如果你也在 怎样金融数学Financial Mathematics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。金融数学Financial Mathematics是将数学方法应用于金融问题。(有时使用的同等名称是定量金融、金融工程、数学金融和计算金融)。它借鉴了概率、统计、随机过程和经济理论的工具。传统上,投资银行、商业银行、对冲基金、保险公司、公司财务部和监管机构将金融数学的方法应用于诸如衍生证券估值、投资组合结构、风险管理和情景模拟等问题。依赖商品的行业(如能源、制造业)也使用金融数学。 定量分析为金融市场和投资过程带来了效率和严谨性,在监管方面也变得越来越重要。

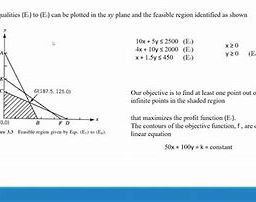

定量金融作为经济学的一个子领域,关注资产和金融工具的估值以及资源的配置。几个世纪的经验产生了关于经济运行方式和我们评估资产的方式的基本理论。模型描述了基本变量之间的关系,如资产价格、市场运动和利率。这些数学工具使我们能够得出原本难以发现或从直觉上无法立即看出的结论。模型应用的一个例子是银行的压力测试。 特别是在现代计算技术的帮助下,我们可以存储大量的数据并同时对许多变量进行建模,从而有能力对相当大和复杂的系统进行建模。因此,科学计算的技术,如数值分析、蒙特卡洛模拟和优化是金融数学的重要组成部分。

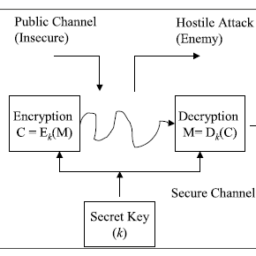

任何科学的很大一部分都是在对研究对象的基本了解的基础上建立可检验的假设,并通过可重复的研究来证明或反驳这些假设的能力。从这个角度来看,数学是代表理论的语言,并提供测试其有效性的工具。例如,在布莱克、斯科尔斯和默顿的期权定价理论中,提出了一个股票价格变动的模型,结合无风险投资将获得无风险收益率的理论,研究者们推断出可以给期权分配一个价值。

my-assignmentexpert™金融数学Financial Mathematics作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的金融数学Financial Mathematics作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此金融数学Financial Mathematics作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在金融数学Financial Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的金融数学Financial Mathematics代写服务。我们的专家在金融数学Financial Mathematics代写方面经验极为丰富,各种金融数学Financial Mathematics相关的作业也就用不着 说。

我们提供的金融数学Financial Mathematics及其相关学科的代写,服务范围广, 其中包括但不限于:

- 随机微积分 Stochastic calculus

- 随机分析 Stochastic analysis

- 随机控制理论 Stochastic control theory

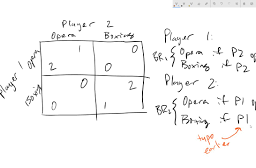

- 微观经济学 Microeconomics

- 数量经济学 Quantitative Economics

- 宏观经济学 Macroeconomics

- 经济统计学 Economic Statistics

- 经济学理论 Economic Theory

- 计量经济学 Econometrics

经济代写

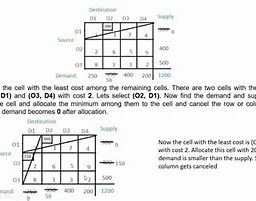

数学代写|金融数学作业代写 Financial Mathematics代考|Fractional calculus

Fractional calculus is a generalization and extension of classical calculus. The development of calculus is usually attributed to Gottfried Leibnitz and Isaac Newton, though the two men had a bitter life-long dispute as to which of them actually developed calculus. Leibnitz published his first work on calculus in 1684 ; Newton made use of calculus in his Principia published in 1687 . Although some of the key ideas of calculus had been known for centuries to Greek, Arab, and Persian mathematicians, it was Leibnitz and Newton who created a complete framework for calculus and established the fundamental theorem of calculus that links derivatives and integrals.

The derivative of a function, represented as $\frac{d f}{d x}$ or $f^{\prime}$, is defined as the limit, if it exists, of the difference quotient: $\frac{d f}{d x}=\lim {\Delta x \rightarrow 0} \frac{\Delta f}{\Delta x}$, while the (indefinite) integral is defined as the limit of the sum $\int{a}^{x} f(u) d u=\lim \sum \Delta f \Delta x$, where the sum is extended to all $\Delta x$ that form a partition of the interval $(a, x)$.

A function $F(x)$ is called an antiderivative (or primitive function) of $f(x)$ if: $\frac{d F(x)}{d x}=f(x)$. The fundamental theorem of calculus states that the indefinite integral $F(x)=\int_{a}^{x} f(u) d u$ is a primitive function of $f(x)$ and that the definite integral can be computed as $\int_{a}^{b} f(u) d u=F(b)-F(a)$, where $F$ is any primitive function of $f$. Integration is the inverse operation of differentiation.

By recursively applying the operation of taking a derivative (differentiation), we can define derivatives of any order: $D^{n}(f)=\frac{d}{d x}\left(\frac{d^{n-1} f}{d x^{n-1}}\right)$. We can apply the same iterative process to integration in order to define the integral of $n$ th order: $. D^{-n}(f) \equiv \int_{a}^{x} \int_{a}^{y_{1}} \cdots \int_{a}^{y_{n-1}} f\left(y_{n}\right) d y_{n} d y_{n-1} \cdots d y_{1}$. Therefore: $\frac{d^{n} D^{m} f}{d x^{n}}=$ $D^{m-n} f, m>n$.

The following integration formula, generally attributed to Cauchy, holds:

$$

D^{-n} f \equiv \int_{a}^{x} \int_{a}^{y_{1}} \cdots \int_{a}^{y_{n-1}} f\left(y_{n}\right) d y_{n} d y_{n-1} \cdots d y_{1}=\frac{1}{(n-1) !} \int_{a}^{x}(x-t)^{n-1} f(t) d t

$$

Immediately after the introduction of calculus, it became a key research topic for mathematicians. In 1695 , a leading mathematician of his time and author of the first French treatise on calculus, le Marquis de l’Hôpital Guillaume François Antoine wrote to Leibnitz asking what would happen if the order of differentiation were a real number instead of an integer. Leibnitz’s reply: “It will lead to a paradox, from which one day useful consequences will be drawn.” This exchange between Marquis and Leibnitz is generally considered to be the beginning of fractional calculus. However, the actual development of fractional calculus had to wait until 1832. It was then that Joseph Liouville first introduced what is now called the Riemann-Liouville definition of fractional derivative, based on the Riemann-Liouville fractional integral:

$$

D^{-\alpha} f \equiv \frac{1}{\Gamma(\alpha)} \int_{a}^{x}(x-t)^{\alpha-1} f(t) d t

$$

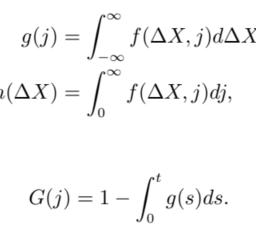

数学代写|金融数学作业代写 Financial Mathematics代考|Fractional processes

A stochastic process is called Markovian if it has the Markov property which is expressed as follows: $P\left(X_{s} \mid \Im_{t}\right)=P\left(X_{s} \mid X_{t}\right), t<s$ or, equivalently, $P\left(X_{s} \mid \Im_{t}\right)=$ $P\left(X_{s} \mid \sigma\left(X_{t}\right), t<s\right)$. That is, the probability distribution of $X_{s}$ given the information available at time $t<s$, which is embodied in the sigma-algebra $\Im_{t}$, is equal to the probability distribution of $X_{s}$ given the value taken by $X_{t}$.

Financial and economic processes are often represented as diffusions. A diffusion is a Markovian stochastic process with continuous sample paths. Diffusions are characterized by a drift and diffusion coefficients. Two main representations of diffusions are used in finance and economics. The first is based on stochastic differential equations:

$$

d X_{t}=\mu\left(X_{t}, t\right) d t+\sigma\left(X_{t}, t\right) d B_{t}

$$

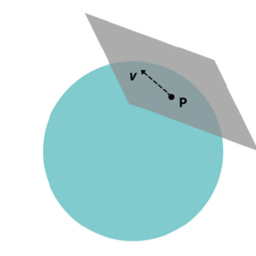

where $\mu, \sigma$ are deterministic functions of $\left(X_{t}, t\right)$ called, respectively, the drift and the diffusion coefficients, and $d B_{t}$ is the stochastic differential of the standard Brownian motion $B_{t}$, also called a Wiener process. The standard Brownian motion is defined as a process that starts at zero, has continuous paths, and independent Gaussian increments. Paths of Brownian motions have fractal dimension. It can be demonstrated that such a process exists.

The second representation is based on a partial differential equation, the Forward Kolmogorov equation, also called the Fokker-Planck equation. The FokkerPlanck equation describes the evolution of the conditional probability density function $p$ of $X_{t}$. It states that:

$$

\frac{\partial p}{\partial t}=-\frac{\partial}{\partial x}(\mu(x, t) p)+\frac{1}{2} \frac{\partial^{2}}{\partial x^{2}}\left(\sigma^{2}(x, t) p\right)

$$

where $p$ is the conditional density $p \equiv p(x, t \mid y, s)$ and $\mu, \sigma$ the drift and the diffusion coefficients.

数学代写|金融数学作业代写 Financial Mathematics代考|fractional Brownian motion

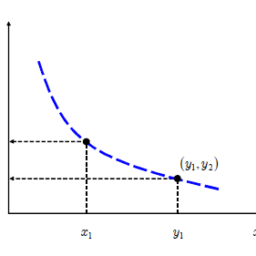

A fractional Brownian motion $-\mathrm{fBm}-B_{t}^{H}$ with Hurst parameter $0<H<1$, is a Gaussian process with continuous paths with covariance:

$$

E\left(B_{t}^{H} B_{s}^{H}\right)=\frac{1}{2}\left(s^{2 H}+t^{2 H}-|t-s|^{2 H}\right)

$$

An fBm becomes a standard Bm for $H=0.5$. It is a self-similar process with index $H$.

A fractional Brownian motion has stationary increments. A process has stationary increments if the distribution of $\left{X_{t+h}-X_{t}\right}$ is independent of $t$ for any $h$. A Brownian motion has independent stationary increments; a fractional Brownian motion has stationary increments which are not independent.

A fractional Brownian motion is an anomalous diffusion with $E\left[B_{t}^{H}\right]^{2} \propto|t|^{2 H}$. It is a path-dependent, non Markovian process. A fractional Brownian motion is not a semi-martingale, so the usual Itô stochastic calculus does not apply. That is, it is not possible to define stochastic differential equations that describe a fractional Brownian motion.

数学代写|金融数学作业代写 FINANCIAL MATHEMATICS代考|FRACTIONAL CALCULUS

分数阶微积分是经典微积分的推广和扩展。微积分的发展通常归功于戈特弗里德·莱布尼茨和艾萨克·牛顿,尽管这两个人对于他们中的哪一个真正发展了微积分一直存在着激烈的争论。莱布尼茨于 1684 年发表了他的第一部微积分著作;牛顿在 1687 年出版的《原理》中使用了微积分。尽管几个世纪以来,希腊、阿拉伯和波斯的数学家都知道微积分的一些关键思想,但莱布尼茨和牛顿为微积分创建了一个完整的框架,并建立了连接导数和积分的微积分基本定理。

函数的导数,表示为dFdX要么F′, 定义为差商的极限(如果存在):dFdX=林ΔX→0ΔFΔX,而一世nd和F一世n一世吨和积分被定义为和的极限∫一种XF(你)d你=林∑ΔFΔX, 其中总和扩展到所有ΔX形成区间的一个分区(一种,X).

一个函数F(X)被称为反衍生物○rpr一世米一世吨一世v和F你nC吨一世○n的F(X)如果:dF(X)dX=F(X). 微积分基本定理指出,不定积分F(X)=∫一种XF(你)d你是一个原始函数F(X)并且定积分可以计算为∫一种bF(你)d你=F(b)−F(一种), 在哪里F是的任何原始函数F. 积分是微分的逆运算。

通过递归地应用求导的操作d一世FF和r和n吨一世一种吨一世○n,我们可以定义任意阶的导数:Dn(F)=ddX(dn−1FdXn−1). 我们可以将相同的迭代过程应用于积分,以定义积分n订单:.D−n(F)≡∫一种X∫一种和1⋯∫一种和n−1F(和n)d和nd和n−1⋯d和1. 所以:dnD米FdXn= D米−nF,米>n.

以下积分公式,通常归因于 Cauchy,成立:

D−nF≡∫一种X∫一种和1⋯∫一种和n−1F(和n)d和nd和n−1⋯d和1=1(n−1)!∫一种X(X−吨)n−1F(吨)d吨

微积分问世后,立即成为数学家的重点研究课题。1695 年,他那个时代的主要数学家和第一部关于微积分的法国论文的作者,le Marquis de l’Hôpital Guillaume François Antoine 写信给莱布尼茨,询问如果微分阶是实数而不是整数会发生什么。莱布尼茨的回答是:“这将导致一个悖论,有一天会从中得出有用的结果。” Marquis 和 Leibnitz 之间的这种交流通常被认为是分数阶微积分的开始。然而,分数阶微积分的实际发展要等到 1832 年。那时,约瑟夫·刘维尔首先在黎曼-刘维尔分数积分的基础上引入了现在称为黎曼-刘维尔分数导数的定义:

D−一种F≡1Γ(一种)∫一种X(X−吨)一种−1F(吨)d吨

数学代写|金融数学作业代写 FINANCIAL MATHEMATICS代考|FRACTIONAL PROCESSES

如果随机过程具有马尔可夫性质,则称为马尔可夫过程,表示如下:磷(Xs∣ℑ吨)=磷(Xs∣X吨),吨<s或者,等效地,磷(Xs∣ℑ吨)= 磷(Xs∣σ(X吨),吨<s). 也就是说,概率分布Xs鉴于当时可用的信息吨<s, 这体现在 sigma 代数中ℑ吨, 等于概率分布Xs给定的值X吨.

金融和经济过程通常表现为扩散。扩散是具有连续样本路径的马尔可夫随机过程。扩散的特征在于漂移和扩散系数。金融和经济学中使用了两种主要的扩散表示法。第一个是基于随机微分方程:

dX吨=μ(X吨,吨)d吨+σ(X吨,吨)d乙吨

在哪里μ,σ是确定性函数(X吨,吨)分别称为漂移系数和扩散系数,和d乙吨是标准布朗运动的随机微分乙吨,也称为维纳过程。标准布朗运动定义为从零开始、具有连续路径和独立高斯增量的过程。布朗运动的路径具有分形维数。可以证明存在这样的过程。

第二种表示基于偏微分方程,前向 Kolmogorov 方程,也称为 Fokker-Planck 方程。FokkerPlanck 方程描述了条件概率密度函数的演变p的X吨. 它指出:

∂p∂吨=−∂∂X(μ(X,吨)p)+12∂2∂X2(σ2(X,吨)p)

在哪里p是条件密度p≡p(X,吨∣和,s)和μ,σ漂移系数和扩散系数。

数学代写|金融数学作业代写 FINANCIAL MATHEMATICS代考|FRACTIONAL BROWNIAN MOTION

分数布朗运动−F乙米−乙吨H带赫斯特参数0<H<1, 是具有协方差的连续路径的高斯过程:

和(乙吨H乙sH)=12(s2H+吨2H−|吨−s|2H)

fBm 成为标准 BmH=0.5. 是一个带索引的自相似过程H.

分数布朗运动具有固定增量。如果一个过程的分布是平稳的\left{X_{t+h}-X_{t}\right}\left{X_{t+h}-X_{t}\right}独立于吨对于任何H. 布朗运动具有独立的静止增量;分数布朗运动具有不独立的固定增量。

分数布朗运动是异常扩散和[乙吨H]2∝|吨|2H. 这是一个路径依赖的非马尔可夫过程。分数布朗运动不是半鞅,因此通常的伊藤随机演算不适用。也就是说,不可能定义描述分数布朗运动的随机微分方程。

计量经济学代写请认准my-assignmentexpert™ Economics 经济学作业代写

微观经济学代写请认准my-assignmentexpert™ Economics 经济学作业代写

宏观经济学代写请认准my-assignmentexpert™ Economics 经济学作业代写