如果你也在 怎样代写宏观经济学Macroeconomics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。宏观经济学Macroeconomics(来自希腊语前缀makro-,意思是 “大 “+经济学)是经济学的一个分支,处理整个经济体的表现、结构、行为和决策。例如,使用利率、税收和政府支出来调节经济的增长和稳定。这包括区域、国家和全球经济。根据经济学家Emi Nakamura和Jón Steinsson在2018年的评估,经济 “关于不同宏观经济政策的后果的证据仍然非常不完善,可以受到严重批评。

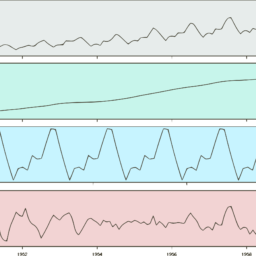

宏观经济学Macroeconomics研究的主题包括GDP(国内生产总值)、失业(包括失业率)、国民收入、价格指数、产出、消费、通货膨胀、储蓄、投资、能源、国际贸易和国际金融。宏观经济学和微观经济学是经济学中最普遍的两个领域。联合国可持续发展目标17有一个目标,即通过政策协调和一致性来加强全球宏观经济稳定,这是2030年议程的一部分。

my-assignmentexpert™ 宏观经济学Macroeconomics作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的宏观经济学Macroeconomics作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此宏观经济学Macroeconomics作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在经济Economy作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的宏观经济学Macroeconomics代写服务。我们的专家在经济Economy代写方面经验极为丰富,各种宏观经济学Macroeconomics相关的作业也就用不着 说。

我们提供的宏观经济学Macroeconomics及其相关学科的代写,服务范围广, 其中包括但不限于:

经济代写|宏观经济学作业代写Macroeconomics代考|Specification of the VAR

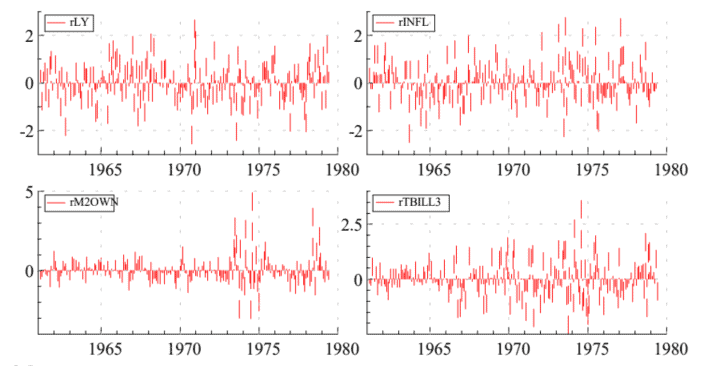

The first step of the empirical analysis is the specification of the VAR. The specification of the VAR requires the consideration of two issues pertaining respectively to the set of variables included in the VAR and to the lag length of the VAR. These are important issues in that mis-specification of the VAR leads to misleading inference. In general the set of variables to be included in the VAR is determined by the economic problem at hand, however this criterion does not rule out the possibility of mis-specification. Consider the case of the set of variables chosen for our example, they include all the variables used in a simple IS-LM model of a closed economy, but nothing guarantees that the US economy is correctly described by such model. Suppose that the central bank targets expected inflation by using short term interest rates as an instrument. The model is mis-specified if it omits any leading indicator for inflation monitored by Central Bank. An obvious candidate is the commodity price index but there might be more, such as long-term interest rates or other asset prices. In absence of an obvious baseline model, the behaviour of residuals is taken as an indicator of mis-specification. In a correctly specified model residuals should be random normal variables with zero mean and constant variance-covariance matrix, departure of fitted residuals from those hypotheses could be taken as an indicator of mis-specification. However, even when all the relevant variables have been included, the model could be still mis-specified because of omitted relevant dynamics. The selection of the order of the VAR is an important step in the specification. $\operatorname{Sims}([52])$ suggests a statistics to test the validity of restrictions imposed on a general model:

$$

(T-k)\left[\log \left|\Sigma_{r}\right|-\log \left|\Sigma_{u n r}\right|\right]

$$

where $\mathrm{T}$ is the sample size, $\mathrm{k}$ is the number of parameters estimated in each equation of the VAR, $\left|\Sigma_{r}\right|$ is the determinant of the variance-covariance ma- trix of the residuals of the fitted restricted model, $\left|\Sigma_{u n r}\right|$ is the determinant of the variance-covariance matrix of the residuals of the fitted general un restricted model. The statistic has a $\chi^{2}$ distribution with degrees of freedom equal to the number of restrictions in the system. The term $(T-k)$ includes a small sample correction, in fact as $\mathrm{T}$ becomes larger the correction for small sample $(T-k) / T$ converges towards unity. Obviously, the selection of variables and the selection of the lag length are not independent processes, in fact a longer lag length might be the consequence of omission of one relevant variable from the VAR. In practice we shall start from a baseline VAR including the set of variables suggested by the theory and a sufficiently long lag, check the behaviour of residuals. When well-behaved residuals are obtained, we proceed to reduction of the lag length by testing the validity of the implied restrictions.

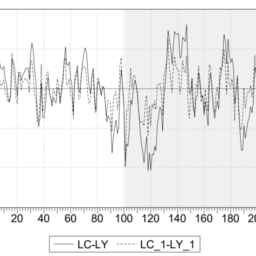

Our general baseline model is a VAR estimated over the sample 1960:1-1979:6, including fifteen lags of each of the five variables, a constant and a trend, so we have:

$$

\left(\begin{array}{c}

y_{t} \

\pi_{t} \

(m-p){t} \ R{t}^{m} \

R_{t}^{b}

\end{array}\right)=\mathbf{a}{o}+\mathbf{a}{1} t+\sum_{i=1}^{14} A_{i} L^{i}\left(\begin{array}{c}

y_{t} \

\pi_{t} \

(m-p){t} \ R{t}^{m} \

R_{t}^{b}

\end{array}\right)+\mathbf{u}_{t}

$$

经济代写|宏观经济学作业代写Macroeconomics代考|Selection of the deterministic components in the VECM specification

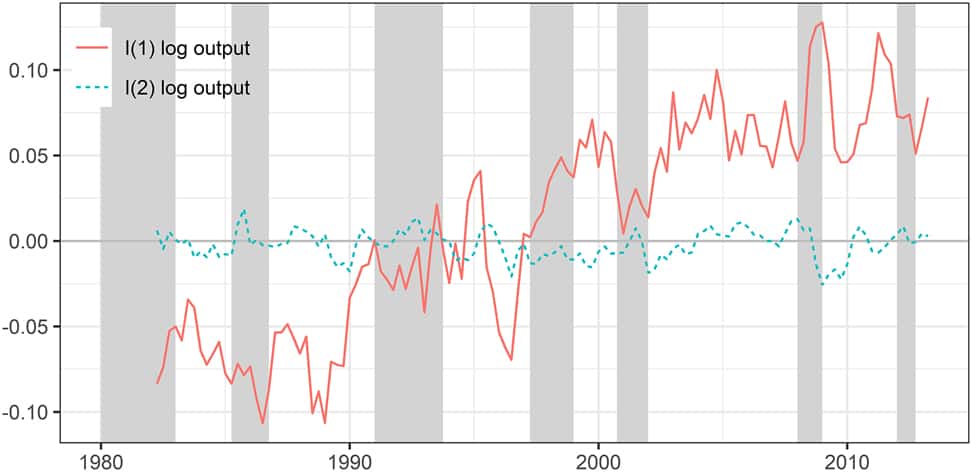

The choice of the determistic components in the VAR is not trivial, given that it affects the distribution of the relevant st atistics to perform cointegration analysis. Given the following general VECM model:

$$

\Delta \mathbf{y}{t}=\mu{0}+\mu_{1} t+\Pi_{1} \Delta \mathbf{y}{t-1}+\Pi{1} \Delta \mathbf{y}{t-2}+\ldots+\Pi \mathbf{y}{t-n}+\mathbf{u}_{t}

$$

five possible specifications for the deterministic components have been considered in the literature:

(i) $\mu_{0}=0, \mu_{1}=0$ this would determine a zero mean in the $\mathrm{I}(0)$ components and a non-zero mean in the $I(1)$ components

(ii) $\mu_{0}=\alpha \beta_{1}, \mu_{1}=0$ this would restrict the constant to belong to the cointegrating space inducing a non-zero mean both in the $I(0)$ and the $I(1)$ components

(iii) $\mu_{0}=$ unrestricted, $\mu_{1}=0$ this would generate a zero mean in the $\mathrm{I}(0)$ components and a linear trend in the $\mathrm{I}(1)$ component

(iv) $\mu_{0}=$ unrestricted, $\mu_{1}=\alpha \beta_{1}$ this would generate a linear trend both in the $I(0)$ and the $I(1)$ components

(v) $\mu_{0}=$ unrestricted, $\mu_{1}=$ unrestricted, this would generate a linear trend in the $\mathrm{I}(0)$ components and a quadratic trend in the $\mathrm{I}(1)$ components

Different critical values have been tabulated for each specification ([?]) and are now automatically available in all packages peforming the Johansen procedure. Note that the inclusion of intervention dummies also modifies the deterministic components of the VAR and this requires in principle in ad-hoc tabulation of the relevant critical values $([37])$.

In our application we choose specification $(i v)$ as some of our series show trends in levels and, as already stated, we ignore the modification of the relevant distribution generated by the inclusion of dummies.

经济代写|宏观经济学作业代写MACROECONOMICS代考|Test for the rank of $\Pi$

Having specified the VAR and chosen the specification of th deterministic component, we can estimate the $\Pi$ matrix and start our analysis of the long-run properties of the system. We apply the Johansen procedure to identify the rank of the matrix $\Pi$ in the following re-parameterisation of our model:

$$

\begin{aligned}

{\left[\begin{array}{l}

\Delta y_{t} \

\Delta \pi_{t} \

\Delta R_{t}^{m} \

\Delta R_{t}^{b} \

\Delta(m-p){t} \end{array}\right]=} & {\left[\begin{array}{l} d{0,11} \

d_{0,21} \

d_{0,31} \

d_{0,41}

\end{array}\right]+\sum_{i=0}^{6} F_{i} \Delta_{12} L P C M_{t-i}+\mathbf{g}^{\prime} \mathbf{D U M _ { t }}+} \

& {\left[\begin{array}{l}

\Delta y_{t-i} \

\Delta \pi_{t-i} \

\Delta R_{t-i}^{m} \

\Delta R_{t-i}^{b} \

\Delta(m-p){t-i} \end{array}\right]+\Pi\left[\begin{array}{l} y{t-6} \

\pi_{t-6} \

R_{t-6}^{m} \

R_{t-6}^{b} \

(m-p){t-6} \end{array}\right]+\left[\begin{array}{l} u{1 t} \

u_{2 t} \

u_{3 t} \

u_{4 t} \

u_{5 t}

\end{array}\right] }

\end{aligned}

$$

宏观经济学代写

经济代写|宏观经济学作业代写MACROECONOMICS代考|SPECIFICATION OF THE VAR

实证分析的第一步是指定 VAR。VAR 的规范需要考虑两个问题,分别与 VAR 中包含的变量集和 VAR 的滞后长度有关。这些是重要的问题,因为对 VAR 的错误说明会导致误导性推断。通常,要包含在 VAR 中的变量集由当前的经济问题决定,但是该标准不排除错误指定的可能性。考虑为我们的示例选择的变量集的情况,它们包括封闭经济的简单 IS-LM 模型中使用的所有变量,但不能保证这种模型正确描述了美国经济。假设中央银行使用短期利率作为工具来控制预期通胀。如果该模型省略了中央银行监测的任何通胀领先指标,则该模型指定错误。一个明显的候选者是商品价格指数,但可能还有更多,例如长期利率或其他资产价格。在没有明显的基线模型的情况下,残差的行为被视为错误规范的指标。在正确指定的模型中,残差应该是具有零均值和恒定方差 – 协方差矩阵的随机正态变量,拟合残差与这些假设的偏离可以被视为错误指定的指标。然而,即使所有相关变量都已包括在内,模型仍可能由于省略相关动态而被错误指定。模拟人生([52])建议使用统计数据来测试对一般模型施加的限制的有效性:

(吨−ķ)[日志|Σr|−日志|Σ在nr|]

在哪里吨是样本量,ķ是在 VAR 的每个方程中估计的参数数量,|Σr|是拟合受限模型残差的方差-协方差矩阵的行列式,|Σ在nr|是拟合的一般无限制模型的残差的方差-协方差矩阵的行列式。该统计具有χ2自由度等于系统中限制数量的分布。术语(吨−ķ)包括一个小样本校正,实际上是吨小样本的校正变大(吨−ķ)/吨趋于统一。显然,变量的选择和滞后长度的选择不是独立的过程,实际上较长的滞后长度可能是从 VAR 中遗漏了一个相关变量的结果。在实践中,我们将从包括理论建议的一组变量和足够长的滞后的基线 VAR 开始,检查残差的行为。当获得良好的残差时,我们通过测试隐含限制的有效性来继续减少滞后长度。

我们的一般基线模型是在 1960:1-1979:6 样本上估计的 VAR,包括五个变量中每个变量的 15 个滞后、一个常数和一个趋势,所以我们有:

$$

\left\begin{数组}{c} y_{t} \ \pi_{t} \ (mp\begin{数组}{c} y_{t} \ \pi_{t} \ (mp{t} \ R {t}^{m} \

R_{t}^{b}

\end{数组}\right)=\mathbf{a} {o}+\mathbf{a} {1} t+\sum_ {i=1}^{14} A_{i} L^{i}\left\begin{数组}{c} y_{t} \ \pi_{t} \ (mp\begin{数组}{c} y_{t} \ \pi_{t} \ (mp{t} \ R {t}^{m} \

R_{t}^{b}

\end{数组}\right)+\mathbf{u}_{t}

$$

经济代写|宏观经济学作业代写MACROECONOMICS代考|SELECTION OF THE DETERMINISTIC COMPONENTS IN THE VECM SPECIFICATION

VAR 中确定性分量的选择并非微不足道,因为它会影响相关统计数据的分布以执行协整分析。给定以下通用 VECM 模型:

$$

\Delta \mathbf{y} {t}=\mu {0}+\mu_{1} t+\Pi_{1} \Delta \mathbf{y} {t-1}+ \Pi {1} \Delta \mathbf{y} {t-2}+\ldots+\Pi \mathbf{y} {tn}+\mathbf{u}_{t}

$$

文献中考虑了确定性组件的五种可能规范:

一世 μ0=0,μ1=0这将确定在一世(0)分量和非零均值一世(1)组件

一世一世 μ0=一种b1,μ1=0这将限制常数属于协整空间,从而在一世(0)和一世(1)组件

一世一世一世 μ0=不受限制,μ1=0这将在一世(0)成分和线性趋势一世(1)零件

一世在 μ0=不受限制,μ1=一种b1这将在一世(0)和一世(1)组件

在 μ0=不受限制,μ1=不受限制,这将在一世(0)分量和二次趋势一世(1)组件

每种规格都有不同的临界值[?]并且现在在执行 Johansen 程序的所有包中自动可用。请注意,干预虚拟变量的包含也修改了 VAR 的确定性分量,这原则上需要相关临界值的临时表格([37]).

在我们的应用程序中,我们选择规范(一世在)由于我们的一些系列显示了水平趋势,并且如前所述,我们忽略了由于包含假人而产生的相关分布的修改。

经济代写|宏观经济学作业代写MACROECONOMICS代考|TEST FOR THE RANK OF圆周率

在指定了 VAR 并选择了确定性分量的规格后,我们可以估计圆周率矩阵并开始我们对系统的长期属性的分析。我们应用 Johansen 过程来识别矩阵的秩圆周率在我们模型的以下重新参数化中:

$$

\begin{aligned}

{\left[\begin{array}{l}

\Delta y_{t} \

\Delta \pi_{t} \

\Delta R_{t} ^{m} \

\Delta R_{t}^{b} \

\Delta米−p{t} \end{array}\right]=} & {\left[\begin{array}{l} d {0,11} \

d_{0,21} \

d_{0,31} \

d_{0 ,41}

\end{array}\right]+\sum_{i=0}^{6} F_{i} \Delta_{12} LPC M_{ti}+\mathbf{g}^{\prime} \mathbf {DUM _ { t }}+} \

& {\left[\begin{array}{l}

\Delta y_{ti} \

\Delta \pi_{ti} \

\Delta R_{ti}^{m} \

\ Delta R_{ti}^{b} \

\Delta米−p{ti} \end{array}\right]+\Pi\left[\begin{array}{l} y {t-6} \

\pi_{t-6} \

R_{t-6}^{m} \

R_{t-6}^{b} \

米−p{t-6} \end{array}\right]+\left[\begin{array}{l} u {1 t} \

u_{2 t} \

u_{3 t} \

u_{4 t} \

u_ {5 t}

\end{array}\right] }

\end{aligned}

$$

经经济代写|宏观经济学作业代写Macroeconomics代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。