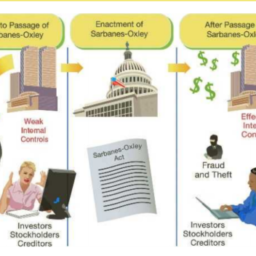

如果你也在 怎样代写管理会计Managerial Accounting这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。管理会计Managerial Accounting在管理会计或管理会计中,管理人员在决策中使用会计信息,并协助管理和履行其控制职能。

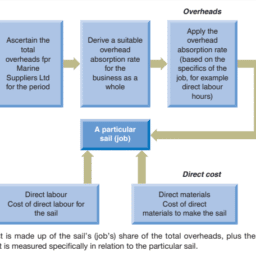

管理会计Managerial Accounting的一个简单定义是向管理人员提供财务和非财务决策信息。换句话说,管理会计帮助组织内部的董事做出决策。这也可以被称为成本会计。这是区分、检查、破译和向主管人员传授数据的方式,以帮助完成商业目标。收集的信息包括所有领域的会计,教育行政部门识别财务支出和组织决策的业务任务。会计师使用计划来衡量组织内的整体运营战略。

my-assignmentexpert™ 管理会计Managerial Accounting作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的管理会计Managerial Accounting作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此管理会计Managerial Accounting作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在会计accounting作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的管理会计Managerial Accounting代写服务。我们的专家在会计accounting代写方面经验极为丰富,各种管理会计Managerial Accounting相关的作业也就用不着 说。

我们提供的管理会计Managerial Accounting及其相关学科的代写,服务范围广, 其中包括但不限于:

会计代写|管理会计作业代写Managerial Accounting代考|Nature of Fixed Assets

Fixed assets are long-term or relatively permanent assets such as equipment, machinery, buildings, and land. Other descriptive titles for fixed assets are plant assets or property, plant, and equipment. Fixed assets have the following characteristics:

- They exist physically and, thus, are tangible assets.

- They are owned and used by the company in its normal operations.

- They are not offered for sale as part of normal operations.

Fixed assets are critical to the success of many businesses. For example, computers and Internet servers are critical fixed assets for a business that provides online retail or technology services.

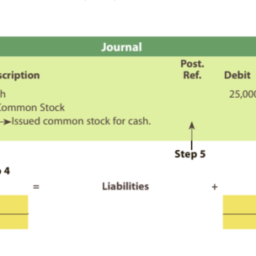

Classifying Costs

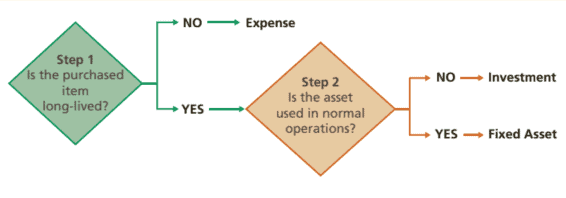

A cost that has been incurred may be classified as a fixed asset, an investment, or an expense. Exhibit 1 shows how to determine the proper classification of a cost and how it should be recorded.

会计代写|管理会计作业代写Managerial Accounting代考|Accounting for Depreciation

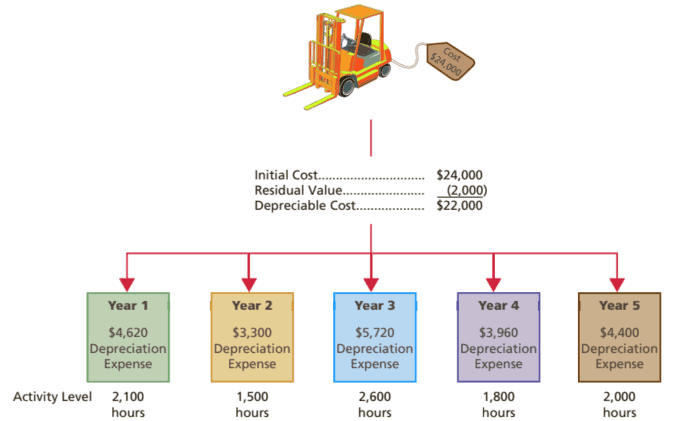

Over time, fixed assets, with the exception of land, lose their ability to provide services. Thus, the costs of fixed assets such as equipment and buildings should be recorded as an expense over their useful lives. Recording the cost of fixed assets as an expense is called depreciation. Because land has an unlimited life, it is not depreciated.

Depreciation can be caused by physical or functional factors.

- Pbysical depreciation factors include wear and tear during use or from exposure to weather.

- Functional depreciation factors include obsolescence and changes in customer needs that cause the asset to no longer provide services for which it was intended. For example, equipment may become obsolete due to changing technology.

Two common misunderstandings that exist about depreciation as used in accounting include:

- Depreciation does not measure a decline in the market value of a fixed asset. Instead, depreciation is an allocation of a fixed asset’s cost to expense over the asset’s useful life. Thus, the book value of a fixed asset (cost less accumulated depreciation) usually does not agree with the asset’s market value. This is justified in accounting because a fixed asset is for use in a company’s operations rather than for resale.

- Depreciation does not provide cash to replace fixed assets as they wear out. This misunderstanding may occur because depreciation, unlike most expenses, does not require an outlay of cash when it is recorded.

会计代写|管理会计作业代写Managerial Accounting代考|Disposal of Fixed Assets

Fixed assets that are no longer useful may be discarded or sold. ${ }^{6}$ In such cases, the fixed asset is removed from the accounts. Just because a fixed asset is fully depreciated, however, does not mean that it should be removed from the accounts.

If a fixed asset is still being used, its cost and accumulated depreciation should remain in the ledger even if the asset is fully depreciated. If the asset was removed from the ledger, the accounts would contain no evidence of their continued existence. In addition, cost and accumulated depreciation data on such assets are often needed for property tax and income tax reports.

管理会计代写

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|NATURE OF FIXED ASSETS

固定资产是设备、机器、建筑物、土地等长期或相对永久性的资产。固定资产的其他描述性标题是厂房资产或不动产、厂房和设备。固定资产具有以下特点:

- 它们实际存在,因此是有形资产。

- 它们由公司在其正常运营中拥有和使用。

- 它们不作为正常运营的一部分出售。

固定资产对许多企业的成功至关重要。例如,计算机和 Internet 服务器是提供在线零售或技术服务的企业的关键固定资产。

成本

分类 已发生的成本可分类为固定资产、投资或费用。图表 1 显示了如何确定成本的正确分类以及应如何记录它。

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|ACCOUNTING FOR DEPRECIATION

随着时间的推移,除土地外的固定资产将失去提供服务的能力。因此,设备和建筑物等固定资产的成本应在其使用寿命内记为费用。将固定资产的成本记录为费用称为折旧。因为土地有无限的生命,它不会贬值。

折旧可能是由物理或功能因素引起的。

- 物理折旧因素包括使用过程中或暴露在天气中的磨损。

- 功能性折旧因素包括导致资产不再提供预期服务的过时和客户需求变化。例如,由于技术的变化,设备可能会过时。

关于会计中使用的折旧存在两个常见的误解包括:

- 折旧并不衡量固定资产市场价值的下降。相反,折旧是在资产的使用寿命内将固定资产的成本分配给费用。因此,固定资产的账面价值C这s吨l和ss一种CC在米在l一种吨和dd和pr和C一世一种吨一世这n通常不同意资产的市场价值。这在会计上是合理的,因为固定资产用于公司的运营而不是转售。

- 折旧不提供现金来更换磨损的固定资产。这种误解可能会发生,因为与大多数费用不同,折旧在记录时不需要现金支出。

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|DISPOSAL OF FIXED ASSETS

不再使用的固定资产可能被丢弃或出售。6在这种情况下,固定资产将从帐户中删除。然而,仅仅因为固定资产完全折旧并不意味着它应该从账户中删除。

如果固定资产仍在使用中,即使该资产已完全折旧,其成本和累计折旧也应保留在分类账中。如果资产从分类账中删除,账户将不包含其继续存在的证据。此外,财产税和所得税报告通常需要此类资产的成本和累计折旧数据。

会计代写|管理会计作业代写Managerial Accounting代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。