如果你也在 怎样代写金融机构管理Financial Institution Management 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。金融机构管理Financial Institution Management是金融的一个领域,涉及资金来源、公司的资本结构、管理者为增加公司对股东的价值而采取的行动,以及用于分配金融资源的工具和分析。公司金融的主要目标是最大化或增加股东价值。

金融机构管理Financial Institution Management最常见的金融机构类型是商业银行、投资银行、保险公司和经纪公司。这些实体为个人和商业客户提供广泛的产品和服务,如存款、贷款、投资和货币兑换。

金融机构管理Financial Institution Management代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。最高质量的金融机构管理Financial Institution Management作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此金融机构管理Financial Institution Management作业代写的价格不固定。通常在专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

我们在金融 Finaunce代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的金融 Finaunce代写服务。我们的专家在金融机构管理Financial Institution Management代写方面经验极为丰富,各种金融机构管理Financial Institution Management相关的作业也就用不着说。

金融代写|金融机构管理代写Financial Institution Management代考|FINANCIAL INSTITUTIONS’ RAISON D’ÊTRE

Economic literature includes a rich debate on why firms exist as they do-the main question being why firm boundaries are defined in the ways that we observe. Certain types of activities that could remain in-house are routinely outsourced, while many activities with the potential to be outsourced remain internal to the firm. Mergers, acquisitions, and divestitures do exhibit certain patterns with respect to how firms believe their own boundaries ought to be defined, but these patterns are by no means exhaustive nor are their outcomes obviously probative. Some corporate restructurings are metamorphic and highlight the question of what makes a financial institution a financial institution. For example, in 1987 Greyhound Corp., a bus line company since 1929 , spun off its bus line operating units so that it could “focus on its core business of financial services.” To even think about which firms should be defined as belonging to the financial services sector we need to have some practical mechanism or criteria for inclusion. Theoretically we could simply enumerate a comprehensive list of financial services and products, and include firms that engage in this set of activities. With a boundary so constructed, we would have an identified set of institutions to analyze. But does that boundary really exist or is it helpful even as an abstraction? Retail sales finance is one of the largest and most obvious types of boundary blurring, often occurring at the direct expense of banks and retail credit suppliers. Captive finance subsidiaries for manufacturing firms are also common and the obvious complementarity between manufacturing goods and financing their sale seems to suggest that the latter function can be effectively internalized. But while the economic incentive to encroach on the boundaries of financial services seems to be predominantly one way-that is, we have not heard of things like mortgage institutions directly engaging in home construction-no hard and fast rule seems to apply.There are well-known cases of captive finance companies whose financial services activities grew beyond financing the parent’s manufactured products-in one case so much so that the entity became a systemically significant financial institution in its own right with only remnant relationships between their financing activities and the financing of the parent’s products. Are there economic principles that would allow us to explain why, and the extent to which (for example) auto sales and lease financing are or are not more thoroughly internalized within auto manufacturers? While to economists the answer is surely yes (what area of human endeavor do economists feel cannot be explained by economics?), it seems clear that management teams at financial institutions themselves do not recognize or embrace such principles. For if they believed they understood the principles that define why the financial institution exists, they would surely leverage those same principles to establish firms that function better overall.

金融代写|金融机构管理代写Financial Institution Management代考|Low Barriers to Entry

Over the bulk of the financial industry’s long history, practical barriers to entry in banking and insurance were quite high. In the modern era this was primarily due to regulatory and licensing requirements, but also due to consumer preferences for brand stability and stature. Over the past 100 years or so great banking and insurance industry firms were founded on brand strength, and their ability to attract depositors and policy holders was their primary determinant of growth. However, those barriers began to erode during the twentieth century as cultural changes and an increasing dependence on technology changed both the supply and demand sides of financial services markets. Changing regulatory requirements produced periods that alternated between stimulating and dampening bank and insurance company formation as well as merger activity, which is beyond the scope of this book to either document or survey. What is important is that evidence can be presented to support the claim of low barriers to entry.

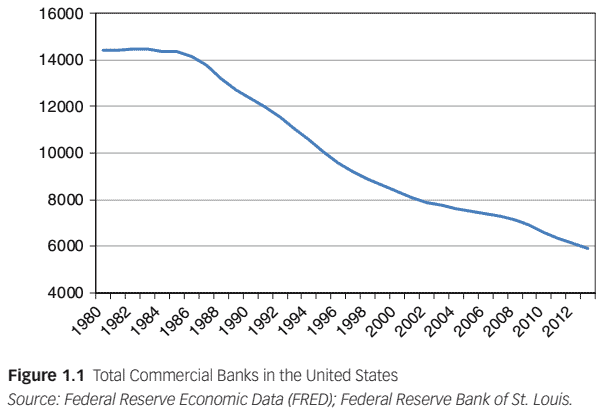

Interestingly, the aggregate data does not show an upward trend in the number of operating financial institutions. For banks, the total number of operating institutions in the United States hovered around 14,000 for the nearly 20 years between the early 1960s and the early 1980s. Then, after the savings and loan crisis began to unfold, the total number of banks began to drop-a trend that continues to this day, with the number of banks dropping by more than 50 percent from its 1980s total to fewer than 6,000 in 2013 (see Figure 1.1). However, looking only at the total number of institutions does not tell the whole story. In particular, the stability of the total number of institutions during that 20-year period between the 1960 s and the 1980 s reflected an offset between periods of great consolidation through mergers and acquisitions that reduced the total and periods of rapid entry of new institutions-particularly savings and loans associations, prior to the S\&L crisis. Overall, entry into the banking sector has remained brisk and steady, despite the stable, then declining, count totals. Hubert Janicki and Edward Prescott observed that, “Despite the large number of banks that have exited the industry over the last 45 years, there has been a consistent flow of new bank entries,” and calculated the average annual entry rate at about 1.5 percent of operating banks. The authors further observe that, “It is striking that despite the huge number of bank exits starting in the 1980 s, entry remained strong throughout the entire period. Interestingly, it is virtually uncorrelated with exit. For example, the correlation between exit and entry for the $1985-2005$ period is only $-0.07 .^{\prime \prime}$

金融机构管理代写

金融代写|金融机构管理代写Financial Institution Management代考|FINANCIAL INSTITUTIONS’ RAISON D’ÊTRE

经济文献包括关于企业为何存在的丰富辩论——主要问题是为什么企业边界以我们观察到的方式定义。可以保留在内部的某些类型的活动通常会外包,而许多有可能外包的活动仍保留在公司内部。合并、收购和资产剥离确实表现出某些模式,这些模式与公司认为应该如何定义自己的边界有关,但这些模式绝不是详尽无遗的,其结果也不是显而易见的。一些公司重组是变质的,突出了是什么让金融机构成为金融机构的问题。例如,1987 年成立的 Greyhound Corp.,一家自 1929 年成立的公交线路公司,剥离其公交线路运营部门,以便“专注于其金融服务的核心业务”。甚至要考虑哪些公司应该被定义为属于金融服务部门,我们需要有一些实用的机制或标准来纳入。从理论上讲,我们可以简单地列举一份完整的金融服务和产品清单,并包括从事这组活动的公司。有了如此构建的边界,我们将有一组确定的制度来分析。但是这个边界是否真的存在,或者即使作为一种抽象,它是否有用?零售金融是最大和最明显的边界模糊类型之一,通常以银行和零售信贷供应商的直接费用为代价。制造企业的专属金融子公司也很常见,制造商品与为其销售融资之间的明显互补性似乎表明后者的功能可以有效地内部化。但是,虽然侵占金融服务边界的经济动机似乎主要是一种方式——也就是说,我们还没有听说过抵押贷款机构直接参与房屋建设——似乎没有硬性规定适用。有很好的- 金融服务活动超出母公司制成品融资范围的专属金融公司的已知案例 – 在一个案例中,以至于该实体凭借其自身的权利成为具有系统重要性的金融机构,其融资活动与融资之间仅存在残余关系父母的产品。

汽车销售和租赁融资在汽车制造商内部是否更彻底地内部化?而对经济学家来说,答案肯定是肯定的是肯定的whatareaofhumanendeavordoeconomistsfeelcannotbeexplainedbyeconomics?, 很明显,金融机构的管理团队本身并不承认或 接受这些原则。因为如果他们相信自己了解定义金融机构存在原因的原则,他们肯定会利用这些相同的原则来建立整体运作更好的公司。

金融代写|金融机构管理代写Financial Institution Management代考|LOW BARRIERS TO ENTRY

在金融业漫长历史的大部分时间里,进入银行业和保险业的实际门槛都相当高。在现代,这主要是由于监管和许可要求,但也由于消费者对品牌稳定性和地位的偏好。在过去大约 100 年里,伟大的银行和保险业公司都是建立在品牌实力之上的,它们吸引储户和保单持有人的能力是它们增长的主要决定因素。然而,随着文化变革和对技术的日益依赖改变了金融服务市场的供需双方,这些壁垒在二十世纪开始消失。不断变化的监管要求产生了在刺激和抑制银行和保险公司的形成以及合并活动之间交替的时期,这超出了本书的范围,无论是记录还是调查。重要的是可以提供证据来支持低进入壁垒的说法。

有趣的是,总体数据并末显示出经营金融机构数量的上升趋势。对银行而言,从60年代初到 80 年代初的近 20 年间,美国的营业机构总数徘徊在 1.4 万家左右。然后,在储䐸和贷款危机开始展开后,银行总数开始下降一一这一趋势一直持续到今天,银行数量从 1980 年代的总数下降了 $50 \%$ 以 上,到 2013 年不到 6,000 家seeFigure1.1. 然而,仅看机构总数并不能说明全部情况。特别是,在 1960 年代和 80 年代之间的 20 年期间,机构总 数的稳定性反映了通过合并和收购减少新机构总数和快速进入的时期的大规模整合时期之间的抵诮一-特别是储帒协会,在 $S \backslash \& L$ 危机之前。总体 而言,尽管总数稳定,然后下降,但进入银行业的人数仍然活跃而稳定。Hubert Janicki和 Edward Prescott观察到, “尽管在过去 45 年中有大量银 行退出了该行业,但新银行进入的流量一直持续”,并计算出平均年进入率约为 1.5\%经营银行。作者进一步观察到,“令人惊讶的是,尽管从 1980 年代开始有大量银行退出,但在整个时期内,进入的势头依然虽劲。有趣的是,它实际上与退出无关。例如,退出和进入之间的相关性 $1985-2005$ 期间只有 -0.07 . $^{\prime \prime}$

金融代写|金融机构管理代写Financial Institution Management代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。