如果你也在 怎样代写微观经济学Microeconomics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。微观经济学Microeconomics是主流经济学的一个分支,研究个人和公司在做出有关稀缺资源分配的决策时的行为以及这些个人和公司之间的互动。微观经济学侧重于研究单个市场、部门或行业,而不是宏观经济学所研究的整个国民经济。

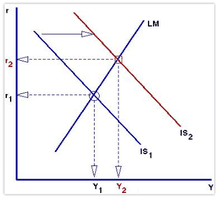

微观经济学Microeconomics的一个目标是分析在商品和服务之间建立相对价格的市场机制,并在各种用途之间分配有限资源。微观经济学显示了自由市场导致理想分配的条件。它还分析了市场失灵,即市场未能产生有效的结果。微观经济学关注公司和个人,而宏观经济学则关注经济活动的总和,处理增长、通货膨胀和失业问题以及与这些问题有关的国家政策。微观经济学还处理经济政策(如改变税收水平)对微观经济行为的影响,从而对经济的上述方面产生影响。特别是在卢卡斯批判之后,现代宏观经济理论大多建立在微观基础上,即基于微观层面行为的基本假设。

my-assignmentexpert™ 微观经济学Microeconomics作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的微观经济学Microeconomics作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此微观经济学Microeconomics作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在经济Economy作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的微观经济学Microeconomics代写服务。我们的专家在经济Economy代写方面经验极为丰富,各种微观经济学Microeconomics相关的作业也就用不着 说。

我们提供的微观经济学Microeconomics及其相关学科的代写,服务范围广, 其中包括但不限于:

经济代写|微观经济学作业代写Microeconomics代考|Background and problems

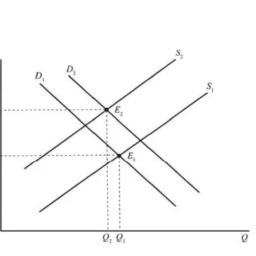

Economic theory introduces various institutions in order to deal with production, exchange and consumption of goods. The central institution is the “market” which confronts the offers and demands of some good and renders them compatible through a price. Substitutive institutions follow the same aim of regulating the exchanges, but along more or less different procedures: asymmetric auction mechanisms, planning procedures, bilateral negociations. Complementary institutions act as support of the market by framing the exchanges: exchange rights fix legal conditions for exchange, money fluidifies the implementation of exchanges, trust makes possible the bilateral exchange between goods and money when non synchronized. Further institutions frame the global transaction system: technical conventions codify the goods and technologies, moral norms determine the exchangeable goods, property rights fix the owner of the goods.

Several taxonomies of institutions have been proposed in the literature, however introducing fuzzy categories. Structurally, an “organic institution” appears as a human organization while an “epistemic institution” is a mental representation endorsed by all agents. For instance, the state, a central bank, a firm or a syndicate are of the first kind while money, trust, a shared belief or an allocation norm are of the second kind. A “constitutive institution” makes possible a new social activity while a “regulative institution” acts as a mediator in an already existing activity. For instance, a new type of money, an artificial financial market or an original technical language are of the first kind while patents, business contracts or traffic rules are of the second kind. In the following, only epistemic and regulative institutions, which act directly on agents’ beliefs and preferences, will be considered. However, firms are studied in chapter 7 and syndicates are treated through a model in section 3 .

In economic theory, different schools of thought stressed the basic role of institutions around and outside the market. The “institutionnalists” (Veblen, 1899; Commons, 1934; Mitchell, 1949) remarked that institutions are habits or customs which influence the agents’ behaviors and facilitate their expectation. The “cognitivists” (Hayek, 1973) considered that institutions (like markets) produce signals (like prices) which are a good summary for the information needed by agents. The “transaction costs” theory (Williamson, 1975) explained the choice of various coordination modes – market, hierarchy – by the reduction of the transaction costs involved. The “property rights” theory (Coase, 1937, AlchianDemsetz, 1973) stressed the importance of well-defined property rights when evaluating the efficiency of an economic system. The “regulationists” (Boyer, 2004) explained the heterogeneity of institutions by their adaptation to different places and periods.

经济代写|微观经济学作业代写Microeconomics代考|Canonical principles

The genesis of a convention is studied in the standard framework of evolutionary game theory (see chapter 3 ). In a large population, players interact infinitely many times, but only through their actions without direct communication. They interact on some network, each player meeting more or less randomly the opponents situated in some neighborhood. Each player follows a given strategy, and is moreover characterized by some exogenous “labels” related to its position or role in the game. He gets a payoff at each period depending on all players’ actions (through a payoff matrix) and this payoff is observed by him instantaneously. Moreover, each player observes precisely or on average the others’ actions as well as the others’ labels, but the interactions are other way anonymous. For instance, if the label takes value $\mathrm{A}$ or $\mathrm{B}$, each player interacts only with players with opposed labels and adapts his strategy to the label observed.

According to the precise specification of his behavior, each player follows various learning processes. In a belief-based learning process, each player implements an action which is a best response to the observed frequency of others’ past actions. In a reinforcement learning process, each player implements an action according to the performance obtained in the past with that action. The last process is formally similar to an evolutionary process where each player reproduces according to the past performance obtained in the past with his fixed strategy. In any case, the learning processes of the players define conjointly a dynamical stochastic process. Such a process can be summarized in a phase diagram showing in what directions the system evolves from a given position. It can be noticed that nothing implies that the mean utility increases in such a process, evolution and utility being disjoined.

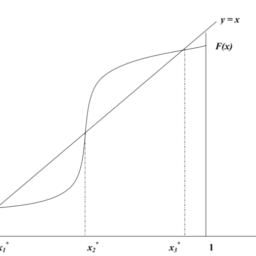

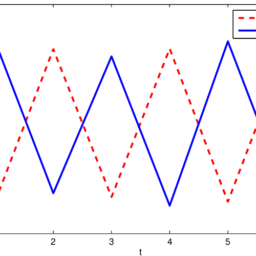

The process may adopt a chaotic behavior, cycle indefinitely or converge towards some asymptotic state. The last is moreover submitted to stability conditions which are more or less strong (asymptotic stability, dynamic stability). When players interact in a systematic way, the asymptotic state may be an equilibrium state of the basic game which is repeated, such as a Nash equilibrium. Especially, the process may converge towards an “evolutionary stable equilibrium”, which is just a refinement of a Nash equilibrium. In $2 \times 2$ games, two situations are considered. When the players are not labelled, an equilibrium state is a value $p$ where each player plays the first action with probability $p$. When the players are labelled, an equilibrium state is a couple $(p, q)$ where the first player (labelled $\mathrm{A}$ ) takes the first action with probability $p$ and the second (labelled B) takes the first action with probability $q$. When the players are situated on a network, equilibria are more complex since a given state is achieved in some areas and another in other areas.

微观经济学代写

经济代写|微观经济学作业代写MICROECONOMICS代考|BACKGROUND AND PROBLEMS

经济理论引入了各种制度来处理商品的生产、交换和消费。中央机构是“市场”,它面对某些商品的供应和需求,并通过价格使它们兼容。替代机构遵循监管交易所的相同目标,但遵循或多或少不同的程序:不对称拍卖机制、计划程序、双边谈判。互补性机构通过构建交易所充当市场的支持者:交换权确定了交换的法律条件,货币流动了交换的实施,信任使非同步的货物和货币之间的双边交换成为可能。进一步的机构构建了全球交易系统:技术公约将商品和技术编入法典,

文献中提出了几种制度分类法,但引入了模糊类别。在结构上,“有机机构”表现为人类组织,而“认知机构”是所有主体认可的心理表征。例如,国家、中央银行、公司或辛迪加属于第一类,而货币、信托、共同信仰或分配规范属于第二类。“构成性机构”使新的社会活动成为可能,而“调节性机构”在现有活动中充当调解者。例如,新型货币、人工金融市场或原创技术语言属于第一类,而专利、商业合同或交通规则属于第二类。在下文中,只有认知和监管机构,将考虑直接作用于代理人的信念和偏好。然而,第 7 章研究了公司,第 3 章通过模型处理了辛迪加。

在经济理论中,不同学派都强调制度在市场内外的基础性作用。“制度主义者”在和bl和n,1899;C这米米这ns,1934;米一世吨CH和ll,1949指出制度是影响代理人行为并促进他们期望的习惯或习俗。“认知主义者”H一种是和ķ,1973认为机构l一世ķ和米一种rķ和吨s产生信号l一世ķ和pr一世C和s这是对代理所需信息的一个很好的总结。“交易成本”理论在一世ll一世一种米s这n,1975解释了通过降低所涉及的交易成本来选择各种协调模式——市场、等级制度。“产权”理论C这一种s和,1937,一种lCH一世一种nD和米s和吨和,1973在评估经济体系的效率时,强调了明确产权的重要性。“监管者”乙这是和r,2004通过适应不同的地点和时期来解释制度的异质性。

经济代写|微观经济学作业代写MICROECONOMICS代考|CANONICAL PRINCIPLES

在进化博弈论的标准框架中研究约定的起源s和和CH一种p吨和r3. 在庞大的人口中,玩家可以无限多次互动,但只能通过他们的行动而不是直接交流。他们在某个网络上进行交互,每个玩家或多或少地随机遇到位于某个附近的对手。每个玩家都遵循给定的策略,而且还具有一些与其在游戏中的位置或角色相关的外生“标签”。根据所有玩家的行为,他在每个时期都会获得回报吨Hr这在GH一种p一种是这FF米一种吨r一世X他立即观察到这种回报。此外,每个玩家精确或平均地观察其他人的行为以及其他人的标签,但互动是匿名的。例如,如果标签取值一种或者乙,每个玩家只与标签相反的玩家互动,并根据观察到的标签调整他的策略。

根据其行为的精确规范,每个玩家都遵循不同的学习过程。在基于信念的学习过程中,每个玩家执行一个动作,该动作是对观察到的其他人过去动作频率的最佳响应。在强化学习过程中,每个玩家根据过去通过该动作获得的表现来实施一个动作。最后一个过程在形式上类似于一个进化过程,每个玩家根据过去获得的过去表现以他的固定策略进行复制。在任何情况下,玩家的学习过程共同定义了一个动态随机过程。这样的过程可以概括为相图,显示系统从给定位置向什么方向发展。

该过程可能采用混沌行为,无限循环或收敛到某个渐近状态。最后一个还受到或多或少强的稳定性条件一种s是米p吨这吨一世Cs吨一种b一世l一世吨是,d是n一种米一世Cs吨一种b一世l一世吨是. 当玩家以系统的方式进行交互时,渐近状态可能是重复的基本博弈的均衡状态,例如纳什均衡。特别是,这个过程可能会收敛到一个“进化稳定均衡”,这只是纳什均衡的一个改进。在2×2游戏,考虑两种情况。当玩家没有被标记时,均衡状态是一个值p每个玩家都有概率执行第一个动作p. 当玩家被标记时,平衡状态是一对(p,q)第一个玩家在哪里l一种b和ll和d$一种$以概率采取第一个动作p第二个l一种b和ll和d乙以概率采取第一个动作q. 当参与者位于网络上时,平衡会更加复杂,因为在某些区域实现给定状态,而在其他区域实现另一个状态。

经济代写|微观经济学作业代写MICROECONOMICS代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。