如果你也在 怎样代写宏观经济学Macroeconomics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。宏观经济学Macroeconomics(来自希腊语前缀makro-,意思是 “大 “+经济学)是经济学的一个分支,处理整个经济体的表现、结构、行为和决策。例如,使用利率、税收和政府支出来调节经济的增长和稳定。这包括区域、国家和全球经济。根据经济学家Emi Nakamura和Jón Steinsson在2018年的评估,经济 “关于不同宏观经济政策的后果的证据仍然非常不完善,可以受到严重批评。

宏观经济学Macroeconomics研究的主题包括GDP(国内生产总值)、失业(包括失业率)、国民收入、价格指数、产出、消费、通货膨胀、储蓄、投资、能源、国际贸易和国际金融。宏观经济学和微观经济学是经济学中最普遍的两个领域。联合国可持续发展目标17有一个目标,即通过政策协调和一致性来加强全球宏观经济稳定,这是2030年议程的一部分。

my-assignmentexpert™ 宏观经济学Macroeconomics作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的宏观经济学Macroeconomics作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此宏观经济学Macroeconomics作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在经济Economy作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的宏观经济学Macroeconomics代写服务。我们的专家在经济Economy代写方面经验极为丰富,各种宏观经济学Macroeconomics相关的作业也就用不着 说。

我们提供的宏观经济学Macroeconomics及其相关学科的代写,服务范围广, 其中包括但不限于:

经济代写|宏观经济学作业代写Macroeconomics代考|Conditional and unconditional densities

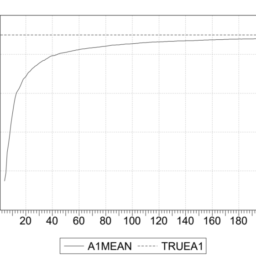

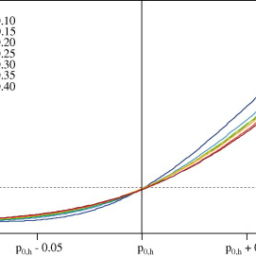

We distinguish between conditional and unconditional density of a time-series. The unconditional density is obtained under the hypothesis that no observation on the time series is available, while conditional densities are based on the observation of some realization of the random variables. In the case of the time series we derive unconditional by putting ideally ourselves at the moment in time preceeding the observation of any realization of the time series. At the moment the information set is given only by the knowledge of the process generating the observations. As observations become available conditional densities can be computed. As distributions are summarized by their moments, let us illustrate the difference between conditional and unconditional densities by looking at our $A R(1)$ model.

The moments of the density of $x_{t}$ conditional upon $x_{t-1}$ are immediately obtained from (2.1) as follows:

$$

\begin{aligned}

E\left(x_{t} \mid x_{t-1}\right) &=\rho_{0}+\rho_{1} x_{t-1} \

\operatorname{Var}\left(x_{t} \mid x_{t-1}\right) &=\sigma_{\epsilon}^{2} \

\operatorname{Cov}\left[\left(x_{t} \mid x_{t-1}\right),\left(x_{t-j} \mid x_{t-j-1}\right)\right] &=0 \text { for each } j

\end{aligned}

$$

To derive the moments of the density of $x_{t}$ conditional upon $x_{t-2}$, we need to substitute for $x_{t-1}$ in terms of $x_{t-2}$ from (2.1) to obtain:

$$

\begin{aligned}

E\left(x_{t} \mid x_{t-2}\right) &=\rho_{0}+\rho_{0} \rho_{1}+\rho_{1}^{2} x_{t-2} \

\operatorname{Var}\left(x_{t} \mid x_{t-2}\right) &=\sigma_{\epsilon}^{2}\left(1+\rho_{1}^{2}\right) \

\operatorname{Cov}\left[\left(x_{t} \mid x_{t-2}\right),\left(x_{t-j} \mid x_{t-j-2}\right)\right] &=\rho_{1} \sigma_{\epsilon}^{2} \quad \text { for } j=1 \

\operatorname{Cov}\left[\left(x_{t} \mid x_{t-2}\right),\left(x_{t-j} \mid x_{t-j-2}\right)\right] &=0 \quad \text { for } j>1

\end{aligned}

$$

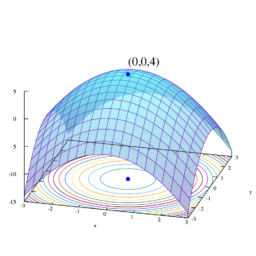

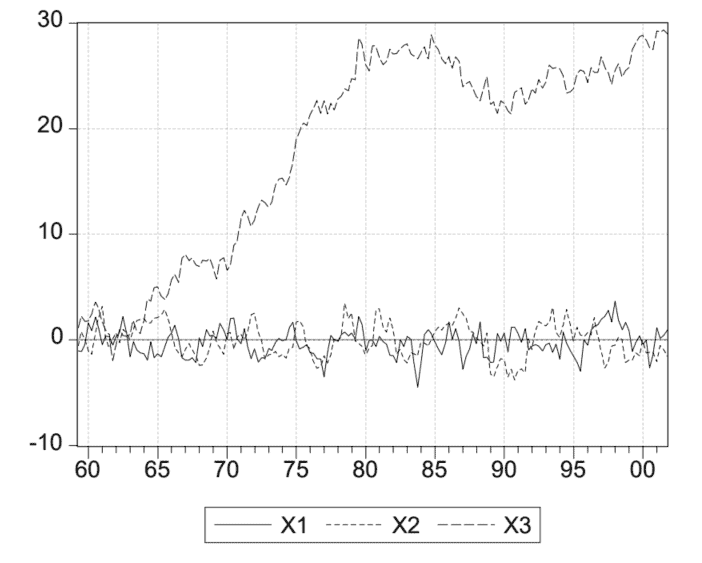

经济代写|宏观经济学作业代写Macroeconomics代考|Stationarity

A stochastic process is said to be stricly stationary if its joint density function does not depend on time. More formally a stochastic process is stationary if, for each $j_{1}, j_{2}, \ldots j_{n}$, the joint distribution,

$$

f\left(x_{t}, x_{t+j_{1}}, x_{t+j_{2}}, x_{t+j_{n}}\right)

$$

does not depend on t.

A stochastic process is said to be covariance stationary if its two first undiconditional moments do not depend on time, i.e. if the following relations are satisfied for each $\mathrm{h}, \mathrm{i}, \mathrm{j}$ :

$$

\begin{aligned}

E\left(x_{t}\right) &=E\left(x_{t+h}\right)=\mu \

E\left(x_{t}^{2}\right) &=E\left(x_{t+h}^{2}\right)=\mu_{2} \

E\left(x_{t+i} x_{t+j}\right) &=\mu_{i j}

\end{aligned}

$$

In the case of our $\operatorname{AR}(1)$ process the condition for stationarity is that $\left|\rho_{1}\right|<1$. In fact, when such condition is satisfied we have:

$$

\begin{aligned}

E\left(x_{t}\right) &=E\left(x_{t+h}\right)=\frac{\rho_{0}}{1-\rho_{1}} \

\operatorname{Var}\left(x_{t}\right) &=\operatorname{Var}\left(x_{t+h}\right)=\frac{\sigma_{\epsilon}^{2}}{1-\rho_{1}^{2}} \

\operatorname{Cov}\left(x_{t}, x_{t-j}\right) &=\rho_{1}^{j} \operatorname{Var}\left(x_{t}\right)

\end{aligned}

$$

on the other hand it easily shown that, when $\left|\rho_{1}\right|=1$, the process is non stationary.

In fact we have:

$$

\begin{aligned}

E\left(x_{t}\right) &=\rho_{0} t+x_{0} \

\operatorname{Var}\left(x_{t}\right) &=\sigma_{\epsilon}^{2} t \

\operatorname{Cov}\left(x_{t}, x_{t-j}\right) &=\sigma_{\epsilon}^{2}(t-j)

\end{aligned}

$$

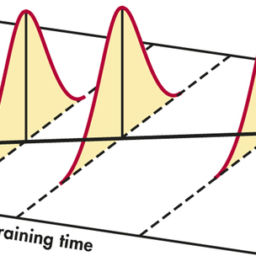

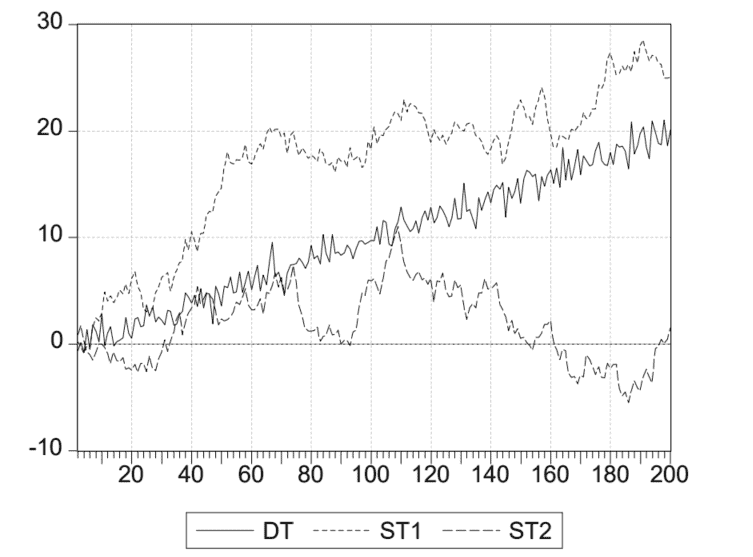

经济代写|宏观经济学作业代写MACROECONOMICS代考|ARMA processes

Before introducing the fundamentals of time-series we have asserted that whitenoise processes were too simplistic to describe economic time series and that a closer fit could be obtained by considering combination of white-noises. we have

then introduced ARMA models and discussed the fundamentals to understand their properties, but we have not yet shown that ARMA models can be considered as combination of white-noise processes. The point is shown by considering a time-series as a polynomial distributed lag of a white-noise process:

$$

\begin{aligned}

x_{t} &=u_{t}+b_{1} u_{t-1}+b_{2} u_{t-2}+\ldots b_{n} u_{t-n} \

&=\left(1+b_{1} L+b_{2} L^{2}+\ldots+b_{n} L^{n}\right) u_{t} \

&=b(L) u_{t}

\end{aligned}

$$

where $L$ is the lag operator. The Wald-decomposition theorem, which states that any stationary stochastic process could be expressed as the sum of a deterministic component and of a stochastic moving average component warrant generality of our representation. However in general, to describe successfully a time-series, a very high order in the polynomial $\mathrm{b}(\mathrm{L})$ is required. This feature can be problematic for estimation, given the usual limitations for sample sizes. This potential problem if the polynomial $\mathrm{b}(\mathrm{L})$ can be represented as the ratio of two polynomial of lower order. In this case we have:

$$

\begin{aligned}

x_{t} &=b(L) u_{t} \

&=\frac{a(L)}{c(L)} u_{t} \

c(L) x_{t} &=a(L) u_{t}

\end{aligned}

$$

宏观经济学代写

经济代写|宏观经济学作业代写MACROECONOMICS代考|CONDITIONAL AND UNCONDITIONAL DENSITIES

我们区分时间序列的条件密度和无条件密度。无条件密度是在没有可用时间序列观察的假设下获得的,而条件密度是基于对随机变量的某些实现的观察。在时间序列的情况下,我们通过将自己理想地置于时间序列的任何实现之前的时间来得出无条件的。目前,信息集仅由生成观察的过程的知识给出。随着观察变得可用,可以计算条件密度。由于分布是通过它们的矩来总结的,让我们通过查看我们的说明来说明条件密度和无条件密度之间的区别一种R(1)模型。

密度的时刻X吨有条件的X吨−1立即从2.1如下:

和(X吨∣X吨−1)=ρ0+ρ1X吨−1 曾是(X吨∣X吨−1)=σε2 这[(X吨∣X吨−1),(X吨−j∣X吨−j−1)]=0 对于每个 j

导出密度的矩X吨有条件的X吨−2,我们需要代入X吨−1按照X吨−2从2.1获得:

和(X吨∣X吨−2)=ρ0+ρ0ρ1+ρ12X吨−2 曾是(X吨∣X吨−2)=σε2(1+ρ12) 这[(X吨∣X吨−2),(X吨−j∣X吨−j−2)]=ρ1σε2 为了 j=1 这[(X吨∣X吨−2),(X吨−j∣X吨−j−2)]=0 为了 j>1

经济代写|宏观经济学作业代写MACROECONOMICS代考|STATIONARITY

如果随机过程的联合密度函数不依赖于时间,则称该随机过程是严格平稳的。更正式地说,一个随机过程是平稳的,如果,对于每个j1,j2,…jn, 联合分布,

F(X吨,X吨+j1,X吨+j2,X吨+jn)

不依赖于 t。

如果随机过程的前两个无条件矩不依赖于时间,即如果每个随机过程满足以下关系,则称该随机过程是协方差平稳的H,一世,j:

和(X吨)=和(X吨+H)=μ 和(X吨2)=和(X吨+H2)=μ2 和(X吨+一世X吨+j)=μ一世j

在我们的情况下和(1)处理平稳性的条件是|ρ1|<1. 事实上,当满足这样的条件时,我们有:

和(X吨)=和(X吨+H)=ρ01−ρ1 曾是(X吨)=曾是(X吨+H)=σε21−ρ12 这(X吨,X吨−j)=ρ1j曾是(X吨)

另一方面,它很容易表明,当|ρ1|=1,过程是非平稳的。

事实上我们有:

和(X吨)=ρ0吨+X0 曾是(X吨)=σε2吨 这(X吨,X吨−j)=σε2(吨−j)

经济代写|宏观经济学作业代写MACROECONOMICS代考|ARMA PROCESSES

在介绍时间序列的基本原理之前,我们断言白噪声过程过于简单,无法描述经济时间序列,并且可以通过考虑白噪声的组合来获得更接近的拟合。我们有

然后介绍了 ARMA 模型并讨论了了解其属性的基础知识,但我们尚未证明 ARMA 模型可以被视为白噪声过程的组合。通过将时间序列视为白噪声过程的多项式分布滞后来说明这一点:

X吨=在吨+b1在吨−1+b2在吨−2+…bn在吨−n =(1+b1大号+b2大号2+…+bn大号n)在吨 =b(大号)在吨

在哪里大号是滞后算子。Wald 分解定理指出,任何平稳的随机过程都可以表示为确定性分量和随机移动平均分量之和,这保证了我们表示的一般性。然而,一般来说,要成功描述时间序列,多项式中的阶数非常高b(大号)是必须的。考虑到样本量的通常限制,这个特征可能会给估计带来问题。这个潜在的问题,如果多项式b(大号)可以表示为两个低阶多项式之比。在这种情况下,我们有:

X吨=b(大号)在吨 =一种(大号)C(大号)在吨 C(大号)X吨=一种(大号)在吨

经经济代写|宏观经济学作业代写Macroeconomics代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。