如果你也在 怎样代写金融衍生品Financial Derivatives 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。金融衍生品Financial Derivatives是金融工具的三大类之一,另外两类是股权(即股票或股份)和债权(即债券和抵押贷款)。历史上最古老的衍生品例子,由亚里士多德证明,被认为是古希腊哲学家泰勒斯签订的橄榄合同交易,他在交换中获利。1936年被取缔的桶装水商店是一个较近的历史例子。

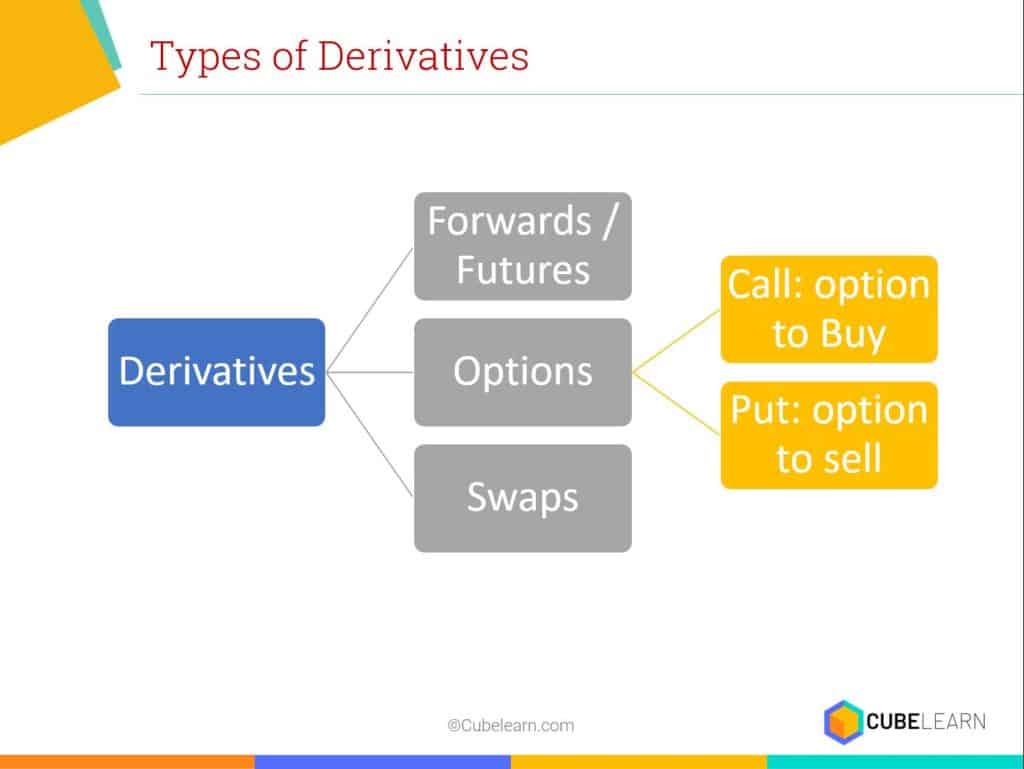

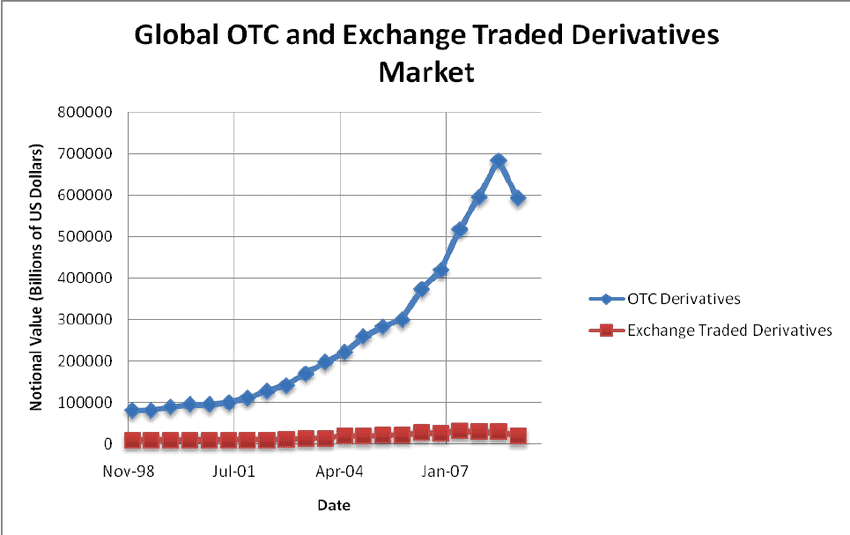

金融衍生品Financial Derivatives在金融领域,衍生品是一种合同,其价值来自于一个基础实体的表现。衍生品可用于多种目的,包括对价格变动进行保险(套期保值),为投机增加价格变动的风险,或进入其他难以交易的资产或市场。一些更常见的衍生品包括远期、期货、期权、掉期,以及这些的变体,如合成抵押债务和信用违约掉期。大多数衍生品在场外(场外)或芝加哥商品交易所等交易所进行交易,而大多数保险合同已经发展成为一个独立的行业。在美国,在2007-2009年的金融危机之后,将衍生品转移到交易所进行交易的压力越来越大。

金融衍生品Financial Derivatives代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。最高质量的金融衍生品Financial Derivatives作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此金融衍生品Financial Derivatives作业代写的价格不固定。通常在专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

金融代写|金融衍生品代写Financial Derivatives代考|Netting and Novation in Exchange and OTC Markets

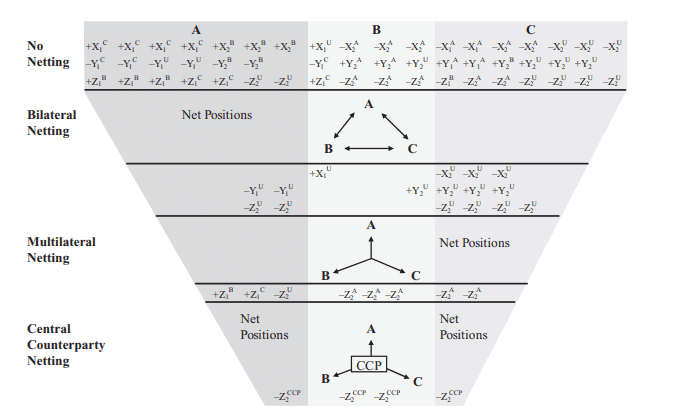

Derivatives users in the exchange and the OTC markets employ netting techniques across the pre- and posttrading functions. Prior to the trade, the technique of netting guides the assumption of risk in trading and intermediation in the front office of derivatives investors, brokers, and dealers. It is also frequently utilized in the middle office to inform the risk management activities of dealers, asset managers, and their principals, allowing the recognition of offsets and the monitoring of the risk of the traders, positions, particular strategies, and for the organization at large. But it is in the postrade setting that netting delivers the greatest potential benefit by reducing actual obligations and payments resulting in effective reduction in settlement and counterparty default risk.

In posttrade processing, the practice of netting, or the reduction of payment and asset flows by the recognition of offsetting positions held among counterparties, is an important means by which exchanges and other financial networks have reduced risks associated with settlement (i.e., with respect to payments and deliveries associated with transactions). Until recently, OTC dealers primarily employed bilateral netting techniques in positions and payments. In the bilateral context, position netting is accomplished when two counterparties recognize and offset similar obligations they have to each other. For example, assume Party A has a contract obligating it to deliver 50 securities to Party B and Party B has a contract obligating it to deliver 100 of the same securities to Party A. If the counterparties agree to net their obligations, Party B would make a single transfer of 50 securities to Party A. As a result of netting, two transfers are reduced to one, lowering settlement risk. In addition, Party $\mathrm{A}$ is now exposed to nonperformance on only 50 securities, while Party B’s exposure is reduced to zero, resulting in lower credit exposure for both counterparties (Culp 2004).

Position netting between counterparties in OTC derivatives is complicated by the fact that some privately negotiated transactions contain customized features that limit their fungibility. Contracts on more standard OTC derivatives are amenable for position netting, and more widespread application of position netting could lower delivery costs as well as reduce settlement risks. At the time of the publication of his book, Culp (2004) noted that of the four types of netting (position, payment, novation, and closeout) only closeout netting was commonly applied to OTC transactions. While netting has long been identified as a goal of dealers in the OTC markets, netting on a widespread basis has been hampered by the necessity of adopting and confirming bilateral netting agreements (e.g., through netting provisions in ISDA Master Agreements) and the prevalence of manual processes in the delivery and payment systems (ISDA, 2004).

金融代写|金融衍生品代写Financial Derivatives代考|TRANSPARENCY AND INFORMATION IN THE EXCHANGE AND OTC MARKETPLACES

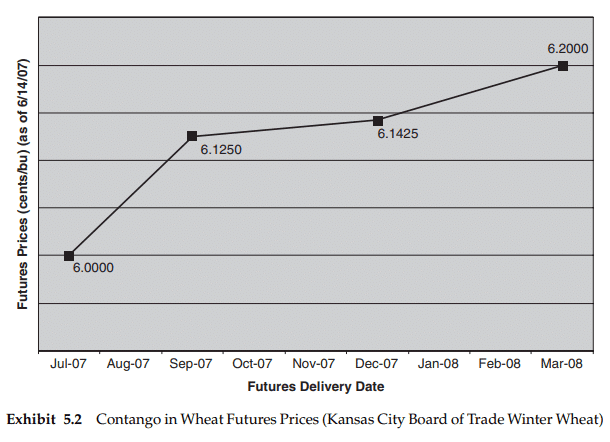

One of the primary functions of organized exchanges that became evident early in their history is that the prices that result from transactions in the market are regarded as benchmarks for transactions off the exchange. The assembly of trading interest and the transmission of order information regarding the prices at which customers are willing to buy and sell allow market participants to assess market conditions and others’ expectations. As information arrives from various sources and is reflected in the bids, offers, and transaction prices, the exchange mechanism acts as an information aggregator, and this contributes to highly efficient price discovery. As the primary mechanism of price discovery, exchanges have attracted both the commercial interest and the ire of producers, millers, elevator operators, refiners, utilities, distributors, and consumers, all of whom look to the prices generated in the markets for guidance in pricing their transactions in the cash commodity.

Various OTC contracts utilize the prices generated in the exchange marketplace. This feature, sometimes referred to as price basing, is exemplary of the complementary nature of the exchange and OTC markets. However, different approaches used in pricing complex products, in addition to conditions of illiquidity that have resulted in a paucity of prices, have increased suspicion that OTC markets represent an obscure source of market, credit, and systemic risk. Even as effective mechanisms for risk management have been adopted and have become common to OTC derivatives and asset management operations, their implementation in the OTC market has been called into question due to a perceived lack of transparency and the different methods of pricing the assets available in the OTC setting.

Because of their structure, exchanges are able to centralize information collection and dissemination, leading to a high degree of transparency about the volume of assets traded and their values. Customized contracts characteristic of OTC markets are less amenable to the exchange model, since individual terms of contracts can be quite diverse, making prices and information harder to aggregate. Prices may differ due to terms related to the contract, the quality of the asset and delivery characteristics, differences in the times entered, the prevailing liquidity considerations, and even differences in the credit quality of the counterparties. For the same reasons, efforts to clear OTC products also face the challenge of finding adequate benchmarks to set their value and accommodate the mark-to-market process.

OTC trading systems, the most successful of which is the ICE, are sometimes referred to by critics as “dark markets” due to the perception that they are less transparent than organized exchanges. But it is important to remember that these markets are primarily designed as wholesale markets, with users confined to large commercial entities and institutional investors. Since these markets are not open to retail investors and are limited to large and sophisticated entities, regulation adopted in 2000 provided them with an exemption from many of the disclosure and supervisory responsibilities applied to exchanges. While the tiered regulatory approach was initially heralded as a practical means to accommodate the different characteristics of a proprietary market and its users, critics of OTC markets have argued that the exemptions give them an unfair competitive advantage over exchanges, which are subject to direct regulation by the Commodity Futures Trading Commission (CFTC), and could attract manipulators and speculators bent on avoiding the watchful eye of the regulator.

金融衍生品代写

金融代写|金融衍生品代写Financial Derivatives代考|Netting and Novation in Exchange and OTC Markets

交易所和场外市场的衍生品用户在交易前和交易后使用净额结算技术。在交易之前,净额结算技术指导衍生品投资者、经纪人和交易商在交易和中介过程中的风险承担。它也经常被用于中办,告知交易商、资产经理及其委托人的风险管理活动,允许确认抵消和监控交易者、头寸、特定策略以及整个组织的风险。但只有在交易后的环境中,净额结算才能带来最大的潜在好处,因为它减少了实际的义务和支付,从而有效地减少了结算和交易对手违约风险。在交易后处理中,通过确认交易对手之间持有的抵消头寸来减少支付和资产流动的做法,是交易所和其他金融网络降低与结算(即与交易相关的支付和交付)相关风险的重要手段。直到最近,场外交易商在头寸和支付中主要采用双边净额结算技术。在双边情况下,当两个交易对手承认并抵消他们彼此承担的类似义务时,就实现了头寸净额。例如,假设甲方有义务向乙方交付50只证券的合同,而乙方有义务向甲方交付100只相同的证券的合同。如果交易对手双方同意将其义务抵扣,则乙方将向甲方一次性转让50只证券。由于抵扣,两次转让减少为一次,降低了结算风险。此外,方$\ mathm {A}$现在只有50只证券的不良风险敞口,而乙方的风险敞口减少到零,导致交易对手双方的信用风险敞口降低(Culp 2004)。场外衍生品交易对手之间的头寸净额结算是复杂的,因为一些私下协商的交易包含限制其可替代性的定制特征。更标准的场外衍生品合约可以采用头寸净额结算,而头寸净额结算的更广泛应用可以降低交割成本,降低结算风险。在他的书出版时,Culp(2004)指出,在四种类型的净额结算(持仓、支付、创新和清仓)中,只有清仓净额结算通常适用于场外交易。虽然净额结算长期以来一直被认为是场外交易市场交易商的目标,但由于必须采用和确认双边净额结算协议(例如,通过ISDA主协议中的净额结算条款)以及在交付和支付系统中普遍采用手工流程,广泛的净额结算一直受到阻碍(ISDA, 2004年)。

金融代写|金融衍生品代写Financial Derivatives代考|TRANSPARENCY AND INFORMATION IN THE EXCHANGE AND OTC MARKETPLACES

有组织的交易所的主要功能之一是,市场交易的价格被视为交易所外交易的基准,这一点在其历史早期就很明显。交易兴趣的集合和有关客户愿意买卖的价格的订单信息的传递使市场参与者能够评估市场状况和他人的期望。由于信息来自不同的来源,并反映在出价、出价和交易价格中,交换机制充当了信息聚合器,这有助于高效地发现价格。作为价格发现的主要机制,交易所既吸引了生产商、磨坊主、电梯操作员、炼油厂、公用事业公司、分销商和消费者的商业兴趣,也吸引了他们的愤怒,他们都以市场产生的价格为指导,为他们的现金商品交易定价。

各种场外交易合约利用交易所市场产生的价格。这一特点,有时被称为价格基础,是交易所和场外交易市场互补性的典范。然而,在复杂产品定价中使用的不同方法,加上导致价格缺乏的非流动性条件,增加了人们对OTC市场代表市场、信用和系统风险的模糊来源的怀疑。尽管有效的风险管理机制已被采用,并已成为场外衍生品和资产管理业务的常见机制,但由于缺乏透明度和场外交易环境中可用资产的不同定价方法,这些机制在场外市场的实施受到了质疑。

由于其结构,交易所能够集中信息收集和传播,从而使交易资产的数量及其价值具有高度透明度。场外交易市场的定制合同特征不太适合交易所模式,因为单个合同条款可能非常多样化,使得价格和信息难以汇总。价格可能会因与合同相关的条款、资产质量和交付特征、进入时间的差异、普遍的流动性考虑,甚至交易对手的信用质量差异而有所不同。出于同样的原因,清算场外交易产品的努力也面临着寻找足够的基准来确定其价值并适应按市值计价的过程的挑战。

场外交易系统——其中最成功的是洲际交易所(ICE)——有时被批评者称为“黑暗市场”,因为人们认为它们不如有组织的交易所透明。但重要的是要记住,这些市场主要是作为批发市场设计的,用户仅限于大型商业实体和机构投资者。由于这些市场不对散户投资者开放,而且仅限于大型和成熟的实体,2000年通过的监管规定为它们提供了豁免,使它们不必承担适用于交易所的许多披露和监管责任。虽然分级监管方法最初被认为是一种实用的手段,可以适应自营市场及其用户的不同特点,但场外市场的批评者认为,这些豁免使它们相对于交易所具有不公平的竞争优势,而交易所受美国商品期货交易委员会(CFTC)的直接监管,可能会吸引有意避开监管机构监管的操纵者和投机者。

金融代写|金融衍生品代写Financial Derivatives代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。