MY-ASSIGNMENTEXPERT™可以为您提供 lse.ac.uk FM322 Financial Derivatives金融衍生品的代写代考和辅导服务!

这是伦敦政经学校金融衍生品课程的代写成功案例。

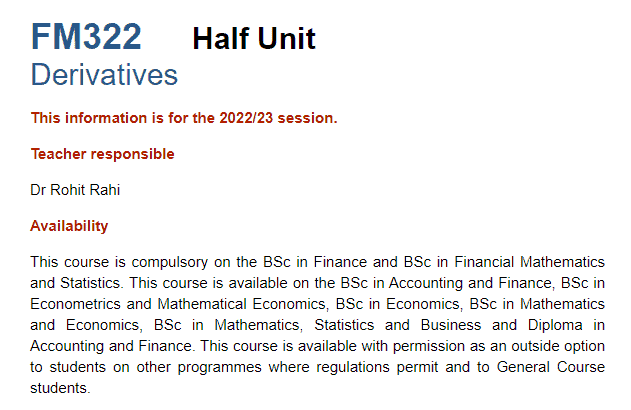

FM322课程简介

This course is compulsory on the BSc in Finance and BSc in Financial Mathematics and Statistics. This course is available on the BSc in Accounting and Finance, BSc in Econometrics and Mathematical Economics, BSc in Economics, BSc in Mathematics and Economics, BSc in Mathematics, Statistics and Business and Diploma in Accounting and Finance. This course is available with permission as an outside option to students on other programmes where regulations permit and to General Course students.

Prerequisites

This course is intended for third-year undergraduates and builds upon FM212/FM213 Principles of Finance. This course focuses on derivatives, with a particular emphasis on equity derivatives (standard call and put options, exotic options), futures and forward contracts, and interest rate derivatives (swaps, caps and floors, swaptions). It systematically addresses three basic questions: how do these products work, i.e. what are their payoffs? How can they be used, for hedging purposes or as part of trading strategies? And above all: how are they priced? The course emphasises a small number of powerful ideas: absence of arbitrage, replication, and risk-neutral pricing. These are typically introduced in the context of discrete-time models, but the course also covers some well-known continuous-time models, starting with a comprehensive treatment of the Black-Scholes model. The level of mathematics is appropriate for third-year students with a solid quantitative background.

FM322 Financial Derivatives HELP(EXAM HELP, ONLINE TUTOR)

Determine which statement about zero-cost purchased collars is FALSE (A) A zero-width, zero-cost collar can be created by setting both the put and call strike prices at the forward price. (B) There are an infinite number of zero-cost collars. (C) The put option can be at-the-money. (D) The call option can be at-the-money. (E) The strike price on the put option must be at or below the forward price.

The statement that is FALSE is (E) The strike price on the put option must be at or below the forward price.

In a zero-cost purchased collar, an investor can finance the purchase of a put option by selling a call option with the same expiration date and underlying asset. The premium received from selling the call option offsets the cost of purchasing the put option, resulting in a net zero cost.

To create a zero-width, zero-cost collar, the strike price of the call option and the put option should both be set at the forward price of the underlying asset. This ensures that the investor is protected against both upside and downside price movements, while not incurring any net cost.

There are indeed an infinite number of possible combinations of strike prices and expiration dates for zero-cost collars, as long as the premium received from selling the call option equals the premium paid for the put option.

The put option can be at-the-money, meaning that the strike price is equal to the current market price of the underlying asset, and the call option can also be at-the-money. This creates a collar that provides protection against a decline in the price of the underlying asset, while still allowing for potential upside gains.

However, the strike price on the put option does not have to be at or below the forward price. In fact, the strike price on the put option can be higher than the forward price, although this would typically result in a net cost for the investor.

You are given the following:

The current price to buy one share of XYZ stock is 500 .

The stock does not pay dividends.

The continuously compounded risk-free interest rate is $6 \%$.

A European call option on one share of XYZ stock with a strike price of $K$ that expires in one year costs 66.59 .

A European put option on one share of XYZ stock with a strike price of $K$ that expires in one year costs 18.64 .

Using put-call parity, calculate the strike price, $K$.

(A) 449

(B) 452

(C) 480

(D) 559

(E) 582

Put-call parity is given by $C+K e^{-rT} = P+S_0$, where $C$ and $P$ are the prices of the call and put options, respectively, $S_0$ is the current stock price, $K$ is the strike price, $r$ is the continuously compounded risk-free interest rate, and $T$ is the time to expiration of the options.

Plugging in the given values, we have:

$66.59 + K e^{-0.06\cdot 1} = 18.64 + 500$

Simplifying and solving for $K$, we get:

$K = \frac{18.64 + 500 – 66.59}{e^{-0.06}} = 452.14$

Rounding to the nearest whole number, we get $K = \boxed{\text{(B) 452}}$.

MY-ASSIGNMENTEXPERT™可以为您提供 LSE.AC.UK FM322 FINANCIAL DERIVATIVES金融衍生品的代写代考和辅导服务!