这是一份 The University of Sydney悉尼大学ECMT3150作业代写的成功案例

Instructions:

Lecturer: Simon Kwok

Due: 5pm, 18 March 2022 (Friday)

[Total: 20 marks] Bob is a grown-up now. With the pocket money from his dad Simon, Bob went to the casino to try his luck. Being a first-time gambler, he decided to start by betting big-and-small.

For the sake of this question, we assume the game is fair in the sense that all rounds are independent and the probabilities of winning and losing in a round are both equal to $0.5$. More precisely, we define the indicator $y_{n}$ as follows:

$y_{n}=\left{\begin{array}{cl}1 & \text { if Bob wins in the } n \text {th round }, \ -1 & \text { if Bob loses in the } n \text {th round }\end{array}\right.$

The assumptions on the game given above imply that $\left(y_{n}\right){n \geq 1}$ is a sequence of iid random variables with $P\left(y{n}=1\right)=P\left(y_{n}=-1\right)=0.5$.

Let $V_{n}$ (in dollars) denote Bob’s stake in the $n$th round. The stake is determined by Bob before the $n$th round starts. If Bob bets $V_{n}$ in the $n$th round and wins, he will gain $V_{n}$ in that round (hence receiving a total of $2 V_{n}$ ); otherwise he will lose $V_{n}$ (hence receiving a total of 0 dollars). Note that $V_{n}$ may depend on the outcomes of the first $n-1$ rounds. A given sequence $\left(V_{n}\right)_{n \geq 1}$ defines a betting strategy.

Let $X_{n}$ denote Bob’s total gain after the $n$th round. We set $X_{0}=0$. It is clear that $X_{n}$ is given by

$$

X_{n}=\sum_{i=1}^{n} V_{i} y_{i}

$$

(a) [4 marks] Define $\Delta X_{n}:=X_{n}-X_{n-1}$ for $n \geq 1$. Show that the sequence $\left(\Delta X_{n}\right){n \geq 1}$ is a martingale difference sequence. (b) $[3$ marks $]$ Show that $E\left(X{n}\right)=0$ for all $n$. In words, Bob will break even on average.

Suppose Bob adopts the “grandpa’s strategy” by betting $\$ 1$ in each round regardless of what happened, i.e., $V_{n} \equiv 1$ for all $n$.

(c) [3 marks] What is the distribution of Bob’s total gain after 5 rounds?

(d) [2 marks] What is the probability that Bob will suffer a loss after 5 rounds?

Bob claims that he can beat the house by adopting the following betting strategy (let’s call it “the banker’s strategy”): He bets $\$ 1$ in the first round. If Bob wins in the previous round, he stops playing; otherwise he doubles the bet in the following round. Bob will keep playing until he wins for the first time or he uses up all the money that Simon gave him, whichever happens first. More precisely, we can represent the banker’s strategy as follows: $V_{1}=1$, and for $n>1$,

$$

V_{n}=\left{\begin{array}{cc}

2^{n-1} & \text { if } y_{1}=-1, y_{2}=-1, \ldots, y_{n-1}=-1 \

0 & \text { otherwise }

\end{array}\right.

$$

(e) [2 marks] What is Bob’s total loss after he loses all the first 10 rounds, supposing that Bob has enough pocket money to survive beyond 10 rounds?

(f) [2 marks] What is Bob’s total gain after he wins for the first time?

(g) [4 marks] Bob claims that by adopting the banker’s strategy he will for sure bring back home with more money than what Simon gave him if he plays long enough. Assuming that the game is fair, do you agree with Bob? Why or why not?

| I_(t)=-1 | I_(t)=0 | I_(t)=1 | ||

|---|---|---|---|---|

| I_(t-1)=-1 | 0.04 | 0.14 | 0.02 | 0.2 |

| I_(t-1)=0 | 0.14 | p_(00) | p_(01) | 0.7 |

| I_(t-1)=1 | 0.02 | p_(10) | p_(11) | 0.1 |

| 0.2 | 0.7 | 0.1 |

[Total: 20 marks]

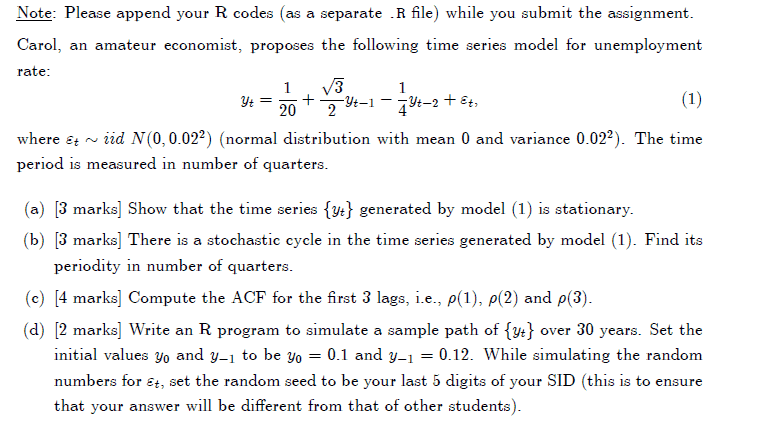

Note: Please append your $R$ codes (as a separate . $R$ file) while you submit the assignment.

Carol, an amateur economist, proposes the following time series model for unemployment rate:

$$

y_{t}=\frac{1}{20}+\frac{\sqrt{3}}{2} y_{t-1}-\frac{1}{4} y_{t-2}+\varepsilon_{t}

$$

where $\varepsilon_{t} \sim$ iid $N\left(0,0.02^{2}\right.$ ) (normal distribution with mean 0 and variance $0.02^{2}$ ). The time period is measured in number of quarters.

(a) $[3$ marks $]$ Show that the time series $\left{y_{t}\right}$ generated by model (1) is stationary.

(b) [3 marks] There is a stochastic cycle in the time series generated by model (1). Find its periodity in number of quarters.

(c) $[4$ marks $]$ Compute the ACF for the first 3 lags, i.e., $\rho(1), \rho(2)$ and $\rho(3)$.

(d) [2 marks] Write an R program to simulate a sample path of $\left{y_{t}\right}$ over 30 years. Set the initial values $y_{0}$ and $y_{-1}$ to be $y_{0}=0.1$ and $y_{-1}=0.12$. While simulating the random numbers for $\varepsilon_{t}$, set the random seed to be your last 5 digits of your SID (this is to ensure that your answer will be different from that of other students).

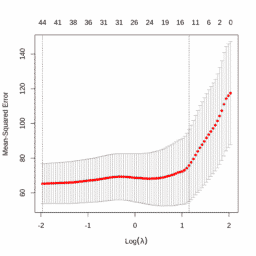

(e) [2 marks] Plot the sample ACF and record its value for the first 3 lags (the values can be retrieved from the acf command output stored as a list). Why are they different from your answers in part (c)?

(f) $[3$ marks $]$ Using the simulated sample path in part (d), estimate an $A R(2)$ model using the $R$ command arima. Write down the estimated model with the parameter estimates and their standard error. Also record the estimated variance of the innovations.

[Important note: the “intercept” estimate in the arima output is in fact the unconditional mean; see Rob Hyndman’s page for details: https://robjhyndman.com/hyndsight/ arimaconstants/.]

(g) [3 marks] Using the simulated sample path in part (d) and the $R$ package forecast, plot the point forecast and the confidence interval for each period over the next 5 years. Describe the short-run and long-run behaviour of the point forecast and the confidence interval.

matlab代写请认准UprivateTA™.

经济代写

1. ECON 220W: Communication in Economics 1

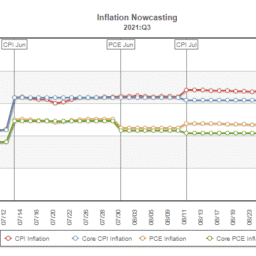

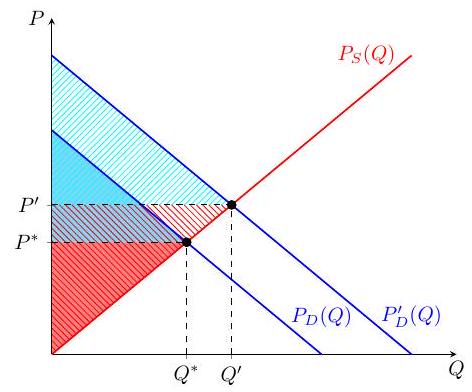

Assignment 2: graphic analysis

In 30 minutes describe the key features of the graph below in at 200 to 250 words. You need to start with an overview to what the graph is about and then you need to cover all key information you can understand from the graph and finish your analysis with what you can conclude from the graph. In particular, the following questions should be addressed: what does each curve represent? Where can such a positive shock in the demand come from? What are the two points displayed on the graph? Are firms and consumers better off after the shock?

Don’t forget to start with a plan. Time is limited to 30 minutes. Write your work in Word or Libreoffice, Times New Roman font, and upload your work in the pdf format. Leave the last final minutes for self editing, and uploading. Late submissions are not accepted. You will be assessed based on the following criteria: Don’t forget to start with a plan. Time is limited to 30 minutes. Write your work in Word or Libreoffice, Times New Roman font, and upload your work in the pdf format. Leave the last final minutes for self editing, and uploading. Late submissions are not accepted. You will be assessed based on the following criteria:

2. An overview is provided

- All key features are accurately described; keywords are used and defined if needed;

- There is coherence and cohesion and a logical flow all throughout;

- A range of sentence structures and vocabulary is used;

- Grammar, punctuation, and spelling are accurate.

Please write your analysis using Microsoft Word or LibreOffice and upload your .pdf document on canvas.

3. The effect of a demand shock from PD(Q) to PD′(Q)

1 All rights reserved (c) 2022 Sepideh Fotovatian – Thomas Vigié.

更多经济代写案例请参阅此处。