MY-ASSIGNMENTEXPERT™可以为您提供lse.ac.uk FM302 Corporate Finance公司金融学课程的代写代考和辅导服务!

这是伦敦政经学校公司金融学课程的代写成功案例。

FM302课程简介

This course introduces concepts and theories to critically assess major corporate financial policy decisions. The course focuses in particular on a firm’s capital structure and the impact of taxes, bankruptcy costs, agency conflicts, and asymmetric information on a firm’s financing decisions. We will also discuss other major topics in corporate finance, such as the market for corporate control. In developing tools to analyze these issues, we will introduce the key concepts of corporate finance theory, including debt overhang, risk shifting, and the free-rider problem.

Prerequisites

Formative coursework

Students will be expected to produce 9 problem sets in the LT.

Indicative reading

Detailed course programmes and reading lists are distributed at the start of the course. Illustrative texts include: “Financial Markets and Corporate Strategy” by Hillier, Grinblatt and Titman. “Corporate Finance” by Ivo Welch, and “The Theory of Corporate Finance” by Tirole.

FM302 Corporate Finance HELP(EXAM HELP, ONLINE TUTOR)

1 What are the four basic cycles of a company?

2/Why do we say that financial flows are the flip side of investment and operating flows?

3/Define operating cash flow. Should the company be able to spend this surplus as it likes?

4/Is operating cash flow an accounting profit?

5/Why do we say that, as a general rule, operating cash flow should be positive? Provide a simple example that demonstrates that operating cash flow can be negative during periods of strong growth, start-up periods and in the event of strong seasonal fluctuations.

6/When a cash flow budget is drawn up for the purposes of assessing an investment, can free cash flows be negative? If so, is it more likely that this will be the case at the beginning or at the end of the business plan period? Why?

7/Among the following different flows, which will be appropriated by both shareholders and lenders: operating receipts, operating cash flow, free cash flows? Who has priority, shareholders or lenders? Why?

8/A feature of a supermarket chain such as Tesco in the UK or the Dutch retailer Ahold is a very fast rotation of food stocks (six days), cash payments by customers, long supplier credit periods ( 60 days) and very low administrative costs. Will the operating cycle generate cash requirements or a cash surplus?

9/Should the cash outflows of launching a new perfume be considered as an operating outlay or an investment outlay?

10 /How is an investment decision analysed from a cash standpoint?

11/After reading this chapter, can you guess how to define bankruptcy?

12/Is debt capital risk free for the lender? Can you analyse what the risk is? Why do some borrowers default on loans?

More questions are waiting for you at www.vernimmen.com.

Questions

1/Operating, investment, debt and equity cycles.

2/Because negative free cash flows generated by operating and investment cycles must be compensated by resources from the financial cycle. When free cash flows are positive, they are entirely absorbed by the financial cycle (debts are repaid, dividends are paid, etc).

$3 /$ It is the balance of the operating cycle. No, as it has to repay bank debts when they are due, for example.

$4 /$ No, it is a cash flow, not an accounting profit.

5/It measures flows generated by the company’s operations, i.e. its business or raison d’être. If it is not positive in the long term, the company will be in trouble. Major shortfall due to operating cycle, large inventories, operating losses on startup, heavy swings in operating cycle.

6/Yes. At the beginning, an investment may need time to run at full speed.

7/Free cash flows since all operating or investment outlays have been paid. The lenders because of contractual agreement.

8/A cash surplus, as customer receipts come in before suppliers are paid.

9 /Investment outlays, from which the company will benefit over several financial years as the product is being put onto the market.

10/Expenditure should generate inflows over several financial periods.

11 /The inability to find additional resources to meet the company’s financial obligations.

$12 /$ No. The risk is the borrowers’ failure to honour contracts either because of inability to repay due to poor business conditions or because of bad faith.

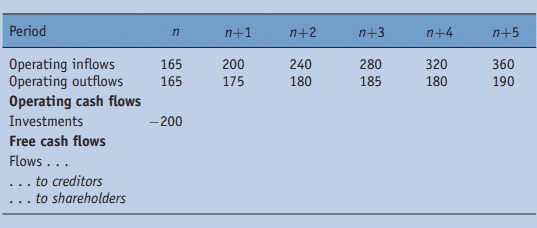

1/Boomwichers NV, a Dutch company financed by shareholders’ equity only, decides, during the course of year $n$, to finance an investment project worth $€ 200 \mathrm{~m}$ using shareholders’ equity $(50 \%)$ and debt $(50 \%)$. The loan it takes out $(\epsilon 100 \mathrm{~m})$ will be paid off in full in $n+5$, and the company will pay $5 \%$ interest per year over the period. At the end of the period, you are asked to complete the following simplified table (no further investments are to be made):

\begin{tabular}{|c|c|c|c|c|c|c|}

\hline Period & $n$ & $n+1$ & $n+2$ & $n+3$ & $n+4$ & $n+5$ \

\hline Operating inflows & 165 & 200 & 240 & 280 & 320 & 360 \

\hline Operating outflows & 165 & 175 & 180 & 185 & 180 & 190 \

\hline \multicolumn{7}{|c|}{ Operating cash flows } \

\hline Investments & -200 & & & & & \

\hline \multicolumn{7}{|c|}{ Free cash flows } \

\hline \multicolumn{7}{|l|}{ Flows … } \

\hline \multicolumn{7}{|l|}{$\begin{array}{l}\text {… to creditors } \

\text {… to shareholders }\end{array}$} \

\hline

\end{tabular}

What do you conclude from the above?

A detailed Excel version of the solutions is available at www.vernimmen.com.

1 Boomwichers NV

\begin{tabular}{lrrrrrr}

Period & $n$ & $n+1$ & $n+2$ & $n+3$ & $n+4$ & $n+5$ \

Operating inflows & 165 & 200 & 240 & 280 & 320 & 360 \

Operating outflows & 165 & 175 & 180 & 185 & 180 & 190 \

Operating cash flows & 0 & 25 & 60 & 95 & 140 & 170 \

Investments & -200 & 0 & 0 & 0 & 0 & 0 \

Free cash flows & -200 & 25 & 60 & 95 & 140 & 170 \

Flows … & & & & & & \

… to creditors & -100 & 5 & 5 & 5 & 5 & 105 \

… to shareholders & -100 & 20 & 55 & 90 & 135 & 65 \

\hline

\end{tabular}

The investment makes it possible to repay creditors and leave cash for shareholders.

2/Ellingham plc opens a Spanish subsidiary, which starts operating on 2 January 2014. On 2 January 2014 it has to buy a machine costing $€ 30 \mathrm{~m}$, partly financed by a $€ 20 \mathrm{~m}$ bank loan repayable in instalments of $€ 2 \mathrm{~m}$ every 15 July and 15 January over 5 years. Financial expenses, payable on a half-yearly basis, are as follows:

\begin{tabular}{ccccccccccc}

\hline 2014 & & \multicolumn{2}{c}{2015} & & \multicolumn{2}{c}{2016} & & 2017 & & \multicolumn{2}{c}{2018} \

\hline June & Dec & June & Dec & June & Dec & June & Dec & June & Dec \

1 & 0.9 & 0.8 & 0.7 & 0.6 & 0.5 & 0.4 & 0.3 & 0.2 & 0.1 \

\hline

\end{tabular}

Profits are tax free. Sales will be $€ 12 \mathrm{~m}$ per month. A month’s inventory of finished products will have to be built up. Customers pay at 90 days.

The company is keen to have a month’s worth of advance purchases and, accordingly, plans to buy two months’ worth of supplies in January 2011. Requirements in a normal month amount to $€ 4 \mathrm{~m}$.

The supplier grants the company a 90-day payment period. Other costs are:

- personnel costs of $€ 4 \mathrm{~m}$ per month;

- shipping, packaging and other costs amounting to $€ 2 \mathrm{~m}$ per month and paid at 30 days. These costs are incurred from 1 January 2014.

Draw up a monthly and an annual cash flow plan.

How much cash will the subsidiary need at the end of each month over the first year? And if operations are identical, how much will it need each month over 2015? What is the change in the cash position over 2015 (no additional investments are planned)?

2/Ellingham plc exercise, see page 68.

To learn more about cash flows:

G. Friedlob, R. Welton, Keys to Reading an Annual Report, 4th edn, Barrons Educational Series, 2008.

T. Ittelson, Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports, 2nd edn, Career Pr Inc, 2009.

MY-ASSIGNMENTEXPERT™可以为您提供LSE.AC.UK FM302 CORPORATE FINANCE公司金融学课程的代写代考和辅导服务!