如果你也在 怎样代写投资组合Portfolio Theory 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。投资组合Portfolio Theory是金融投资的集合,如股票、债券、商品、现金和现金等价物,包括封闭式基金和交易所交易基金(ETF)。人们普遍认为,股票、债券和现金构成了投资组合的核心。

投资组合Portfolio Theory是资产的集合,可以包括股票、债券、共同基金和交易所交易基金等投资。投资组合更像是一个概念,而不是一个物理空间,特别是在数字投资的时代,但把你的所有资产放在一个比喻的屋顶下可能会有帮助。

投资组合Portfolio Theory代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。最高质量的投资组合Portfolio Theory作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此投资组合Portfolio Theory作业代写的价格不固定。通常在专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

金融代写|投资组合代写Portfolio Theory代考|Impact Investing

We are all, therefore, impact investors, at least on some level. ${ }^1$ The conversation surrounding impact investing is not really about whether it should be done-the illustration above readily demonstrates that we all do itrather, the conversation is about what matters to me. We can all agree that slavery is wrong. But what about fossil fuels? Or gender equality? Or investing in Japanese stocks?

It is here that the industry has taken its usual approach: we build products, then sell them to clients. Impact investing is no different: here is what we care about, so you should care about that, too. But goals-based investing starts with the client’s wishes. It is about the client’s goals, not ours. I have found that, more than any other topic we may cover, impact, ethical, and environmental, social, and governance (ESG) investing is very personal. What you consider important may not be important to your client. What matters to me in impact/ESG investing is not necessarily what matters to you.

In that way, ethical/impact/ESG investing is a perfect topic for goalsbased portfolio theory. As should by now be obvious, investors very often have multiple goals they wish to achieve. As individuals have become more socially aware (and certainly more aware of the potential harms their investment dollars may enable), the goals-space has now expanded to include objectives that are not strictly financial. Impact investing is one example of a nonfinancial, but very real, goal.

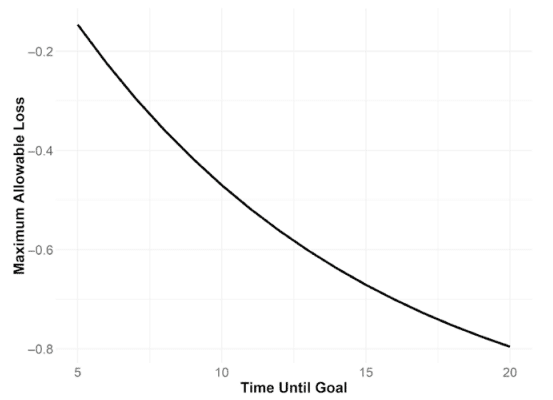

Yet these types of goals offer some specific challenges to the practitioner. First, since they are not financial nor futuristic, they are achievable right now. In other words, if your goal is to not invest in oil and gas companies, that goal can be accomplished by simply reallocating away from oil and gas companies. But what is the cost to your long-term financial goals to avoid oil and gas companies in your portfolio? How much has your new probability of achievement changed by adding this restriction to your portfolio? Is that change worth it?

To date, these questions have been given only a superficial treatment. There are those who claim that ESG constraints and impact investing are a long-term good for any portfolio-that it is just good investing. There are others who insist that investors must be giving up something to incorporate any investment constraint, ESG constraints included.

It is not my intent to wade into this debate. In my opinion, an honest review of the literature leaves me as undecided as I ever was. The point for goals-based practitioners is not necessarily to have an answer or strong opinion on this topic. Rather, it is our job, as practitioners, to help investors accomplish their goals. If my client wishes to retire on a rowboat in the middle of Lake Erie, my job is to help her retire on a rowboat in the middle of Lake Erie, not to pass judgment on whether that is a worthy goal. Similarly, if it is our investor’s objective to incorporate an ESG constraint or impact mandate, our role is to help her do so, and help her to manage any tradeoffs, not to impose our value judgements onto her decision. With the framework of goals-based investing, we can now advise our clients whether or not they should incorporate an ESG or impact mandate, given their desire to achieve other goals, as well.

We begin, as usual, with an understanding of our client’s goals, which includes understanding the time horizon, funding requirement, and total pool of current wealth. From there, we have the client rank her goals from most important to least important, then elicit the value ratios of each goal to the other (this is all covered in Chapter 3). Note that the impact mandate will simply be another goal in the goals-space, listed and understood along with all the rest. The difference is that the impact mandate has no funding requirement, only an allocation requirement, so we have to code it a bit differently in the model.

金融代写|投资组合代写Portfolio Theory代考|Taxes and Rebalancing

I will be the first to admit that a chapter on taxes and rebalancing sounds like a chapter I would skip were I reading this book. I have enough somnolence in my day. Unfortunately, this is where the rubber meets the road and the balancing act of an individual’s tax situation, various goals and ethical constraints, the firm’s capital market expectations, along with the practical constraints of our chosen investment universe all come together. This is the job, as it were. The other challenge for practitioners and theorists alike is that this is not a simple problem to solve. Putting all of this theory together is a complex task, and each practitioner will likely have her own approach. My objective here is not to lay out the right answer, but rather, to sketch a framework for thinking about the problem and present $a$ potential solution.

In a perfect world, the solution to the rebalancing problem would be quite simple. However, in addition to the challenges posed by the individualization offered by the goals-based framework, it is very common for potential investments to themselves have varied allocations to subcomponents. A firm building capital market expectations around economic sectors, for example, may have to account for Amazon.com’s link to both the technology sector and its link to the consumer staples and consumer discretionary sectors. A given stock will have exposure to multiple factors of concern to factororiented firms (i.e., value, size, quality, momentum. etc.), or a blended mutual fund may have allocation to stocks, bonds, and foreign exchange risks. This problem alone makes rebalancing a complicated task. Stacking the added complications brought on by the goals-based framework creates a decidedly nontrivial problem.

The literature on investing in the presence of tax costs has grown quite large. I won’t recount all of it here, but suffice it to say that taxes should be considered in an investment strategy. What is most difficult for practitioners, however, is that optimizing for taxes often requires depositing funds into various locked-up account types today, for possible use at some future date. Full tax costs are not generally known at that future date, and thus the full benefits and costs of locking up the funds cannot even be calculated! In addition, many investors find themselves in the distribution phase and must decide how to optimally liquidate these various account types. For the latter problem, there tends to be standard advice in the industry, expected to apply to everyone. ${ }^1$ As we have learned (and will show through this chapter), “standard advice” should not be applied to goals-based investors. The problem is not standardized, after all! ${ }^2$

To tackle the problem, let’s begin with the basic goals-based utility function with $N$-number of goals, and $v(i)$ is the value of goal $i, W_i$ is the funding requirement of goal $i$, and $t_i$ is the number of years within which goal $i$ must be accomplished:

$$

u(G)=\sum_i^N v(i) \phi\left(\varpi \vartheta_i, W_i, t_i\right)

$$

投资组合代写

金融代写|投资组合代写Portfolio Theory代考|Impact Investing

因此,至少在某种程度上,我们都是影响力投资者。${}^1$围绕影响力投资的讨论并不是关于是否应该这样做——上面的例子很好地说明了我们都这样做——而是关于什么对我重要。我们都同意奴隶制是错误的。但是化石燃料呢?还是性别平等?或者投资日本股票?在这里,这个行业采取了通常的方法:我们制造产品,然后把它们卖给客户。影响力投资也不例外:这是我们所关心的,所以你也应该关心。但基于目标的投资始于客户的愿望。这是客户的目标,而不是我们的。我发现,与我们可能涉及的任何其他主题相比,影响力、道德、环境、社会和治理(ESG)投资是非常个人化的。你认为重要的对你的客户来说可能并不重要。在影响力/ESG投资中,对我重要的未必对你重要。因此,道德/影响/ESG投资是基于目标的投资组合理论的完美主题。现在应该很明显,投资者通常有多个希望实现的目标。随着个人越来越有社会意识(当然也越来越意识到他们的投资可能带来的潜在危害),目标空间现在已经扩大到包括严格意义上的财务目标。影响力投资是一个与财务无关,但非常真实的目标。然而,这些类型的目标为实践者提供了一些特定的挑战。首先,因为它们既不是金融的,也不是未来的,所以它们现在是可以实现的。换句话说,如果你的目标不是投资石油和天然气公司,那么你可以通过重新配置石油和天然气公司来实现这个目标。但是,在投资组合中避开油气公司对您的长期财务目标有何影响?在你的投资组合中加入这一限制后,你的新成功概率改变了多少?这种改变值得吗?迄今为止,这些问题只得到了肤浅的处理。有些人声称,ESG约束和影响力投资对任何投资组合都是长期有益的——这就是好的投资。还有一些人坚持认为,投资者必须放弃一些东西,才能纳入任何投资约束,包括ESG约束。我无意介入这场辩论。在我看来,对文献的诚实回顾让我一如既往地犹豫不决。基于目标的实践者并不一定要对这个话题有一个答案或强烈的意见。相反,作为从业者,我们的工作是帮助投资者实现他们的目标。如果我的客户希望在伊利湖中央的划艇上退休,我的工作就是帮助她在伊利湖中央的划艇上退休,而不是评判这是否值得实现。同样,如果我们的投资者的目标是纳入ESG约束或影响授权,我们的角色是帮助她这样做,并帮助她管理任何权衡,而不是将我们的价值判断强加给她的决定。在基于目标的投资框架下,鉴于客户希望实现其他目标,我们现在可以建议他们是否应该纳入ESG或影响授权。像往常一样,我们首先要了解客户的目标,包括了解时间范围、资金需求和当前财富总额。在此基础上,我们让客户按照最重要到最不重要的顺序对目标进行排序,然后得出每个目标与其他目标的价值比率(这将在第3章中介绍)。请注意,影响任务将只是目标空间中的另一个目标,与所有其他目标一起列出并理解。不同之处在于,影响任务没有资金需求,只有分配需求,因此我们必须在模型中对其进行稍微不同的编码。

金融代写|投资组合代写Portfolio Theory代考|Taxes and Rebalancing

我将首先承认,如果我读这本书,关于税收和再平衡的一章听起来像是我会跳过的一章。我一天中已经够困了。不幸的是,这是橡胶遇到道路的地方,个人的税收状况,各种目标和道德约束,公司的资本市场预期,以及我们所选择的投资领域的实际限制都需要平衡。可以说,这就是工作。实践者和理论家面临的另一个挑战是,这不是一个简单的问题。将所有这些理论整合在一起是一项复杂的任务,每个实践者可能都有自己的方法。我在这里的目的不是给出正确的答案,而是勾勒出一个思考问题的框架,并提出$a$潜在的解决方案。

在一个完美的世界里,再平衡问题的解决方案将非常简单。然而,除了基于目标的框架提供的个性化所带来的挑战之外,潜在投资本身对子组件的分配也很常见。举例来说,如果一家公司对经济领域建立资本市场预期,可能就必须考虑到亚马逊与科技行业、与基本消费品和非必需消费品行业的联系。一个给定的股票将暴露于要素导向公司关注的多个因素(即,价值,规模,质量,动量)。等),或者混合型共同基金可以分配给股票、债券和外汇风险。仅这个问题就使再平衡成为一项复杂的任务。将基于目标的框架所带来的额外复杂性叠加起来,无疑会产生一个非同小可的问题。

关于在存在税收成本的情况下进行投资的文献越来越多。我不会在这里重述所有这些,但我只想说,在投资策略中应该考虑税收。然而,对从业者来说最困难的是,优化税收通常需要将资金存入各种锁定的账户类型,以备将来某个日期使用。在未来的日子里,全部的税收成本通常是不知道的,因此锁定资金的全部收益和成本甚至无法计算!此外,许多投资者发现自己处于分配阶段,必须决定如何最佳地清算这些不同的账户类型。对于后一个问题,业内往往有标准的建议,期望适用于所有人。${ }^1$正如我们所学到的(并将通过本章展示),“标准建议”不应该适用于以目标为基础的投资者。问题毕竟是不规范的!${ }^2$

为了解决这个问题,让我们从基于目标的基本效用函数$N$ -目标数开始,$v(i)$是目标的值$i, W_i$是目标$i$的资金需求,$t_i$是目标$i$必须完成的年数:

$$

u(G)=\sum_i^N v(i) \phi\left(\varpi \vartheta_i, W_i, t_i\right)

$$

金融代写|投资组合代写Portfolio Theory代考 请认准exambang™. exambang™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。