如果你也在 怎样代写微观经济学Microeconomics 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。微观经济学Microeconomics是主流经济学的一个分支,研究个人和公司在做出有关稀缺资源分配的决策时的行为以及这些个人和公司之间的互动。微观经济学侧重于研究单个市场、部门或行业,而不是宏观经济学所研究的整个国民经济。

微观经济学Microeconomic的一个目标是分析在商品和服务之间建立相对价格的市场机制,并在各种用途之间分配有限资源。微观经济学显示了自由市场导致理想分配的条件。它还分析了市场失灵,即市场未能产生有效的结果。微观经济学关注公司和个人,而宏观经济学则关注经济活动的总和,处理增长、通货膨胀和失业问题以及与这些问题有关的国家政策。微观经济学还处理经济政策(如改变税收水平)对微观经济行为的影响,从而对经济的上述方面产生影响。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

我们在经济Economy代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的经济Economy代写服务。我们的专家在微观经济学Microeconomics代写方面经验极为丰富,各种微观经济学Microeconomics相关的作业也就用不着 说。

经济代写|微观经济学代考Microeconomics代写|THE DETERMINANTS OF THE DEADWEIGHT LOSS

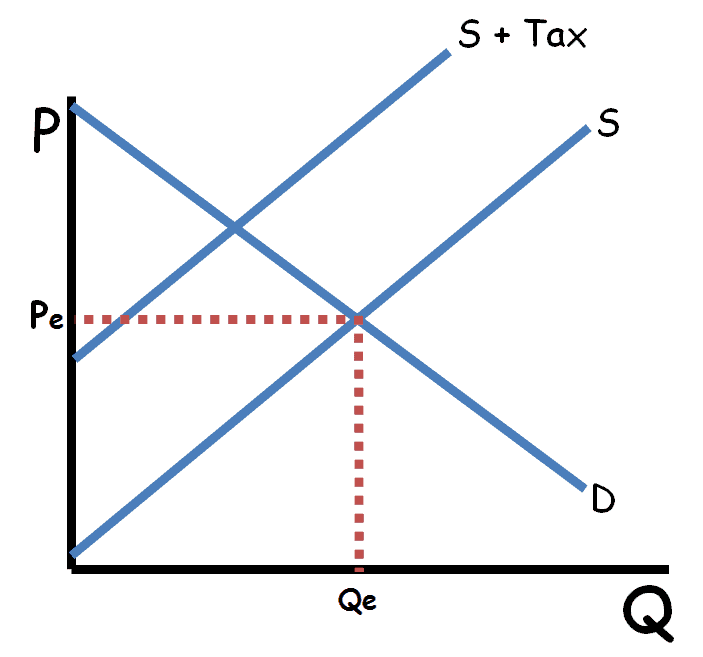

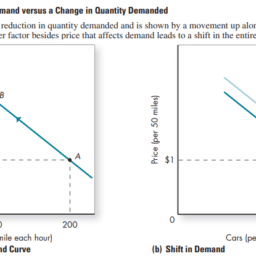

What determines whether the deadweight loss from a tax is large or small? The answer is the price elasticities of supply and demand, which measure how much the quantity supplied and quantity demanded respond to changes in the price.

relatively elastic: Quantity supplied responds substantially to changes in the price. Notice that the deadweight loss, the area of the triangle between the supply and demand curves, is larger when the supply curve is more elastic.

Similarly, the bottom two panels of Figure 8-5 show how the elasticity of demand affects the size of the deadweight loss. Here the supply curve and the size of the tax are held constant. In panel (c) the demand curve is relatively inelastic, and the deadweight loss is small. In panel (d) the demand curve is more elastic, and the deadweight loss from the tax is larger.

The lesson from this figure is easy to explain. A tax has a deadweight loss because it induces buyers and sellers to change their behavior. The tax raises the price paid by buyers, so they consume less. At the same time, the tax lowers the price received by sellers, so they produce less. Because of these changes in behavior, the size of the market shrinks below the optimum. The elasticities of supply and demand measure how much sellers and buyers respond to the changes in the price and, therefore, determine how much the tax distorts the market outcome. Hence, the greater the elasticities of supply and demand, the greater the deadweight loss of a tax.

CASE STUDY THE DEADWEIGHT LOSS DEBATE

Supply, demand, elasticity, deadweight loss – all this economic theory is enough to make your head spin. But believe it or not, these ideas go to the heart of a profound political question: How big should the government be? The reason the debate hinges on these concepts is that the larger the deadweight loss of taxation, the larger the cost of any government program. If taxation entails very large deadweight losses, then these losses are a strong argument for a leaner government that does less and taxes less. By contrast, if taxes impose only small deadweight losses, then government programs are less costly than they otherwise might be.

So how big are the deadweight losses of taxation? This is a question about which economists disagree. To see the nature of this disagreement, consider the most important tax in the U.S. economy-the tax on labor. The Social Security tax, the Medicare tax, and, to a large extent, the federal income tax are labor taxes. Many state governments also tax labor earnings. A labor tax places a wedge between the wage that firms pay and the wage that workers receive. If we add all forms of labor taxes together, the marginal tax rate on labor income-the tax on the last dollar of earnings-is almost 50 percent for many workers.

Although the size of the labor tax is easy to determine, the deadweight loss of this tax is less straightforward. Economists disagree about whether this 50 percent labor tax has a small or a large deadweight loss. This disagreement arises because they hold different views about the elasticity of labor supply.

Economists who argue that labor taxes are not very distorting believe that labor supply is fairly inelastic. Most people, they claim, would work full-time regardless of the wage. If so, the labor supply curve is almost vertical, and a tax on labor has a small deadweight loss.

Economists who argue that labor taxes are highly distorting believe that labor supply is more elastic. They admit that some groups of workers may supply their labor inelastically but claim that many other groups respond more to incentives. Here are some examples:

Many workers can adjust the number of hours they work-for instance, by working overtime. The higher the wage, the more hours they choose to work.

Some families have second earners — often married women with childrenwith some discretion over whether to do unpaid work at home or paid work in the marketplace. When deciding whether to take a job, these second earners compare the benefits of being at home (including savings on the cost of child care) with the wages they could earn.

Many of the elderly can choose when to retire, and their decisions are partly based on the wage. Once they are retired, the wage determines their incentive to work part-time.

Some people consider engaging in illegal economic activity, such as the drug trade, or working at jobs that pay “under the table” to evade taxes. Economists call this the underground economy. In deciding whether to work in the underground economy or at a legitimate job, these potential criminals compare what they can earn by breaking the law with the wage they can earn legally.

In each of these cases, the quantity of labor supplied responds to the wage (the price of labor). Thus, the decisions of these workers are distorted when their labor earnings are taxed. Labor taxes encourage workers to work fewer hours, second earners to stay at home, the elderly to retire early, and the unscrupulous to enter the underground economy.

These two views of labor taxation persist to this day. Indeed, whenever you see two political candidates debating whether the government should provide more services or reduce the tax burden, keep in mind that part of the disagreement may rest on different views about the elasticity of labor supply and the deadweight loss of taxation.

经济代写|微观经济学代考Microeconomics代写|DEADWEIGHT LOSS AND TAX REVENUE AS TAXES VARY

Taxes rarely stay the same for long periods of time. Policymakers in local, state, and federal governments are always considering raising one tax or lowering another. Here we consider what happens to the deadweight loss and tax revenue when the size of a tax changes.

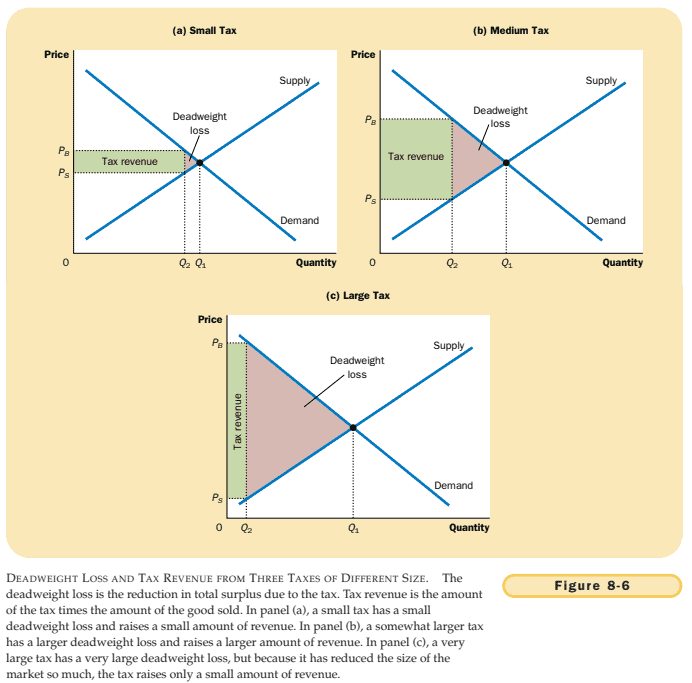

Figure 8-6 shows the effects of a small, medium, and large tax, holding constant the market’s supply and demand curves. The deadweight loss-the reduction in total surplus that results when the tax reduces the size of a market below the optimum-equals the area of the triangle between the supply and demand curves. For the small tax in panel (a), the area of the deadweight loss triangle is quite small. But as the size of a tax rises in panels (b) and (c), the deadweight loss grows larger and larger.

Indeed, the deadweight loss of a tax rises even more rapidly than the size of the tax. The reason is that the deadweight loss is an area of a triangle, and an area of a triangle depends on the square of its size. If we double the size of a tax, for instance, the base and height of the triangle double, so the deadweight loss rises by a factor of 4 . If we triple the size of a tax, the base and height triple, so the deadweight loss rises by a factor of 9 .

The government’s tax revenue is the size of the tax times the amount of the good sold. As Figure 8-6 shows, tax revenue equals the area of the rectangle between the supply and demand curves. For the small tax in panel (a), tax revenue is small. As the size of a tax rises from panel (a) to panel (b), tax revenue grows. But as the size of the tax rises further from panel (b) to panel (c), tax revenue falls because the higher tax drastically reduces the size of the market. For a very large tax, no revenue would be raised, because people would stop buying and selling the good altogether.

Figure 8-7 summarizes these results. In panel (a) we see that as the size of a tax increases, its deadweight loss quickly gets larger. By contrast, panel (b) shows that tax revenue first rises with the size of the tax; but then, as the tax gets larger, the market shrinks so much that tax revenue starts to fall.

微观经济学代写

经济代写|微观经济学代考MICROECONOMICS代写|THE DETERMINANTS OF THE DEADWEIGHT LOSS

什么决定了税收的无谓损失是大还是小? 答案是供需价格弹性,它衡量供给量和需求量对价格变化的反应程度。

相对弹性:供给量对价格变化的反应很大。请注意,当供应曲线更具弹性时,无谓损失(供需曲线之间的三角形面积)会更大。

同样,图 8-5 底部的两个面板显示了需求弹性如何影响无谓损失的大小。这里的供给曲线和税收规模保持不变。在面板中 $c$ 需求曲线相对缺乏弹 性,无谓损失很小。在面板中 $d$ 需求曲线更有弹性,税收的无谓损失更大。

这个图的教训很容易解释。税收有无谓损失,因为它会促使买卖双方改变他们的行为。税收提高了买家支付的价格,因此他们的消费减少了。同 时,税收降低了卖家收到的价格,因此他们生产更少。由于这些行为的变化,市场规模缩小到最佳水平以下。供需䩑性衡量买卖双方对价格变化 的反应程度,因此决定了税收扭曲市场结果的程度。因此,供给和需求的弹性越大,税收的无谓损失就越大。

案例研究无谓损失辩论

供应、需求、弹性、无谓损失一-所有这些经济理论足以让你头星目眩。但不管你信不信,这些想法触及了一个深刻的政治问题的核心:政府应该 有多大? 争论取决于这些概念的原因是税收的无谓损失越大,任何政府计划的成本就越大。如果税收带来非常大的无谓损失,那么这些损失是支 持精简政府、少做事和少征税的有力论据。相比之下,如果税收仅造成很小的无谓损失,那么政府计划的成本就会低于它们可能的成本。 那么税收的无谓损失有多大呢? 这是一个经济学家不同意的问题。要了解这种分歧的本质,请考虑美国经济中最重要的税收一一劳动税。社会保障 税、医疗保险税,以及在很大程度上,联邦所得税都是劳动税。许多州政府还对劳动收入征税。劳动税在企业支付的工资和工人收到的工资之间 设置了一个楔子。如果我们将所有形式的劳动税加在一起,劳动收入的边际税率一对收入的最后一美元征税一一对许多工人来说几乎是 $50 \%$ 。 虽然劳动税的规模很容易确定,但这种税收的无谓损失并不那么简单。经济学家对于这 $50 \%$ 的劳动税的无谓损失是小还是大存在分歧。产生这种 分歧是因为他们对劳动力供给弹性的看法不同。

认为劳动税不会造成严重扭曲的经济学家认为,劳动力供应相当缺乏弹性。他们声称,无论工资多少,大多数人都会全职工作。如果是这样,劳 动力供给曲线几乎是垂直的,对劳动力征税的无谓损失很小。

认为劳动力税具有高度扭曲性的经济学家认为,劳动力供给更有弹性。他们承认某些工人群体可能会缺乏弹性地提供他们的劳动力,但声称许多 其他群体对激励的反应更大。这里有些例子:

许多工人可以调整他们的工作时间一一例如,通过加班。工资越高,他们选择工作的时间就越长。

有些家庭有第二收入者一一通常是已婚有孩子的妇女,她们可以自行决定是在家里做无偿工作还是在市场上做有偿工作。在决定是否接受工作时, 这些第二收入者会比较在家的好处includingsavingsonthecostofchildcare用他们能蒹到的工资。

许多老年人可以选择何时退休,他们的决定部分取决于工资。一旦他们退休,工资决定了他们从事兼职工作的动机。

有些人考虑从事非法经济活动,例如毒品交易,或从事“私下”支付的工作以逃棁。经济学家称之为地下经济。在决定是从事地下经济工作还是从 事合法工作时,这些潜在的犯罪分子会将他们通过违法获得的收入与他们可以合法获得的工资进行比较。

在每一种情况下,劳动供给量都对工资做出反应thepriceoflabor. 因此,当他们的劳动收入被征税时,这些工人的决定就会被扭曲。劳动税鼓励 工人减少工作时间,鼓励第二收入者留在家里,鼓励老年人提前退休,鼓励不择手段的人进入地下经济。

这两种关于劳务税的观点一直沿用至今。事实上,每当你看到两位政治候选人争论政府是应该提供更多服务还是减少税收负担时,请记住,部分 分歧可能源于对劳动力供应弹性和税收无谓损失的不同看法。

经济代写|微观经济学代考MICROECONOMICS代写|DEADWEIGHT LOSS AND TAX REVENUE AS TAXES VARY

税收很少长期保持不变。地方、州和联邦政府的政策制定者总是在考虑提高一种税收或降低另一种税收。在这里,我们考虑当税收规模发生变化 时无谓损失和税收收入会发生什么变化。

图 8-6 显示了小型、中型和大型税收的影响,保持市场供求曲线不变。无谓损失一-当税收使市场规模低于最优值时导致的总剩余减少一-等于供 给曲线和需求曲线之间的三角形面积。对于面板中的小税 $a$ ,无谓损失三角形的面积相当小。但随着面板中税收规模的增加b和 $c$ ,无谓损失越来越 大。

事实上,税收的无谓损失比税收规模增长得更快。原因是无谓损失是三角形的面积,而三角形的面积取决于其大小的平方。例如,如果我们将税 收规模加倍,三角形的底数和高度都会加倍,因此无谓损失会增加 4 倍。如果我们将税收规模扩大三倍,税基和税高也会增加三倍,因此无谓损 失会增加 9 倍。

政府的税收收入是税收规模乘以商品销售量。如图 8-6 所示,税收收入等于供给曲线和需求曲线之间矩形的面积。对于面板中的小税 $a$ ,税收收入 小。随着面板的税收规模增加 $a$ 面板 $b$ ,税收收入增长。但随着税收规模进一步上升 $b$ 面板 $c$ ,税收收入下降,因为较高的税收大大缩小了市场规 模。对于非常大的税收,不会增加收入,因为人们会完全停止买卖商品。

图 8-7 总结了这些结果。在面板中 $a$ 我们看到,随着税收规模的增加,其无谓损失迅速变大。相比之下,面板 $b$ 表明税收收入首先随着税收规模的增 加而增加;但是随后,随着税收越来越大,市场菨缩得如此厉害,以至于税收收入开始下降。

经济代写|微观经济学代考Microeconomics代写 请认准exambang™. exambang™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。