如果你也在 怎样代写管理会计Management Accounting 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。管理会计Management Accounting为组织的内部管理部门、其雇员、经理和行政人员提供财务信息,以便为决策提供依据并提高绩效。换句话说,管理会计师是战略伙伴。在管理会计或管理会计中,管理人员在决策中使用会计信息,并协助管理和履行其控制职能。

管理会计 Management Accounting的一个简单定义是向管理人员提供财务和非财务决策信息。换句话说,管理会计帮助组织内部的董事进行决策。这也可以被称为成本会计。这是区分、检查、破译和向主管人员传授数据的方式,以帮助完成商业目标。收集的信息包括所有领域的会计,教育行政部门识别财务支出和组织决策的业务任务。会计师使用计划来衡量组织内的整体运营战略。

管理会计Management Accounting代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。最高质量的管理会计Management Accounting作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此管理会计Management Accounting作业代写的价格不固定。通常在专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

会计代写|管理会计代写Management Accounting代考|PLANT-WIDE (BLANKET) OVERHEAD RATES

The most simplistic traditional costing system assigns indirect costs (overheads) to cost objects using a single overhead rate for the organization as a whole, known as blanket overhead rate or plant-wide rate. Such a costing system would be located at the extreme left of the level of sophistication shown in Figure 3.2. Let us assume that the total manufacturing overheads for the manufacturing plant of Arcadia are $£ 9$ million and that the company has selected direct labour hours as the allocation base for assigning overheads to products. Assuming that the total number of direct labour hours are 600000 for the period, the plant-wide overhead rate for Arcadia is $£ 15$ per direct labour hour ( $£ 9$ million/ 600000 direct labour hours). This calculation consists of two stages. First, overheads are accumulated in one single plant-wide pool for a period. Second, a plant-wide rate is computed by dividing the total amount of overheads accumulated ( $£ 9$ million) by the selected allocation base ( 600000 direct labour hours). The overhead costs are assigned to products by multiplying the plant-wide rate by the units of the selected allocation base (direct labour hours) used by each product.

Assume now that Arcadia is considering establishing separate overheads for each of its three production departments. Further investigations reveal that the products made by the company require different operations and some products do not pass through all three departments. These investigations also indicate that the $£ 9$ million total manufacturing overheads and 600000 direct labour hours can be analyzed as follows:

Now consider a situation where product $\mathrm{Z}$ requires 20 direct labour hours in department $\mathrm{C}$ but does not pass through departments $A$ and $B$. If a plant-wide overhead rate is used then overheads of $£ 300(20$ hours at $£ 15$ per hour) will be allocated to product $\mathrm{Z}$. On the other hand, if a departmental overhead rate is used, only $£ 100$ (20 hours at $£ 5$ per hour) would be allocated to product $\mathrm{Z}$. Which method should be used? The logical answer must be to establish separate departmental overhead rates, since product $\mathrm{Z}$ only consumes overheads in department $\mathrm{C}$. If the plant-wide overhead rate were applied, all the factory overhead rates would be averaged out and product $\mathrm{Z}$ would be indirectly allocated with some of the overheads of department B. This would not be satisfactory, since product $\mathrm{Z}$ does not consume any of the resources and this department incurs a large amount of the overhead expenditure.

Where some departments are more ‘overhead-intensive’ than others, products spending more time in the overhead-intensive departments should be assigned more overhead costs than those spending less time. Departmental rates capture these possible effects but plant-wide rates do not, because of the averaging process. We can conclude that a plant-wide rate will generally result in the reporting of inaccurate product costs and can only be justified when all products consume departmental overheads in approximately the same proportions (i.e. low product diversity applies). In the above illustration each department accounts for one-third of the total direct labour hours. If all products spend approximately one-third of their time in each department, a plant-wide overhead rate can safely be used. Consider a situation where product $\mathrm{X}$ spends one hour in each department and product $\mathrm{Y}$ spends five hours in each department. Overheads of $£ 45$ and $£ 225$ respectively would be allocated to products $\mathrm{X}$ and $\mathrm{Y}$ using either a plant-wide rate ( 3 hours at $£ 15$ and 15 hours at $£ 15$ ) or separate departmental overhead rates. However, if a diverse product range is produced with products spending different proportions of time in each department, separate departmental overhead rates should be established.

会计代写|管理会计代写MANAGEMENT ACCOUNTING代考|THE TWO-STAGE ALLOCATION PROCESS

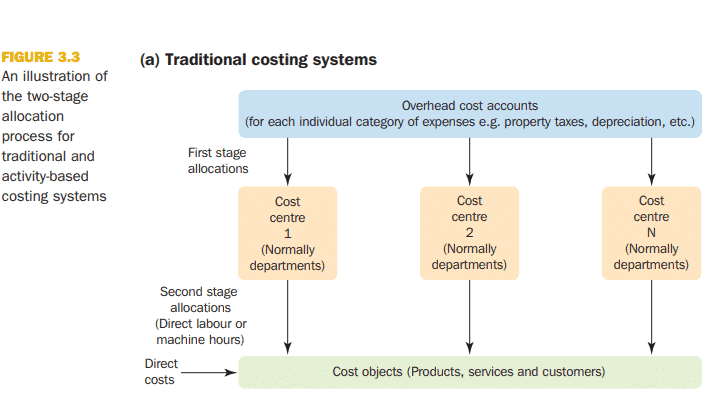

It is apparent from the previous section that separate departmental overhead rates should normally be established. To establish departmental overhead rates, an approach known as the two-stage allocation process, is used. This process applies to assigning costs to other cost objects, besides products, and is applicable to all organizations that assign indirect costs to cost objects. The approach applies to both traditional and $\mathrm{ABC}$ systems.

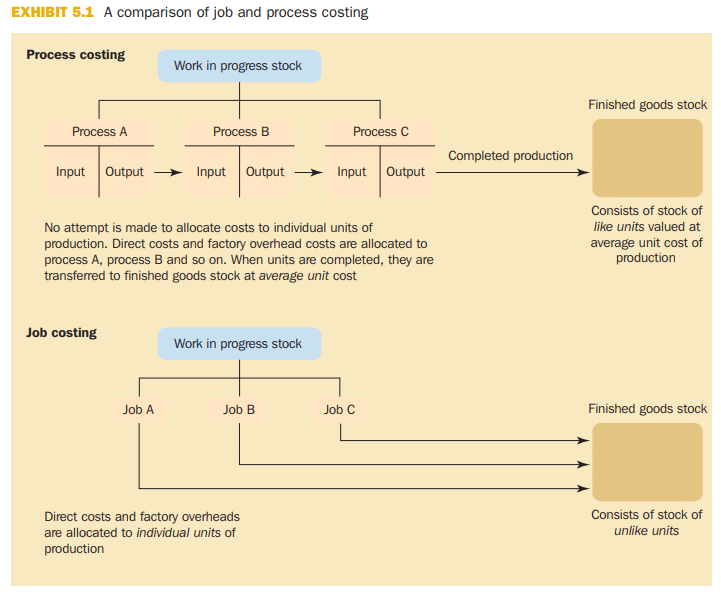

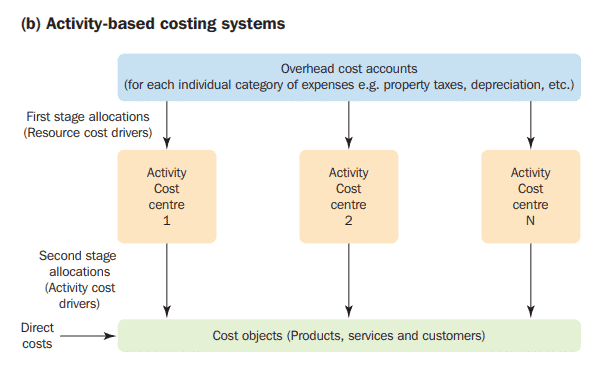

The two-stage allocation process is illustrated in Figure 3.3. You can see that in the first stage overheads are assigned to cost centres (also called cost pools). The terms cost centres or cost pools are used to describe a location to which overhead costs are initially assigned. Normally cost centres consist of departments, but in some cases they consist of smaller segments such as separate work centres within a department. In the second stage the costs accumulated in the cost centres are allocated to cost objects using selected allocation bases (you should remember from our discussion earlier that allocation bases are also called cost drivers). Traditional costing systems tend to use a small number of second stage allocation bases, typically direct labour hours or machine hours. In other words, traditional systems assume that direct labour or machine hours have a significant influence in the long term on the level of overhead expenditure. Other allocation bases used to a lesser extent by traditional systems are direct labour cost, direct materials cost and units of output. These methods are described and illustrated in Learning Note 3.1 on the dedicated digital support resources (see Preface for details).

Within the two-stage allocation process $\mathrm{ABC}$ systems differ from traditional systems by having a greater number of cost centres in the first stage and a greater number, and variety, of cost drivers or allocation bases in the second stage. Both systems will be described in more detail later in the chapter.

How many cost centres should a firm establish? If only a small number of cost centres are established it is likely that activities within a cost centre will not be homogeneous and, if the consumption of the activities by products/services within the cost centres varies, activity resource consumption will not be accurately measured. Therefore, in most situations, increasing the number of cost centres increases the accuracy of measuring the indirect costs consumed by cost objects. The choice of the number of cost centres should be based on cost-benefit criteria using the principles described on pages 47-48. Exhibit 3.1 (first section) shows the number of cost centres and second stage cost allocation bases reported by Drury and Tayles (2005) in a survey of $170 \mathrm{UK}$ organizations. It can be seen that 35 per cent of the organizations used less than 11 cost centres whereas 36 per cent used more than 20 cost centres. In terms of the number of different types of second stage cost drivers/allocation bases 59 per cent of the responding organizations used less than three.

管理会计代写

会计代写|管理会计代写Management Accounting代考|PLANT-WIDE (BLANKET) OVERHEAD RATES

最简单的传统成本计算系统使用整个组织的单一管理费用率(称为一揽子管理费用率或全厂管理费用率)将间接成本(管理费用)分配给成本对象。这种成本计算制度将位于图3.2所示复杂程度的最左边。让我们假设Arcadia制造工厂的总制造费用为900万英镑,并且该公司选择直接劳动时间作为分配管理费用给产品的分配基数。假设这一时期的直接劳动小时总数为60万,则阿卡迪亚全厂间接费用费率为每直接劳动小时15美元(每60万直接劳动小时900万美元)。这个计算包括两个阶段。首先,管理费用在一段时间内累积在整个工厂的一个池中。其次,整个工厂的费率是通过将累积的管理费用总额(900万英镑)除以选定的分配基数(60万直接劳动小时)来计算的。通过将全厂范围内的成本乘以每个产品所使用的分配基数(直接劳动小时)的单位,将间接成本分配给产品。现在假设Arcadia正在考虑为它的三个生产部门分别建立单独的管理费用。进一步调查发现,该公司生产的产品需要不同的操作,有些产品并没有通过这三个部门。这些调查还表明,900万美元的总制造费用和60万美元的直接人工工时可以分析如下:

现在考虑一种情况,产品$\ mathm {Z}$需要在$\ mathm {C}$部门使用20个直接人工工时,但不经过$ a $和$B$部门。如果采用全厂管理费用费率,则管理费用$ 300(20$小时,每小时$ 15$)将分配给产品$\ mathm {Z}$。另一方面,如果使用部门间接费用率,则只有$ 100$(按每小时$ 5$计算的20小时)将分配给产品$\ mathm {Z}$。应该使用哪种方法?合理的答案必须是建立单独的部门管理费用率,因为产品$\ mathm {Z}$只消耗部门$\ mathm {C}$的管理费用。如果采用全厂的间接费用费率,则所有的间接费用费率将被平均,并且产品$\ mathm {Z}$将间接分配给b部门的一些间接费用。这将是不令人满意的,因为产品$\ mathm {Z}$不消耗任何资源,而该部门产生了大量的间接费用支出。

如果一些部门比其他部门更“管理费用密集”,那么在管理费用密集部门花费更多时间的产品应该比那些花费较少时间的产品分配更多的管理费用。部门的费率包含了这些可能的影响,但由于平均过程,整个工厂的费率没有。我们可以得出结论,工厂范围的费率通常会导致不准确的产品成本报告,并且只有在所有产品以大致相同的比例消耗部门管理费用(即低产品多样性适用)时才能证明是合理的。在上面的插图中,每个部门占总直接劳动时间的三分之一。如果所有产品在每个部门花费大约三分之一的时间,则可以安全地使用全厂管理费用率。考虑这样一种情况:产品$\ mathm {X}$在每个部门花费1小时,产品$\ mathm {Y}$在每个部门花费5小时。管理费用$ 45$和$ 225$将分别分配给产品$\ mathm {X}$和$\ mathm {Y}$,使用全厂费率($ 15$ 3小时和$ 15$ 15小时)或单独的部门管理费用费率。但是,如果生产不同的产品系列,并且产品在每个部门花费的时间比例不同,则应建立单独的部门管理费用率。

会计代写|管理会计代写MANAGEMENT ACCOUNTING代考|THE TWO-STAGE ALLOCATION PROCESS

从上一节可以明显看出,通常应该制定单独的部门间接费用率。为了确定部门间接费用率,采用了一种称为两阶段分配过程的方法。此过程适用于将成本分配给产品以外的其他成本对象,并适用于将间接成本分配给成本对象的所有组织。该方法既适用于传统系统,也适用于$\ mathm {ABC}$系统。

两阶段的分配过程如图3.3所示。您可以看到,在第一阶段,管理费用被分配到成本中心(也称为成本池)。术语成本中心或成本池用于描述间接成本最初分配到的位置。成本中心通常由部门组成,但在某些情况下,它们由较小的部分组成,例如一个部门内的单独工作中心。在第二阶段,成本中心中积累的成本使用选定的分配基础分配给成本对象(您应该记得,从我们之前的讨论中,分配基础也称为成本驱动因素)。传统的成本核算系统倾向于使用少量的第二阶段分配基数,典型的是直接劳动时数或机器时数。换句话说,传统系统假定直接劳动力或机器工时对间接费用支出水平有长期的重大影响。传统制度使用程度较低的其他分配基础是直接人工成本、直接材料成本和产出单位。这些方法在专用数字支持资源的学习说明3.1中进行了描述和说明(详见前言)。

在两个阶段的分配过程中,系统与传统系统的不同之处在于,在第一阶段有更多的成本中心,在第二阶段有更多的成本驱动因素或分配基础。这两种系统将在本章后面更详细地描述。

一个公司应该建立多少个成本中心?如果只建立了少数成本中心,那么成本中心内的活动很可能不是同质的,如果成本中心内产品/服务的活动消耗不同,则活动资源消耗将无法准确测量。因此,在大多数情况下,增加成本中心的数量增加了测量成本对象消耗的间接成本的准确性。费用中心数目的选择应根据成本效益标准,采用第47至48页所述的原则。图3.1(第一部分)显示了Drury和Tayles(2005)在对170个英国组织的调查中报告的成本中心和第二阶段成本分配基地的数量。可以看出,35%的组织使用不到11个成本中心,而36%的组织使用超过20个成本中心。就第二阶段不同类型的成本驱动因素/分配基数而言,59%的答复组织使用的数量少于3个。

会计代写|管理会计代写MANAGEMENT ACCOUNTING代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。