MY-ASSIGNMENTEXPERT™可以为您提供lse.ac.uk FM302 Corporate Finance公司金融学课程的代写代考和辅导服务!

这是伦敦政经学校公司金融学课程的代写成功案例。

FM302课程简介

This course introduces concepts and theories to critically assess major corporate financial policy decisions. The course focuses in particular on a firm’s capital structure and the impact of taxes, bankruptcy costs, agency conflicts, and asymmetric information on a firm’s financing decisions. We will also discuss other major topics in corporate finance, such as the market for corporate control. In developing tools to analyze these issues, we will introduce the key concepts of corporate finance theory, including debt overhang, risk shifting, and the free-rider problem.

Prerequisites

Formative coursework

Students will be expected to produce 9 problem sets in the LT.

Indicative reading

Detailed course programmes and reading lists are distributed at the start of the course. Illustrative texts include: “Financial Markets and Corporate Strategy” by Hillier, Grinblatt and Titman. “Corporate Finance” by Ivo Welch, and “The Theory of Corporate Finance” by Tirole.

FM302 Corporate Finance HELP(EXAM HELP, ONLINE TUTOR)

1/A company raises $€ 500 \mathrm{~m}$ in shareholders’ equity for an R\&D project. Has it become richer or poorer? By how much? What is your answer if the company spends half of the funds in the first two years, and the project does not produce results? In the third year, the company uses the remaining funds to acquire a competitor that is overvalued by $25 \%$. But thanks to synergies with this new subsidiary, it is able to improve its earnings by $€ 75 \mathrm{~m}$. Has it become richer or poorer? By how much?

2/What are the accounting items corresponding to additions to wealth for shareholders, lenders and the State?

3 /In concrete terms, based on the diagram on page 35 , by how much does a company create wealth over a given financial period? Why?

4/Comment on the following two statements: “This year, we’re going to have to go into debt to cover our losses” and “We’ll be able to buy out our main competitor, thanks to the profits we made this year”.

5/In 2014, a company’s free cash flow turns negative. Has the company created or destroyed wealth?

6/Does EBITDA always flow directly into a company’s bank account?

7/Is it correct to say that a company’s wealth is increased each year by the amount of EBITDA?

8/According to the terminology used in Chapter 2, is depreciation a cash outflow or a cost? What is the difference between these two concepts?

9/Analyse the similarities and the differences between cash and wealth, looking at, for example, investment in real estate and investment in research.

10/Will repayment of a loan always be recorded on the income statement? Will it always be recorded under a cash item?

11/Does the inflation-related increase in the nominal value of an asset appear on the income statement?

12/Why is the increase in inventories of raw materials deducted from purchases in the bynature income statement format?

13/Why is change in finished goods inventories recorded under income in the by-nature income statement format?

$14 /$ Should the sale of a fixed asset be classified as part of the “ordinary course of business” of a company? How is it recorded on the income statement? Why under this heading?

15/Provide several examples illustrating the difference between cash receipts and revenues, cash expenses and costs.

16/What is a non-cash expense? What is a deferred charge? Describe their similarities and the differences between them.

1/Neither. Zero, poorer by $€ 250 \mathrm{~m}$. Richer by $€ 25 \mathrm{~m}: 75-250 \times[25 \% /(1+25 \%)]$

2/Net income, financial expenses, corporate income tax.

3 /EBIT (Operating profit) + non-recurring items – corporate income tax. The wealth created is the wealth to be divided up between lenders (financial expenses), the State (corporate income tax) and shareholders (the balance).

4/Confusion between additions to and deductions from wealth (which is an accounting issue) and cash: in the former, new borrowings do not add wealth to cover the losses; in the latter, profit is not the means used to finance an investment as it does not translate $100 \%$ in cash.

5/There is nothing that tells us whether wealth has been destroyed or created as we do not know what net income for 2014 is.

$6 /$ No, because income and costs may not necessarily correspond to immediate cash receipts or expenses.

7/No, because a company takes on costs that are deductible from EBITDA to form net income – depreciation, financial costs, etc.

$8 /$ It is a non-cash charge, not a cash expense, i.e. a cost that is recorded, but which does not have to be cashed out.

9/From a cash standpoint, an investment in real estate is a cash expense which will only generate income on the day it is sold. From a wealth standpoint, real estate is an attractive asset. For investments in R\&D, returns must be quicker from a cash standpoint. In terms of wealth, however, the disposal value of R\&D is nil.

$10 / \mathrm{No}$, only financial interest is recorded in the income statement. Yes, because debts are repaid in cash.

$11 /$ No, because of the prudence principle.

$12 /$ In order to obtain a figure for purchases consumed in the business in the current year.

$13 /$ In order to counterbalance costs recorded in the income statement which should not affect this year’s net income as they are related to unsold products.

$14 /$ No, except if the company is in the business of regularly selling fixed assets, like a car rental company, for example. Capital gains or losses on the sale of a fixed asset will be recorded as exceptional gains/losses (if this category exists in the accounting system).

15/Sales (revenues) and customer payments (cash receipts). Depreciation and amortisation (costs without cash expenses). Purchase of a machine (cash expense but not a charge).

$16 /$ A non-cash expense is a charge which does not reflect a specific expense, but an accounting valuation of how much wealth has been destroyed. A deferred charge is one that is carried over to the next financial period. Common point: both are based on an accounting decision, resulting in a dilemma for the financial manager: have they been measured properly?

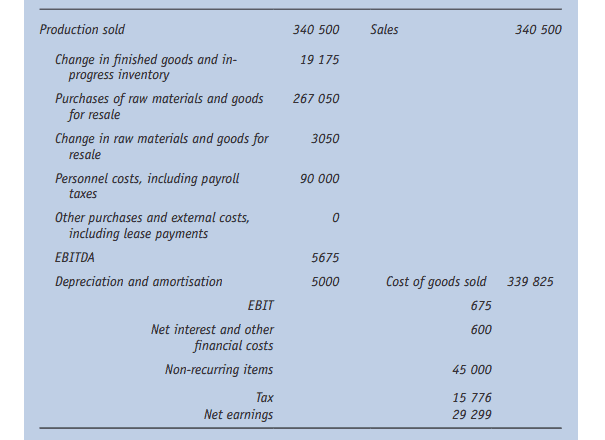

You are asked by a Swedish company that assembles computers to draw up a by-nature and by-function income statement for year $n$. You are provided with the following information:

Retail price of a PC: $€ 1500$.

Cost of various components:

\begin{tabular}{lrcc}

\hline Parts & Price & Opening inventory & Closing inventory \

\hline Case & 50 & 5 & 13 \

Motherboard & 200 & 8 & 2 \

Processor & 300 & 4 & 11 \

Memory & 100 & 6 & 4 \

Graphic card & 50 & 1 & 13 \

Hard disk & 150 & 5 & 10 \

Screen & 200 & 3 & 3 \

DVD combo & 50 & 7 & 19 \

\hline

\end{tabular}

Over the financial period, the company paid out $€ 60000$ in salaries and social security contributions of $50 \%$ of that amount. The company produced $240 \mathrm{PCs}$. Closing stock of finished products was 27 units and opening stock 14 units.

At the end of the financial period, the manager of the company sells the premises that he had bought for $€ 200000$ three years ago (which was depreciated over 40 years) for $€ 230$ 000 , it now occupies old premises that are fully depreciated, and pays off a $€ 12000$ loan on which the company was paying interest at $5 \%$. What impact do these transactions have on EBITDA, operating profit and net income? Tax is levied at a rate of $35 \%$.

Over the course of the financial period, by how much did the company/the lenders/the company manager (who owns $50 \%$ of the shares) get richer/poorer?

1/Stäjö $A B$

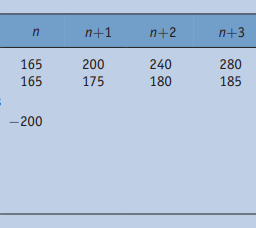

\begin{tabular}{|c|c|c|c|}

\hline Production sold & 340500 & Sales & 340500 \

\hline $\begin{array}{l}\text { Change in finished goods and in- } \

\text { progress inventory }\end{array}$ & 19175 & & \

\hline $\begin{array}{l}\text { Purchases of raw materials and goods } \

\text { for resale }\end{array}$ & 267050 & & \

\hline $\begin{array}{l}\text { Change in raw materials and goods for } \

\text { resale }\end{array}$ & 3050 & & \

\hline $\begin{array}{l}\text { Personnel costs, including payroll } \

\text { taxes }\end{array}$ & 90000 & & \

\hline $\begin{array}{l}\text { Other purchases and extemal costs, } \

\text { including lease payments }\end{array}$ & 0 & & \

\hline EBITDA & 5675 & & \

\hline Depreciation and amortisation & 5000 & Cost of goods sold & 339825 \

\hline EBIT & & 675 & \

\hline $\begin{array}{l}\text { Net interest and other } \

\text { financial costs }\end{array}$ & & 600 & \

\hline Non-recurring items & & 45000 & \

\hline $\operatorname{Tax}$ & & 15776 & \

\hline Net earnings & & 29299 & \

\hline

\end{tabular}

Sale of premises: capital gain of $€ 45000$ shown as a non-recurring item gain.

Rental of premises: extra $€ 12000$ in operating costs (recorded under “Other purchases and external costs”), and disappearance of depreciation and amortisation the following year.

Repayment of the loan: disappearance of $€ 600$ in interest expenses the following financial year.

Over the course of the financial year, and after booking these transactions, the company became richer by $€ 29299$ (after tax), the creditors by $€ 600$ and the company manager by $€ 14649$.

Consider an Indian business that sells oak barrels to vineyards. At the start of the year, its inventory of finished products was zero. It sold 800 of the 900 barrels it had produced, leaving the closing inventory at 100 barrels. Each barrel sells for INR 10000 . To produce one barrel, the company spends INR 5000 on oak purchases and incurs INR 2000 in labour costs. In addition, the sales force generates costs of INR 450 000 per year and the fully outsourced administrative department incurs costs of INR 400 000 p.a. Annual depreciation expense related to the production facilities comes to INR 300000 . The opening inventory of raw materials was INR 400000 and the closing inventory INR 500000 . In sum, the business spent INR 4600000 on raw materials.

Produce the by-nature income statement.

Assuming that depreciation breaks down into INR 200000 for the production machinery, INR 70000 for the sales facilities and INR 30000 for the administrative facilities, produce the by-function income statement. Are you surprised that both formats give the same EBIT? Why? What do you think about Mumbai Oaks’s EBIT margin?

By-nature income statement:

Net sales

Closing inventory of finished products

Opening inventory and work in progress

$=$ Production for the year

Purchases of raw materials and goods for resale

Opening inventory of raw materials and goods for resale

Closing inventory of raw materials and goods for resale

$=$ Gross profit on raw materials and goods for resale used

Personnel expenses

Services (other operating expenses)

Depreciation and amortisation

= EBIT (operating profit)

By-function income statement:

Sales (products)

Cost of sales

Selling and marketing costs

General and administrative costs

EBIT (operating profit)

$800 \times$ INR $10000=8000000$

$100 \times(5000+7000)=1700000+$ Changes in inventories of finished goods and work in progress

8700000

$-4600000=$ Raw materials and goods

$-400000$

for resale consumed

$+500000$

4200000

$900 \times$ INR $2000+$ INR $450000=-2250000$

$-400000$

$-300000$

1250000

800 units $\times 10000=$ INR 8000000

$200000+800$ units $\times 7000=$ INR 5800000

$70000+450000=$ INR 520000

$30000+400000=$ INR 430000

INR 1250000

This corresponds exactly to the gross margin per unit of INR 3000 multiplied by the 800 units sold minus fixed costs of INR 450000 (sales force), INR 400000 (administration) and INR 300000 (depreciation).

As by-nature and by-function formats differ only by presentation and not substance, it is quite logical that the different formats do not lead to a difference in reported EBIT!

Achieving an EBIT of INR 1250000 out of a turnover of INR 8000000 is a very nice margin (15.6\%). Most industrial groups do not achieve this kind of margin. This may be due to the fact that in most small companies, owners prefer to be paid a low wage and receive higher dividends which are generally taxed at a lower rate than ordinary salaries.

MY-ASSIGNMENTEXPERT™可以为您提供LSE.AC.UK FM302 CORPORATE FINANCE公司金融学课程的代写代考和辅导服务!