MY-ASSIGNMENTEXPERT™可以为您提供 my.uq.edu.au ECON1020 Macroeconomics宏观经济学的代写代考和辅导服务!

这是昆士兰大学宏观经济学课程的代写成功案例。

ECON1020课程简介

Course Description: Examines functioning of the economy & its interaction with international economy. Studies GDP, unemployment & inflation, interest rates, investment, government expenditure, taxation policies & balance of payments. Alternative macroeconomic theories & models examined.

Assumed Background:

Economics – This is an introductory course without prerequisites. We assume that you have not studied economics before. It is unlikely that much of this course is a mere repetition or compression of high school economics.

Prior or concurrent study of ECON1010 (Introductory Microeconomics) is recommended but not required.

Prerequisites

Mathematics – The assumed mathematical background of people enrolling in ECON1020 is modest. You need to know basic arithmetic (+, -, x, /). You will need to perform very simple manipulations of equations (e.g., re-arranging terms).

Note that higher-level courses (e.g. ECON2020, ECON3020) often involve more mathematics. So, if you are planning to take later core microeconomics or macroeconomics courses, we advise you to take ECON1050 or its equivalent early in your degree program, especially if your maths background is weak.

Repeating the course – Although the course contents remain largely the same across semesters, the course coordinator/instructors could be different and therefore have different emphases in their teaching and assessments.

ECON1020 Macroeconomics HELP (EXAM HELP, ONLINE TUTOR)

Exercise 1.1 (Easy)

My credit card has an APR (annualized percentage rate) of $16.8 \%$. What is the daily interest rate?

Exercise 1.2 (Easy)

My loan shark is asking for $\$ 25$ in interest for a one-week loan of $\$ 1,000$. What is that, as an annual interest rate?

Exercise 1.1

You may have noticed that this question glosses over the compounding issue. You were intended to assume that the APR was quoted as a simple interest rate. Accordingly, the daily interest rate is just:

$$

R=\frac{16.8 \%}{365} \approx 0.046027 \%

$$

Exercise 1.2

This exercise glossed over the compounding issue again. Assuming no compounding over the week, the interest rate is:

$$

R=\left(\frac{25}{1,000}\right)(52)=1.3=130 \%

$$

Exercise 1.3 (Moderate)

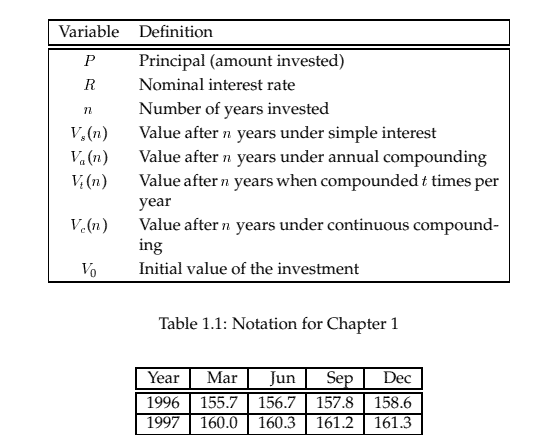

The Consumer Price Index (CPI) is a measure of the prices of goods that people buy. Bigger numbers for the index mean that things are more expensive. Here are the CPI numbers for four months of 1996 and 1997 :

What is the growth rate of the CPI between June 1996 and September 1996? (Use a continuous growth rate and annualize your answer.)

Exercise 1.4 (Moderate)

Use the CPI data from the previous exercise to compute the growth rates in the CPI in the four quarters starting in March 1996 (i.e, Mar-Jun 1996, Jun-Sep 1996, etc.). (Use a continuous growth rate but do not annualize your answer.) Show that the sum of these four rates equals the (continuous) growth rate from March 1996 to March 1997.

Exercise 1.3

The key to this question is that the units you use to measure time in the exponent are the same units of time for the resulting interest rate. For example, if you measure $n$ in years, then solving for $R$ gives you an annual interest rate. If you measure $n$ in “quarters”, then $R$ will be a quarterly interest rate.

Since this question asks you to annualize the answer, you want to measure $n$ in years. The time interval is 3 months, which is $1 / 4$ of a year. Accordingly:

$$

\begin{gathered}

157.8=\lefte^{(R)(1 / 4)}\right, \text { so: } \

R=4[\ln (157.8)-\ln (156.7)] \approx 0.02798104=2.798104 \%

\end{gathered}

$$

Exercise 1.4

You do not want to annualize these interest rates, so you measure $n$ in quarters, i.e., $n=1$ :

1st quarter: $R_1=\ln (156.7)-\ln (155.7) \approx 0.00640207=0.640207 \%$.

2nd quarter: $R_2=\ln (157.8)-\ln (156.7) \approx 0.00699526=0.699526 \%$.

3rd quarter: $R_3=\ln (158.6)-\ln (157.8) \approx 0.00505690=0.505690 \%$.

4th quarter: $R_4=\ln (160.0)-\ln (158.6) \approx 0.00878851=0.878851 \%$.

You can see that by adding these four lines together, all but two terms cancel, leaving: $R=\ln (160.0)-\ln (155.7) \approx 0.02724274=2.724274 \%$. And of course, this is precisely the formula for the annual growth using a continuous interest rate.

Exercise 1.5 (Easy)

Real output of the United States will likely grow by about $2 \%$ over the first half of the next century. At that rate (of continuous growth), how long will it take for real output to double? Compare your exact answer with the approximation given by the “Rule of 72. “2

Exercise 1.6 (Hard)

This morning you invest $\$ 10,000$ at $6.5 \%$ interest that compounds annually. What is the first date on which you would have at least $\$ 15,000$ ? Quote the answer in terms of years + days from today. Interest accrues each night, but compounds only annually.

Exercise 1.5

$$

\begin{gathered}

(2)(\mathrm{GDP})=\lefte^{(0.02)(n)}\right, \text { so: } \

n=\frac{\ln (2)}{0.02}=34.66 \text { years. }

\end{gathered}

$$

The Rule of 72 says that it should take about $72 / 2=36$ years, which is pretty close (it is off by about $3.9 \%$ ). Of course, you are smart enough to look at:

$$

n=\frac{\ln (2)}{0.02}

$$

and notice that a better rule would be the “Rule of 69 “, but nobody is very good at dividing into 69 in their head.

Exercise 1.6

The first thing you need to do is calculate the number of whole (i.e., undivided) years this investment will require. There is some number $n$ of years such that:

$$

\begin{gathered}

(1+0.065)^n(\$ 10,000)<\$ 15,000, \quad \text { but where: } \ (1+0.065)^{n+1}(\$ 10,000)>\$ 15,000 .

\end{gathered}

$$

This implies that $n=6$. After the 6th year, the investment has grown to:

$$

(1+0.065)^6(\$ 10,000)=\$ 14,591.42

$$

That becomes the principal of the investment in the 7th year, since interest was able to compound at the end of the 6th year. Now you need to figure out the number of days of simple interest the investment will need in the 7th year. It is short of $\$ 15,000$ by $\$ 408.58$, and each day the investment earns:

$$

\left(\frac{0.065}{365}\right)(\$ 14,591.42)=\$ 2.60 .

$$

You use these facts to calculate the required number of days:

$$

\frac{\$ 408.58}{\$ 2.60}=157.23

$$

Since interest only accrues after a full day, the investment would not earn the interest from the last 0.23 days until 158 days had passed. All in all then, the investment would require 6 years and 158 days.

MY-ASSIGNMENTEXPERT™可以为您提供 MY.UQ.EDU.AU ECON1020 MACROECONOMICS宏观经济学的代写代考和辅导服务!