如果你也在 怎样代写管理会计Managerial Accounting这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。管理会计Managerial Accounting在管理会计或管理会计中,管理人员在决策中使用会计信息,并协助管理和履行其控制职能。

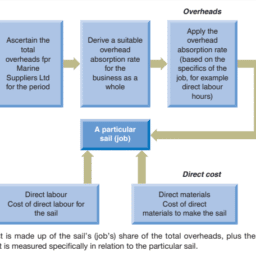

管理会计Managerial Accounting的一个简单定义是向管理人员提供财务和非财务决策信息。换句话说,管理会计帮助组织内部的董事做出决策。这也可以被称为成本会计。这是区分、检查、破译和向主管人员传授数据的方式,以帮助完成商业目标。收集的信息包括所有领域的会计,教育行政部门识别财务支出和组织决策的业务任务。会计师使用计划来衡量组织内的整体运营战略。

my-assignmentexpert™ 管理会计Managerial Accounting作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的管理会计Managerial Accounting作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此管理会计Managerial Accounting作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在会计accounting作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的管理会计Managerial Accounting代写服务。我们的专家在会计accounting代写方面经验极为丰富,各种管理会计Managerial Accounting相关的作业也就用不着 说。

我们提供的管理会计Managerial Accounting及其相关学科的代写,服务范围广, 其中包括但不限于:

会计代写|管理会计作业代写Managerial Accounting代考|Flow of Accounting Information

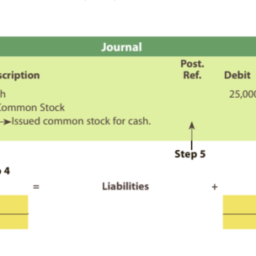

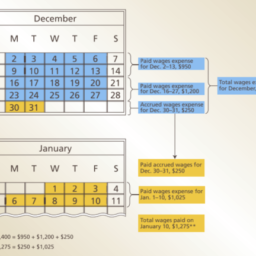

The process of adjusting the accounts and preparing financial statements is one of the most important in accounting. Using the NetSolutions illustration from Chapters 1-3 and an end-ofperiod spreadsheet, the flow of accounting data in adjusting accounts and preparing financial statements are summarized in Exhibit $1 .$

The end-of-period spreadsheet in Exhibit 1 begins with the unadjusted trial balance. The unadjusted trial balance verifies that the total of the debit balances equals the total of the credit balances. If the trial balance totals are unequal, an error has occurred. Any errors must be found and corrected before the end-of-period process can continue.

The adjustments for NetSolutions from Chapter 3 are shown in the Adjustments columns of the spreadsheet. Cross-referencing (by letters) the debit and credit of each adjustment is useful in reviewing the effect of the adjustments on the unadjusted account balances. The adjustments are normally entered in the order in which the data are assembled. If the titles of the accounts to be adjusted do not appear in the unadjusted trial balance, the accounts are inserted in their proper order in the Account Title column. The total of the Adjustments columns verifies that the total debits equal the total credits for the adjusting entries. The total of the Debit column must equal the total of the Credit column.

The adjustments in the spreadsheet are added to or subtracted from the amounts in the Unadjusted Trial Balance columns to arrive at the amounts inserted in the Adjusted Trial Balance columns. In this way, the Adjusted Trial Balance columns of the spreadsheet illustrate the effect of the adjusting entries on the unadjusted accounts. The totals of the Adjusted Trial Balance columns verify that the totals of the debit and credit balances are equal after adjustment.

会计代写|管理会计作业代写Managerial Accounting代考|Financial Statements

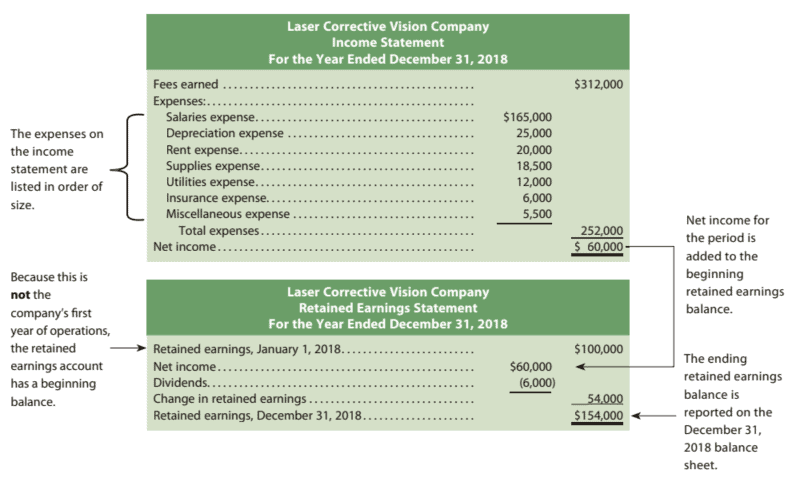

The financial statements for NetSolutions can be prepared. The income statement, the retained earnings statement, and the balance sheet are shown in Exhibit $2 .$

Income Statement

The income statement is prepared directly from the Adjusted Trial Balance columns of the Exhibit 1 spreadsheet, beginning with fees earned of $\$ 16,840$. The expenses in the income statement in Exhibit 2 are listed in order of size, beginning with the larger items. Miscellaneous expense is the last item, regardless of its amount.Retained Earnings Statement

The first item normally presented on the retained earnings statement is the balance of the retained earnings account at the beginning of the period. Since NetSolutions began operations on November 1, this balance is zero in Exhibit 2. Then, the retained earnings statement shows the net income for the two months ended December 31, 2017. The amount of dividends is deducted from the net income to arrive at the retained earnings as of December 31, $2017 .$

会计代写|管理会计作业代写Managerial Accounting代考|Closing Entries

As discussed in Chapter 3 , the adjusting entries are recorded in the journal at the end of the accounting period. For NetSolutions, the adjusting entries are shown in Exhibit 7 of Chapter $3 .$

After the adjusting entries are posted to NetSolutions’ ledger, shown in Exhibit 6 of this chapter, the ledger agrees with the data reported on the financial statements.

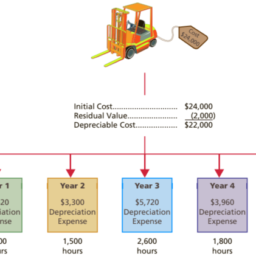

The balances of the accounts reported on the balance sheet are carried forward from year to year. Because they are relatively permanent, these accounts are called permanent accounts or real accounts. For example, Cash, Accounts Receivable, Equipment, Accumulated Depreciation, Accounts Payable, Common Stock, and Retained Earnings are permanent accounts.

The balances of the accounts reported on the income statement are not carried forward from year to year. Also, the balance of the dividends account, which is reported on the retained earnings statement, is not carried forward. Because these accounts report amounts for only one period, they are called temporary accounts or nominal accounts. Temporary accounts are not carried forward because they relate only to one period. For example, the Fees Earned of $\$ 16,840$ and Wages Expense of $\$ 4,525$ for NetSolutions shown in Exhibit 2 are for the two months ending December 31,2017 , and should not be carried forward to 2018 .

At the beginning of the next period, temporary accounts should have zero balances. To achieve this, temporary account balances are transferred to permanent accounts at the end of the accounting period. The entries that transfer these balances are called closing entries. The transfer process is called the closing process and is sometimes referred to as closing the books.

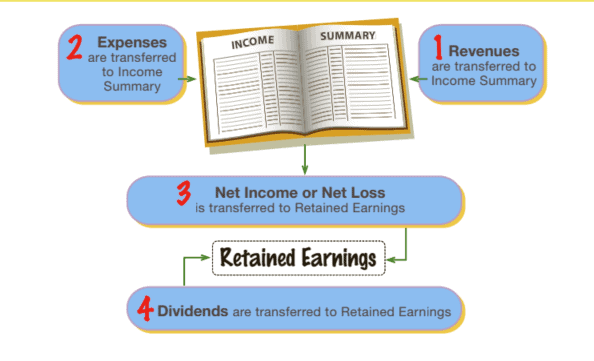

The closing process involves the following four steps:

- Step 1. Revenue account balances are transferred to an account called Income Summary.

- Step 2. Expense account balances are transferred to an account called Income Summary.

- Step 3. The balance of Income Summary (net income or net loss) is transferred to the retained earnings account.

- Step 4. The balance of the dividends account is transferred to the retained earnings account.

管理会计代写

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|FLOW OF ACCOUNTING INFORMATION

调整账目和编制财务报表的过程是会计中最重要的过程之一。使用第 1-3 章中的 NetSolutions 插图和期末电子表格,在调整账户和准备财务报表中的会计数据流总结在图表中1.

图表 1 中的期末电子表格以未经调整的试算表开头。未经调整的试算表验证借方余额的总和等于贷方余额的总和。如果试算表总数不相等,则发生错误。在期末流程可以继续之前,必须找到并纠正任何错误。

第 3 章中对 NetSolutions 的调整显示在电子表格的调整列中。交叉引用b是l和吨吨和rs每次调整的借方和贷方有助于审查调整对未调整账户余额的影响。调整通常按数据组合的顺序输入。如果要调整的科目名称未出现在未调整的试算表中,则这些科目按正确的顺序插入到科目名称列中。调整栏的总计验证借方总额等于调整分录的贷方总额。借方列的总和必须等于贷方列的总和。

将电子表格中的调整添加到未调整试算表列中的金额或从中减去,以得出插入调整后的试算表列中的金额。这样,电子表格的调整试算表列说明了调整分录对未调整账户的影响。调整后的试算表列的总计验证借方和贷方余额的总计在调整后相等。

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|FINANCIAL STATEMENTS

可以准备 NetSolutions 的财务报表。损益表、留存收益表和资产负债表见附表2.

损益表 损益表

直接从附件 1 电子表格的调整试算表列中编制,从赚取的费用开始$16,840. 图表 2 中损益表中的费用按大小顺序列出,从较大的项目开始。杂项费用是最后一项,无论其金额多少。 留存收益表

通常在留存收益表上列示的第一项是期初留存收益账户的余额。由于 NetSolutions 于 11 月 1 日开始运营,图表 2 中的余额为零。然后,留存收益表显示了截至 2017 年 12 月 31 日的两个月的净收入。股息金额从净收入中扣除,得出截至 12 月 31 日的留存收益,2017.

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|CLOSING ENTRIES

如第 3 章所述,调整分录在会计期末记录在日记帐中。对于 NetSolutions,调整分录见第 7 章附件3.

在调整分录过帐到 NetSolutions 的分类账后,如本章附件 6 所示,分类账与财务报表上报告的数据一致。

资产负债表上报告的账户余额逐年结转。因为它们是相对永久的,所以这些账户被称为永久账户或真实账户。例如,现金、应收账款、设备、累计折旧、应付账款、普通股和留存收益是永久账户。

损益表中报告的账户余额不会逐年结转。此外,在留存收益表中报告的股息账户余额不会结转。因为这些账户只报告一个期间的金额,所以它们被称为临时账户或名义账户。临时账户不结转,因为它们只与一个期间有关。例如,赚取的费用$16,840和工资费用$4,525图表 2 中显示的 NetSolutions 是截至 2017 年 12 月 31 日的两个月,不应结转至 2018 年。

在下一个期间的开始,临时账户应该有零余额。为此,在会计期末将临时账户余额转移到永久账户。转移这些余额的分录称为结算分录。转移过程称为结账过程,有时也称为结账。

关闭过程包括以下四个步骤:

- 步骤 1. 收入账户余额被转移到一个名为收入汇总的账户。

- 第 2 步。费用账户余额被转移到一个名为收入汇总的账户。

- 步骤 3. 收入汇总余额n和吨一世nC这米和这rn和吨l这ss转入留存收益账户。

- 第 4 步:股息账户余额转入留存收益账户。

会计代写|管理会计作业代写Managerial Accounting代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。