MY-ASSIGNMENTEXPERT™可以为您提供sydney.edu.au ACCT2019 Management Accounting管理会计的代写代考和辅导服务!

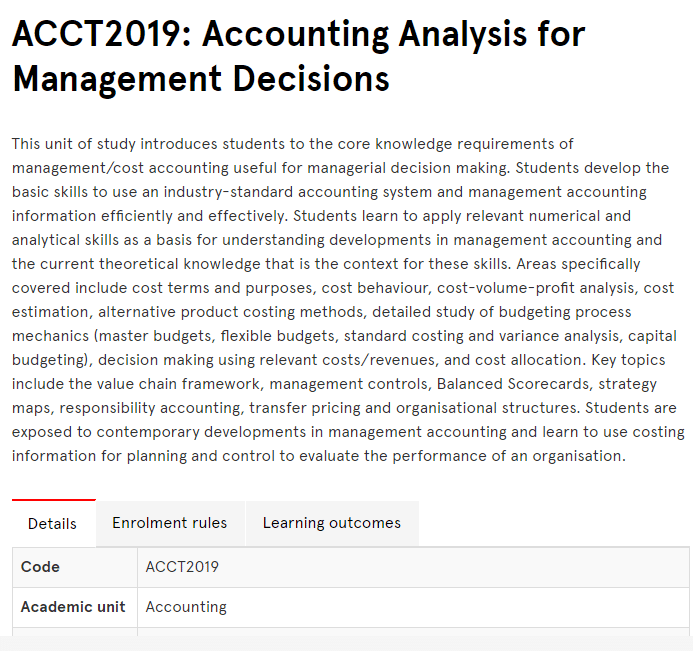

BACCT2019课程简介

This unit of study introduces students to the core knowledge requirements of management/cost accounting useful for managerial decision making. Students develop the basic skills to use an industry-standard accounting system and management accounting information efficiently and effectively. Students learn to apply relevant numerical and analytical skills as a basis for understanding developments in management accounting and the current theoretical knowledge that is the context for these skills. Areas specifically covered include cost terms and purposes, cost behaviour, cost-volume-profit analysis, cost estimation, alternative product costing methods, detailed study of budgeting process mechanics (master budgets, flexible budgets, standard costing and variance analysis, capital budgeting), decision making using relevant costs/revenues, and cost allocation. Key topics include the value chain framework, management controls, Balanced Scorecards, strategy maps, responsibility accounting, transfer pricing and organisational structures. Students are exposed to contemporary developments in management accounting and learn to use costing information for planning and control to evaluate the performance of an organisation.

Prerequisites

At the completion of this unit, you should be able to:

LO1. manage, analyse, evaluate, and use management accounting information efficiently and effectively

LO2. think critically and apply management accounting theories and concepts to business problems and practice

LO3. communicate confidently and coherently to a professional standard expected of management accountants, and plan and achieve goals, and meet challenges and deadlines, working individually or in a group setting

LO4. apply ethical decision-making criteria and sustainability considerations as part of management accounting expertise, in a broad business context

LO5. employ technologies effectively in communicating information relevant to management accounting practice, and demonstrate ability to work with an industry-standard management accounting system.

ACCT2019 Management Accounting HELP(EXAM HELP, ONLINE TUTOR)

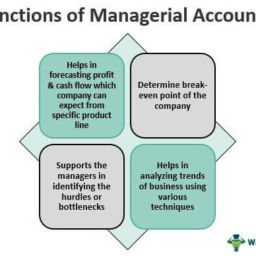

How does management accounting improve operational efficiencies, decrease operating costs and benefit senior leadership with decisions that impact product/service lines, mergers/acquisitions, and course corrections?

Management accounting plays a crucial role in improving operational efficiencies, decreasing operating costs, and benefiting senior leadership with decisions that impact product/service lines, mergers/acquisitions, and course corrections. Here are a few ways in which management accounting achieves these objectives:

- Cost analysis and reduction: Management accounting provides senior leadership with detailed insights into the costs of running a business. By analyzing the cost of each process and activity, management accountants can identify areas where costs can be reduced, and efficiency can be improved. This leads to cost savings, which can be reinvested in the business to fuel growth.

- Performance measurement and evaluation: Management accounting provides senior leadership with performance metrics that help them evaluate the performance of various business units and processes. By measuring and evaluating performance, senior leadership can identify areas of improvement and take corrective actions to improve efficiency and reduce costs.

- Budgeting and forecasting: Management accounting helps senior leadership create realistic budgets and forecasts for the business. By using historical data and industry benchmarks, management accountants can forecast future revenues, expenses, and profits. This helps senior leadership make informed decisions about product/service lines, mergers/acquisitions, and course corrections.

- Decision-making support: Management accounting provides senior leadership with the information they need to make informed decisions. By analyzing data, management accountants can identify trends, opportunities, and risks. This helps senior leadership make strategic decisions that positively impact the business.

Overall, management accounting plays a vital role in improving operational efficiencies, decreasing operating costs, and benefiting senior leadership with decisions that impact product/service lines, mergers/acquisitions, and course corrections. By providing detailed insights into the financial and operational aspects of the business, management accounting helps senior leadership make informed decisions that positively impact the bottom line.

Where can management accounting knowledge be applied, and what can I do with a mastery of management accounting? Is there ease in transferring this skill across industries? What options exist should I want to pursue a different path mid-career?

Management accounting knowledge can be applied in various industries and job roles, including:

- Corporate finance: Management accountants can work in the finance department of a company, where they are responsible for financial planning, budgeting, and forecasting.

- Consulting: Management accountants can work as consultants, providing financial and operational advice to companies across different industries.

- Public accounting: Management accountants can work in public accounting firms, where they provide financial and advisory services to clients.

- Entrepreneurship: Management accountants can use their knowledge to start and run their own businesses, where they can apply their financial and operational skills to achieve success.

- Non-profit organizations: Management accountants can work in non-profit organizations, where they can help manage finances and improve operational efficiencies.

Mastering management accounting can open up various career opportunities and lead to a fulfilling career. The skillset developed in management accounting is transferable across industries, as the core principles and practices remain the same. However, some industries may require additional training or specific industry knowledge to excel in the role.

If you want to pursue a different path mid-career, there are various options available, such as:

- Pursuing a different specialization within the accounting field, such as tax accounting, audit, or financial accounting.

- Pursuing an advanced degree, such as an MBA or a Master’s in Finance, to broaden your skill set and open up new career opportunities.

- Pursuing a career in a related field, such as operations management or business development.

- Starting your own business or becoming an entrepreneur.

In summary, management accounting knowledge can be applied in various industries and job roles, and mastering management accounting can open up various career opportunities. The skillset developed in management accounting is transferable across industries, and there are various options available should you want to pursue a different path mid-career.

MY-ASSIGNMENTEXPERT™可以为您提供UNIVERSITY OF ILLINOIS URBANA-CHAMPAIGN MATH2940 linear algebra线性代数课程的代写代考和辅导服务! 请认准MY-ASSIGNMENTEXPERT™. MY-ASSIGNMENTEXPERT™为您的留学生涯保驾护航。