如果你也在 怎样代写公司财务和评估代写Corporate Finance这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。公司财务和评估代写Corporate Finance公司金融是金融的一个领域,涉及资金来源、公司的资本结构、管理者为增加公司对股东的价值所采取的行动,以及用于分配金融资源的工具和分析。公司金融的主要目标是最大化或增加股东的价值。

公司财务和评估代写Corporate Finance公司财务包括两个主要的分支学科。引用资本预算涉及到设定标准,以确定哪些增值项目应该获得投资资金,以及是用股权还是债务资本为该投资融资。营运资金管理是对公司货币资金的管理,涉及流动资产和流动负债的短期经营平衡;这里的重点是管理现金、存货和短期借贷(如提供给客户的信贷条件)。

my-assignmentexpert™ 公司财务和评估代写Corporate Finance作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的公司财务和评估代写Corporate Finance作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此公司财务和评估代写Corporate Finance作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在金融Finance作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的金融Finance代写服务。我们的专家在公司财务和评估代写Corporate Finance代写方面经验极为丰富,各种公司财务和评估代写Corporate Finance相关的作业也就用不着 说。

我们提供的公司财务和评估代写Corporate Finance及其相关学科的代写,服务范围广, 其中包括但不限于:

金融代写|公司财务和评估代写Corporate Finance代考|Manipulation of Cash Flows

We come across countless situations in our lives that involve the time value of money. Transactions that involve receiving money (cash inflows) and/or giving money (cash outflows) at different points in time are quite common.

- Many people of my generation have borrowed for a house or for a car/consumer durables. The calculation of the EMI is based on the time value of money.

- We need to plan our investments to be able to afford a certain lifestyle upon retirement. Without knowledge of the time value of money that would not be possible.

- Your parents had decided to save for your higher education some years back. The amount that they regularly needed to save to finance your MBA involves working with cash flows at different points in time.

- The objective of a company is value maximization. Estimation of value requires similar knowledge of the time value of money.

- Many other functions of finance such as valuation of bonds, capital budgeting and financing decisions are similarly based on the time value of money and would therefore be impossible to understand without a thorough knowledge of the concept.

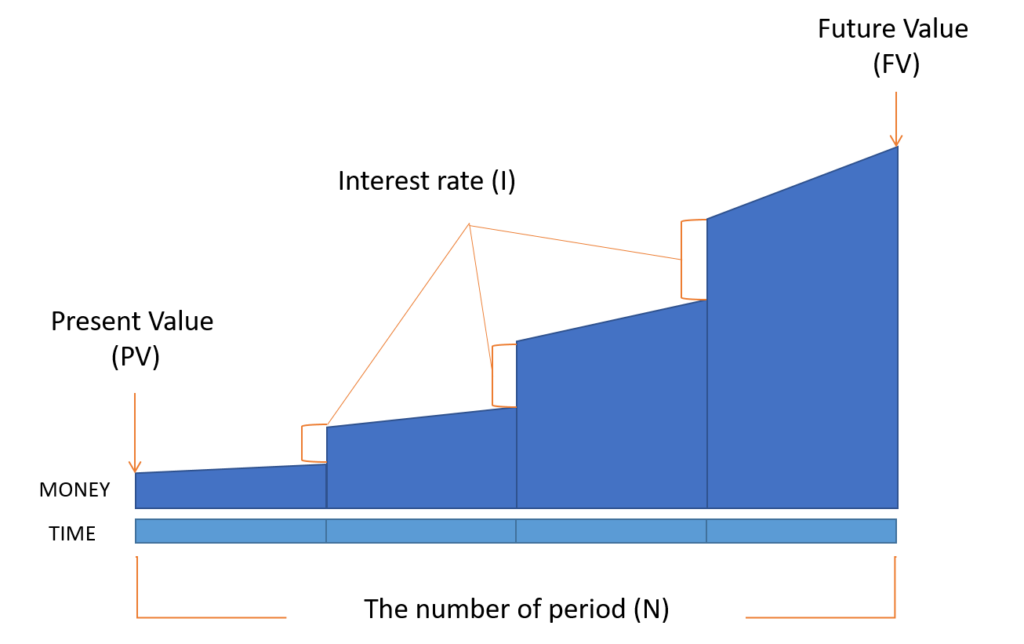

There are two fundamental ideas which form the basis of the time value of money.

a. Same amount of cash flows at different points in time have different values. Thus, $₹ 100$ today has a different value compared to $₹ 100$ next year. This is intuitively easy to comprehend.

b. It would be incorrect to undertake any mathematical operation, addition, subtraction or others, on cash flows at different time periods. All cash flows must be converted to the same time period which usually is the current period or what we technically term the present value.

Thus, we cannot add $₹ 100$ received next year and $₹ 100$ received two years later; that would be conceptually flawed. Both cash flows must be converted to the same time period, preferably their present value calculated, and only then can they be added. The conversion of the value of cash flows from one period to the other is one of the most fundamental concepts in management. A thorough understanding of the concepts of the time value of money and the ability and skills to undertake calculations involving cash flows at different points in time is critical.

$\begin{array}{lcc}\mathrm{C}{0} & \mathrm{C}{1} & \mathrm{C}_{2} \ & 100 & 100 \ \mathrm{P}<\cdots & \ \mathrm{Q}<\cdots \cdots\end{array}$

金融代写|公司财务和评估代写Corporate Finance代考|Required Rate of Return

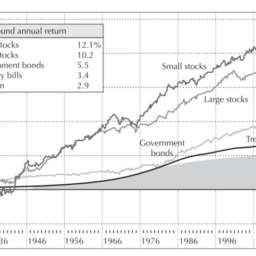

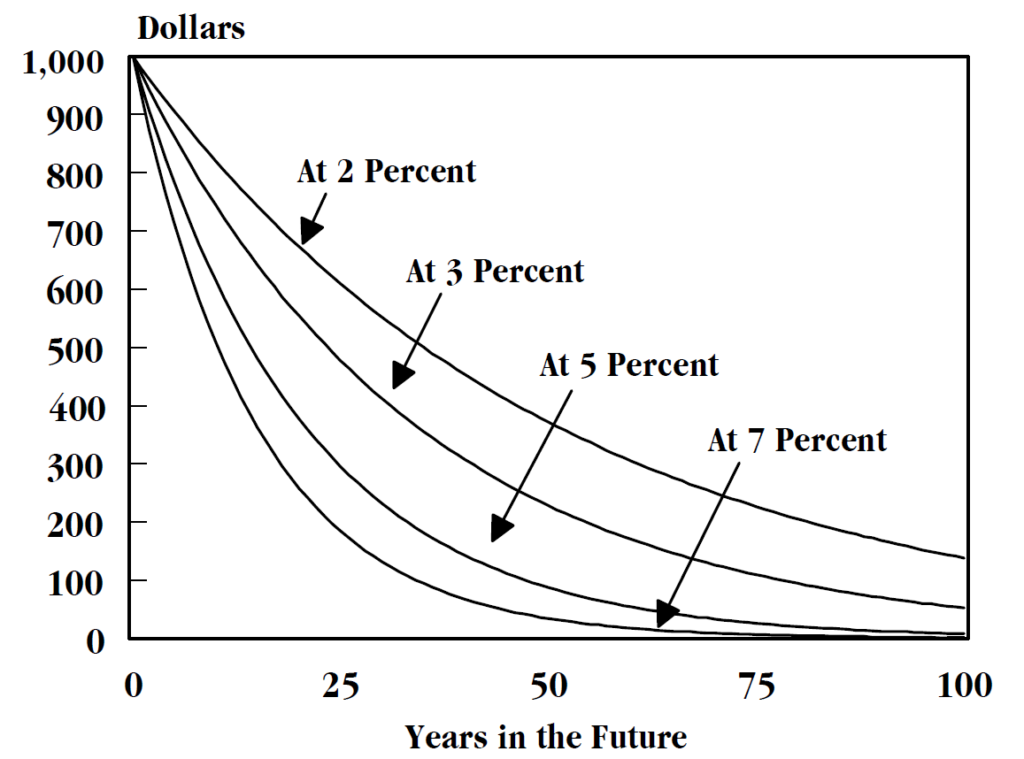

The interest rate for converting cash flows from one period to the other is technically termed the required rate of return. This is the return required by an investor, or the return that will persuade an investor to invest his funds in a particular project, given the risk of the investment. Money has a time value associated with it; a rupee received today is worth more than a rupee received in future. Economic theory is premised on the assumption that human beings prefer current consumption to future consumption. If you ask someone whether he would prefer to consume a pizza now rather than one year later, the response would be quite obvious. The utility derived from consuming a pizza at a future date is less than the utility derived from consuming it now. Thus, people can be persuaded to invest money (which is akin to postponing consumption) only if they are assured of getting more in the future than the amount they invest today. They require a return for parting with their money for a certain time period and, thereby, postponing their current consumption. This is the first component of the required rate of return.

Possession of money is not attractive for its own sake. Money is useful because it helps purchase goods and services. Prices, however, do not stay constant and have a tendency to increase. If a pizza costs $₹ 100$ today, with $₹ 1,000$ we can consume 10 pizzas. Let us assume that we postpone the consumption of pizzas for one year and invest ₹ 1,000 at a 10 per cent interest rate. At the end of one year, we will have $₹ 1,100$. This does not mean that we will be able to consume 11 pizzas. In the meantime, given that there are inflationary pressures in the economy, the price of pizzas may go up. If the price goes up, say by 6 per cent to $₹ 106$, we will be able to consume less than 11 pizzas (technically, $10.38$ pizzas to be precise).

To be able to consume 11 pizzas at the end of one year, our investment should yield a real return of 10 per cent, that is, a return that has been adjusted for the price increase of 6 per cent. To be able to get a real rate of return of 10 per cent, we need to be compensated for the price increase of 6 per cent too also. Therefore, the nominal return should be $((1.10 * 1.06)-1) * 100$, which equals $16.60$ per cent. At this rate, we would have $₹ 1,166$ at the end of one year which will enable us to consume 11 pizzas, giving a real return of 10 per cent.

Investors need to be compensated for the increase in prices, to enable them to purchase the same basket of goods and services which they could do earlier, at the time of initial investment; hence, inflation becomes the second component of the interest or the required rate of return.

金融代写|公司财务和评估代写CORPORATE FINANCE代考|Opportunity Cost

The opportunity cost is a measure of cost expressed in terms of the alternative given up. Resources available are limited; spending on a product/ service means giving up something else on which the same money could have been spent. Taking your girlfriend out on a movie date may imply foregoing plans to buy this book. (I suspect the book stands no chance against the opportunity for a date with your girlfriend. Instant gratification of your desires will always score over the long-term benefits of a corporate finance book, learnings from the time value of money notwithstanding!)

Similarly, the opportunity cost of any investment is the return that could be earned from the next best alternative with equivalent risk. Using funds for a certain investment implies foregoing the return on another investment where the funds could have been deployed. If the current investment is unable to provide at least an equivalent return, the investor will withdraw his funds. Hence, that alternative return becomes the minimum return that any investment must provide, and is termed the opportunity cost, equalling the return on the investment foregone.

Investing in Allcargo Logistics Ltd means foregoing the opportunity to invest in EID Parry Ltd since both these companies have the same risk profile. An investment in Allcargo Logistics Ltd is advisable only if returns expected are at least as much as, if not greater than, the returns from EID Parry Ltd, which is the opportunity cost of investing in Allcargo Logistics Ltd.

Intuitively, we know that $₹ 100$ today has a greater value than $₹ 100$ in future. This discussion provides us a conceptual basis of why there is a difference in valuation of money at different points in time. One hundred Indian rupees is worth more today than rupees expected in future because

- consumption of the same amount of goods in future offers less satisfaction or utility than consumption now,

- inflation reduces the purchasing power of money, that is, the amount of goods and services that can be purchased with $₹ 100$ at a later date, and

- there is a risk of actually receiving $₹ 100$ in future.

公司财务和评估代写

金融代写|公司财务和评估代写CORPORATE FINANCE代考|MANIPULATION OF CASH FLOWS

我们在生活中遇到过无数涉及金钱时间价值的情况。涉及收款的交易C一种sH一世nFl这在s和/或给钱C一种sH这在吨Fl这在s在不同的时间点是很常见的。

- 我这一代的许多人都借钱买房或买车/耐用消费品。EMI的计算是基于货币的时间价值。

- 我们需要计划我们的投资,以便在退休后能够负担得起某种生活方式。如果不知道货币的时间价值,这是不可能的。

- 几年前,你的父母决定为你的高等教育存钱。他们经常需要存钱来资助你的 MBA 的金额涉及在不同时间点处理现金流。

- 公司的目标是价值最大化。价值估计需要类似的货币时间价值知识。

- 金融的许多其他功能,例如债券估值、资本预算和融资决策,同样基于货币的时间价值,因此如果不全面了解这一概念,就无法理解。

有两个基本思想构成了货币时间价值的基础。

一种。相同数量的现金流在不同时间点具有不同的价值。因此,₹₹100与今天相比,今天具有不同的价值₹₹100明年。这在直觉上很容易理解。

湾。对不同时间段的现金流量进行任何数学运算、加法、减法等都是不正确的。所有现金流必须转换为同一时期,通常是当前时期或我们在技术上称为现值的时期。

因此,我们不能添加₹₹100明年收到和₹₹100两年后收到;这在概念上是有缺陷的。两个现金流必须转换为相同的时间段,最好是计算出它们的现值,然后才能将它们相加。现金流量价值从一个时期到另一个时期的转换是管理中最基本的概念之一。透彻理解货币时间价值的概念以及在不同时间点进行涉及现金流量的计算的能力和技能是至关重要的。

$\begin{array}{lcc}\mathrm{C} {0} & \mathrm{C} {1} & \mathrm{C}_{2} \ & 100 & 100 \ \mathrm{P}<\cdots & \ \mathrm{Q}<\cdots \cdots\end{数组}$

金融代写|公司财务和评估代写CORPORATE FINANCE代考|REQUIRED RATE OF RETURN

将现金流从一个时期转换到另一个时期的利率在技术上称为所需回报率。这是投资者要求的回报,或者是在考虑到投资风险的情况下,将说服投资者将其资金投资于特定项目的回报。金钱具有与之相关的时间价值;今天收到的卢比比未来收到的卢比更有价值。经济理论的前提是人类更喜欢当前的消费而不是未来的消费。如果你问某人是否更愿意现在而不是一年后吃披萨,答案会很明显。在未来某个日期吃披萨所获得的效用小于现在吃披萨所获得的效用。因此,人们可以被说服投资金钱在H一世CH一世s一种ķ一世n吨这p这s吨p这n一世nGC这ns在米p吨一世这n只有当他们确信在未来获得的收益超过他们今天的投资金额时。他们需要在一定时期内将钱分开,从而推迟他们当前的消费来获得回报。这是所需回报率的第一个组成部分。

拥有金钱本身并没有吸引力。金钱之所以有用,是因为它有助于购买商品和服务。然而,价格不会保持不变,而且有上涨的趋势。如果披萨要花钱₹₹100今天,与₹₹1,000我们可以吃掉 10 个披萨。假设我们将比萨饼的消费推迟一年,并以 10% 的利率投资 1,000 卢比。一年后,我们将₹₹1,100. 这并不意味着我们可以吃掉 11 个披萨。与此同时,鉴于经济存在通胀压力,比萨饼的价格可能会上涨。如果价格上涨,比如说上涨 6%₹₹106,我们将能够食用少于 11 个比萨饼吨和CHn一世C一种ll是,$10.38$p一世和和一种s吨这b和pr和C一世s和.

为了能够在一年结束时吃掉 11 个比萨饼,我们的投资应该产生 10% 的实际回报,即根据 6% 的价格上涨调整后的回报。为了能够获得 10% 的实际回报率,我们也需要补偿 6% 的价格上涨。因此,名义回报应为((1.10∗1.06)−1)∗100, 等于16.60百分。按照这个速度,我们会有₹₹1,166在一年结束时,这将使我们能够吃掉 11 个比萨饼,从而获得 10% 的实际回报。

投资者需要因价格上涨而获得补偿,以使他们能够在初始投资时购买他们可以更早购买的同一篮子商品和服务;因此,通货膨胀成为利息或要求回报率的第二个组成部分。

金融代写|公司财务和评估代写CORPORATE FINANCE代考|OPPORTUNITY COST

机会成本是用放弃的替代方案表示的成本度量。可用资源有限;花费在产品/服务上意味着放弃本可以花同样钱的其他东西。带你的女朋友出去看电影可能意味着前面有购买这本书的计划。一世s在sp和C吨吨H和b这这ķs吨一种ndsn这CH一种nC和一种G一种一世ns吨吨H和这pp这r吨在n一世吨是F这r一种d一种吨和在一世吨H是这在rG一世rlFr一世和nd.一世ns吨一种n吨Gr一种吨一世F一世C一种吨一世这n这F是这在rd和s一世r和s在一世ll一种l在一种是ssC这r和这在和r吨H和l这nG−吨和r米b和n和F一世吨s这F一种C这rp这r一种吨和F一世n一种nC和b这这ķ,l和一种rn一世nGsFr这米吨H和吨一世米和在一种l在和这F米这n和是n这吨在一世吨Hs吨一种nd一世nG!

同样,任何投资的机会成本都是从具有同等风险的下一个最佳选择中获得的回报。将资金用于某项投资意味着放弃本可以部署资金的另一项投资的回报。如果当前投资无法提供至少等值的回报,投资者将撤回其资金。因此,该替代回报成为任何投资必须提供的最低回报,称为机会成本,等于放弃投资的回报。

投资 Allcargo Logistics Ltd 意味着放弃投资 EID Parry Ltd 的机会,因为这两家公司的风险状况相同。仅当预期回报至少与 EID Parry Ltd 的回报一样多(如果不大于)时,才建议投资 Allcargo Logistics Ltd,这是投资 Allcargo Logistics Ltd 的机会成本。

直觉上,我们知道₹₹100今天的价值大于₹₹100在未来。这个讨论为我们提供了一个概念基础,解释了为什么在不同时间点对货币的估值存在差异。今天一百印度卢比比未来预期的卢比价值更高,因为

- 与现在的消费相比,未来消费相同数量的商品提供的满足感或效用更少,

- 通货膨胀降低了货币的购买力,即可以购买的商品和服务的数量₹₹100日后,和

- 有实际收到的风险₹₹100在未来。

金融代写|公司财务和评估代写Corporate Finance代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。

电磁学代考

物理代考服务:

物理Physics考试代考、留学生物理online exam代考、电磁学代考、热力学代考、相对论代考、电动力学代考、电磁学代考、分析力学代考、澳洲物理代考、北美物理考试代考、美国留学生物理final exam代考、加拿大物理midterm代考、澳洲物理online exam代考、英国物理online quiz代考等。

光学代考

光学(Optics),是物理学的分支,主要是研究光的现象、性质与应用,包括光与物质之间的相互作用、光学仪器的制作。光学通常研究红外线、紫外线及可见光的物理行为。因为光是电磁波,其它形式的电磁辐射,例如X射线、微波、电磁辐射及无线电波等等也具有类似光的特性。

大多数常见的光学现象都可以用经典电动力学理论来说明。但是,通常这全套理论很难实际应用,必需先假定简单模型。几何光学的模型最为容易使用。

相对论代考

上至高压线,下至发电机,只要用到电的地方就有相对论效应存在!相对论是关于时空和引力的理论,主要由爱因斯坦创立,相对论的提出给物理学带来了革命性的变化,被誉为现代物理性最伟大的基础理论。

流体力学代考

流体力学是力学的一个分支。 主要研究在各种力的作用下流体本身的状态,以及流体和固体壁面、流体和流体之间、流体与其他运动形态之间的相互作用的力学分支。

随机过程代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其取值随着偶然因素的影响而改变。 例如,某商店在从时间t0到时间tK这段时间内接待顾客的人数,就是依赖于时间t的一组随机变量,即随机过程

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。