MY-ASSIGNMENTEXPERT™可以为您提供sce.cornell.edu ECON1110 Microeconomics微观经济学的代写代考和辅导服务!

这是康乃尔大学 微观经济学课程的代写成功案例。

ECON1110课程简介

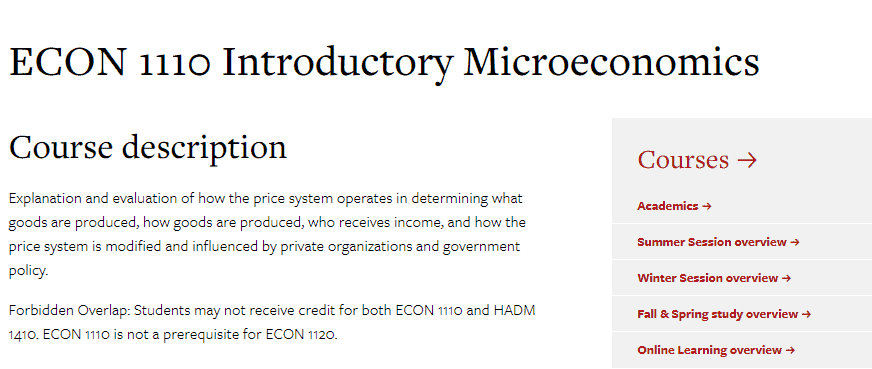

Course description

Explanation and evaluation of how the price system operates in determining what goods are produced, how goods are produced, who receives income, and how the price system is modified and influenced by private organizations and government policy.

Forbidden Overlap: Students may not receive credit for both ECON 1110 and HADM 1410. ECON 1110 is not a prerequisite for ECON 1120.

Prerequisites

ECON 1110

ECON 1110Introductory Microeconomics

Course information provided by the Courses of Study 2020-2021.

Explanation and evaluation of how the price system operates in determining what goods are produced, how goods are produced, who receives income, and how the price system is modified and influenced by private organizations and government policy.

When Offered Fall, Winter, Spring, Summer.

Forbidden Overlaps Forbidden Overlap: due to an overlap in content, students will not receive credit for both ECON 1110 and HADM 1410.

Distribution Category (SBA-AS, SSC-AS)

Comments ECON 1110 is not a prerequisite for ECON 1120.

ECON1110 Microeconomics HELP(EXAM HELP, ONLINE TUTOR)

In P\&R textbook you can find figure 5.6 , that represents preferences of a risk averse agent in terms of expected return and standard deviation. In this exercise you are asked to analyze the implicit assumptions that stay behind this graph.

(a) Suppose that individual has quadratic Bernoulli utility function $u(x)=x-b x^2$, where $b>0$. Show that for this individual the expected utility from a distribution is determined by the mean and variance of the distribution and, in fact, by these moments alone. Draw the resulting indifference curves in the same axes as in figure 5.5. [Note: to guarantee non-satiation we assume that distribution cannot take values larger than $1 /(2 b)$.

(b) Suppose that individual considered in (a) can invest in treasury bills or stocks or in some combination of the two. Treasury bills bring zero expected return and are assumed to be risk-free. Stocks bring positive expected return $R_s$ and are assumed to be risky with standard deviation of $\sigma_s>0$. Suppose this investor has initial wealth equal to 1 .

(i) Derive the budget constraint in terms of mean and standard deviation of the portfolio and illustrate it graphically.

(ii) Solve the resulting utility maximization problem to get demand for risky and risk-free assets (consider interior solution only). Illustrate graphically.

(c) Suppose that individual from (b) invests in both assets. How is the optimal portfolio affected by:

(i) an increase in coefficient $b$ ?

(ii) an increase in variance of risky asset?

Question

a.

$$

\begin{gathered}

\max _y \pi=0.9(A-B y) y-\frac{1}{2} y^2 \

\Rightarrow y^M=\frac{0.9 A}{1.8 B+1}<\frac{A}{2 B+1}=y^*

\end{gathered}

$$

Price received by the consumers,

$$

p^C=\frac{0.9 A B+A}{1.8 B+1}>\frac{A B+A}{2 B+1}=p^*

$$

Price received by the firm,

$$

p^M=0.9 p^C=\frac{0.81 A B+0.9 A}{1.8 B+1}<\frac{A B+A}{2 B+1}=p^*

$$

Profit of the firm,

$$

\pi^M=\frac{0.41 A^2}{1.8 B+1}<\pi^*

$$

b.

In presence of the profit tax the optimization problem is

$$

\max _y(1-t)\left[(A-B y) y-\frac{1}{2} y^2\right]

$$

which is the same problem as the original one in 2.a and hence the output and price decision is same as in 2.a and the profit is just $t$ proportion lower than the original one. Therefore given this result the consumers will always prefer profit tax over sales tax as profit tax doesn’t distort the pricing and supply decision of the firm while sales tax does,

c.

The fixed cost again doesn’t change the profit maximizing price-output choice of the firm, but lowers profit by the amount of the fixed cost. Therefore the argument that selling band of air-wave lengths to the highest bidder through auctions would rive up the price is not well founded as the cost paid to government to get this right is like a fixed cost to the monopolist.

Water conservation is higher under the first scheme but the second scheme brings more revenue

Hint: look at substitution effect

Hint for graphical analysis:

$$

T R_1=p^1 x\left(p^1, M\right)=M-y\left(p^1, M\right) \text { and } T R_2=F+p^0 x\left(p^0, M-F\right)=M-y\left(p^0, M-F\right)

$$

Dan has utility function $u(w)=\sqrt{w}$, where $w$ is his wealth. All his initial wealth, equal to $\$ 36$, is deposited at bank M. With probability of 0.5 this bank can become bankrupt. Had this happened, Dan would get only $\$ 4$ guaranteed by the government. A risk neutral firm $\mathrm{N}$ proposes Dan to purchase his problem deposit (before the uncertainty is resolved) for $\$ X$.

(a) Find all values of $X$ that are mutually beneficial for Dan and firm $N$, provide graphical solution.

(b) Suppose that $X=20$. A corrupted manager from bank $M$ possesses information about the bank’s position and can say with certainty whether bankruptcy will take place. He offers Dan to sell this information. What is the maximum amount that Dan is willing to pay for this information? Provide algebraic solution and illustrate your solution on a diagram with contingent commodities.

(c) Suppose that Zara faces exactly the same problem as Dan but she is risk neutral. Find the maximum sum that Zara is willing to pay for the information offered by the corrupted manager described in (b) and compare with the maximum sum that Dan is willing to pay. Illustrate on the same graph.

(d) Compare the maximum prices found in (b) and (c). Would the result of this comparison be different if Dan had different preferences but the same type of risk attitude?

MY-ASSIGNMENTEXPERT™可以为您提供SCE.CORNELL.EDU ECON1110 MICROECONOMICS微观经济学的代写代考和辅导服务!