MY-ASSIGNMENTEXPERT™可以为您提供lse.ac.uk FM302 Corporate Finance公司金融学课程的代写代考和辅导服务!

这是伦敦政经学校公司金融学课程的代写成功案例。

FM302课程简介

This course introduces concepts and theories to critically assess major corporate financial policy decisions. The course focuses in particular on a firm’s capital structure and the impact of taxes, bankruptcy costs, agency conflicts, and asymmetric information on a firm’s financing decisions. We will also discuss other major topics in corporate finance, such as the market for corporate control. In developing tools to analyze these issues, we will introduce the key concepts of corporate finance theory, including debt overhang, risk shifting, and the free-rider problem.

Prerequisites

Formative coursework

Students will be expected to produce 9 problem sets in the LT.

Indicative reading

Detailed course programmes and reading lists are distributed at the start of the course. Illustrative texts include: “Financial Markets and Corporate Strategy” by Hillier, Grinblatt and Titman. “Corporate Finance” by Ivo Welch, and “The Theory of Corporate Finance” by Tirole.

FM302 Corporate Finance HELP(EXAM HELP, ONLINE TUTOR)

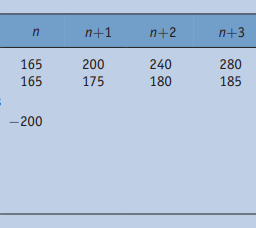

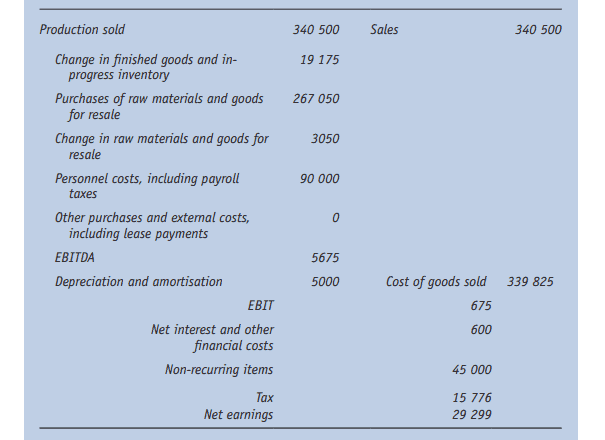

Problem 1. Today, you are going to buy luxury boat to travel around the world and you are offered three alternatives. Which one will be better for you if the annual interest rate $(r)$ is $11 \%$ ?

$(1,5$ points $)$

$$

P V=\frac{450,000}{1+11 \%)^6}=240,588.37

$$

$$

\begin{aligned}

& \text { PV }=? \

& \text { FV: } 450.000 \

& \mathrm{~N}=5 \

& \mathrm{r}=11 \%

\end{aligned}

$$

The present value of the first option is calculated as follows:

PV = FV / (1 + r)^N PV = 450,000 / (1 + 11%)^5 PV = 240,588.37

Therefore, the present value of the first option is €240,588.37.

B) An immediate down payment of $€_{22,000}$ and semiannual payments of $€_{35,000}$ for 4 years. The first payment is made 6 months from now. $$ \left.P V=22,000+\frac{35,000}{5.5 \%} * 41-\frac{1}{1+5.5 \%)^8}\right)=243,709.8 € $$ PV: Present value of the cashflow C: 35.000 $\mathrm{m}=4^* 2=8$ $r=11 \% / 2=5.5 \%$

The present value of the second option is calculated as follows:

PV = down payment + (semiannual payment / (1 + r/2)^1) + (semiannual payment / (1 + r/2)^2) + … + (semiannual payment / (1 + r/2)^N) PV = 22,000 + (35,000 / (1 + 5.5%/2)^1) + (35,000 / (1 + 5.5%/2)^2) + … + (35,000 / (1 + 5.5%/2)^8) PV = 22,000 + (35,000 * ((1 – (1 / (1 + 5.5%/2)^8)) / (5.5%/2))) PV = 243,709.8 €

Therefore, the present value of the second option is €243,709.8.

C) Annual payments growing at a rate of $2 \%$ per year. The first payment of $€ 65,000$ is made in one-year time.

$$

\left.P V=\frac{) 5,000}{11 \%-2 \%} *\left(1-4 \frac{1+2 \%}{1+11 \%}\right)^5\right)=249,009.1 €

$$

PV: Present value of the cashflow

$$

\begin{aligned}

& \mathrm{C}_1: 65,000 \

& \mathrm{n}=5 \

& \mathrm{r}=11 \% \

& \mathrm{~g}=2 \%

\end{aligned}

$$

The present value of the third option is calculated using the growing perpetuity formula:

PV = (C / (r – g)) * (1 – ((1 + g) / (1 + r))^N) PV = (65,000 / (11% – 2%)) * (1 – ((1 + 2%) / (1 + 11%))^5) PV = 249,009.1 €

Therefore, the present value of the third option is €249,009.1.

MY-ASSIGNMENTEXPERT™可以为您提供LSE.AC.UK FM302 CORPORATE FINANCE公司金融学课程的代写代考和辅导服务!