MY-ASSIGNMENTEXPERT™可以为您提供stanford.edu MS&E310 Linear Programming线性规划课程的代写代考和辅导服务!

MS&E310课程简介

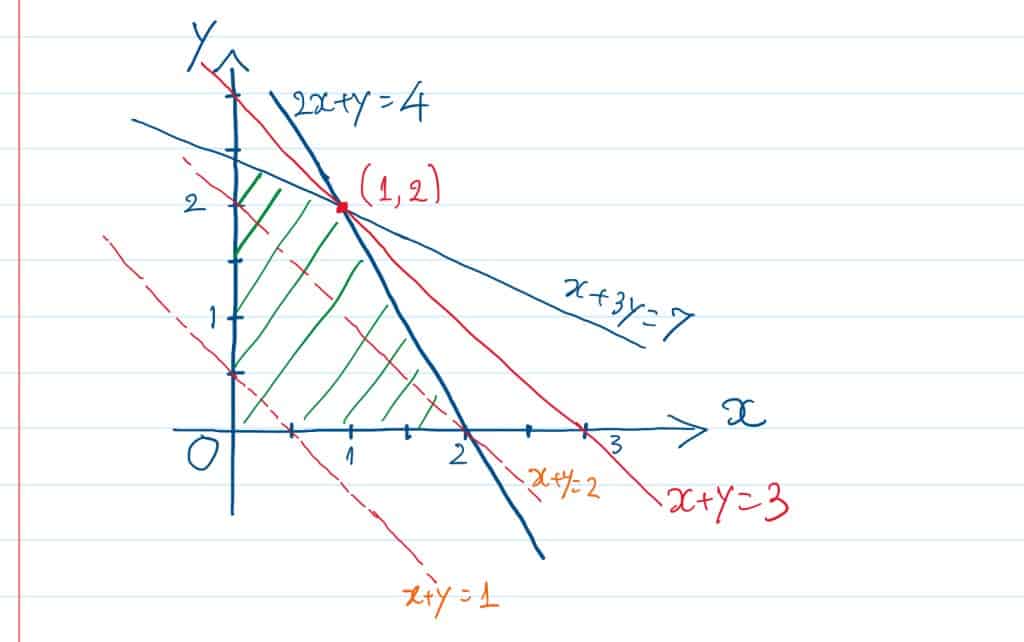

Topics include: Problem formulation of standard (conic) linear programming models, the theory of polyhedral and conic convex sets, linear inequalities, alternative theorems and duality, sensitivity analyses and economic interpretations, and relaxations of harder optimization problems. Algorithms include the simplex method, interior-point methods, and ADMM and other (first-order) iterative methods. Complexity and/or computation efficiency analysis for linear programming. Applications include dynamic resource allocation, on-line mechanism design, algorithmic game-theory, SVM/data-classification, and MDP/reinforced learning.

Prerequisites

The field of optimization is concerned with the study of maximization and minimization of mathematical functions. Very often the arguments of (i.e., variables in) these functions are subject to side conditions or constraints. By virtue of its great utility in such diverse areas as applied science, engineering, economics, finance, medicine, and statistics, optimization holds an important place in the practical world and the scientific world. Indeed, as far back as the Eighteenth Century, the famous Swiss mathematician and physicist Leonhard Euler (1707-1783) proclaimed that … nothing at all takes place in the Universe in which some rule of maximum or minimum does not appear. The subject is so pervasive that we even find some optimization terms in our everyday language.

MS&E310 Linear Programming HELP(EXAM HELP, ONLINE TUTOR)

Assume that short is not allowed, that is, one can only buy shares not sell. Formulate the problem to decide how many shares of each security to purchase so as to maximize the worst-case (minimum) pay-off when the game is finally realized.

To formulate the problem, we can use the concept of a worst-case scenario analysis, which assumes that the actual outcome of the investment will be the worst possible outcome within a certain range of possibilities.

Let’s assume that there are n securities available for purchase, each with a price p_i and a potential pay-off in the future of x_i. The problem is to decide how many shares of each security to purchase, denoted by s_i, so as to maximize the worst-case pay-off when the game is finally realized.

We can formulate this problem as a linear programming problem as follows:

Maximize: z

Subject to:

- z <= x_1 * s_1 + x_2 * s_2 + … + x_n * s_n (worst-case scenario constraint)

- s_1, s_2, …, s_n >= 0 (non-negativity constraint)

The objective function maximizes the worst-case pay-off, represented by the variable z. The worst-case scenario constraint ensures that the value of z is less than or equal to the minimum potential pay-off among all securities, weighted by the number of shares purchased. Finally, the non-negativity constraint ensures that the number of shares purchased for each security is non-negative.

The solution to this linear programming problem will give us the optimal number of shares to purchase for each security, which will maximize the worst-case pay-off.

Now assume there is no share limit (can be ∞) and short is allowed, that is, the decision variable can be both positive (buy) and negative (sell). Reformulate the portfolio problem to decide how many shares of each security to purchase so as to maximize the worst-case (minimum) pay-off when the game is finally realized.

When short-selling is allowed, the decision variable for each security can be both positive (buy) and negative (sell), and there is no limit on the number of shares that can be bought or sold. We can reformulate the portfolio problem to account for these changes as follows:

Let s_i be the number of shares bought (positive) or sold (negative) for security i, with p_i as the price of security i and x_i as the potential pay-off in the future.

The problem is to decide how many shares of each security to buy or sell to maximize the worst-case pay-off when the game is finally realized. We can formulate this as a linear programming problem as follows:

Maximize: z

Subject to:

- z <= min{x_1s_1, x_2s_2, …, x_ns_n} (worst-case scenario constraint)

- s_1p_1 + s_2p_2 + … + s_np_n = 0 (budget constraint)

- s_1, s_2, …, s_n unrestricted (unrestricted decision variables)

The objective function maximizes the worst-case pay-off, represented by the variable z. The worst-case scenario constraint ensures that the value of z is less than or equal to the minimum potential pay-off among all securities, weighted by the number of shares bought or sold. The budget constraint ensures that the total cost of buying and selling shares is zero, meaning that the total amount spent on buying shares is equal to the total amount earned by selling shares. Finally, the decision variables s_i are unrestricted, meaning that they can be positive or negative and there is no limit on the number of shares that can be bought or sold.

The solution to this linear programming problem will give us the optimal number of shares to buy or sell for each security, which will maximize the worst-case pay-off.

MY-ASSIGNMENTEXPERT™可以为您提供UNIVERSITY OF ILLINOIS URBANA-CHAMPAIGN MATH2940 linear algebra线性代数课程的代写代考和辅导服务! 请认准MY-ASSIGNMENTEXPERT™. MY-ASSIGNMENTEXPERT™为您的留学生涯保驾护航。