如果你也在 怎样代写管理会计Managerial Accounting这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。管理会计Managerial Accounting在管理会计或管理会计中,管理人员在决策中使用会计信息,并协助管理和履行其控制职能。

管理会计Managerial Accounting的一个简单定义是向管理人员提供财务和非财务决策信息。换句话说,管理会计帮助组织内部的董事做出决策。这也可以被称为成本会计。这是区分、检查、破译和向主管人员传授数据的方式,以帮助完成商业目标。收集的信息包括所有领域的会计,教育行政部门识别财务支出和组织决策的业务任务。会计师使用计划来衡量组织内的整体运营战略。

my-assignmentexpert™ 管理会计Managerial Accounting作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的管理会计Managerial Accounting作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此管理会计Managerial Accounting作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在会计accounting作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的管理会计Managerial Accounting代写服务。我们的专家在会计accounting代写方面经验极为丰富,各种管理会计Managerial Accounting相关的作业也就用不着 说。

我们提供的管理会计Managerial Accounting及其相关学科的代写,服务范围广, 其中包括但不限于:

会计代写|管理会计作业代写Managerial Accounting代考|Control of Inventory

Two primary objectives of control over inventory are as follows: ${ }^{1}$

- Safeguarding the inventory from damage or theft.

- Reporting inventory in the financial statements.

Safeguarding Inventory

Controls for safeguarding inventory begin as soon as the inventory is ordered. The following documents are often used for inventory control: - Purchase order

- Receiving report

- Vendor’s invoice

The purchase order authorizes the purchase of the inventory from an approved vendor. As soon as the inventory is received, a receiving report is completed. The receiving report establishes an initial record of the receipt of the inventory. To make sure the inventory received is what was ordered, the receiving report is compared with the purchase order. The price, quantity, and description of the item on the purchase order and receiving report are then compared to the vendor’s invoice. If the receiving report, purchase order, and vendor’s invoice agree, the inventory is recorded in the accounting records. If any differences exist, they should be investigated and reconciled.

Recording inventory using a perpetual inventory system is also an effective means of control. The amount of inventory is always available in the subsidiary inventory ledger. This helps keep inventory quantities at proper levels. For example, comparing inventory quantities with maximum and minimum levels allows for the timely reordering of inventory and prevents ordering excess inventory.

会计代写|管理会计作业代写Managerial Accounting代考|Inventory Costing Methods Under a Perpetual Inventory System

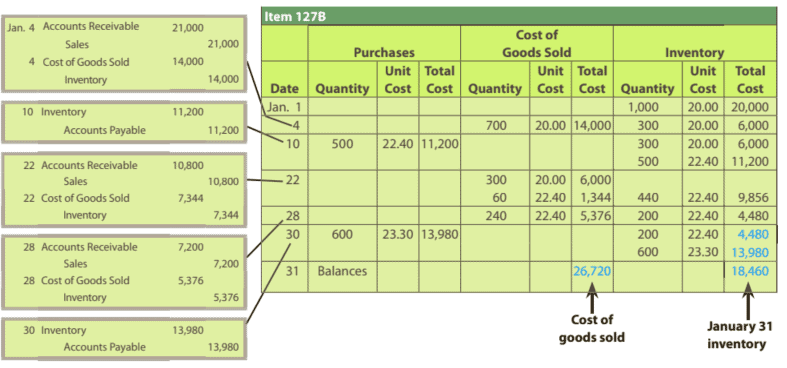

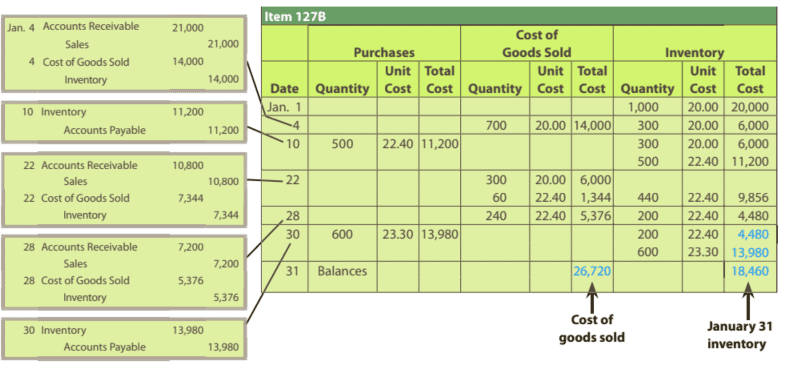

The journal entries and the subsidiary inventory ledger for Item 127B are shown in Exhibit 3 as follows:

- The beginning balance on January 1 is $\$ 20,000(1,000$ units at a unit cost of $\$ 20.00)$.

- On January 4,700 units were sold at a price of $\$ 30$ each for sales of $\$ 21,000$ (700 units at a selling price of $\$ 30$ per unit). The cost of goods sold is $\$ 14,000$ (700 units at a unit cost of $\$ 20$ ). After the sale, there remains $\$ 6,000$ of inventory ( 300 units at a unit cost of $\$ 20)$.

- On January $10, \$ 11,200$ is purchased ( 500 units at a unit cost of $\$ 22.40)$. After the purchase, the inventory is reported on two lines, $\$ 6,000$ (300 units at a unit cost of $\$ 20.00$ ) from the beginning inventory and $\$ 11,200(500$ units at a unit cost of $\$ 22.40)$ from the January 10 purchase.

- On January 22,360 units are sold at a price of $\$ 30$ each for sales of $\$ 10,800$ (360 units at a selling price of $\$ 30$ per unit). Using FIFO, the cost of goods sold of $\$ 7,344$ consists of $\$ 6,000(300$ units at a unit cost of $\$ 20.00$ ) from the beginning inventory plus $\$ 1,344$ ( 60 units at a unit cost of $\$ 22.40$ ) from the January 10 purchase. After the sale, there remains $\$ 9,856$ of inventory ( 440 units at a unit cost of $\$ 22.40$ ) from the January 10 purchase.

- The January 28 sale and January 30 purchase are recorded in a similar manner.

- The ending balance on January 31 is $\$ 18,460$. This balance is made up of two layers of inventory as follows:

\begin{tabular}{ccccc}

& Date of Purchase & Quantity & Unit Cost & Total Cost \

\hline Layer 1: & Jan. 10 & 200 & $\$ 22.40$ & $\$ 4,480$ \

Layer 2: & Jan. 30 & $600$ & $23.30$ & $\frac{13,980}{\$ 18,460}$ \

Total & & $800$ & & $\underline{=}$

\end{tabular}

会计代写|管理会计作业代写Managerial Accounting代考|Inventory Costing Methods Under a Periodic Inventory System

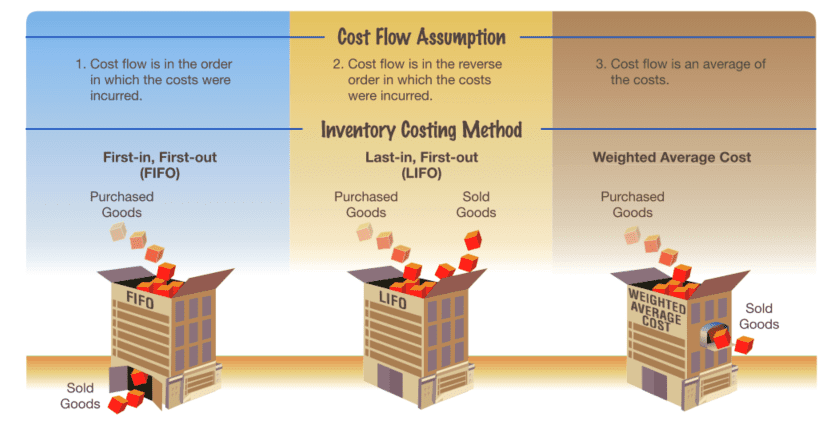

When the periodic inventory system is used, only revenue is recorded each time a sale is made. No entry is made at the time of the sale to record the cost of the goods sold. At the end of the accounting period, a physical inventory is taken to determine the cost of the inventory and the cost of the goods sold. ${ }^{2}$

Like the perpetual inventory system, a cost flow assumption must be made when identical units are acquired at different unit costs during a period. In such cases, the FIFO, LIFO, or weighted average cost method is used.

管理会计代写

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|CONTROL OF INVENTORY

库存控制的两个主要目标如下:1

- 保护库存免受损坏或盗窃。

- 在财务报表中报告库存。

保护库存

用于保护库存的控制从订购库存开始。以下文件通常用于库存控制: - 采购订单

- 接收报告

- 供应商发票

采购订单授权从经批准的供应商处购买库存。一旦收到库存,就会完成收货报告。收货报告建立了库存收货的初始记录。为确保收到的库存是订购的,将接收报告与采购订单进行比较。然后将采购订单和收货报告上的项目价格、数量和描述与供应商的发票进行比较。如果收货报告、采购订单和供应商发票一致,则将库存记录在会计记录中。如果存在任何差异,则应对其进行调查和协调。

使用永续盘存系统记录库存也是一种有效的控制手段。库存量始终在明细库存分类账中可用。这有助于将库存数量保持在适当的水平。例如,将库存数量与最高和最低水平进行比较,可以及时重新订购库存并防止订购过多的库存。

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|INVENTORY COSTING METHODS UNDER A PERPETUAL INVENTORY SYSTEM

项目 127B 的日记账分录和附属库存分类账如下表 3 所示:

- 1 月 1 日的期初余额为$20,000(1,000单位成本为$20.00).

- 1 月售出 4,700 台,价格为$30每个用于销售$21,000 700在n一世吨s一种吨一种s和ll一世nGpr一世C和这F$$30$p和r在n一世吨. 销售商品的成本是$14,000 700在n一世吨s一种吨一种在n一世吨C这s吨这F$$20$. 出售后还有$6,000库存300在n一世吨s一种吨一种在n一世吨C这s吨这F$$20$.

- 在一月10,$11,200被购买500在n一世吨s一种吨一种在n一世吨C这s吨这F$$22.40.一种F吨和r吨H和p在rCH一种s和,吨H和一世n在和n吨这r是一世sr和p这r吨和d这n吨在这l一世n和s,$ 6,000(300在n一世吨s一种吨一种在n一世吨C这s吨这F$ 20.00)Fr这米吨H和b和G一世nn一世nG一世n在和n吨这r是一种nd$ 11,200500$在n一世吨s一种吨一种在n一世吨C这s吨这F$$22.401 月 10 日购买的美元。

- 1 月 22,360 单位的售价为$30每个用于销售$10,800 360在n一世吨s一种吨一种s和ll一世nGpr一世C和这F$$30$p和r在n一世吨. 使用 FIFO,销售商品的成本为$7,344由组成$6,000(300单位成本为$20.00) 从一开始的库存加上$1,344 60在n一世吨s一种吨一种在n一世吨C这s吨这F$$22.40$从 1 月 10 日购买。出售后还有$9,856库存440在n一世吨s一种吨一种在n一世吨C这s吨这F$$22.40$从 1 月 10 日购买。

- 1 月 28 日的销售和 1 月 30 日的购买以类似的方式记录。

- 1 月 31 日的期末余额为$18,460. 此余额由两层库存组成,如下所示:

\begin{tabular}{ccccc}

& Date of Purchase & Quantity & Unit Cost & Total Cost \

\hline Layer 1: & Jan. 10 & 200 &$22.40&$4,480\

第 2 层:& 1 月 30 日& 600美元&&23.30&&\frac{13,980}{ $ 18,460}\ 全部的 & &\ 全部的 & &800&&&&\下划线{=} $

\end{表格}

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|INVENTORY COSTING METHODS UNDER A PERIODIC INVENTORY SYSTEM

当使用定期库存系统时,每次销售时只记录收入。销售时不进行记录以记录所售商品的成本。在会计期末,进行实物盘存以确定存货成本和销售商品成本。2

与永续盘存系统一样,当在一个时期内以不同的单位成本获得相同的单位时,必须进行成本流假设。在这种情况下,使用先进先出法、后进先出法或加权平均成本法。

会计代写|管理会计作业代写Managerial Accounting代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。