my-assignmentexpert™ Economics 经济学作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 $100 \%$ 原创。my-assignmentexpert™, 最高质量的ECON经济学作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于economics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此经济作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在经济学作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的经济代写服务。我们的专家在经济学 代写方面经验极为丰富,各种economics相关的作业也就用不着 说。

我们提供的econ代写服务范围广, 其中包括但不限于:

- 微观经济学

- 货币银行学

- 数量经济学

- 宏观经济学

- 经济统计学

- 经济学理论

- 商务经济学

- 计量经济学

- 金融经济学

- 国际经济学

- 健康经济学

- 劳动经济学

Exchange Edgeworth box|Econ经济作业代写Economics代考

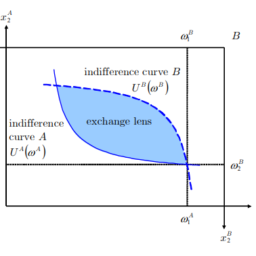

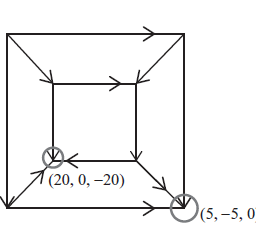

2.1.1. Introducing the Edgeworth box for two consumers. We consider agents or households that consume bundles of goods. A distribution of such bundles among all households is called an allocation. In a two-agent twogood environment, allocations can be visualized via the Edgeworth box. Exchange Edgeworth boxes allow to depict preferences by the use of indifference curves. The reader may remember the production Edgeworth box introduced in chapter VIII, pp. $216 .$

The analysis of bargaining between consumers in an exchange Edgeworth box is due to Francis Ysidro Edgeworth (1881) who lived 1845-1926. Edgeworth is the author of a book with the beautiful title “Mathematical Psychics”. Figure XIV.1 represents the exchange Edgeworth box for goods 1 and 2 and individuals $A$ and $B$. The exchange Edgeworth box exhibits two points of origin, one for individual $A$ (bottom left corner) and another one for individual $B$ (top right).

Every point in the box denotes an allocation: how much of each good belongs to which individual. One possible allocation is the (initial) endowment. For all allocations $\left(x^{A}, x^{B}\right)$ with $x^{A}=\left(x_{1}^{A}, x_{2}^{A}\right)$ for individual $A$ and $x^{B}=\left(x_{1}^{B}, x_{2}^{B}\right)$ for individual $B$ we have

$$

\begin{aligned}

&x_{1}^{A}+x_{1}^{B}=\omega_{1}^{A}+\omega_{1}^{B} \text { and } \

&x_{2}^{A}+x_{2}^{B}=\omega_{2}^{A}+\omega_{2}^{B}

\end{aligned}

$$

Individual $A$ possesses an endowment $\omega^{A}=\left(\omega_{1}^{A}, \omega_{2}^{A}\right)$, i.e., $\omega_{1}^{A}$ units of good 1 and $\omega_{2}^{A}$ units of good 2. Similarly, individual $B$ has an endowment $\omega^{B}=\left(\omega_{1}^{B}, \omega_{2}^{B}\right)$.

Production Edgeworth box.|ECON经济作业代写ECONOMICS代考

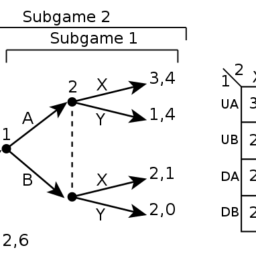

2.2. Production Edgeworth box. With respect to the production Edgeworth box, we can argue in a similar fashion. Remember producer 1 ‘s marginal rate of technical substitution $M R T S_{1}=\left|\frac{d C_{1}}{d L_{1}}\right|$. We now understand this expression as producer 1 ‘s marginal willingness to pay for an additional unit of labor in terms of capital units. If two producers 1 and 2 produce goods 1 and 2, respectively, with inputs labor and capital, both can increase their production as long as the marginal rates of technical substitution differ. Thus, Pareto efficiency means

$$

\left|\frac{d C_{1}}{d L_{1}}\right|=M R T S_{1} \stackrel{!}{=} M R T S_{2}=\left|\frac{d C_{2}}{d L_{2}}\right|

$$

so that the marginal willingness to pay for input factors are the same.

Two markets — one factory.|ECON经济作业代写ECONOMICS代考

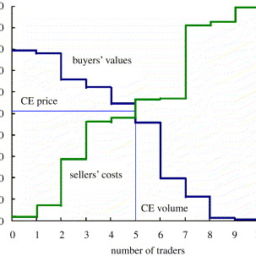

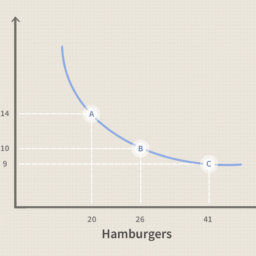

2.3. Two markets – one factory. The third subcase under the heading “equality of the marginal willingness to pay” concerns a firm that produces in one factory but supplies two markets 1 and 2 . The idea is to consider the marginal revenue $M R=\frac{d R}{d x_{i}}$ as the monetary marginal willingness to pay for selling one extra unit of good $i$. How much can a firm pay for the sale of one additional unit?

Thus, the marginal revenue is a marginal rate of substitution $\left|\frac{d R}{d x_{i}}\right|$. The role of the denominator good is taken over by good 1 or 2 , respectively, while the nominator good is “money” (revenue). Now, profit maximization by a firm selling on two markets 1 and 2 implies

$$

\left|\frac{d R}{d x_{1}}\right|=M R_{1} \stackrel{!}{=} M R_{2}=\left|\frac{d R}{d x_{2}}\right|

$$

as we have seen in chapter XI, p. 307 .

EXCHANGE EDGEWORTH BOX|ECON经济作业代写ECONOMICS代考

2.1.1。为两位消费者介绍御剑盒。我们考虑消费成捆商品的代理人或家庭。这种捆绑在所有家庭中的分配称为分配。在两个智能体两个良好的环境中,分配可以通过 Edgeworth 框可视化。Exchange Edgeworth 框允许通过使用无差异曲线来描述偏好。读者可能还记得第 VIII 章 pp. 中介绍的生产御剑盒。216.

弗朗西斯·伊西德罗·埃奇沃斯 (Francis Ysidro Edgeworth) (1881) 对交换御剑盒中消费者之间讨价还价的分析是由于他生活在 1845-1926 年。御剑是一本名为“数学心理学”的书的作者。图 XIV.1 表示商品 1 和 2 以及个人的交换 Edgeworth 盒子一种和乙. 交换御剑盒展品两处原产地,一处为个人一种(左下角)和另一个个人乙(右上)。

方框中的每个点都表示一个分配:每种商品有多少属于哪个个体。一种可能的分配是(初始)禀赋。对于所有分配(X一种,X乙)和X一种=(X1一种,X2一种)对于个人一种和X乙=(X1乙,X2乙)对于个人乙我们有

X1一种+X1乙=ω1一种+ω1乙 和 X2一种+X2乙=ω2一种+ω2乙

个人一种拥有禀赋ω一种=(ω1一种,ω2一种), IE,ω1一种商品单位 1 和ω2一种商品单位 2. 同样,个人乙有禀赋ω乙=(ω1乙,ω2乙).

PRODUCTION EDGEWORTH BOX.|ECON经济作业代写ECONOMICS代考

2.2. 生产御剑盒。关于生产御剑盒,我们可以用类似的方式争论。记住生产者 1 的边际技术替代率米R吨小号1=|dC1d一世1|. 我们现在将这个表达式理解为生产者 1 以资本单位为单位支付额外劳动单位的边际意愿。如果两个生产者 1 和 2 分别生产商品 1 和 2,投入劳动力和资本,只要边际技术替代率不同,双方都可以增加产量。因此,帕累托效率意味着

|dC1d一世1|=米R吨小号1=!米R吨小号2=|dC2d一世2|

使得对投入要素的边际支付意愿相同。

TWO MARKETS — ONE FACTORY.|ECON经济作业代写ECONOMICS代考

2.3. 两个市场——一个工厂。“边际支付意愿的平等”标题下的第三个子案例涉及一家在一个工厂生产但供应两个市场 1 和 2 的公司。这个想法是考虑边际收入米R=dRdX一世为多卖一单位商品的货币边际意愿一世. 一家公司可以为多售一个单位支付多少?

因此,边际收益是边际替代率|dRdX一世|. 分母商品的角色分别由商品 1 或 2 接管,而指定商品是“金钱”(收入)。现在,公司在两个市场 1 和 2 上销售的利润最大化意味着

|dRdX1|=米R1=!米R2=|dRdX2|

正如我们在第 XI 章第 307 .

matlab代写请认准UprivateTA™.

经济代写

计量经济学代写请认准my-assignmentexpert™ Economics 经济学作业代写

微观经济学代写请认准my-assignmentexpert™ Economics 经济学作业代写

宏观经济学代写请认准my-assignmentexpert™ Economics 经济学作业代写