如果你也在 怎样代写管理会计Managerial Accounting这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。管理会计Managerial Accounting在管理会计或管理会计中,管理人员在决策中使用会计信息,并协助管理和履行其控制职能。

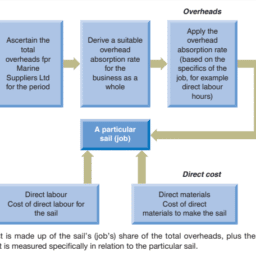

管理会计Managerial Accounting的一个简单定义是向管理人员提供财务和非财务决策信息。换句话说,管理会计帮助组织内部的董事做出决策。这也可以被称为成本会计。这是区分、检查、破译和向主管人员传授数据的方式,以帮助完成商业目标。收集的信息包括所有领域的会计,教育行政部门识别财务支出和组织决策的业务任务。会计师使用计划来衡量组织内的整体运营战略。

my-assignmentexpert™ 管理会计Managerial Accounting作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的管理会计Managerial Accounting作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此管理会计Managerial Accounting作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在会计accounting作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的管理会计Managerial Accounting代写服务。我们的专家在会计accounting代写方面经验极为丰富,各种管理会计Managerial Accounting相关的作业也就用不着 说。

我们提供的管理会计Managerial Accounting及其相关学科的代写,服务范围广, 其中包括但不限于:

会计代写|管理会计作业代写Managerial Accounting代考|Current Liabilities

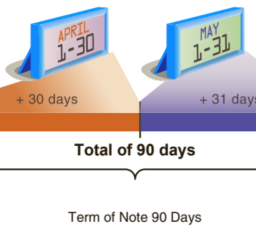

When a company or a bank advances credit, it is making a loan. The company or bank is called a creditor (or lender). The individuals or companies receiving the loan are called debtors (or borrowers).

Debt is recorded as a liability by the debtor. Long-term liabilities are debts due beyond one year. Thus, a 30-year mortgage used to purchase property is a long-term liability. Current liabilities are debts that will be paid out of current assets and are due within one year.

Types of current liabilities discussed in this section include the following:

- Accounts payable and accruals

- Short-term notes payable

- Current portion of long-term debt

Accounts Payable and Accruals

Accounts payable transactions have been described and illustrated in earlier chapters. These transactions involve a variety of purchases on account, including the purchase of merchandise and supplies.

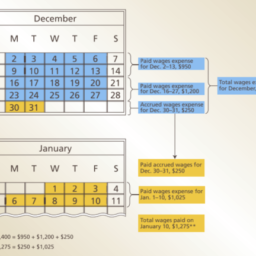

Accruals have also been described and illustrated in earlier chapters. Accrued liabilities reflect an obligation to pay current assets in the future. Accrued liabilities are normally recorded at the end of an accounting period as part of the adjustment process. For example, wages due employees at the end of the period are recorded as an expense (Wages Expense) and an accrued liability (Wages Payable).

For most companies, accounts payable and accrued liabilities are the largest portion of current liabilities.

会计代写|管理会计作业代写Managerial Accounting代考|Payroll Liabilities

In accounting, payroll refers to the amount paid to employees for services they provided during the period. A company’s payroll is important for the following reasons:

- Payroll and related payroll taxes significantly affect the net income of most companies.

- Payroll is subject to federal and state regulations.

- Good employee morale requires payroll to be paid timely and accurately.

Liability for Employee Earnings

Salary usually refers to payment for managerial and administrative services. Salary is normally expressed in terms of a month or a year. Wages usually refers to payment for employee manual labor. The rate of wages is normally stated on an hourly or a weekly basis. The salary or wage of an employee may be increased by bonuses, commissions, profit sharing, or cost-of-living adjustments.

Companies engaged in interstate commerce must follow the Fair Labor Standards Act. This act, sometimes called the Federal Wage and Hour Law, requires employers to pay a minimum rate of $1 / 2$ times the regular rate for all hours worked in excess of 40 hours per week. Exemptions are provided for executive, administrative, and some supervisory positions. Increased rates for working overtime, nights, or holidays are common, even when not required by law. These rates may be as much as twice the regular rate.

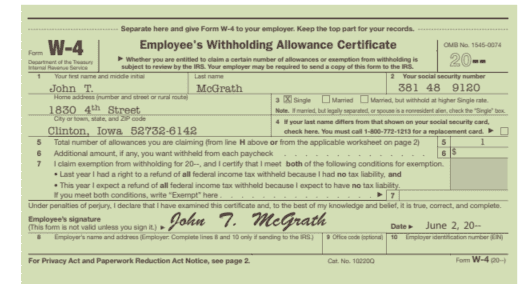

To illustrate computing an employee’s earnings, assume that John T. McGrath is a salesperson employed by Mo ermott Sup y Co. McGrath’s regular rate is $\$ 34$ per hour, and any hours worked in excess of 40 hours per week are paid at $1 / 2$ times the regular rate. McGrath worked 42 hours for the week ended December 27 . His earnings of $\$ 1,462$ for the week are computed as follows:

Earnings at regular rate $(40 \mathrm{hrs}$. $\times \$ 34) \quad \$ 1,360$

Earnings at overtime rate [ 2 hrs, $\times(\$ 34 \times 11 / 2)]$

Total earnings

$\frac{102}{\$ 1,462}$

会计代写|管理会计作业代写Managerial Accounting代考|Employees’ Fringe Benefits

Many companies provide their employees benefits in addition to salary and wages earned. Such fringe benefits may include vacation, medical, and retirement benefits.

The cost of employee fringe benefits is recorded as an expense by the employer. To match revenues and expenses, the estimated cost of fringe benefits is recorded as an expense during the period in which the employees earn the benefits.

Vacation Pay

Most employers provide employees vacations, sometimes called compensated absences. The liability to pay for employee vacations could be accrued as a liability at the end of each pay period. However, many companies wait and record an adjusting entry for accrued vacation at the end of the year.

管理会计代写

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|CURRENT LIABILITIES

当一家公司或一家银行预支信贷时,它就是在进行贷款。公司或银行称为债权人这rl和nd和r. 接受贷款的个人或公司称为债务人这rb这rr这在和rs.

债务被债务人记录为负债。长期负债是一年以上到期的债务。因此,用于购买房产的 30 年抵押贷款是一项长期负债。流动负债是指将从流动资产中偿还并在一年内到期的债务。

本节讨论的流动负债类型包括:

- 应付账款和应计项目

- 短期应付票据

- 长期债务

应付账款和

应计应付账款交易的流动部分已在前几章中进行了描述和说明。这些交易涉及各种赊购,包括商品和供应品的购买。

在前面的章节中也对应计进行了描述和说明。应计负债反映了在未来支付流动资产的义务。作为调整过程的一部分,应计负债通常在会计期末记录。例如,期末应付雇员的工资记录为费用在一种G和s和Xp和ns和和应计负债在一种G和s磷一种是一种bl和.

对于大多数公司来说,应付账款和应计负债是流动负债的最大部分。

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|PAYROLL LIABILITIES

在会计中,工资单是指员工在此期间提供的服务所支付的金额。公司的工资单很重要,原因如下:

- 工资和相关工资税显着影响大多数公司的净收入。

- 工资单受联邦和州法规的约束。

- 良好的员工士气需要及时准确地支付工资。

员工收入工资责任

通常是指管理和行政服务的支付。工资通常用一个月或一年来表示。工资通常是指员工体力劳动的报酬。工资率通常按每小时或每周计算。员工的薪水或工资可能会因奖金、佣金、利润分享或生活成本调整而增加。

从事州际贸易的公司必须遵守《公平劳工标准法》。该法案有时称为《联邦工资和工时法》,要求雇主支付最低工资1/2每周工作超过 40 小时的所有小时的正常工资的倍数。对行政、行政和一些监督职位提供豁免。即使法律没有要求,加班、夜间或节假日的加班费也很常见。这些费率可能是正常费率的两倍。

为了说明计算员工的收入,假设 John T. McGrath 是 Moermott Sup y Co. 雇用的一名销售人员。McGrath 的常规费率为$34每小时,并且每周工作超过 40 小时的任何小时都按1/2倍于正常利率。McGrath 在截至 12 月 27 日的那一周工作了 42 小时。他的收入为$1,462一周的计算如下:

以正常利率计算的收入(40Hrs. ×$34)$1,360

加班费收入2Hrs,$×($34×11/2)吨这吨一种l和一种rn一世nGs\frac{102}{ $ 1,462}$

会计代写|管理会计作业代写MANAGERIAL ACCOUNTING代考|EMPLOYEES’ FRINGE BENEFITS

除了工资和工资外,许多公司还为员工提供福利。这种附加福利可能包括假期、医疗和退休福利。

雇员附带福利的成本由雇主记录为费用。为了匹配收入和支出,附加福利的估计成本在员工获得福利的期间记录为费用。

假期工资

大多数雇主为员工提供假期,有时称为带薪缺勤。支付员工假期的负债可以在每个支付期结束时作为负债累计。然而,许多公司在年底等待并记录应计假期的调整分录。

会计代写|管理会计作业代写Managerial Accounting代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。