my-assignmentexpert™ Economics 经济学作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 $100 \%$ 原创。my-assignmentexpert™, 最高质量的ECON经济学作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于economics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此经济作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在经济学作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的经济代写服务。我们的专家在经济学 代写方面经验极为丰富,各种economics相关的作业也就用不着 说。

我们提供的econ代写服务范围广, 其中包括但不限于:

- 微观经济学

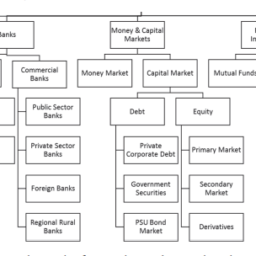

- 货币银行学

- 数量经济学

- 宏观经济学

- 经济统计学

- 经济学理论

- 商务经济学

- 计量经济学

- 金融经济学

- 国际经济学

- 健康经济学

- 劳动经济学

Two factories — one market|Econ经济作业代写Economics代考

While the marginal revenue can be understood as the monetary marginal willingness to pay for selling, the marginal cost $M C=\frac{d C}{d y}$ can be seen as the monetary marginal opportunity cost of production. How much money (the second good) must the producer forgo in order to produce an extra unit of $y$ (the first good)? Thus, the marginal cost can be seen as a special case of the marginal rate of transformation, $M R T=\left|\frac{d x_{2}}{d x_{1}}\right|^{\text {transformation curve }}.

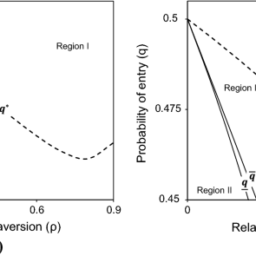

According to chapter XI, p. 309, a firm supplying a market from two factories (or a cartel in case of homogeneous goods), obeys the equality

The cartel also makes clear that Pareto improvements and Pareto optimality have to be defined relative to a specific group of agents. While the cartel solution (maximizing the sum of profits) is optimal for the producers, it is not, in general, optimal for the economy as a whole because the sum of producers’ and consumers’ (!) rent may well be below the welfare optimum.

Now we have Ricardo’s result in the form it is usually presented: As long as the comparative costs (more precise: the ratio of marginal costs) between two goods differ, international trade (more or less of it) is worthwhile for both countries.

Thus, Pareto optimality requires the equality of the marginal opportunity costs between any two goods produced in any two countries. The economists before Ricardo clearly saw that absolute cost advantages make international trade profitable. If England can produce cloth cheaper than Portugal while Portugal can produce wine cheaper than England, we have

$$

\begin{aligned}

&M C_{C l}^{E}M C_{W}^{P}

\end{aligned}

$$

so that England should produce more cloth and Portugal should produce more wine. Ricardo observed that for the implied division of labor to be profitable, it is sufficient that the ratio of the marginal costs differ:

$$

\frac{M C_{C l}^{E}}{M C_{W}^{E}}<\frac{M C_{C l}^{P}}{M C_{W}^{P}}

$$

Do you see that this inequality follows from the two inequalities above, but not vice versa?

Bargaining between countries (international trade).|ECON经济作业代写ECONOMICS代考

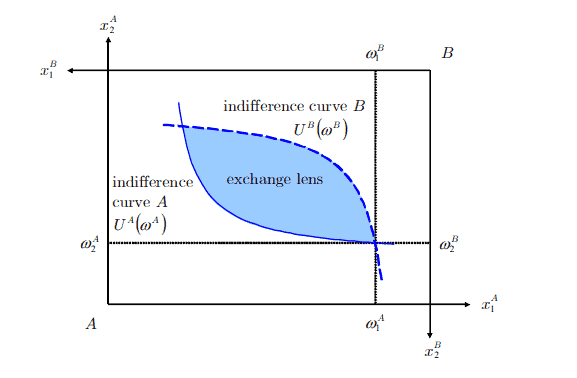

3.2. Bargaining between countries (international trade). David Ricardo (1772-1823) has shown that international trade is profitable as long as the marginal rates of transformation between any two countries are different. Let us consider the classic example of England and Portugal producing wine $(W)$ and cloth $(\mathrm{Cl})$. Suppose that the marginal rates of transformation differ:

$$

4=M R T^{P}=\left|\frac{d W}{d C l}\right|^{P}>\left|\frac{d W}{d C l}\right|^{E}=M R T^{E}=2

$$

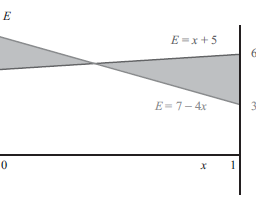

Both countries can be made better off, irrespective of whether we start from autarchy or not. Indeed, let England produce another unit of cloth $\mathrm{Cl}$ that it exports to Portugal. England’s production of wine reduces by $M R T^{E}=2$ gallons. Portugal, that imports one unit of cloth, reduces the cloth production and can produce additional $M R T^{P}=4$ units of wine. Therefore, if England obtains 3 gallons of wine in exchange for the one unit of cloth it gives to Portugal, both countries are better off.

Ricardo’s theorem is known under the heading of “comparative cost advantage”. So far, it is unclear why this is a good name for his theorem. The answer is provided by the following lemma.

LEMMA XIV.1. Assume that $f$ is a differentiable transformation function $x_{1} \mapsto x_{2}$. Assume also that the cost function $C\left(x_{1}, x_{2}\right)$ is differentiable. Then, the marginal rate of transformation between good 1 and good 2 can be obtained by

$$

\operatorname{MRT}\left(x_{1}\right)=\left|\frac{d f\left(x_{1}\right)}{d x_{1}}\right|=\frac{M C_{1}}{M C_{2}} .

$$

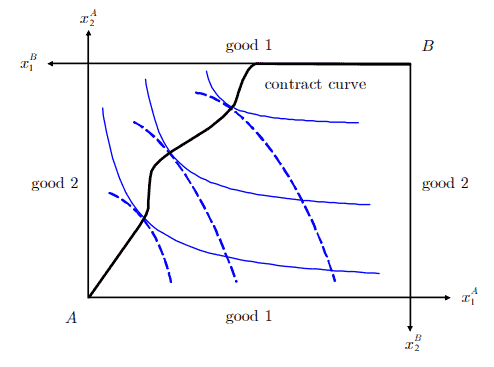

PROOF. Reconsider the production Edgeworth box encountered in chapter VIII. We assume a given volume of factor endowments and given factor prices (perfect competition!). Then, the overall cost for the production of goods 1 and 2 is constant and does not change along the transformation curve. Therefore, we can write

$$

C\left(x_{1}, x_{2}\right)=C\left(x_{1}, f\left(x_{1}\right)\right)=\text { constant. }

$$

If, now, we produce more of good 1 and less of good 2, the costs do not change:

$$

\frac{\partial C}{\partial x_{1}}+\frac{\partial C}{\partial x_{2}} \frac{d f\left(x_{1}\right)}{d x_{1}}=0

$$

Solving for the marginal rate of transformation yields

$$

M R T=-\frac{d f\left(x_{1}\right)}{d x_{1}}=\frac{M C_{1}}{M C_{2}}

$$

Two markets — one factory.|ECON经济作业代写ECONOMICS代考

2.3. Two markets – one factory. The third subcase under the heading “equality of the marginal willingness to pay” concerns a firm that produces in one factory but supplies two markets 1 and 2 . The idea is to consider the marginal revenue $M R=\frac{d R}{d x_{i}}$ as the monetary marginal willingness to pay for selling one extra unit of good $i$. How much can a firm pay for the sale of one additional unit?

Thus, the marginal revenue is a marginal rate of substitution $\left|\frac{d R}{d x_{i}}\right|$. The role of the denominator good is taken over by good 1 or 2 , respectively, while the nominator good is “money” (revenue). Now, profit maximization by a firm selling on two markets 1 and 2 implies

$$

\left|\frac{d R}{d x_{1}}\right|=M R_{1} \stackrel{!}{=} M R_{2}=\left|\frac{d R}{d x_{2}}\right|

$$

as we have seen in chapter XI, p. 307 .

TWO FACTORIES — ONE MARKET|ECON经济作业代写ECONOMICS代考

边际收益可以理解为为销售支付的货币边际意愿,边际成本米C=dCd和可以看作是生产的货币边际机会成本。生产者必须放弃多少金钱(第二种商品)才能生产额外的单位和(第一个好)?因此,边际成本可以看作是边际转换率的一个特例,$MRT=\left|\frac{d x_{2}}{d x_{1}}\right|^{\text {transformation曲线 }}。

根据第十一章,p。309,一家公司从两个工厂(或同质商品的卡特尔)供应市场,遵守平等

卡特尔还明确指出,必须相对于特定的代理组来定义帕累托改进和帕累托最优性。虽然卡特尔解决方案(最大化利润总和)对生产者来说是最优的,但总的来说,它对于整个经济来说并不是最优的,因为生产者和消费者(!)租金的总和可能远低于福利最佳。

现在我们得到了李嘉图通常呈现的结果:只要两种商品之间的比较成本(更准确地说:边际成本的比率)不同,国际贸易(或多或少)对两国来说都是值得的。

因此,帕累托最优要求任何两个国家生产的任何两种商品的边际机会成本相等。李嘉图之前的经济学家清楚地看到,绝对成本优势使国际贸易有利可图。如果英格兰可以生产比葡萄牙便宜的布料,而葡萄牙可以生产比英格兰便宜的葡萄酒,我们有

米CC一世和米C在磷

所以英国应该生产更多的布料,葡萄牙应该生产更多的葡萄酒。李嘉图观察到,要使隐含的分工有利可图,边际成本的比率不同就足够了:

米CC一世和米C在和<米CC一世磷米C在磷

你看到这个不等式是从上面的两个不等式得出的,但反之不行吗?

BARGAINING BETWEEN COUNTRIES (INTERNATIONAL TRADE).|ECON经济作业代写ECONOMICS代考

3.2. 国家之间的讨价还价(国际贸易)。大卫李嘉图(1772-1823)表明,只要任何两个国家之间的边际转化率不同,国际贸易就是有利可图的。让我们考虑一下英格兰和葡萄牙生产葡萄酒的经典例子(在)和布(C一世). 假设边际转化率不同:

4=米R吨磷=|d在dC一世|磷>|d在dC一世|和=米R吨和=2

无论我们是否从专制开始,两国都可以变得更好。的确,让英国再生产一块布C一世它出口到葡萄牙。英格兰的葡萄酒产量减少了米R吨和=2加仑。进口一单位布料的葡萄牙减少了布料的产量,并且可以生产额外的布料米R吨磷=4单位的酒。因此,如果英格兰用它给葡萄牙的一单位布换取3加仑的葡萄酒,那么两国的情况都会更好。

李嘉图定理以“比较成本优势”为名。到目前为止,尚不清楚为什么这是他的定理的好名字。答案由以下引理提供。

引理 XIV.1。假使,假设F是一个可微的变换函数X1↦X2. 还假设成本函数C(X1,X2)是可微的。那么,商品 1 和商品 2 之间的边际转化率可以由下式获得

捷运(X1)=|dF(X1)dX1|=米C1米C2.

证明。重新考虑第八章中遇到的生产御剑盒。我们假设给定数量的要素禀赋和给定的要素价格(完全竞争!)。那么,生产商品 1 和 2 的总成本是恒定的,不会沿着转换曲线变化。因此,我们可以写

C(X1,X2)=C(X1,F(X1))= 持续的。

如果现在我们生产更多的商品 1 而更少的商品 2,成本不会改变:

∂C∂X1+∂C∂X2dF(X1)dX1=0

求解边际转化率

米R吨=−dF(X1)dX1=米C1米C2

TWO MARKETS — ONE FACTORY.|ECON经济作业代写ECONOMICS代考

2.3. 两个市场——一个工厂。“边际支付意愿的平等”标题下的第三个子案例涉及一家在一个工厂生产但供应两个市场 1 和 2 的公司。这个想法是考虑边际收入米R=dRdX一世为多卖一单位商品的货币边际意愿一世. 一家公司可以为多售一个单位支付多少?

因此,边际收益是边际替代率|dRdX一世|. 分母商品的角色分别由商品 1 或 2 接管,而指定商品是“金钱”(收入)。现在,公司在两个市场 1 和 2 上销售的利润最大化意味着

|dRdX1|=米R1=!米R2=|dRdX2|

正如我们在第 XI 章第 307 .

matlab代写请认准UprivateTA™.

经济代写

计量经济学代写请认准my-assignmentexpert™ Economics 经济学作业代写

微观经济学代写请认准my-assignmentexpert™ Economics 经济学作业代写

宏观经济学代写请认准my-assignmentexpert™ Economics 经济学作业代写