如果你也在 怎样代写公司财务和评估代写Corporate Finance这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。公司财务和评估代写Corporate Finance公司金融是金融的一个领域,涉及资金来源、公司的资本结构、管理者为增加公司对股东的价值所采取的行动,以及用于分配金融资源的工具和分析。公司金融的主要目标是最大化或增加股东的价值。

公司财务和评估代写Corporate Finance公司财务包括两个主要的分支学科。引用资本预算涉及到设定标准,以确定哪些增值项目应该获得投资资金,以及是用股权还是债务资本为该投资融资。营运资金管理是对公司货币资金的管理,涉及流动资产和流动负债的短期经营平衡;这里的重点是管理现金、存货和短期借贷(如提供给客户的信贷条件)。

my-assignmentexpert™ 公司财务和评估代写Corporate Finance作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的公司财务和评估代写Corporate Finance作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此公司财务和评估代写Corporate Finance作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在金融Finance作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的金融Finance代写服务。我们的专家在公司财务和评估代写Corporate Finance代写方面经验极为丰富,各种公司财务和评估代写Corporate Finance相关的作业也就用不着 说。

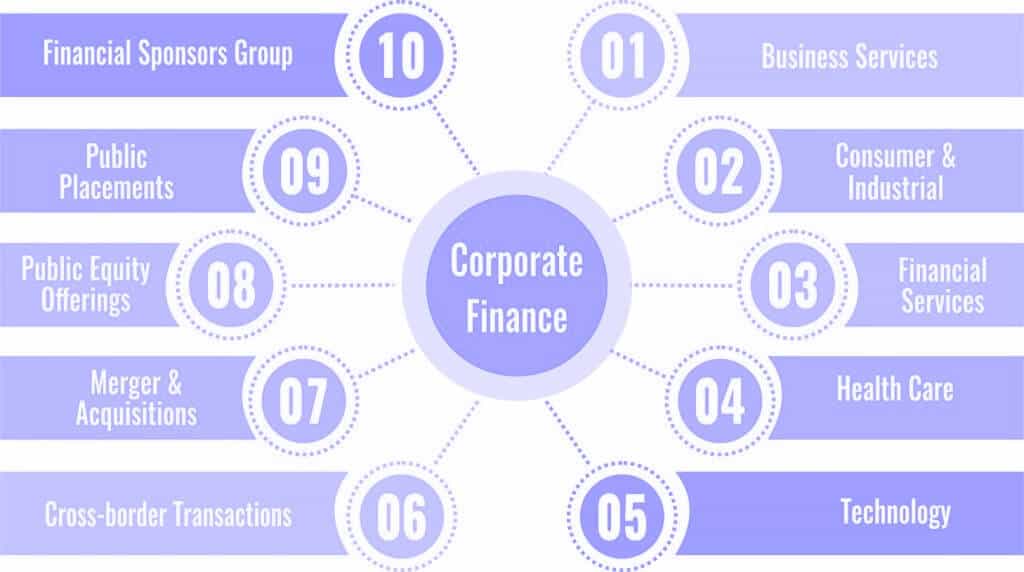

我们提供的公司财务和评估代写Corporate Finance及其相关学科的代写,服务范围广, 其中包括但不限于:

金融代写|公司财务和评估代写Corporate Finance代考|The Financial Markets

Understanding and interfacing with financial markets is integral to the functioning of a CFO. The CFO relies considerably on financial markets to achieve the company’s objectives. As we will discuss later, a company’s objective is to maximize its value and, therefore, the pricing of its equity and bonds is critical. The CFO must have expert knowledge of how prices are determined in financial markets. He needs to constantly access the financial markets for satisfying the requirement for funds. Other functions such as treasury investments, risk management, acquisitions and dividends also require deep knowledge of and experience in financial markets. The CFO must communicate effectively with investors. In fact, investor relations have become a priority with most companies today.

While we will discuss financial markets in much greater detail in the next chapter, it is useful to point out its impact on individuals and corporates briefly.

Financial markets enable an individual’s earnings pattern and his corresponding spending pattern to be different over his lifespan. Without financial markets, the consumption and earnings pattern must correspond, wherein the individual is able to consume only what he earns during a given period of time.

When a person starts earning, he may wish to save, either for a rainy day or for his postretirement days. Alternatively, he may be like the generation ‘ $\mathrm{Y}$ ‘, which believes in consumption today rather than in some uncertain future time period; they borrow now against future income to acquire a house, an automobile, an expensive mobile handset or even an exotic holiday abroad. After finishing your MBA and securing a well-paying job, you are unlikely to wait for years to buy your favourite car or a house of your own. The financial markets enable you to borrow to fund the purchase. The borrowing will be paid off from your future income. This implies an exchange of your future income for present consumption. This is unlike the author, who, being at the end of his employment, is consuming less than his current income to pay for past borrowings as well as save for his post-retirement needs.

Mortgage Financing

Ownership of a house was a difficult proposition for people of my generation. Financial institutions lending for purchase of a house were non-existent. The only option was to accumulate sufficient savings, which took a lifetime. Severe shortage of housing ensured that property prices rose faster than accumulation of savings. It was a very frustrating catch-up game.

The establishment of HDFC Limited in the 1980 s and its subsequent growth ushered in the mortgage industry in India. Three decades later, the mortgage sector growth shows no sign of abating. Borrowing long term to buy a house is a simple proposition in today’s developed financial markets.

金融代写|公司财务和评估代写Corporate Finance代考|Objectives of a Company

In order to effectively manage a company, it is essential that all stakeholders agree on and work towards the objectives the company seeks to accomplish. It is widely believed that companies must maximize profits. However, that would be a flawed metric to try and achieve for various reasons.

- Profits can be easily manipulated, as they sometimes are. Accountants have this wonderful knack of generating the specific profit figure that will please the management. Widely divergent figures can be made to represent a ‘true and fair’ picture of a company’s performance under a broad interpretation of the generally accepted accounting principles (GAAP).

- For it to be an effective metric, the period over which the company maximizes profits needs to be specified. For instance, if the objective is to maximize profits in the current year, there are many ways of achieving this at the cost of profits in later years. A pharmaceutical company can easily reduce expenditure on research and development (R\&D) to inflate immediate profits. Similarly, a fast-moving consumer goods (FMCG) company may show a better picture of earnings by reducing investments in brands in the current year. The management usually has considerable leeway in manipulating profits over different years.

Such practices are not healthy for business, and such companies are unlikely to survive for long. Companies have been known to declare profits that are always in line with expectations of investors, irrespective of the actual performance. We have often witnessed a new chief executive officer (CEO) ‘clean up the books’ by recognizing all past losses and liabilities, attribute the same to the previous CEO and start afresh. Cleaning up the books would, of course, not have been undertaken if the previous CEO had continued in his position. - It is important to factor in the investments required to generate a certain level of profit. Absolute profit by itself is meaningless. Company A’s $₹ 100$ million profit is better than $₹ 200$ million profit by company $B$ if the investment in company $A$ is less than half the amount invested in company B. It is the return on investment which is more significant than just the absolute amount of profit.

- Finally, the risk assumed to generate the given profit is critical. A higher profit may not be desirable if the company has been exposed to excessive risk in generating that profit. Not only can the profits disappear in the future, such risks can jeopardize the very existence of the company. Risk will be discussed in detail later in the book.

金融代写|公司财务和评估代写CORPORATE FINANCE代考|Governance

The various forms of business organizations differ significantly in terms of how they are managed. The difference in the governance structure is significant.

Sole proprietorship and partnerships are easy to manage. The proprietor and the partners take all decisions with respect to the business and, in case of disagreement in a partnership, the partners can vote in proportion to their respective stakes.

The governance of companies is more complex. There are a large number of shareholders, sometimes numbering in millions, each with a different stake in the company. The shareholders are located in different parts of the country and even abroad. Despite advancement in technology and means of transportation and communication, it is virtually impossible to get them together on a regular basis to decide on various business issues.

Shareholders resolve the problem by empowering the board of directors (the ‘board’) as the apex body managing the company on their behalf. The board establishes the vision and mission of the company to guide its current operations and future development. The board has the following responsibilities:

- It establishes the strategic policy framework of the company.

- It appoints the managing director and other senior managers for day-to-day operations.

- It is responsible for overseeing the management and ensuring the highest standards of corporate governance.

公司财务和评估代写

金融代写|公司财务和评估代写CORPORATE FINANCE代考|THE FINANCIAL MARKETS

了解金融市场并与之互动对于首席财务官的职能来说是不可或缺的。首席财务官在很大程度上依赖金融市场来实现公司的目标。正如我们稍后将讨论的,公司的目标是使其价值最大化,因此,其股票和债券的定价至关重要。首席财务官必须具备金融市场如何确定价格的专业知识。他需要不断地进入金融市场以满足资金需求。其他职能,如资金投资、风险管理、收购和股息,也需要对金融市场有深入的了解和经验。CFO 必须与投资者进行有效沟通。事实上,投资者关系已成为当今大多数公司的优先事项。

虽然我们将在下一章更详细地讨论金融市场,但简要指出它对个人和企业的影响是有用的。

金融市场使个人的收入模式和相应的支出模式在他的一生中有所不同。没有金融市场,消费和收入模式必须对应,其中个人只能消费他在给定时间段内赚取的收入。

当一个人开始赚钱时,他可能希望存钱以备不时之需或退休后的日子。或者,他可能就像一代人一样是’,它相信今天的消费,而不是未来某个不确定的时期;他们现在用未来的收入借钱来买房子、汽车、昂贵的手机,甚至是在国外度过一个充满异国情调的假期。在完成 MBA 并找到一份高薪工作后,您不太可能等待数年才能购买自己喜欢的汽车或房屋。金融市场使您能够借入资金购买。借款将从您未来的收入中偿还。这意味着用你未来的收入换取当前的消费。这与提交人不同,他在工作结束时,消费低于当前收入的消费来支付过去的借款以及为退休后的需要储蓄。

抵押贷款

对于我这一代人来说,拥有房子是一个困难的提议。不存在贷款购买房屋的金融机构。唯一的选择是积累足够的积蓄,这需要一生的时间。严重的住房短缺确保了房价上涨的速度快于储蓄的积累。这是一场非常令人沮丧的追赶比赛。

1980 年代 HDFC Limited 的成立及其随后的发展在印度迎来了抵押贷款行业。三年后,抵押贷款行业的增长没有减弱的迹象。在当今发达的金融市场中,长期借款买房是一个简单的命题。

金融代写|公司财务和评估代写CORPORATE FINANCE代考|OBJECTIVES OF A COMPANY

为了有效地管理公司,所有利益相关者都同意并朝着公司寻求实现的目标努力是至关重要的。人们普遍认为,公司必须实现利润最大化。然而,由于各种原因,这将是一个有缺陷的指标。

- 利润很容易被操纵,有时就是这样。会计师有这种奇妙的诀窍,可以产生令管理层满意的具体利润数字。在普遍接受的会计原则的广泛解释下,可以制作出差异很大的数字来代表公司业绩的“真实和公平”G一种一种磷.

- 为了使其成为一个有效的指标,需要指定公司实现利润最大化的时期。例如,如果目标是在当年实现利润最大化,那么有很多方法可以以牺牲以后几年的利润为代价来实现这一目标。制药公司可以轻松减少研发支出R&D夸大即时利润。同样,快速消费品F米CG公司可能会通过减少本年度对品牌的投资来更好地展示收益情况。管理层在操纵不同年份的利润方面通常有相当大的回旋余地。

这种做法对企业不利,而且这些公司不太可能长期存在。众所周知,无论实际业绩如何,公司都会宣布始终符合投资者预期的利润。我们经常目睹新的首席执行官C和这通过承认所有过去的损失和负债来“清理账目”,将其归咎于前任首席执行官并重新开始。当然,如果前任 CEO 继续担任他的职务,就不会进行账目清理工作。 - 重要的是要考虑产生一定水平的利润所需的投资。绝对利润本身是没有意义的。A公司的₹₹100百万利润优于₹₹200公司利润百万乙如果对公司的投资一种不到B公司投资金额的一半。投资回报比绝对利润更重要。

- 最后,产生给定利润的假设风险至关重要。如果公司在产生利润时面临过大的风险,则可能不希望获得更高的利润。不仅未来利润会消失,这种风险还会危及公司的生存。本书后面将详细讨论风险。

金融代写|公司财务和评估代写CORPORATE FINANCE代考|GOVERNANCE

各种形式的商业组织在管理方式上存在显着差异。治理结构的差异是显着的。

独资企业和合伙企业易于管理。业主和合伙人就业务做出所有决定,如果在合伙企业中出现分歧,合伙人可以根据各自的股份比例投票。

公司的治理更为复杂。有大量股东,有时数以百万计,每个人都持有不同的公司股份。股东分布在全国各地,甚至国外。尽管技术、交通和通讯手段取得了进步,但几乎不可能定期将他们聚集在一起以决定各种业务问题。

股东通过授权董事会解决问题吨H和‘b这一种rd′作为代表他们管理公司的最高机构。董事会确立了公司的愿景和使命,以指导其当前的运营和未来的发展。董事会具有以下职责:

- 它建立了公司的战略政策框架。

- 它任命董事总经理和其他高级管理人员进行日常运营。

- 它负责监督管理并确保最高标准的公司治理。

金融代写|公司财务和评估代写Corporate Finance代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。

电磁学代考

物理代考服务:

物理Physics考试代考、留学生物理online exam代考、电磁学代考、热力学代考、相对论代考、电动力学代考、电磁学代考、分析力学代考、澳洲物理代考、北美物理考试代考、美国留学生物理final exam代考、加拿大物理midterm代考、澳洲物理online exam代考、英国物理online quiz代考等。

光学代考

光学(Optics),是物理学的分支,主要是研究光的现象、性质与应用,包括光与物质之间的相互作用、光学仪器的制作。光学通常研究红外线、紫外线及可见光的物理行为。因为光是电磁波,其它形式的电磁辐射,例如X射线、微波、电磁辐射及无线电波等等也具有类似光的特性。

大多数常见的光学现象都可以用经典电动力学理论来说明。但是,通常这全套理论很难实际应用,必需先假定简单模型。几何光学的模型最为容易使用。

相对论代考

上至高压线,下至发电机,只要用到电的地方就有相对论效应存在!相对论是关于时空和引力的理论,主要由爱因斯坦创立,相对论的提出给物理学带来了革命性的变化,被誉为现代物理性最伟大的基础理论。

流体力学代考

流体力学是力学的一个分支。 主要研究在各种力的作用下流体本身的状态,以及流体和固体壁面、流体和流体之间、流体与其他运动形态之间的相互作用的力学分支。

随机过程代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其取值随着偶然因素的影响而改变。 例如,某商店在从时间t0到时间tK这段时间内接待顾客的人数,就是依赖于时间t的一组随机变量,即随机过程

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。