如果你也在 怎样代写管理会计Managerial Accounting这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。管理会计Managerial Accounting在管理会计或管理会计中,管理人员在决策中使用会计信息,并协助管理和履行其控制职能。

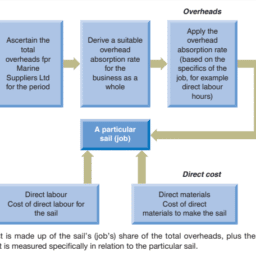

管理会计Managerial Accounting的一个简单定义是向管理人员提供财务和非财务决策信息。换句话说,管理会计帮助组织内部的董事做出决策。这也可以被称为成本会计。这是区分、检查、破译和向主管人员传授数据的方式,以帮助完成商业目标。收集的信息包括所有领域的会计,教育行政部门识别财务支出和组织决策的业务任务。会计师使用计划来衡量组织内的整体运营战略。

my-assignmentexpert™ 管理会计Managerial Accounting作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的管理会计Managerial Accounting作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此管理会计Managerial Accounting作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在会计accounting作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的管理会计Managerial Accounting代写服务。我们的专家在会计accounting代写方面经验极为丰富,各种管理会计Managerial Accounting相关的作业也就用不着 说。

我们提供的管理会计Managerial Accounting及其相关学科的代写,服务范围广, 其中包括但不限于:

会计代写|管理会计作业代写Managerial Accounting代考|Uncollectible Receivables

In prior chapters, the accounting for sales of merchandise or services on account (on credit) was described and illustrated. A major issue that has not yet been discussed is that some customers will not pay their accounts. That is, some accounts receivable will be uncollectible. Companies may shift the risk of uncollectible receivables to other companies. For example, some retailers do not accept sales on account but will only accept cash or credit cards. Such policies shift the risk to the credit card companies.

Companies may also sell their receivables. This is often the case when a company issues its own credit card. For example, Macy’s and JCPenmey issue their own credit cards. Selling receivables is called factoring the receivables. The buyer of the receivables is called a factor. An advantage of factoring is that the company selling its receivables immediately receives cash for operating and other needs. Also, depending on the factoring agreement, some of the risk of uncollectible accounts is shifted to the factor.

Regardless of how careful a company is in granting credit, some credit sales will be uncollectible. The operating expense recorded from uncollectible receivables is called bad debt expense, uncollectible accounts expense, or doubtful accounts expense.

There is no general rule for when an account becomes uncollectible. Some indications that an account may be uncollectible include the following:

- The receivable is past due.

- The customer does not respond to the company’s attempts to collect.

- The customer files for bankruptcy.

- The customer closes its business.

- The company cannot locate the customer.

If a customer doesn’t pay, a company may turn the account over to a collection agency. After the collection agency attempts to collect payment, any remaining balance in the account is considered worthless.

The two methods of accounting for uncollectible receivables are as follows: - The direct write-off method records bad debt expense only when an account is determined to be worthless.

- The allowance method records bad debt expense by estimating uncollectible accounts at the end of the accounting period.

会计代写|管理会计作业代写Managerial Accounting代考|Comparing Direct Write-Off and Allowance Methods

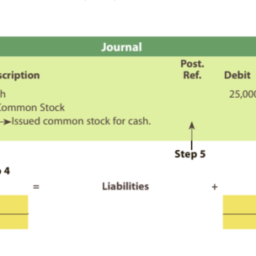

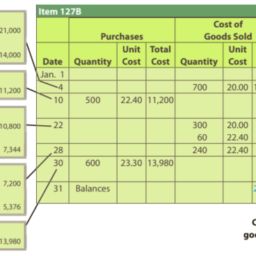

Journal entries for the direct write-off and allowance methods are illustrated and compared in this section. As a basis for illustration, the following transactions, taken from the records of Hobbs Company for the year ending December 31, are used:

Mar. 1. Wrote off account of C. York, $\$ 3,650$.

Apr. 12. Received $\$ 2,250$ as partial payment on the $\$ 5,500$ account of Cary Bradshaw. Wrote off the remaining balance as uncollectible.

June 22. Received the $\$ 3,650$ from C. York, which had been written off on March 1. Reinstated the account and recorded the cash receipt.

Sept. 7. Wrote off the following accounts as uncollectible (record as one journal entry):

$\begin{array}{lr}\text { Jason Bigg } & \$ 1,100 \ \text { Steve Bradey } & 2,220 \ \text { Samantha Neeley } & 775 \ \text { Stanford Noonan } & 1,360 \ \text { Aiden Wyman } & 990\end{array}$

Dec. 31. Hobbs Company uses the percent of credit sales method of estimating uncollectible expenses. Based on past history and industry averages, $1.25 \%$ of credit sales are expected to be uncollectible. Hobbs recorded $\$ 3,400,000$ of credit sales during the year.

Exhibit 4 illustrates the journal entries for Hobbs using the direct write-off and allowance methods. Using the direct write-off method, there is no adjusting entry on December 31 for uncollectible accounts. In contrast, the allowance method records an adjusting entry for estimated uncollectible accounts of $\$ 42,500$.

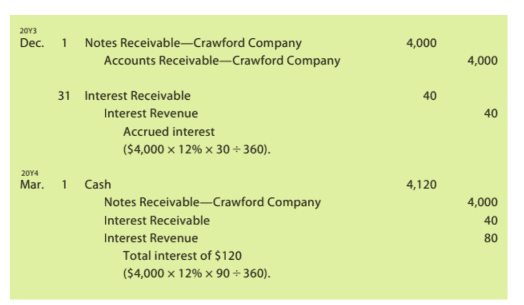

会计代写|管理会计作业代写Managerial Accounting代考|Notes Receivable

A note has some advantages over an account receivable. By signing a note, the debtor recognizes the debt and agrees to pay it according to its terms. Thus, a note is a stronger legal claim.

Characteristics of Notes Receivable

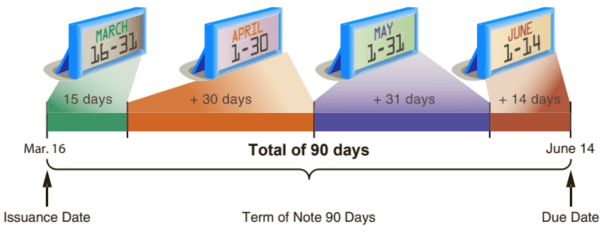

A promissory note is a written promise to pay the face amount, usually with interest, on demand or at a date in the future. ${ }^{2}$ Characteristics of a promissory note are as follows:

1 . The maker is the party making the promise to pay.

- The payee is the party to whom the note is payable.

管理会计代写

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|UNCOLLECTIBLE RECEIVABLES

在前面的章节中,商品或服务销售的会计核算这nCr和d一世吨进行了描述和说明。尚未讨论的一个主要问题是一些客户不会支付他们的账户。也就是说,一些应收账款将无法收回。公司可能会将无法收回的应收账款的风险转移给其他公司。例如,一些零售商不接受赊销,而只接受现金或信用卡。这些政策将风险转移到信用卡公司。

公司也可以出售其应收账款。当公司发行自己的信用卡时,通常会出现这种情况。例如,梅西百货和 JCPenmey 发行自己的信用卡。出售应收账款称为应收账款保理。应收账款的买方称为保理商。保理的一个优势是出售其应收账款的公司会立即收到现金以满足运营和其他需求。此外,根据保理协议,无法收回账户的一些风险转移到了保理商身上。

无论公司在授予信贷方面多么谨慎,一些信贷销售将无法收回。从无法收回的应收款项中记录的运营费用称为坏账费用、无法收回的账户费用或呆账费用。

帐户何时无法收回没有一般规则。帐户可能无法收回的一些迹象包括:

- 应收款项已逾期。

- 客户没有回应公司的收款尝试。

- 客户申请破产。

- 客户关闭其业务。

- 公司无法找到客户。

如果客户不付款,公司可能会将帐户移交给收款机构。在收款机构尝试收款后,账户中的任何余额都被视为一文不值。

无法收回的应收账款的两种会计处理方法如下: - 直接核销法仅在确定帐户毫无价值时才记录坏账费用。

- 备抵法通过在会计期末估计坏账来记录坏账费用。

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|COMPARING DIRECT WRITE-OFF AND ALLOWANCE METHODS

本节说明并比较了直接核销和备抵法的日记帐分录。作为说明的基础,使用了以下交易,取自 Hobbs 公司截至 12 月 31 日的年度记录:

3 月 1 日。$3,650.

4月12日. 收到$2,250作为部分付款$5,500卡里布拉德肖的帐户。将余额记为无法收回。

6 月 22 日,收到$3,650来自 C. York,已于 3 月 1 日注销。恢复帐户并记录现金收入。

9 月 7 日,将以下账目注销为无法收回r和C这rd一种s这n和j这在rn一种l和n吨r是:

杰森·比格 $1,100 史蒂夫·布雷迪 2,220 萨曼莎尼利 775 斯坦福·努南 1,360 艾登·怀曼 990

12 月 31 日。Hobbs 公司使用赊销百分比法估算无法收回的费用。根据过去的历史和行业平均水平,1.25%的赊销预计将无法收回。霍布斯记录$3,400,000年内赊销。

图表 4 显示了 Hobbs 使用直接核销和备抵法的日记账分录。使用直接核销法,12 月 31 日的坏账没有调整分录。相比之下,备抵法记录了估计无法收回的账户的调整分录$42,500.

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|NOTES RECEIVABLE

与应收账款相比,票据具有一些优势。通过签署票据,债务人承认债务并同意根据其条款支付。因此,票据是更强有力的法律主张。

应收

票据的特征本票是一种书面承诺,即按要求或在未来某一日期支付票面金额,通常附有利息。2本票的特点如下:

1.制造商是承诺付款的一方。

- 收款人是票据的应付方。

会计代写|管理会计作业代写Managerial Accounting代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。