如果你也在 怎样代写管理会计Management Accounting 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。管理会计Management Accounting为组织的内部管理部门、其雇员、经理和行政人员提供财务信息,以便为决策提供依据并提高绩效。换句话说,管理会计师是战略伙伴。在管理会计或管理会计中,管理人员在决策中使用会计信息,并协助管理和履行其控制职能。

管理会计 Management Accounting的一个简单定义是向管理人员提供财务和非财务决策信息。换句话说,管理会计帮助组织内部的董事进行决策。这也可以被称为成本会计。这是区分、检查、破译和向主管人员传授数据的方式,以帮助完成商业目标。收集的信息包括所有领域的会计,教育行政部门识别财务支出和组织决策的业务任务。会计师使用计划来衡量组织内的整体运营战略。

管理会计Management Accounting代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。最高质量的管理会计Management Accounting作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此管理会计Management Accounting作业代写的价格不固定。通常在专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

会计代写|管理会计代写Management Accounting代考|Distinguishing between direct and indirect costs

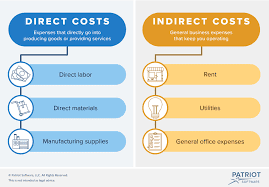

Sometimes, direct costs are treated as indirect because it is not cost effective to trace costs directly to the cost object. For example, the nails used to manufacture a particular desk can be identified specifically with the desk, but, because the cost is likely to be insignificant, the expense of tracing such items does not justify the possible benefits from calculating more accurate product costs.

The distinction between direct and indirect costs also depends on the cost object. A cost can be treated as direct for one cost object but indirect in respect of another. For example, if the cost object is the cost of using different distribution channels, then the rental of warehouses and the salaries of storekeepers will be regarded as direct for each distribution channel. If, on the other hand, the cost object is the product, both the warehouse rental and the salaries of the storekeepers will be an indirect cost because these costs cannot be specifically identified with the product.

Assigning direct and indirect costs to cost objects

Direct costs can be traced easily and accurately to a cost object. For example, where products are the cost object, direct materials and labour used can be physically identified with the different products that an organization produces. It is a relatively simple process to establish an information technology system that records the quantity and cost of direct labour and material resources used to produce specific products.

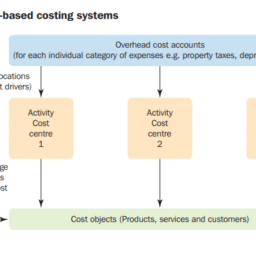

In contrast, indirect costs cannot be traced to cost objects. Instead, an estimate must be made of the resources consumed by cost objects using cost allocations. A cost allocation is the process of assigning costs when a direct measure does not exist for the quantity of resources consumed by a particular cost object. Cost allocations involve the use of surrogate rather than direct measures. For example, consider an activity such as receiving incoming materials. Assuming that the cost of receiving materials is strongly influenced by the number of receipts, then costs can be allocated to products (i.e. the cost object) based on the number of material receipts each product requires. If 20 per cent of the total number of receipts for a period were required for a particular product then 20 per cent of the total costs of receiving incoming materials would be allocated to that product. If that product was discontinued, and not replaced, we would expect action to be taken to reduce the resources required for receiving materials by 20 per cent.

In this example, the surrogate allocation measure is assumed to be a significant determinant of the cost of receiving incoming materials. The process of assigning indirect costs (overheads) and the accuracy of such assignments will be discussed in Chapter 3, but at this stage you should note that only direct costs can be accurately assigned to cost objects. Therefore, the more direct costs that can be traced to a cost object, the more accurate is the cost assignment.

会计代写|管理会计代写MANAGEMENT ACCOUNTING代考|PERIOD AND PRODUCT COSTS

For profit measurement and inventory/stock valuation (i.e. the valuation of completed unsold products and partly completed products or services) purposes it is necessary to classify costs as either product costs or period costs. Product costs are those costs that are identified with goods purchased or produced for resale. In a manufacturing organization they are costs that are attached to the product and that are included in the inventory valuation for finished goods, or for partly completed goods (work in progress), until they are sold; they are then recorded as expenses and matched against sales for calculating profit. Period costs are those costs that are not included in the inventory valuation and as a result are treated as expenses in the period in which they are incurred. Hence no attempt is made to attach period costs to products for inventory valuation purposes.

In a manufacturing organization all manufacturing costs are regarded as product costs and nonmanufacturing costs are regarded as period costs. The treatment of period and product costs for a manufacturing organization is illustrated in Figure 2.2. You will see that both product and period costs are eventually classified as expenses. The major difference is the point in time at which they are so classified.

There are two reasons why non-manufacturing costs are treated as period costs and not included in the inventory valuation. First, inventories are assets (unsold production) and assets represent resources that have been acquired and that are expected to contribute to future revenue. Manufacturing costs incurred in making a product can be expected to generate future revenues to cover the cost of production. There is no guarantee, however, that non-manufacturing costs will generate future revenue, because they do not represent value added to any specific product. Therefore, they are not included in the inventory valuation. Second, many non-manufacturing costs (e.g. distribution costs) are not incurred when the product is being stored. Hence it is inappropriate to include such costs within the inventory valuation.

You should now refer to Example 2.1, which provides an illustration of the accounting treatment of period and product costs for income (profit) measurement purposes for a manufacturing organization. Do merchandising and service organizations need to distinguish between product and period costs? The answer is yes. Companies operating in the merchandising sector purchase goods for resale without changing their basic form. The cost of the goods purchased is regarded as a product cost and all other costs, such as administration and selling and distribution expenses, are considered to be period costs. Therefore, the cost of goods sold for a merchandising company would consist of the beginning merchandise inventory, plus the purchase of merchandise during the period, less the closing merchandise inventory. Note that the opening and closing inventories would be valued at the purchase cost of acquiring the inventories. Service organizations do not have beginning and closing finished goods inventories since it is not possible to store services but they may have work in progress (WIP). The cost of direct materials (if applicable) plus direct labour and overheads that are assigned to cost objects (typically clients/customers) represent the product costs. All other costs represent the period costs. The beginning WIP, plus the cost assigned to the clients during the period, less the closing WIP represents the cost of the services sold for the period. This is equivalent to the cost of goods sold in a manufacturing organization.

管理会计代写

会计代写|管理会计代写Management Accounting代考|Distinguishing between direct and indirect costs

有时,直接成本被视为间接成本,因为将成本直接追踪到成本对象是不符合成本效益的。例如,用于制造特定桌子的钉子可以与桌子特别识别,但是,由于成本可能是微不足道的,跟踪这些物品的费用并不能证明计算更准确的产品成本可能带来的好处。

直接成本和间接成本的区别也取决于成本对象。对于一个成本客体,可以视为直接成本,但对于另一个成本客体,可以视为间接成本。例如,如果成本对象是使用不同分销渠道的成本,那么仓库的租金和仓库管理员的工资将被视为每个分销渠道的直接成本。另一方面,如果成本对象是产品,则仓库租金和仓库管理员的工资都将是间接成本,因为这些成本不能具体地与产品确定。

将直接和间接成本分配给成本对象

直接成本可以很容易和准确地追溯到成本对象。例如,当产品是成本对象时,所使用的直接材料和劳动力可以在物理上与组织生产的不同产品相识别。建立一个信息技术系统,记录用于生产特定产品的直接劳动力和物质资源的数量和成本,是一个相对简单的过程。

相反,间接成本不能追溯到成本对象。相反,必须使用成本分配对成本对象所消耗的资源进行估计。成本分配是指在特定成本对象所消耗的资源量没有直接衡量标准的情况下分配成本的过程。成本分配涉及使用替代方法而不是直接方法。例如,考虑一个活动,例如接收来料。假设接收材料的成本受到收据数量的强烈影响,则可以根据每个产品所需的材料收据数量将成本分配给产品(即成本对象)。如果某一特定产品需要在一段期间内收据总数的20%,那么接收来料总费用的20%将分配给该产品。如果该产品停止生产,而不加以替换,我们预计将采取行动,将接收材料所需的资源减少20%。

在本例中,假定代理分配度量是接收来料成本的重要决定因素。分配间接成本(间接费用)的过程和这种分配的准确性将在第3章中讨论,但在这个阶段,你应该注意到只有直接成本才能准确地分配给成本对象。因此,可以追溯到成本对象的直接成本越多,成本分配就越准确。

会计代写|管理会计代写MANAGEMENT ACCOUNTING代考|PERIOD AND PRODUCT COSTS

有时,直接成本被视为间接成本,因为将成本直接追踪到成本对象是不符合成本效益的。例如,用于制造特定桌子的钉子可以与桌子特别识别,但是,由于成本可能是微不足道的,跟踪这些物品的费用并不能证明计算更准确的产品成本可能带来的好处。

直接成本和间接成本的区别也取决于成本对象。对于一个成本客体,可以视为直接成本,但对于另一个成本客体,可以视为间接成本。例如,如果成本对象是使用不同分销渠道的成本,那么仓库的租金和仓库管理员的工资将被视为每个分销渠道的直接成本。另一方面,如果成本对象是产品,则仓库租金和仓库管理员的工资都将是间接成本,因为这些成本不能具体地与产品确定。

将直接和间接成本分配给成本对象

直接成本可以很容易和准确地追溯到成本对象。例如,当产品是成本对象时,所使用的直接材料和劳动力可以在物理上与组织生产的不同产品相识别。建立一个信息技术系统,记录用于生产特定产品的直接劳动力和物质资源的数量和成本,是一个相对简单的过程。

相反,间接成本不能追溯到成本对象。相反,必须使用成本分配对成本对象所消耗的资源进行估计。成本分配是指在特定成本对象所消耗的资源量没有直接衡量标准的情况下分配成本的过程。成本分配涉及使用替代方法而不是直接方法。例如,考虑一个活动,例如接收来料。假设接收材料的成本受到收据数量的强烈影响,则可以根据每个产品所需的材料收据数量将成本分配给产品(即成本对象)。如果某一特定产品需要在一段期间内收据总数的20%,那么接收来料总费用的20%将分配给该产品。如果该产品停止生产,而不加以替换,我们预计将采取行动,将接收材料所需的资源减少20%。

在本例中,假定代理分配度量是接收来料成本的重要决定因素。分配间接成本(间接费用)的过程和这种分配的准确性将在第3章中讨论,但在这个阶段,你应该注意到只有直接成本才能准确地分配给成本对象。因此,可以追溯到成本对象的直接成本越多,成本分配就越准确。

会计代写|管理会计代写MANAGEMENT ACCOUNTING代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。