MY-ASSIGNMENTEXPERT™可以为您提供sydney.edu.au ACCT2019 Management Accounting管理会计的代写代考和辅导服务!

这是悉尼大学管理会计课程的代写成功案例。

BACCT2019课程简介

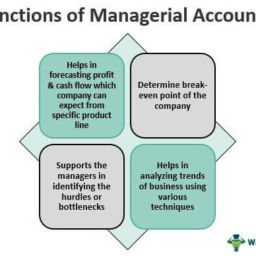

This unit of study introduces students to the core knowledge requirements of management/cost accounting useful for managerial decision making. Students develop the basic skills to use an industry-standard accounting system and management accounting information efficiently and effectively. Students learn to apply relevant numerical and analytical skills as a basis for understanding developments in management accounting and the current theoretical knowledge that is the context for these skills. Areas specifically covered include cost terms and purposes, cost behaviour, cost-volume-profit analysis, cost estimation, alternative product costing methods, detailed study of budgeting process mechanics (master budgets, flexible budgets, standard costing and variance analysis, capital budgeting), decision making using relevant costs/revenues, and cost allocation. Key topics include the value chain framework, management controls, Balanced Scorecards, strategy maps, responsibility accounting, transfer pricing and organisational structures. Students are exposed to contemporary developments in management accounting and learn to use costing information for planning and control to evaluate the performance of an organisation.

Prerequisites

At the completion of this unit, you should be able to:

LO1. manage, analyse, evaluate, and use management accounting information efficiently and effectively

LO2. think critically and apply management accounting theories and concepts to business problems and practice

LO3. communicate confidently and coherently to a professional standard expected of management accountants, and plan and achieve goals, and meet challenges and deadlines, working individually or in a group setting

LO4. apply ethical decision-making criteria and sustainability considerations as part of management accounting expertise, in a broad business context

LO5. employ technologies effectively in communicating information relevant to management accounting practice, and demonstrate ability to work with an industry-standard management accounting system.

ACCT2019 Management Accounting HELP(EXAM HELP, ONLINE TUTOR)

What is Tina’s opportunity cost from investing in the certificate of deposit?

Answer: The opportunity cost is the “profit foregone” from the best action not taken. The payoff from the action not taken is clear: it is the $\$ 350$ in interest expense avoided by paying off the loan. However, there is some ambiguity as to whether the opportunity cost is this $\$ 350$, or the difference between the $\$ 350$, and the $\$ 250$ that would be earned on the certificate of deposit, which is $\$ 100$.

This ambiguity is only a question of semantics with respect to the definition of opportunity cost; it does not create any ambiguity with respect to the information provided by the concept of opportunity cost. Clearly, the opportunity cost of paying off the auto loan implies that Tina is better off paying off the loan than investing in the certificate of deposit.

When opportunity cost is defined in terms of the difference between the two profits (the $\$ 100$ in the above example), then the opportunity cost can be either positive or negative, and a negative opportunity cost implies that the action taken is better than all alternatives.

\begin{tabular}{|c|c|c|c|}

\hline & $\begin{array}{l}\text { Beginning } \

\text { Inventory }\end{array}$ & Activity during the week & $\begin{array}{c}\text { Ending } \

\text { Inventory }\end{array}$ \

\hline Units & 0 & Units made and shipped (sold): 10 & . \

\hline $\begin{array}{l}\text { Costs } \

\text { incurred }\end{array}$ & $\$ 0^*$ & $\begin{array}{lr}\text { Materials: } & \$ 1,900 \

\text { Conversion costs: } & 940\end{array}$ & \

\hline

\end{tabular}

*Throughout these examples, the box for “costs incurred-beginning inventory” reports the beginning balance in the WIP account for the week.

What is the cost per unit for each unit made and sold?

Total costs: $\quad \$ 1,900+\$ 940=\$ 2,840$

Cost per unit: $\$ 2,840 \div 10$ units $=\$ 284$ per unit.

Since there is no ending inventory, there is no work-in-process, and no equivalent unit calculations are necessary. The cost of ending inventory is zero.

Since 10 units were sold, the cost of goods sold is $\$ 284 \times 10=\$ 2,840$.

Example 2: This example introduces ending work-in-process.

\begin{tabular}{|c|c|c|c|c|c|}

\hline & $\begin{array}{l}\text { Beginning } \

\text { Inventory } \

\end{array}$ & Activity during the week & $\mathbf{k}$ & $\begin{array}{c}\text { Ending } \

\text { Inventory } \

\end{array}$ & \

\hline Units & 0 & $\begin{array}{l}\text { Units started: } \

\text { Units completed and shipped: }\end{array}$ & $\begin{array}{r}10 \

9\end{array}$ & $\begin{array}{l}\text { Finished units: } \

\text { Partially finished units: }\end{array}$ & $\begin{array}{l}0 \

1\end{array}$ \

\hline $\begin{array}{l}\text { Costs } \

\text { incurred }\end{array}$ & $\$ 0$ & $\begin{array}{l}\text { Materials: } \

\text { Conversion costs: }\end{array}$ & $\begin{array}{l}9-900 \

940\end{array}$ & & \

\hline

\end{tabular}

Question: What is the cost of goods sold? What is the cost of ending work-in-process?

Unable to determine without knowing the extent to which the partially-finished unit is completed.

Example 3: Same as Example 2, but with additional information about the status of ending work-in-process.

\begin{tabular}{|l|r|l|l|}

\hline & $\begin{array}{c}\text { Beginning } \

\text { Inventory }\end{array}$ & \multicolumn{1}{|c|}{ Activity during the week } & \multicolumn{1}{|c|}{$\begin{array}{c}\text { Ending } \

\text { Inventory }\end{array}$} \

\hline Units & 0 & $\begin{array}{l}\text { Units started: } \

\text { Units completed and shipped: } 9\end{array}$ & $\begin{array}{l}\text { Finished units: } \

\text { Partially finished units: } 1 \

\text { (it is 50\% complete with } \

\text { respect to both materials and } \

\text { conversion costs) }\end{array}$ \

\hline $\begin{array}{l}\text { Costs } \

\text { incurred }\end{array}$ & $\$ 0$ & $\begin{array}{l}\text { Materials: } \

\text { Conversion costs: }\end{array} 900$ & \

\hline

\end{tabular}

Questions: What is cost of goods sold? What is the cost of ending work-in-process?

Answer:

Total costs: $\quad \$ 1,900+\$ 940=\$ 2,840$

Equivalent units: $\quad 9$ completed units +1 unit $50 \%$ complete $=9.5$ equivalent units

Cost per unit: $\quad \$ 2,840 \div 9.5$ units $=\$ 299$ per equivalent unit

Cost of goods sold: $\quad 9$ units were sold. The cost of goods sold is $\$ 299 \times 9=\$ 2,691$.

Work-in-process: $\quad \$ 299$ per unit x 1 unit $50 \%$ complete $=\$ 149.50$

MY-ASSIGNMENTEXPERT™可以为您提供SYDNEY.EDU.AU ACCT2019 MANAGEMENT ACCOUNTING管理会计的代写代考和辅导服务!