经济代写|Open economy macrodynamic 宏观经济学代写

经济代写

Thus far, we have not used the prefix of ‘domestic’ to aggregate output levels, but with the incorporation of the $R o W$ as a sector, it has to be used to distinguish the aggregate output of, say, India from that of the RoW. In this section, we shall provide answers to the following questions: How do exports and imports affect domestic aggregate output levels? How do countries finance 3.5) affect domestic aggregate output levels?

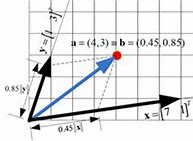

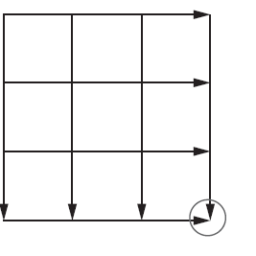

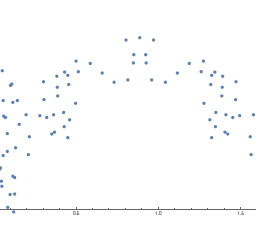

Once again, recall Figure $2.2$, which presented the structure of commodity flows and money flows in the macroeconomy, where the RoW was omitted 78

OUTPUT AND EMPLOYMENT LEVELS

for visual ease. Can you redraw the diagram with the RoW as an additional sector based on the following information? The household sector provides labour to the RoW sector (migrant labour) in return for income (remittances, if they are transferred to their relatives in India). From Chapter 3 , you know that the funds of the foreign institutional investors (FIIs) connect India’s financial sector with that of the RoW and that foreign direct investment (FDI) is one important flow between India’s non-financial sector and the although they go by different names (such as tariff, custom duty, antidumping duty, quota, relaxing of FDI norms and long-term capital gains tax, which are imposed to regulate the inflow of goods, finance and investment). Note that from India’s standpoint, the RoW is a single homogenous sector, but do not forget that it comprises the household, government, financial and non-financial sectors.

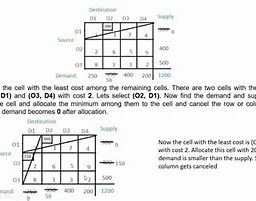

Although we have briefly discussed the determinants of consumption and investment early on in this chapter, we have not yet discussed the rationale for imports and exports. If India is self-sufficient in terms of its domestic production of consumption goods (say, fruits, chocolates, mobile phones) and investment goods (say, chemicals, fuel, machinery), the need for imports would arise only if foreign goods are cheaper than Indian goods. However, India does not produce all that is necessary for domestic needs – both consumption and investment-and, therefore, imports are essential. Table $4.2$ gives you the list of India’s top five imports.

79

MACROECONOMICS

Except for pearls and precious metals, all the oth

Except for pearls and precious metals, all the other commodities can be easily classified as investment goods. However, a part of mineral fuels or oil imports capital goods arises from the inter-industry structure of the Indian economy. The empirical question to address, in this context, is the following: how many units of imported goods are required to produce one unit of (domestic) output in the manufacturing sector? We also import intermediate capital goods to produce exports. Find out how much of our imported pearls and precious export purposes.

Thus far, we have not used the prefix of ‘domestic’ to aggregate output levels, but with the incorporation of the $R o W$ as a sector, it has to be used to distinguish the aggregate output of, say, India from that of the RoW. In this section, we shall provide answers to the following questions: How do exports and imports affect domestic aggregate output levels? How do countries finance 3.5) affect domestic aggregate output levels?

Once again, recall Figure $2.2$, which presented the structure of commodity flows and money flows in the macroeconomy, where the RoW was omitted 78

OUTPUT AND EMPLOYMENT LEVELS

for visual ease. Can you redraw the diagram with the RoW as an additional sector based on the following information? The household sector provides labour to the RoW sector (migrant labour) in return for income (remittances, if they are transferred to their relatives in India). From Chapter 3 , you know that the funds of the foreign institutional investors (FIIs) connect India’s financial sector with that of the RoW and that foreign direct investment (FDI) is one important flow between India’s non-financial sector and the although they go by different names (such as tariff, custom duty, antidumping duty, quota, relaxing of FDI norms and long-term capital gains tax, which are imposed to regulate the inflow of goods, finance and investment). Note that from India’s standpoint, the RoW is a single homogenous sector, but do not forget that it comprises the household, government, financial and non-financial sectors.

Although we have briefly discussed the determinants of consumption and investment early on in this chapter, we have not yet discussed the rationale for imports and exports. If India is self-sufficient in terms of its domestic production of consumption goods (say, fruits, chocolates, mobile phones) and investment goods (say, chemicals, fuel, machinery), the need for imports would arise only if foreign goods are cheaper than Indian goods. However, India does not produce all that is necessary for domestic needs – both consumption and investment-and, therefore, imports are essential. Table $4.2$ gives you the list of India’s top five imports.

79

MACROECONOMICS

Except for pearls and precious metals, all the oth

Except for pearls and precious metals, all the other commodities can be easily classified as investment goods. However, a part of mineral fuels or oil imports capital goods arises from the inter-industry structure of the Indian economy. The empirical question to address, in this context, is the following: how many units of imported goods are required to produce one unit of (domestic) output in the manufacturing sector? We also import intermediate capital goods to produce exports. Find out how much of our imported pearls and precious export purposes.

到目前为止,我们还没有使用“国内”前缀来汇总产出水平,但是随着 $R o W$ 作为一个部门的合并,它必须用来区分印度和印度的总产出的行。在本节中,我们将回答以下问题:进出口如何影响国内总产出水平?国家如何融资 3.5) 影响国内总产出水平?

再次回想一下图 $2.2$,它显示了宏观经济中商品流动和资金流动的结构,其中 RoW 被省略了 78

产出和就业水平

为了视觉方便。您能否根据以下信息重新绘制带有 RoW 的图表作为附加扇区?家庭部门为 RoW 部门提供劳动力(移民劳动力)以换取收入(汇款,如果他们转移给他们在印度的亲戚)。从第 3 章可以看出,外国机构投资者 (FII) 的资金将印度的金融部门与世界其他地区的资金联系起来,外国直接投资 (FDI) 是印度非金融部门之间的重要流动,尽管它们经过不同的名称(如关税、关税、反倾销税、配额、放宽 FDI 规范和长期资本利得税,这些都是为了规范货物、金融和投资的流入而征收的)。请注意,从印度的角度来看,世界其他地区是一个单一的同质部门,但不要忘记它包括家庭、政府、金融和非金融部门。

尽管我们在本章前面简要讨论了消费和投资的决定因素,但我们还没有讨论进出口的基本原理。如果印度在国内生产消费品(例如水果、巧克力、手机)和投资品(例如化学品、燃料、机械)方面能够自给自足,那么只有在外国商品更便宜的情况下才会出现进口需求比印度货。然而,印度并不生产满足国内需求的所有产品——消费和投资——因此,进口是必不可少的。表 $4.2$ 为您提供了印度前五名进口商品的清单。

79

宏观经济

除了珍珠和贵金属,其他所有

除珍珠和贵金属外,其他所有商品都可以轻松归类为投资品。然而,部分矿物燃料或石油进口资本货物来自印度经济的跨行业结构。在这种情况下,要解决的经验问题如下:在制造业中生产一单位(国内)产出需要多少单位的进口商品?我们还进口中间资本货物以生产出口产品。了解我们有多少进口珍珠和珍贵的出口用途。

经济代考

宏观经济学,是以国民经济总过程的活动为研究对象,主要考察就业总水平、国民总收入等经济总量,因此,宏观经济学也被称做就业理论或收入理论。 宏观经济学研究的是经济资源的利用问题,包括国民收入决定理论、就业理论、通货膨胀理论、经济周期理论、经济增长理论、财政与货币政策。

其他相关科目课程代写:组合学Combinatorics集合论Set Theory概率论Probability组合生物学Combinatorial Biology组合化学Combinatorial Chemistry组合数据分析Combinatorial Data Analysis

my-assignmentexpert愿做同学们坚强的后盾,助同学们顺利完成学业,同学们如果在学业上遇到任何问题,请联系my-assignmentexpert™,我们随时为您服务!

宏观经济学是经济学的一个分支,它研究的是一个整体经济,即市场或其他大规模运作的系统是如何运作的。宏观经济学研究经济范围内的现象,如通货膨胀价格水平经济增长,国民收入,国内生产总值,以及失业 .

计量经济学代考

计量经济学是以一定的经济理论和统计资料为基础,运用数学、统计学方法与电脑技术,以建立经济计量模型为主要手段,定量分析研究具有随机性特性的经济变量关系的一门经济学学科。 主要内容包括理论计量经济学和应用经济计量学。 理论经济计量学主要研究如何运用、改造和发展数理统计的方法,使之成为经济关系测定的特殊方法。

相对论代考

相对论(英語:Theory of relativity)是关于时空和引力的理论,主要由愛因斯坦创立,依其研究对象的不同可分为狭义相对论和广义相对论。 相对论和量子力学的提出给物理学带来了革命性的变化,它们共同奠定了现代物理学的基础。

编码理论代写

编码理论(英语:Coding theory)是研究编码的性质以及它们在具体应用中的性能的理论。编码用于数据压缩、加密、纠错,最近也用于网络编码中。不同学科(如信息论、电机工程学、数学、语言学以及计算机科学)都研究编码是为了设计出高效、可靠的数据传输方法。这通常需要去除冗余并校正(或检测)数据传输中的错误。

编码共分四类:[1]

数据压缩和前向错误更正可以一起考虑。

复分析代考

学习易分析也已经很冬年了,七七八人的也续了圧少的书籍和论文。略作总结工作,方便后来人学 Đ参考。

复分析是一门历史悠久的学科,主要是研究解析函数,亚纯函数在复球面的性质。下面一昭这 些基本内容。

(1) 提到复变函数 ,首先需要了解复数的基本性左和四则运算规则。怎么样计算复数的平方根, 极坐标与 $x y$ 坐标的转换,复数的模之类的。这些在高中的时候囸本上都会学过。

(2) 复变函数自然是在复平面上来研究问题,此时数学分析里面的求导数之尖的运算就会很自然的 引入到复平面里面,从而引出解析函数的定义。那/研究解析函数的性贡就是关楗所在。最关键的 地方就是所谓的Cauchy一Riemann公式,这个是判断一个函数是否是解析函数的关键所在。

(3) 明白解析函数的定义以及性质之后,就会把数学分析里面的曲线积分 $a$ 的概念引入复分析中, 定义几乎是一致的。在引入了闭曲线和曲线积分之后,就会有出现复分析中的重要的定理: Cauchy 积分公式。 这个是易分析的第一个重要定理。