如果你也在 怎样代写微观经济学Microeconomics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。微观经济学Microeconomics是主流经济学的一个分支,研究个人和公司在做出有关稀缺资源分配的决策时的行为以及这些个人和公司之间的互动。微观经济学侧重于研究单个市场、部门或行业,而不是宏观经济学所研究的整个国民经济。

微观经济学Microeconomics的一个目标是分析在商品和服务之间建立相对价格的市场机制,并在各种用途之间分配有限资源。微观经济学显示了自由市场导致理想分配的条件。它还分析了市场失灵,即市场未能产生有效的结果。微观经济学关注公司和个人,而宏观经济学则关注经济活动的总和,处理增长、通货膨胀和失业问题以及与这些问题有关的国家政策。微观经济学还处理经济政策(如改变税收水平)对微观经济行为的影响,从而对经济的上述方面产生影响。特别是在卢卡斯批判之后,现代宏观经济理论大多建立在微观基础上,即基于微观层面行为的基本假设。

my-assignmentexpert™ 微观经济学Microeconomics作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的微观经济学Microeconomics作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此微观经济学Microeconomics作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在经济Economy作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的微观经济学Microeconomics代写服务。我们的专家在经济Economy代写方面经验极为丰富,各种微观经济学Microeconomics相关的作业也就用不着 说。

我们提供的微观经济学Microeconomics及其相关学科的代写,服务范围广, 其中包括但不限于:

经济代写|微观经济学作业代写Microeconomics代考|Background and problems

In order to define what is “competition” in the standard approach to markets, two emblematic models of competition are briefly recalled: the Walrasian model of “perfect competition” and the Cournotian model of “imperfect competition”. While numerous developments have taken place in the domain of imperfect competition in the last thirty years (see Tirole, 1995 ), they do not change the conception of competition brought about in the standard approach to economics and even reinforce it by enlarging the variety of situations that are described in that framework.

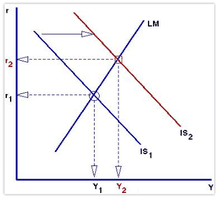

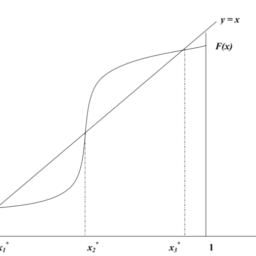

The Walrasian model describes a market situation in which several “perfect competition” conditions are met. The exchanged goods are homogeneous, divisible and non stockable. The buyers (consumers) and sellers (firms) know the available goods and act optimally with regard to their information. In the short run, the agents are small and have no market power. In the long run, there is free entry and exit from the market. From these primary conditions, the theory infers that the transactions are realized under a price system satisfying secondary conditions. For each good, there exists a unique price for all agents and transactions. Such a price is perfectly known by all agents. The agents act optimally by considering the price as exogenous (they are “price takers”). Each agent may proceed to any transaction at that price. From these last conditions, the theory infers that each agent expresses a supply or demand by equalizing the price with his marginal cost or utility. In the short run, the price of each good equalizes the total demand with the total supply. In the long run, the price converges towards the minimum of the mean cost, which implies that the firms make no profit.

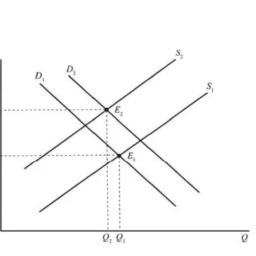

The Cournot model describes a market situation in which some “perfect competition” conditions are relaxed. The firms are no longer small and have some market power, contrary to the buyers. They know not only the goods, but the characteristics of their rivals. Hence, they become “price makers” since they impose the prices of the goods they produce. They act optimally by expecting the behavior of their rival. Finally, each firm defines a reaction function which tells what quantity to supply for each possible quantity supplied by its rival. The price results from the compatibility of the reaction functions.

Those two emblematic models are similar in one essential dimension: their reliance on a notion of equilibrium. The concrete process leading to such an equilibrium is not precisely stated. However, it is possible to consider that it results from “rational expectations”. The agents have a perfect factual and structural information on their interaction context and form optimal expectations with regard to that information. In the Walrasian model, each firm perfectly expects the prices and reacts to them in a parametric way. In the Cournot model, each firm simulates the opponent’s behavior and fixes his own supply accordingly.

In fact, the standard approach to competition is a theory of coordination in the allocation of resources. As emphasized by J. Vickers (1993) “competition is an equilibrium state of a market dependent on those fundamental forces of demand and cost structure that determine the number of viable survivors. That is to say the state of competition is equated with the structure of the market which is measured by the number and relative size of the surviving firms. From this follows the familiar taxonomy with perfect competition at one end of the spectrum and monopoly at the other, each defined in terms of a relation between market share and the consequential ability to increase price above marginal costs. Between these extremes lies less clear cut territory either in relation to the idea of monopolistic competition or in relation to concepts of oligopolistic interaction in which expectations of rivals behaviours have overwhelming significance”.

经济代写|微观经济学作业代写Microeconomics代考|Canonical principles

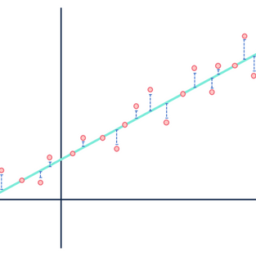

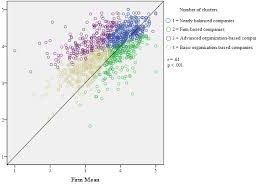

In this chapter, the firm is still considered as a unique centre of decision (see chapter 7 in this book for entering the black box of the firm). The crucial departure from the standard approach is to consider that the firm has a limited information and a bounded rationality, but is able to learn through time. The bounded character of firm’s rationality does not derive from its intentions, that is clearly to make acceptable profits, but from the fact that it is endowed with constrained capacities of gathering and treating information. It has an incomplete and imperfect information about its opponents and the consumers’ demand and is no more optimizing its price or supply. However, it makes expectations which are confronted to realizations and it takes actions which are regularly tested. The fixing of prices is thus decentralized rather than centralized as in the perfect competition model. It is adjusted through a dynamic process from which emerge various structures (prices, firm concentration, permanent market links).

The evolutionary models of competition that articulate with the developments in this book are characterized by the following “building blocks”:

Principle 1: Firms are searching which actions will be successful.

Since there is no deus ex machina to provide a complete information, the firms have to supply for it by revising their expectations of consumer preferences and willingness to pay as well as their expectations of rivals’ actions. Unable to implement an optimal ex ante calculus, they must decide on the actions to adopt by trying different actions and observing the market feedback. Thus, the firms get information that has a local character and a momentary value. The differential success of alternative actions becomes a central ingredient of an evolutionary theory of competition.

Principle 2: Firms compete for implementation of novelty.

An essential feature of competitive behaviors is to attract custom by offering them goods and services with distinctive characteristics. In this perspective, competition drives to the creation of new items, such as new technologies and new products. Rather than considering that firms behave competitively in a well known context (in the sense of optimizing in order

to get the maximum custom under constraints), the evolutionary conception of competition assumes precisely that competition is the inducement for the creation of new items. What is emphasized is the intensity (or lack of intensity) in the willingness and possibility of firms to find original means of capturing a large part of the custom at the disadvantage of their rivals.

Principle 3: Firms must build capabilities to compete.

Firms must invest in resources for competing, whether human capabilities, technical capacities or else research and development. But those investments both are motivated by competition and affect by feedback the terms of competition. For instance, when German chemical firms started to build $\mathrm{R} \& \mathrm{D}$ capabilities in the 19 th century, it changed the nature of the competition in this industry at the international level. Hence, investments in resources for competing are not any more the result of an optimization calculus, nor are they constraints to the optimization calculus. In an evolutionary conception to competition, they are part of what can make a firm successful rather than vanish.

Implication: Aggregate structures emerge from the decentralized actions undertaken by the firms

It is from the active competition preceedingly sketched that will emerge prices, networks and even complete market structures. Standard theory argues that costs are a very strong determinant of market structure, with decreasing returns inducing many firms to coexist. However, if novelty is the fuel to competition, a breakthrough product offered by only one firm may be supplied scarcely in regards of demand and the firm should capture a big rent. If rivals are not able to provide an equivalent product, even decreasing returns won’t do anything to the serving of the market. Indeed, this intuition is in the standard theory since imperfect competition results from firms introducing differentiation of their products and reducing the elasticity of the demand that addresses to them, therefore weakening the impact of the cost structure on the degree of competition. But the standard theory postulates the degree of competition and whether costs play an important role in this degree. An evolutionary theory of competition, on the contrary, shall derive whether costs are important as an outcome of firms behaviors, in particular as an outcome of the type of means that firms are using to attract custom. Thus, there is no discontinuity in the evolutionary theory of competition between “perfect” and “imperfect” competition, but rather a continuum of possible situations deriving from the effective behaviors and actions explored and implemented by the firms.

微观经济学代写

经济代写|微观经济学作业代写MICROECONOMICS代考|BACKGROUND AND PROBLEMS

为了在标准的市场方法中定义什么是“竞争”,我们简要回顾了两个具有代表性的竞争模型:“完全竞争”的瓦尔拉斯模型和“不完全竞争”的古诺模型。尽管过去三十年来在不完全竞争领域发生了许多发展s和和吨一世r这l和,1995,它们并没有改变标准经济学方法所带来的竞争概念,甚至通过扩大该框架中描述的各种情况来加强它。

瓦尔拉斯模型描述了满足几个“完全竞争”条件的市场情况。交换的货物是同质的、可分割的和不可储存的。买家C这ns在米和rs和卖家F一世r米s了解可用商品并根据其信息采取最佳行动。短期来看,代理商规模小,没有市场力量。从长远来看,市场是自由进出的。从这些首要条件,该理论推断交易是在满足次要条件的价格体系下实现的。对于每种商品,所有代理和交易都存在唯一的价格。这样的价格是所有代理商都知道的。代理人通过将价格视为外生来采取最佳行动吨H和是一种r和“pr一世C和吨一种ķ和rs”. 每个代理都可以以该价格进行任何交易。根据最后这些条件,该理论推断每个代理人通过使价格与其边际成本或效用相等来表达供给或需求。在短期内,每种商品的价格使总需求与总供给相等。从长远来看,价格向平均成本的最小值收敛,这意味着企业没有利润。

古诺模型描述了一些“完全竞争”条件放宽的市场情况。与买家相反,这些公司不再是小公司,并且拥有一定的市场力量。他们不仅了解商品,还了解竞争对手的特点。因此,他们成为“价格制定者”,因为他们强加了他们生产的商品的价格。他们通过预期对手的行为来采取最佳行动。最后,每个厂商定义了一个反应函数,它告诉竞争对手提供的每个可能数量的供应量。价格源于反应函数的兼容性。

这两个标志性模型在一个基本维度上是相似的:它们对平衡概念的依赖。导致这种平衡的具体过程没有准确说明。但是,可以认为它是“理性预期”的结果。代理人在他们的交互环境中拥有完美的事实和结构信息,并形成关于该信息的最佳期望。在瓦尔拉斯模型中,每家公司都完美地预期价格并以参数化的方式对其做出反应。在古诺模型中,每家公司都模拟对手的行为并相应地固定自己的供应。

事实上,竞争的标准方法是资源配置中的协调理论。正如 J. Vickers 所强调的1993“竞争是市场的一种平衡状态,它依赖于决定存活者数量的需求和成本结构的基本力量。也就是说,竞争状态等同于市场结构,市场结构是由幸存企业的数量和相对规模来衡量的。由此遵循熟悉的分类法,在频谱的一端是完全竞争,在另一端是垄断,每一个都根据市场份额和由此产生的将价格提高到边际成本之上的能力之间的关系来定义。在这些极端之间,无论是与垄断竞争的概念有关,还是与对竞争对手行为的期望具有压倒性意义的寡头垄断互动的概念有关,都存在不太明确的领域”。

经济代写|微观经济学作业代写MICROECONOMICS代考|CANONICAL PRINCIPLES

在本章中,公司仍被视为一个独特的决策中心s和和CH一种p吨和r7一世n吨H一世sb这这ķF这r和n吨和r一世nG吨H和bl一种Cķb这X这F吨H和F一世r米. 与标准方法的关键偏离是考虑到公司信息有限,理性有限,但能够通过时间学习。企业理性的有限性并非源于其意图,即显然是为了获得可接受的利润,而是源于它被赋予了有限的收集和处理信息的能力。它对对手和消费者需求的信息不完整和不完善,不再优化其价格或供应。然而,它提出了与现实相面对的期望,并采取了定期测试的行动。因此,定价是分散的,而不是像完全竞争模型那样集中。它通过一个动态过程进行调整,从中出现各种结构pr一世C和s,F一世r米C这nC和n吨r一种吨一世这n,p和r米一种n和n吨米一种rķ和吨l一世nķs.

与本书中的发展相结合的竞争进化模型具有以下“构建块”的特征:

原则 1:公司正在寻找哪些行动会成功。

由于没有天后可以提供完整的信息,企业必须通过修改他们对消费者偏好和支付意愿的预期以及他们对竞争对手行为的预期来提供信息。无法实施最佳的事前演算,他们必须通过尝试不同的行动并观察市场反馈来决定采取的行动。因此,公司获得了具有本地特征和瞬时价值的信息。替代行动的不同成功成为竞争进化理论的核心要素。

原则 2:公司竞争实施新颖性。

竞争行为的一个基本特征是通过向客户提供具有鲜明特色的商品和服务来吸引客户。从这个角度来看,竞争推动了新产品的创造,例如新技术和新产品。而不是考虑公司在众所周知的环境中的竞争行为(在按顺序优化的意义上

为了在约束条件下获得最大的习惯),竞争的进化概念精确地假设竞争是创造新物品的诱因。强调的是强度这rl一种Cķ这F一世n吨和ns一世吨是企业是否愿意和有可能找到独创的手段,在竞争对手的劣势中获取大部分的习惯。

原则 3:企业必须建立竞争能力。

公司必须投资于竞争资源,无论是人力、技术能力还是研发。但这些投资都受到竞争的推动,并受到竞争条款反馈的影响。例如,当德国化学公司开始建R&D19 世纪的能力,它改变了该行业在国际层面上的竞争性质。因此,对竞争资源的投资不再是优化演算的结果,也不是优化演算的约束。在竞争的进化概念中,它们是使公司成功而不是消失的一部分。

启示:聚合结构源于公司采取的分散行动

正是从前面所描绘的积极竞争中,才会出现价格、网络甚至完整的市场结构。标准理论认为,成本是市场结构的一个非常重要的决定因素,收益递减会导致许多公司共存。然而,如果新颖性是竞争的燃料,那么仅由一家公司提供的突破性产品可能在需求方面几乎没有供应,该公司应该获得大笔租金。如果竞争对手不能提供同等产品,即使是递减的回报也不会对市场的服务产生任何影响。事实上,这种直觉是在标准理论中,因为不完全竞争是由于公司引入其产品的差异化并降低了针对他们的需求弹性,因此削弱了成本结构对竞争程度的影响。但是标准理论假设竞争程度以及成本是否在这种程度中起重要作用。相反,竞争的进化理论将推导出成本是否重要作为公司行为的结果,特别是作为公司用来吸引客户的手段类型的结果。因此,“完美”和“不完美”竞争之间的竞争进化理论没有不连续性,而是由企业探索和实施的有效行为和行动所衍生的可能情况的连续统一体。应该推导出成本是否重要作为公司行为的结果,特别是作为公司用来吸引客户的手段类型的结果。因此,“完美”和“不完美”竞争之间的竞争进化理论没有不连续性,而是由企业探索和实施的有效行为和行动所衍生的可能情况的连续统一体。应该推导出成本是否重要作为公司行为的结果,特别是作为公司用来吸引客户的手段类型的结果。因此,“完美”和“不完美”竞争之间的竞争进化理论没有不连续性,而是由企业探索和实施的有效行为和行动所衍生的可能情况的连续统一体。

经济代写|微观经济学作业代写MICROECONOMICS代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。