如果你也在 怎样代写公司财务和评估代写Corporate Finance这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。公司财务和评估代写Corporate Finance公司金融是金融的一个领域,涉及资金来源、公司的资本结构、管理者为增加公司对股东的价值所采取的行动,以及用于分配金融资源的工具和分析。公司金融的主要目标是最大化或增加股东的价值。

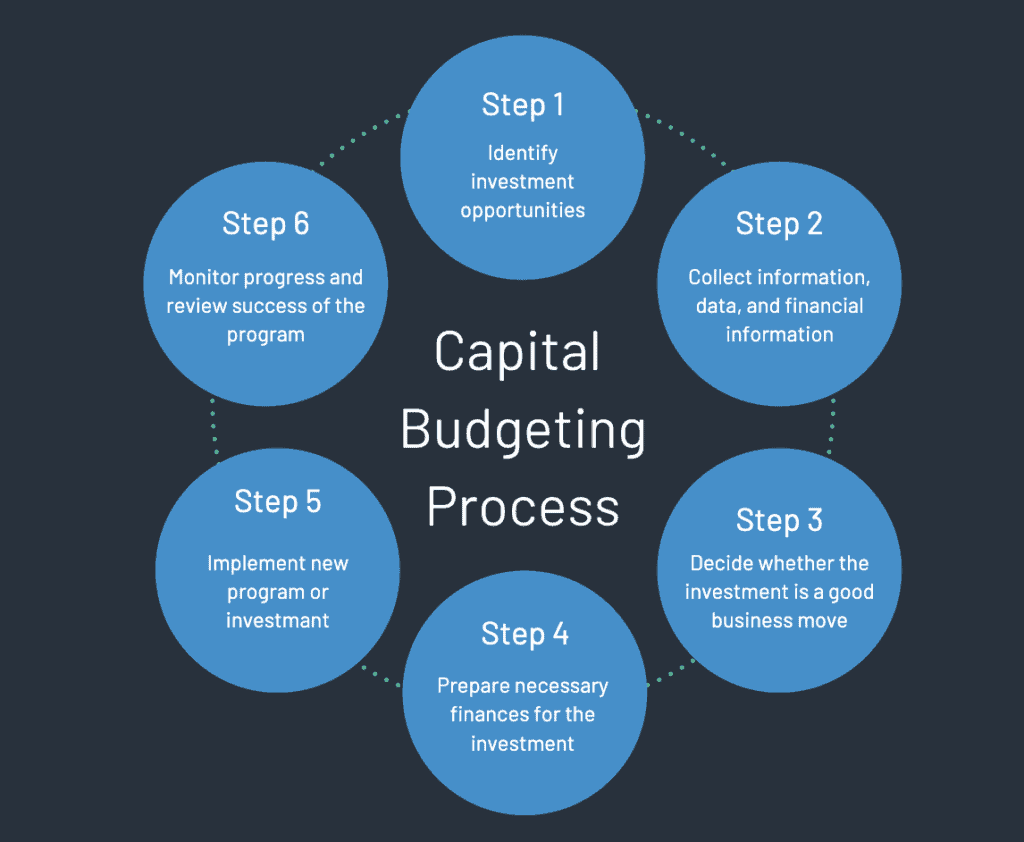

公司财务和评估代写Corporate Finance公司财务包括两个主要的分支学科。引用资本预算涉及到设定标准,以确定哪些增值项目应该获得投资资金,以及是用股权还是债务资本为该投资融资。营运资金管理是对公司货币资金的管理,涉及流动资产和流动负债的短期经营平衡;这里的重点是管理现金、存货和短期借贷(如提供给客户的信贷条件)。

my-assignmentexpert™ 公司财务和评估代写Corporate Finance作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的公司财务和评估代写Corporate Finance作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此公司财务和评估代写Corporate Finance作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在金融Finance作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的金融Finance代写服务。我们的专家在公司财务和评估代写Corporate Finance代写方面经验极为丰富,各种公司财务和评估代写Corporate Finance相关的作业也就用不着 说。

我们提供的公司财务和评估代写Corporate Finance及其相关学科的代写,服务范围广, 其中包括但不限于:

金融代写|公司财务和评估代写Corporate Finance代考|Capital Budgeting

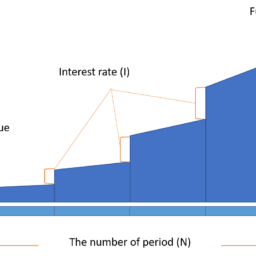

Capital investments are long-term in nature, with cash flows occurring over many years. Typically, there are cash outflows in the initial years when the project is established, followed by cash inflows in subsequent years after the project takes off. However, many different patterns are possible depending on the nature of projects undertaken. The distinguishing feature is that projects have a long life and lead to cash inflows and outflows over a number of years.

A company needs to evaluate which projects to invest in and which ones to forego. If it invests in the right kind of projects, it will not only keep growing but also add to the shareholders’ wealth. On the other hand, investment in wrong projects will reduce value and take it fast on the path of extinction. While it may not be a day-to-day activity, capital budgeting is arguably the most critical function, significantly impacting a company’s long-term performance.

Capital budgeting must be aligned to the strategy of the company in terms of products, markets, customers and technology. The Aditya Birla Group decided a few years back that commodities and metals would be a strategic area for the group. Since then it has been investing in cement and aluminum, both through greenfield investments and by acquiring existing capacities. In 2017, UltraTech Cement Ltd, a group company, acquired six integrated cement plants and five grinding units of the JP Group, with a capacity of $21.2$ million tons for ₹ $161.89$ billion, taking the group capacity to 93 million tons. In the process, it has become the largest cement company in India and the fourth-largest global cement company outside China. The JP Group which has been in a financial crunch, reduced its debt substantially, taking a major step towards restoring its financial health.

Hindalco Ltd, another Aditya Birla Group company, acquired Novelis Inc., a Mexican company, for US\$6 billion in 2007. This was one of the largest acquisitions in the Indian corporate sector. Hindalco Ltd has now become a leading player in the aluminum space in India.

United Breweries was a market leader in the liquor industry. The promoter, Vijay Mallya, got taken in by the apparently lucrative prospects and prestige associated with owning an airline. Despite strong advice to the contrary, he went ahead and established the high-profile Kingfisher Airlines. The outcome was predictable, with Kingfisher Airlines becoming defunct in a few years’ time. In fact, Vijay Mallya had to sell even his flagship company United Breweries Holdings Limited to Diageo PLC. Currently, he is facing court cases for non-payment of dues to creditors, bankers, employees and the government.

金融代写|公司财务和评估代写Corporate Finance代考|Internal Rate of Return

Internal rate of return is the rate that makes the NPV of project cash flows equal to zero. It is the rate which equates the $\mathrm{PV}$ of future cash inflows to the investment made in the project now.

The rate is internal to the cash flows of the project. It depends only on the project cash flows and none outside it. It is a single rate that sort of summarizes a project.

Let us assume a project involves investment of $₹ 100$ today and provides ₹108 after a year. What is the NPV of the project?

$$

\mathrm{NPV}=-100+108 /(1+\mathrm{r}) .

$$

Where $r$ is the discount rate based on the COC. Currently, we do not know what the COC is. What we do know is that at NPV of zero, we are indifferent to the project and taking up the project neither adds value nor reduces it. Is it possible to calculate the rate at which NPV becomes zero?

$$

\begin{aligned}

&0=-100+108 /(1+r) \

&r=8 \%

\end{aligned}

$$

Eight per cent can be defined as the IRR of the project.

Most projects have a life of more than one year, with several cash flows. Calculation of IRR, thus becomes a little more tedious and is possible through trial and error-an iterative process. Different rates must be tried until we find one that makes the NPV of project cash flows equal to zero as shown in Illustration 4.3.

$$

\mathrm{NPV}=\left{\mathrm{C}{1} /(1+\mathrm{r})^{1}+\mathrm{C}{2} /(1+\mathrm{r})^{2}+\ldots+\mathrm{C}{\mathrm{n}} /(1+\mathrm{r})^{\mathrm{n}}\right}-\mathrm{C}{0}=0

$$

The manual process of calculating IRR is relevant for learning purposes. In practice, calculations are undertaken on an Excel spreadsheet wherein Excel will itself take care of the iterations.

金融代写|公司财务和评估代写CORPORATE FINANCE代考|Different Techniques of Capital Budgeting

We have discussed NPV and IRR as the two methods of project evaluation and concluded that NPV is superior to IRR. In case of a conflict, NPV should be preferred. Later in Appendix to this chapter, we will discuss two other methods, namely the payback period and the accounting rate of return. Both these methods are conceptually flawed, since they only consider the absolute amount of the cash flows without taking into account the timing of the cash flows. Despite this, we spend considerable time in discussing these methods and even compare them with the NPV method.

The reason is quite simple. It is important to understand a theory in its entirety, its implications and pitfalls and the manner of its application in real life. Blindly taking numbers and filling up an Excel spreadsheet does not help the management take the best possible decisions. Project evaluation is based on projected cash flows-that are mere estimates. While the management is expected to take utmost care to ensure the projections are as credible as possible, it is aware of the fact that the estimates can go wrong and, at times, by a significant margin. Novelis Inc. was acquired by Hindalco Ltd at the height of the boom years in 2007. The financial crisis and the subsequent recession hit the company hard, and it took almost a decade to recover and add value. Similarly, TML started the Nano car project with unprecedented fanfare. The company received global accolades for what was called ‘the people’s car’. A few years later, the project has been completely shelved and the company no longer manufactures the Nano car.

An assessment of risks inherent in a project can, therefore, be extremely useful. Internal rate of return provides an idea of the margin of safety and, therefore, of the risk inherent in the project which the NPV methodology cannot do. Similarly, PI reveals the value addition per unit of investment which is not only a useful parameter to know but also indicates the level of risk.

Let us assume that an evaluation of a project yields an NPV of $₹ 0.50$ billion. How risky is the project? It is difficult to figure out with only the NPV figure. However, an IRR of 20 per cent and the COC equalling 12 per cent tell us there is sufficient leeway for cash flows to decline without making the project unviable. Similar will be the case with a PI of $1.8$. Project evaluation with more varied criteria is likely to give the management a better grip on risk assessment and hopefully improve decision-making in an area that is fraught with significant level of risk.

公司财务和评估代写

金融代写|公司财务和评估代写CORPORATE FINANCE代考|CAPITAL BUDGETING

资本投资本质上是长期的,现金流会持续多年。通常,在项目成立的最初几年会有现金流出,随后在项目启动后的几年会有现金流入。但是,根据所开展项目的性质,可能会有许多不同的模式。显着的特点是项目的生命周期很长,并且会在数年内导致现金流入和流出。

公司需要评估投资哪些项目以及放弃哪些项目。如果它投资于正确的项目,它不仅会保持增长,而且会增加股东的财富。另一方面,对错误项目的投资会降低价值并使其迅速走上灭绝的道路。虽然这可能不是一项日常活动,但资本预算可以说是最关键的功能,对公司的长期业绩产生重大影响。

资本预算必须与公司在产品、市场、客户和技术方面的战略保持一致。几年前,Aditya Birla Group 决定将大宗商品和金属作为该集团的战略领域。从那时起,它一直通过绿地投资和收购现有产能来投资水泥和铝。2017年,集团公司UltraTech Cement Ltd收购了JP集团的6个综合水泥厂和5个粉磨装置,产能为21.2百万吨 ¥161.89亿,使集团产能达到9300万吨。在此过程中,它已成为印度最大的水泥公司和中国以外的全球第四大水泥公司。陷入财务危机的JP集团大幅减债,朝着恢复财务健康迈出了重要一步。

2007 年,Aditya Birla Group 的另一家公司 Hindalco Ltd 以 60 亿美元收购了墨西哥公司 Novelis Inc.。这是印度企业界最大的收购案之一。Hindalco Ltd 现在已成为印度铝材领域的领先者。

United Breweries 是白酒行业的市场领导者。发起人 Vijay Mallya 被与拥有一家航空公司相关的明显有利可图的前景和声望所吸引。尽管有相反的强烈建议,他还是继续前进并建立了备受瞩目的翠鸟航空公司。结果是可以预见的,翠鸟航空公司在几年后就倒闭了。事实上,Vijay Mallya 甚至不得不将他的旗舰公司 United Breweries Holdings Limited 出售给 Diageo PLC。目前,他因不向债权人、银行家、雇员和政府支付欠款而面临法庭诉讼。

金融代写|公司财务和评估代写CORPORATE FINANCE代考|INTERNAL RATE OF RETURN

内部收益率是使项目现金流的净现值为零的比率。它是等于的速率磷在现在对项目的投资的未来现金流入。

该比率是项目现金流的内部比率。它仅取决于项目现金流,不取决于项目现金流。这是一个总结项目的单一比率。

让我们假设一个项目涉及投资₹₹100今天,一年后提供₹108。项目的 NPV 是多少?

ñ磷在=−100+108/(1+r).

在哪里r是基于 COC 的折现率。目前,我们不知道 COC 是什么。我们所知道的是,在 NPV 为零时,我们对项目漠不关心,接受该项目既不会增加价值,也不会减少价值。是否可以计算 NPV 变为零的比率?

0=−100+108/(1+r) r=8%

8% 可以定义为项目的内部收益率。

大多数项目的寿命超过一年,有几个现金流。因此,IRR 的计算变得更加繁琐,并且可以通过反复试验(一个迭代过程)来实现。必须尝试不同的利率,直到我们找到一个使项目现金流的 NPV 等于 0 的利率,如图 4.3 所示。

$$

\mathrm{NPV}=\left{\mathrm{C} {1} /1+r{1} + \ mathrm {C {2} /1+r^{2}+\ldots+\mathrm{C} {\mathrm{n}} /1+r^{\mathrm{n}}\right}-\mathrm{C} {0}=0

$$

计算 IRR 的手动过程与学习目的相关。在实践中,计算是在 Excel 电子表格上进行的,其中 Excel 将自行处理迭代。

金融代写|公司财务和评估代写CORPORATE FINANCE代考|DIFFERENT TECHNIQUES OF CAPITAL BUDGETING

我们讨论了 NPV 和 IRR 作为项目评估的两种方法,并得出 NPV 优于 IRR 的结论。如果发生冲突,应首选 NPV。在本章后面的附录中,我们将讨论另外两种方法,即投资回收期和会计收益率。这两种方法在概念上都存在缺陷,因为它们只考虑现金流的绝对数量而没有考虑现金流的时间。尽管如此,我们还是花费了大量时间来讨论这些方法,甚至将它们与 NPV 方法进行比较。

原因很简单。重要的是要全面了解一个理论,它的含义和陷阱以及它在现实生活中的应用方式。盲目地取数字和填写 Excel 电子表格并不能帮助管理层做出最佳决策。项目评估基于预计的现金流量——这仅仅是估计。虽然预计管理层将尽最大努力确保预测尽可能可信,但它意识到估计可能出错,有时甚至会出现很大误差。Novelis Inc. 在 2007 年的繁荣时期被 Hindalco Ltd. 收购。金融危机和随后的经济衰退对公司造成了沉重打击,花了将近十年的时间才恢复并增加价值。同样,TML 以前所未有的大张旗鼓启动了 Nano 汽车项目。该公司因被称为“人民的汽车”而获得全球赞誉。几年后,该项目被完全搁置,该公司不再生产 Nano 汽车。

因此,对项目固有风险的评估非常有用。内部收益率提供了安全边际的概念,因此提供了 NPV 方法无法做到的项目固有风险。同样,PI 揭示了每单位投资的增值,这不仅是一个有用的参数,而且还表明了风险水平。

让我们假设一个项目的评估产生的 NPV 为₹₹0.50十亿。项目风险有多大?仅用 NPV 数字很难弄清楚。然而,20% 的内部收益率和等于 12% 的 COC 告诉我们,在不使项目不可行的情况下,现金流有足够的回旋余地。PI 的情况类似1.8. 具有更多不同标准的项目评估可能使管理层更好地控制风险评估,并有望改善充满重大风险领域的决策。

金融代写|公司财务和评估代写Corporate Finance代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。

电磁学代考

物理代考服务:

物理Physics考试代考、留学生物理online exam代考、电磁学代考、热力学代考、相对论代考、电动力学代考、电磁学代考、分析力学代考、澳洲物理代考、北美物理考试代考、美国留学生物理final exam代考、加拿大物理midterm代考、澳洲物理online exam代考、英国物理online quiz代考等。

光学代考

光学(Optics),是物理学的分支,主要是研究光的现象、性质与应用,包括光与物质之间的相互作用、光学仪器的制作。光学通常研究红外线、紫外线及可见光的物理行为。因为光是电磁波,其它形式的电磁辐射,例如X射线、微波、电磁辐射及无线电波等等也具有类似光的特性。

大多数常见的光学现象都可以用经典电动力学理论来说明。但是,通常这全套理论很难实际应用,必需先假定简单模型。几何光学的模型最为容易使用。

相对论代考

上至高压线,下至发电机,只要用到电的地方就有相对论效应存在!相对论是关于时空和引力的理论,主要由爱因斯坦创立,相对论的提出给物理学带来了革命性的变化,被誉为现代物理性最伟大的基础理论。

流体力学代考

流体力学是力学的一个分支。 主要研究在各种力的作用下流体本身的状态,以及流体和固体壁面、流体和流体之间、流体与其他运动形态之间的相互作用的力学分支。

随机过程代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其取值随着偶然因素的影响而改变。 例如,某商店在从时间t0到时间tK这段时间内接待顾客的人数,就是依赖于时间t的一组随机变量,即随机过程

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。