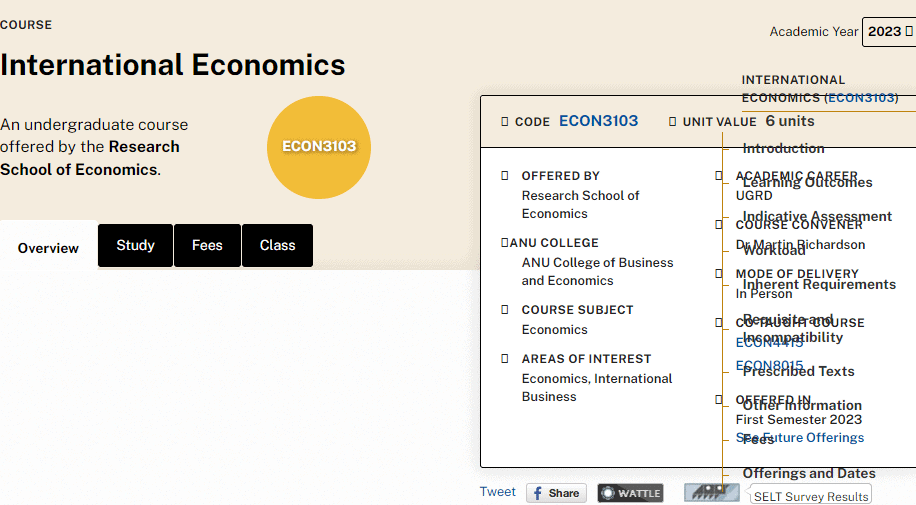

MY-ASSIGNMENTEXPERT™可以为您提供programsandcourses ECON3103 International Economics国际经济学课程的代写代考和辅导服务!

这是澳大利亚国立大学国际经济学课程的代写成功案例。

EC315课程简介

Why do countries trade with each other? How, why and by whom is international trade regulated? What are the welfare consequences of international trade? How does international trade affect individual firms, consumers, workers and industries? Why do some firms decide to export but not others? What is the impact of government policies on trade and welfare, and what are the best policies? Is a tariff war “easy to win”? What are the welfare effects of preferential trading arrangements between countries? What does the WTO do? What determines currency exchange rates and is a low or high dollar a good thing? Is monetary and fiscal policy more or less effective in an open economy than in a closed one? These are some of the questions we might consider in this class.

Prerequisites

Learning Outcomes

Upon successful completion, students will have the knowledge and skills to:

demonstrate an understanding of the main economic theories and models of international trade,

demonstrate an understanding of the likely distributional consequences of trade and thus of conflicting interests within an economy regarding trade liberalization,

demonstrate an understanding of economists’ arguments concerning trade policy and its analysis,

to apply economic reasoning to issues of the day surrounding globalization,

demonstrate an elementary understanding of open-economy macroeconomics and the determinants of exchange rates and the balance of payments.

ECON3103 International Economics HELP(EXAM HELP, ONLINE TUTOR)

c) The transaction is recorded as a credit entry in the goods section of the German goods and services account, which is part of the current account, since Germany exports food and equipment. It also represents a transfer extended to residents of another country and is thus recorded as a debit entry in the secondary income account, which also is a part of the German current account. Note that, ceteris paribus, the transaction does neither affect the German current account balance nor the German financial account balance.

The transaction is recorded as an increase of assets in the other investment section of the German financial account. It is also recorded as an increase in liabilities in the portfolio investment section of the German financial account.

These are solution sketches for the end-of-chapter exercises of the textbook

Harms, Philipp (2016): International Macroeconomics, $2^{\text {nd }}$ edition, Tübingen (Mohr Siebeck).

This version: April 4, 2017. Note: All solutions may be subject to changes.

Note that, ceteris paribus, the transaction neither affects the German financial account balance nor the German current account balance.

The transaction is recorded as a debit entry in the German primary income account, which is part of the current account. It is also recorded as an increase in liabilities in the direct investment section of the German financial account. Note that, ceteris paribus, the transaction reduces the German current account balance and the German financial account balance by the same amount.

There are (at least) three explanations for the low figures in the Euro area balance of payments:

The balance of payments reports net figures, i.e. the difference between exports and imports of goods and services, the increase in assets minus the increase in liabilities, etc. The size of the gross transactions behind these net figures is likely to be much bigger.

Large net positions at the country level may net out if the Euro area is considered as a whole. Hence, if member country A runs a large current account surplus vis-à-vis the rest of the world, while member country $\mathrm{B}$ runs a large current account deficit, the combined current account balance of the two countries may be rather small.

A large set of external transactions of Euro area countries actually involve other Euro area countries. Hence, if member country A is running a current account surplus vis-à-vis member country $B$, this shows up in the individual countries’ balance of payments, but it cancels out in the Euro area’s balance of payments.

The increasingly positive current account balance is clearly driven by growing net exports of goods. By comparison, the increase of net exports of services, the decline of (positive) net primary income, and the decline in (negative) net secondary income is less important.

MY-ASSIGNMENTEXPERT™可以为您提供PROGRAMSANDCOURSES ECON3103 INTERNATIONAL ECONOMICS国际经济学课程的代写代考和辅导服务!