数学分析里面的求导数之尖的运算就会很自然的 引入到复平面里面,从而引出解析函数的定义。那/研究解析函数的性贡就是关楗所在。最关键的 地方就是所谓的Cauchy一Riemann公式,这个是判断一个函数是否是解析函数的关键所在。

(3) 明白解析函数的定义以及性质之后,就会把数学分析里面的曲线积分 $a$ 的概念引入复分析中, 定义几乎是一致的。在引入了闭曲线和曲线积分之后,就会有出现复分析中的重要的定理: Cauchy 积分公式。 这个是易分析的第一个重要定理。