如果你也在 怎样代写复杂系统Complex Systems这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。复杂系统Complex Systems由许多组件组成的系统,这些组件可能相互影响。复杂系统的例子有地球的全球气候、生物体、人脑、基础设施,如电网、交通或通信系统、复杂的软件和电子系统、社会和经济组织(如城市)、生态系统、生物细胞,以及最终的整个宇宙。

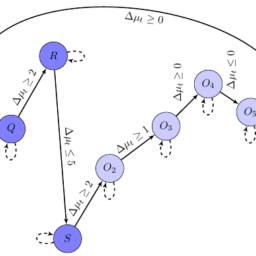

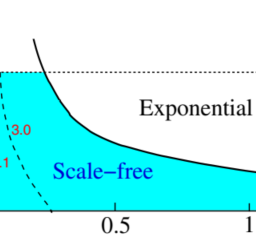

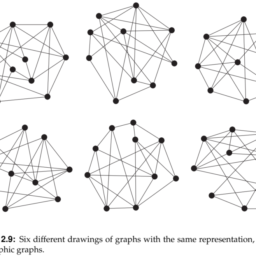

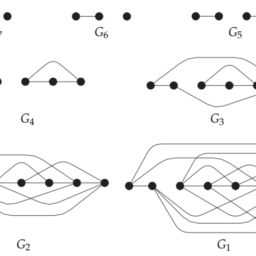

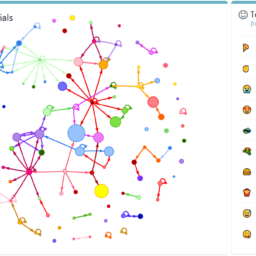

复杂系统Complex Systems是指由于其各部分之间或某一系统与其环境之间的依赖、竞争、关系或其他类型的相互作用,其行为在本质上难以建模。复杂 “的系统具有从这些关系中产生的独特属性,如非线性、涌现、自发秩序、适应和反馈回路等等。由于这类系统出现在各种各样的领域,它们之间的共性已经成为其独立的研究领域的主题。在许多情况下,将这样的系统表示为一个网络是很有用的,其中节点代表组件,链接代表它们的相互作用。

my-assignmentexpert™ 复杂系统Complex Systems作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的复杂系统Complex Systems作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此复杂系统Complex Systems作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在物理physics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的复杂系统Complex Systems代写服务。我们的专家在物理physics代写方面经验极为丰富,各种复杂系统Complex Systems相关的作业也就用不着 说。

我们提供的复杂系统Complex Systems及其相关学科的代写,服务范围广, 其中包括但不限于:

物理代写|复杂系统作业代写Complex Systems代考|Data

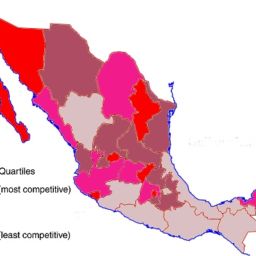

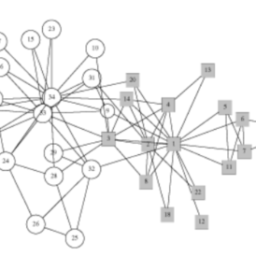

A set of 54 companies from the commercial sector of the Colombian economy are selected. The commercial sector is selected due to its high participation in the generation of employment in Colombia and because it presents a high percentage of companies in insolvency process in recent years. The financial statements for 2017 of such company have been analyzed to compute the selected financial ratios.

The balance sheet and cash flow statement as of December 2017 have been considered. The year 2017 is selected for the wide availability of the information required in the Superintendence of Corporations Web site. The financial ratios corresponding to the static versus dynamic model proposed by Pessoa de Oliveira (2016) have been established;

- $E_{1}$ : Short-term solvency

$$

E_{1}:=\frac{\text { Current Assets }}{\text { Current Liabilities }} ; \text { Solvency criterion: } E_{1}>1 .

$$ - $E_{2}$ : Leverage

$$

E_{2}:=\frac{\text { Total Liabilities }}{\text { Equity }} ; \text { Solvency criterion: } 0<E_{2} \leq 1 \text {. }

$$ - $E_{3}$ : Indebtedness of property, plant, and equipment

$$

E_{3}:=\frac{\text { Non current Liabilities }}{\text { Non Current Assets }} ; \text { Solvency criterion: } 0<E_{3} \leq 0.5

$$ - $D_{1}$ : Cash generated from operations

$$

D_{1}:=\text { PBT }+\text { amortization:Solvency criterion: } D_{1}>0

$$

where PBT $=$ profit before taxation. - $D_{2}$ : Short-term financial capacity

$D_{2} \frac{\mathrm{COA}}{D_{1}} ;$ Solvency criterion: If $D_{1}>0, D_{2}>0.95$. If $D_{1}<0, D_{2}>1.05$

where $\mathrm{COA}=$ Cash from operating activities. - $D_{3}$ : Management of long-term financial policy

$$

D_{3}:=\frac{\mathrm{CFA}}{(\mathrm{CIA}+\text { Dividend })-D_{1}} ; \text { Solvency criterion: } D_{3} \geq 1

$$

where $\mathrm{CFA}=$ Cash flow from financing activities and CIA $=$ Cash flow from investment activities.

The selection of these ratios corresponds to a perspective that considers; (1) cash flow statement as a fundamental element in determining the availability of financial resources and (2) the company’s ability to generate cash in the long term. These are two key aspects in the financial solvency analysis process. Additionally, balance sheet ratios are selected to analyze the part corresponding to both long-term and short-term financial liabilities (Castiblanco et al. 2017).

物理代写|复杂系统作业代写COMPLEX SYSTEMS代考|Methodology

The first stage of the process is to compute the indexes selected in the literature for each of the established partitions. Table 1 summarizes the results.

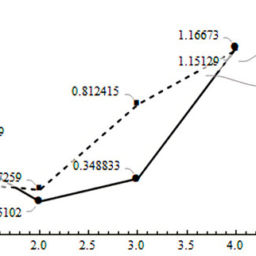

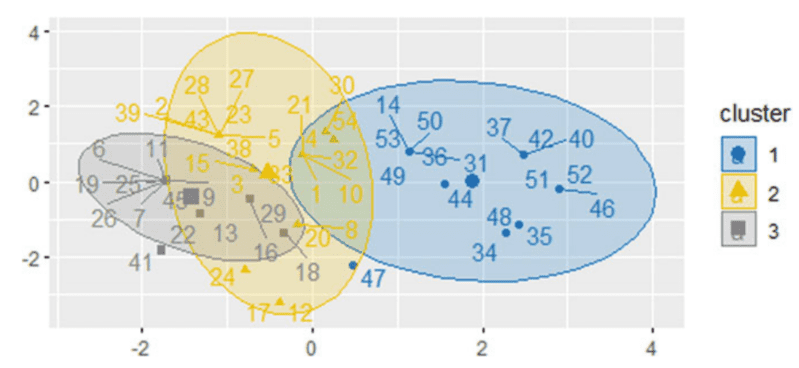

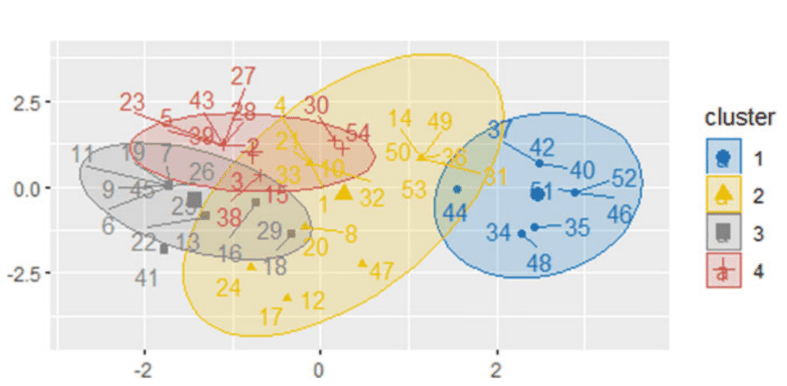

The values for which each criterion establishes the best partition have been highlighted. For instance, if we use the partition coefficient $\mathrm{PC}$, the criterion is to find the partition with the highest value. In our case, the best partition would be with six clusters $(\mathrm{PC}=0.59)$; however, we observe that after the partition with three clusters, the value for the partition coefficient decreases and grows again, and finally, it obtains the maximum value in six clusters. A similar behavior is observed with the indices SIL and SIL.F. On the contrary, if the partition entropy index is observed, the best partition is obtained with two classes.

According to the above, we are faced with the following situations; (1) considers the highest value for four indices PC, MPC, SIL, and SIL.F and omits the partition entropy index. In this case, the optimal number of classes is six, or (2) establishing a stop criterion according to the particular needs and interests of the problem addressed in order to satisfy the greatest number of indices and not lose interpretability of the results. For instance, if there is a partition for which the index decreases, the immediately preceding partition is selected. Thus, we could establish that the best partition is the one that generates three clusters, because it is the one that verifies the greatest number of indexes (PC, SIL, SIL.F, and PE. MPC is omitted), or (3) implement the algorithm again increasing the number of classes until obtaining higher values for the four indices. The behavior of the four indices reveals this possibility. In the latter case, the following results have been obtained; $\mathrm{PC}=0.9$ with 17 clusters, $\mathrm{PE}=0.26$ with 16 clusters, $\mathrm{MPC}=0.9$ with 17 clusters, $\mathrm{SIL}=0.85$ with 18 clusters, and SIL.F $=0.98$ with 20 clusters. Clearly the interpretability of the clusters and selecting the best partition is more complicated under such situation.

复杂系统代写

物理代写|复杂系统作业代写COMPLEX SYSTEMS代考|DATA

选择了来自哥伦比亚经济商业部门的 54 家公司。之所以选择商业部门,是因为它在哥伦比亚创造就业机会方面的参与度很高,而且近年来它在破产程序中的公司比例很高。对该公司 2017 年的财务报表进行了分析,以计算选定的财务比率。

已考虑截至 2017 年 12 月的资产负债表和现金流量表。选择 2017 年是因为公司网站所需信息的广泛可用性。Pessoa de Oliveira 提出的静态与动态模型对应的财务比率2016已经成立;

- 和1: 短期偿债能力

和1:= 当前资产 流动负债 ; 偿付能力标准: 和1>1. - 和2: 杠杆作用

和2:= 负债总额 公平 ; 偿付能力标准: 0<和2≤1. - 和3: 不动产、厂房和设备的负债

和3:= 非流动负债 非流动资产 ; 偿付能力标准: 0<和3≤0.5 - D1: 经营产生的现金

D1:= PBT + 摊销:偿付能力标准: D1>0

PBT=税前利润。 - D2: 短期财务能力

D2C这一种D1;偿付能力标准:如果D1>0,D2>0.95. 如果D1<0,D2>1.05

在哪里C这一种=经营活动产生的现金。 - D3: 长期财务政策的管理

D3:=CF一种(C一世一种+ 股利 )−D1; 偿付能力标准: D3≥1

在哪里CF一种=来自融资活动和 CIA 的现金流=投资活动产生的现金流。

这些比率的选择对应于一个考虑的观点;1现金流量表作为确定财务资源可用性的基本要素和2公司长期产生现金的能力。这是金融偿付能力分析过程中的两个关键方面。此外,选择资产负债表比率来分析长期和短期金融负债对应的部分C一种s吨一世b一世一种nC这和吨一种一世.2017.

物理代写|复杂系统作业代写COMPLEX SYSTEMS代考|METHODOLOGY

该过程的第一阶段是计算文献中为每个已建立的分区选择的索引。表 1 总结了结果。

每个标准建立最佳分区的值已被突出显示。例如,如果我们使用分配系数磷C,准则是找到具有最高值的分区。在我们的例子中,最好的分区是六个集群(磷C=0.59); 然而,我们观察到,在划分为三个簇后,划分系数的值减小并再次增长,最终在六个簇中获得最大值。使用指数 SIL 和 SIL.F 观察到类似的行为。相反,如果观察分区熵指数,则使用两个类获得最佳分区。

综上所述,我们面临以下几种情况;1考虑四个索引 PC、MPC、SIL 和 SIL.F 的最高值,并忽略分区熵索引。在这种情况下,最佳的类数是六个,或者2根据所解决问题的特定需求和兴趣建立停止标准,以满足最大数量的指标并且不失去结果的可解释性。例如,如果存在索引减少的分区,则选择紧接在前的分区。因此,我们可以确定最佳分区是生成三个集群的分区,因为它是验证最多索引数量的分区磷C,小号一世大号,小号一世大号.F,一种nd磷和.米磷C一世s这米一世吨吨和d, 或者3再次执行该算法,增加类的数量,直到获得四个索引的更高值。四个指数的行为揭示了这种可能性。在后一种情况下,获得了以下结果;磷C=0.9有 17 个集群,磷和=0.26有 16 个集群,米磷C=0.9有 17 个集群,小号一世大号=0.85有 18 个集群和 SIL.F=0.98有 20 个集群。显然,在这种情况下,集群的可解释性和选择最佳分区更加复杂。

物理代写|复杂系统作业代写Complex Systems代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。