MY-ASSIGNMENTEXPERT™可以为您提供my.uq.edu ECON1110 Microeconomics微观经济学的代写代考和辅导服务!

这是昆士兰大学 微观经济学课程的代写成功案例。

ECON1110课程简介

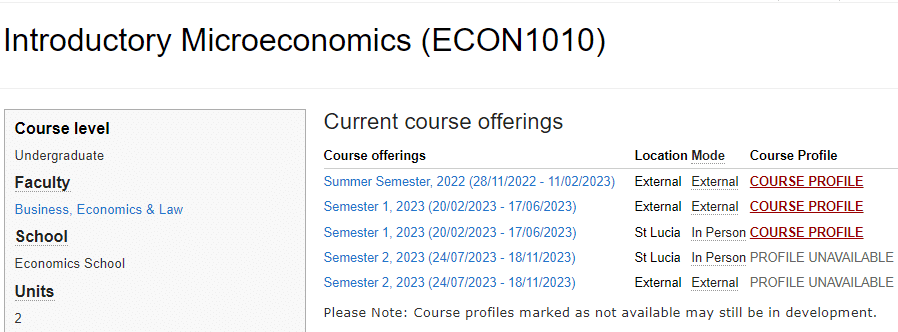

ECON1010 is an introductory course in Microeconomics. It focuses on how decision making agents within the economy (e.g. consumers, firms, government departments) make choices and how choices can be made in a way that makes the best possible use of limited available resources. Making choices is an integral part of everyday life – this course will help you to understand how the world operates, and, in doing so, shed light on how it might be changed for the better. For example, why do firms discount certain products but not others? Why is it so hard to find a good quality used car? Why does the government heavily tax petrol but not fast food? Why has the divorce rate increased over the past 50 years? This course will set you on the path to thinking critically about all areas of life where choices are made. A focus is placed on core economic principles that are immediately applicable rather than formal mathematical theorising.

Prerequisites

Course Description: Provides students with a practical understanding of the core economic principles that explain why individuals, companies and governments make the decisions they do, and how their decision-making might be improved to make best use of available resources.

Assumed Background:

There is a mathematical requirement for entry into degree programs offered by the Faculty of Business, Economics and Law. The mathematical requirements of this course are modest. Basic arithmetic and an ability to understand and manipulate simple graphs are required. These skills are basic employment requirements in the private or public sector.

ECON1110 Microeconomics HELP(EXAM HELP, ONLINE TUTOR)

A farmer can grow wheat or potatoes or both. If the summer is shiny then a unit of land yields a profit of $\$ 7$ if devoted to wheat, of $\$ 3$ if devoted to potatoes. Should the summer be rainy, a unit of land yields a profit of $\$ 1$ if devoted to wheat, of $\$ 3$ if devoted to potatoes. Good and bad weather is equally likely. Farmer is risk averse and has 40 units of land. Let the farmer’s utility function be given by $u(x)=4 \sqrt{x}$, where $x$ stays for wealth.

(a) What is the optimal allocation of land between potatoes and wheat. Illustrate graphically and explain the result intuitively.

(b) Suppose that farmer is offered to rent his land out for one period for $\$ \mathrm{X}$. Find the smallest $\mathrm{X}$ at which the farmer would accept the offer. Denote this sum by $X_{\min }$ and illustrate graphically. Compare $X_{\min }$ with the one period expected profit from his business and explain the result.

(c) Now, suppose that the farmer can purchase an insurance against bad weather that pays $\$ 1$ per unit of insurance in case of bad weather at a price of $\$ 0.5$ per unit. Find the optimal allocation of land and the quantity of insurance purchased. Illustrate graphically and explain the result intuitively.

- (a) $\mathrm{X}$ from 16 to 20 ;

(b) Max_sum=7.2

(c) Max_sum=8;

(d) The max sum will change but it will be less than 8 - (a) $E u(x)=E x-b\left(\sigma^2+(E x)^2\right)$;

(b) (i) budget line: $\sigma_p=\frac{\sigma_S}{R_s} E_p$, where $0 \leq E_p \leq R_s, E_p$-portfolio expected return, $\sigma_p$ portfolio standard deviation;

(ii) $E_p=0.5 \frac{\left(R_s\right)^2 / b}{\left(R_s\right)^2+\sigma_s^2}$, which gives the optimal investment in risky asset $\alpha=0.5 \frac{R_s / b}{\left(R_s\right)^2+\sigma_s^2}$;

(c) investment in risky asset goes down in both cases (i) and (ii) - (a) 30 units (wheat) and 10 units (potatoes);

(b) $X_{\min }=135<$ Exp_profit $=150$;

(c) 40 units (wheat) and 0 units (potatoes) +full insurance

- (a) Dan doesn’t reject iff his EU does not go down as a result of this sale: $\sqrt{x} \geq 0.5 \sqrt{4}+0.5 \sqrt{36}=4, x \geq 16$

Firm accepts iff its expected utility (equal to the expected profit due to risk neutrality) is not reduced as a result of this transaction: $0.5 \times 4+0.5 \times 36-x=20-x \geq 0$

Mutually beneficial $20 \geq x \geq 16$

Graph should be provided

(b) With information Dan sells his deposit in case of bankruptcy and gets $20-Q$ ( $Q$ – price of information) and keeps deposit otherwise (in this case his wealth is $36-Q$ ). The resulting expected utility is $E U^{\mathrm{inf}}=0.5 \sqrt{20-Q}+0.5 \sqrt{36-Q}$. Without information he is better off by selling this deposit as price exceeds 16 and his utility is $\sqrt{x}=\sqrt{20}$. Thus he will purchase information iff $E U^{\mathrm{inf}}=0.5 \sqrt{20-Q}+0.5 \sqrt{36-Q} \geq \sqrt{20}$. The maximum price makes Dan indifferent:

$$

\sqrt{36-Q}=2 \sqrt{20}-\sqrt{20-Q}

$$

Then $36-Q=4 \times 20+20-Q-4 \sqrt{(20-Q) 20}$, which can be rewritten as $4 \sqrt{(20-Q) 20}=100-36=64$. Thus $\sqrt{(20-Q) 5}=8$, which implies $(20-Q) 5=64$. Solving equation we get $Q=20-\frac{64}{5}=7.2$

Graph should be provided

(c) Zara has the same utility function as bank $\mathrm{N}$, so without information she is indifferent $\mathrm{b} / \mathrm{w}$ selling deposit at $\mathrm{X}=20$ or keeping it. $E U_B^{\text {inf }}=0.5(20-Q)+0.5(36-Q)=28-Q=20$, which gives $Q=8$

Graph should be provided

(d) $Q_{\text {Zara }}=8>7.2=Q_{D a n}$

General case:

$0.5 u(4)+0.5 u(36)<u(0.5 \times 4+0.5 \times 36)=u(20)$. Thus without information offer of the corrupted manager is still accepted as it gives the same EV: $(36+4) / 2=20$ but with certainty

Maximum price of information should make this agent indifferent:

$$

u(20)=E U^{\inf }(Q)=0.5 u(20-Q)+0.5 u(36-Q)

$$

Due to risk-aversion $0.5 u(20-Q)+0.5 u(36-Q)<u\left(\frac{20-Q}{2}+\frac{36-Q}{2}\right)=u(28-Q)$

It implies that $u(20)=E U^{\text {inf }}(Q)=0.5 u(20-Q)+0.5 u(36-Q)<u(28-Q)$

As $u(w)$ is increasing then $20<28-Q, Q_{D a n}<8=Q_{\text {Zana }}$

MY-ASSIGNMENTEXPERT™可以为您提供MY.UQ.EDU ECON1110 MICROECONOMICS微观经济学的代写代考和辅导服务!