如果你也在 怎样代写微观经济学Microeconomics 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。微观经济学Microeconomics是主流经济学的一个分支,研究个人和公司在做出有关稀缺资源分配的决策时的行为以及这些个人和公司之间的互动。微观经济学侧重于研究单个市场、部门或行业,而不是宏观经济学所研究的整个国民经济。

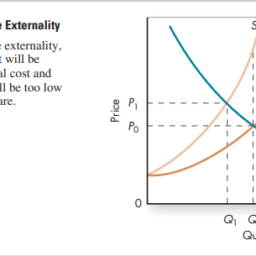

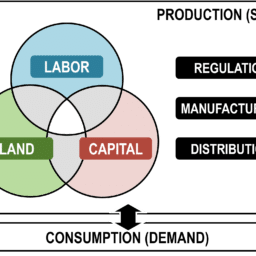

微观经济学Microeconomic的一个目标是分析在商品和服务之间建立相对价格的市场机制,并在各种用途之间分配有限资源。微观经济学显示了自由市场导致理想分配的条件。它还分析了市场失灵,即市场未能产生有效的结果。微观经济学关注公司和个人,而宏观经济学则关注经济活动的总和,处理增长、通货膨胀和失业问题以及与这些问题有关的国家政策。微观经济学还处理经济政策(如改变税收水平)对微观经济行为的影响,从而对经济的上述方面产生影响。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

我们在经济Economy代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的经济Economy代写服务。我们的专家在微观经济学Microeconomics代写方面经验极为丰富,各种微观经济学Microeconomics相关的作业也就用不着 说。

经济代写|微观经济学代考Microeconomics代写|Government Intervention: Excise Taxes and Tariffs

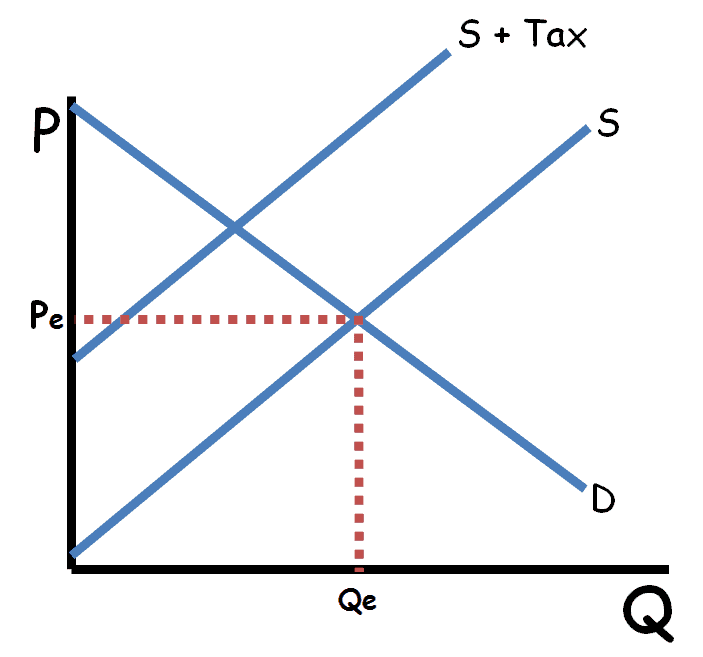

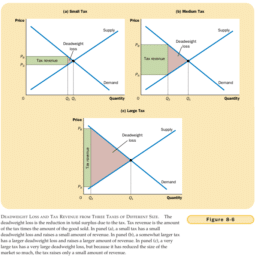

Let’s now consider an example of a tax on goods. An excise tax is a tax that is levied on a specific good. The luxury tax on expensive cars that the United States imposed in 1991 is an example. A tariff is an excise tax on an imported good. What effect will excise taxes and tariffs have on the price and quantity in a market?

To lend some sense of reality, let’s take the example from the $1990 \mathrm{~s}$, when the United States taxed the suppliers of expensive boats. Say the price of a boat before the luxury tax was $\$ 60,000$, and 600 boats were sold at that price. Now the government taxes suppliers $\$ 10,000$ for every luxury boat sold. What will the new price of the boat be, and how many will be sold?

If you were about to answer ” $\$ 70,000$, , be careful. Ask yourself whether I would have given you that question if the answer were that easy. By looking at supply and demand curves in Figure 5-4, you can see why $\$ 70,000$ is the wrong answer.

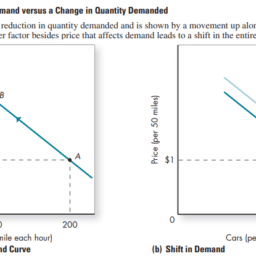

To sell 600 boats, suppliers must be fully compensated for the tax. So the tax of $\$ 10,000$ on the supplier shifts the supply curve up from $S_0$ to $S_1$. However, at $\$ 70,000$, consumers are not willing to purchase 600 boats. They are willing to purchase only 420 boats. Quantity supplied exceeds quantity demanded at $\$ 70,000$. Suppliers lower their prices until quantity supplied equals quantity demanded at $\$ 65,000$, the new equilibrium price.

The new equilibrium price is $\$ 65,000$, not $\$ 70,000$. The reason is that at he higher price, the quantity of boats people demand is less. Some people choose not to buy boats and others find substitute vehicles or purchase their boats outside the United States. The tax causes a movement up along a demand curve to the left. Excise taxes reduce the quantity of goods demanded. That’s why boat manufacturers were up in arms after the tax was imposed and why the revenue generated from the tax was less than expected. Instead of collecting $\$ 10,000 \times 600$ (\$6 million), revenue collected was only $\$ 10,000 \times$ 510 (\$5.1 million). (The tax was repealed three years after it was imposed.)

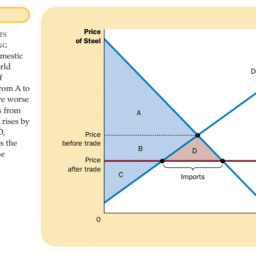

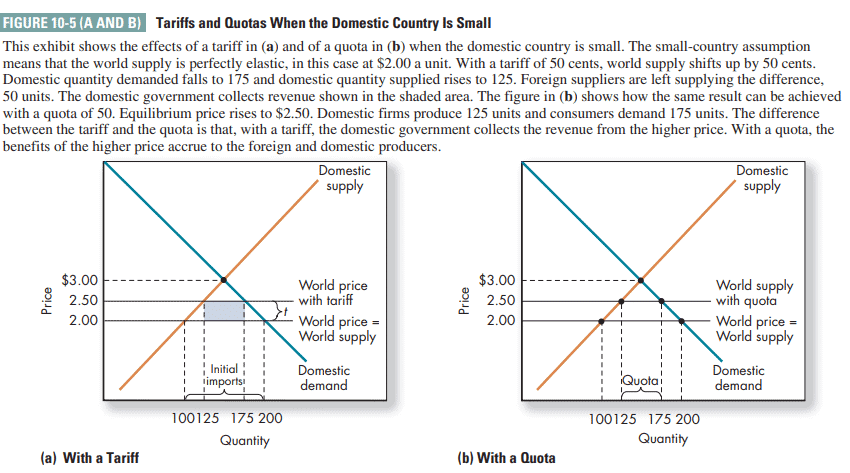

A tariff has the same effect on the equilibrium price and quantity as an excise tax. The difference is that only foreign producers sending goods into the United States pay the tax. An example is the 30 percent tariff imposed on steel imported into the United States in the early 2000s. The government instituted the tariffs because U.S. steelmakers were having difficulty competing with lower-cost foreign steel. The tariff increased the price of imported steel, making U.S. steel more competitive to domestic buyers. As expected, the price of imported steel rose by over 15 percent, to about $\$ 230$ a ton, and the quantity imported declined. Tariffs don’t hurt just the foreign producer. Tariffs increase the cost of imported products to domestic consumers. In the case of steel, manufacturing companies such as automakers faced higher production costs. The increase in the cost of steel lowered production in those industries and increased the cost of a variety of goods to U.S. consumers.

经济代写|微观经济学代考Microeconomics代写|Third-Party-Payer Markets

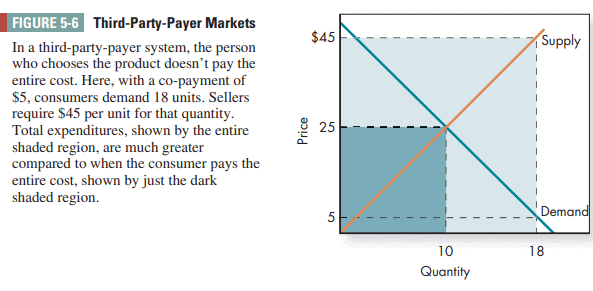

As a final example for this chapter, let’s consider third-party-payer markets. In thirdparty-payer markets, the person who receives the good differs from the person paying for the good. An example is the health care market where many individuals have insurance. They generally pay a co-payment for health care services and an HMO or other insurer pays the remainder. Medicare and Medicaid are both third-party payers. Figure 5-6 shows what happens in the supply/demand model when there is a thirdparty-payer market and a small co-payment. In the normal case, when the individual demander pays for the good, equilibrium quantity is where quantity demanded equals quantity supplied-in this case at an equilibrium price of $\$ 25$ and an equilibrium quantity of 10 .

Under a third-party-payer system, the person who chooses how much to purchase doesn’t pay the entire cost. Because the co-payment faced by the consumer is much lower, quantity demanded is much greater. In this example with a co-payment of $\$ 5$, the consumer demands 18 . Given an upward-sloping supply curve, the seller requires a higher price, in this case $\$ 45$ for each unit supplied to provide that quantity. Assuming the co-payment is for each unit, the consumers pay $\$ 5$ of that price for a total out-ofpocket cost of $\$ 90$ ( $\$ 5$ times 18 ). The third-party payer pays the remainder, $\$ 40$, for a cost of $\$ 720$ (\$40 times 18$)$. Total spending is $\$ 810$. This compares to total spending of only $\$ 250$ (25 times 10 ) if the consumer had to pay the entire price. Notice that with a third-party-payer system, total spending, represented by the large shaded rectangle, is much higher than total spending if the consumer paid, represented by the small darker rectangle.

The third-party-payer system describes much of the health care system in the United States today. Typically, a person with health insurance makes a fixed co-payment for an office visit, regardless of procedures and tests provided. Given this payment system, the insured patient has little incentive to limit the procedures offered by the doctor. The doctor charges the insurance company, and the insurance company pays. The rise in health care costs over the past decades can be attributed in part to the third-party-payer system.

A classic example of how third-party-payer systems can affect choices is a case where a 70-year-old man spent weeks in a hospital recovering from surgery to address abdominal bleeding. The bill, to be paid by Medicare, was nearing $\$ 275,000$ and the patient wasn’t recovering as quickly as expected. The doctor finally figured out that the patient’s condition wasn’t improving because ill-fitting dentures didn’t allow him to eat properly. The doctor ordered the hospital dentist to fix the dentures, but the patient refused the treatment. Why? The patient explained: “Seventy-five dollars is a lot of money.” The $\$ 75$ procedure wasn’t covered by Medicare.

微观经济学代写

经济代写|微观经济学代考Microeconomics代写|Government Intervention: Excise Taxes and Tariffs

现在让我们考虑一个货物税的例子。消费税是对特定商品征收的税。美国在1991年对昂贵汽车征收的奢侈税就是一个例子。关税是对进口商品征收的消费税。消费税和关税会对市场的价格和数量产生什么影响?

为了让我们更有现实感,让我们以1990年的例子为例,当时美国对昂贵船只的供应商征税。假设在征收奢侈税之前,一艘船的价格是6万美元,600艘船以这个价格售出。现在,政府向供应商每售出一艘豪华游艇征收1万美元的税。这艘船的新价格是多少?会卖出多少艘?

如果你要回答“$\$ 70,000$,,”要小心。问问你自己,如果答案这么简单,我还会给你这个问题吗?通过观察图5-4中的供给和需求曲线,你可以看到为什么$ $ 70000 $是错误的答案。要卖出600艘船,供应商必须得到全额补偿。1万美元的税使供给曲线从$S_0$向上平移到$S_1$。然而,在7万美元的价格下,消费者不愿意购买600艘船。他们只愿意购买420艘船。在$ $ 70,000$时,供给量超过需求量。供应商降低价格,直到供给量等于需求量,在新的均衡价格65,000美元处。新的均衡价格是$ 65,000$,而不是$ 70,000$。原因是在较高的价格下,人们对船的需求量较少。有些人选择不买船,而其他人则寻找替代车辆或在美国以外购买船只。税收导致需求曲线向左移动。消费税减少了商品的需求量。这就是船舶制造商在征税后强烈反对的原因,也是税收产生的收入低于预期的原因。而不是收取$ 10,000 $乘以600$($ 600万),收取的收入只有$ 10,000 $乘以510 $($ 510万)。(该税在征收三年后被废除。)

关税对均衡价格和均衡数量的影响与消费税相同。不同之处在于,只有向美国出口商品的外国生产商才需要缴纳关税。一个例子是本世纪初对进口到美国的钢铁征收30%的关税。美国政府之所以征收关税,是因为美国钢铁制造商难以与成本较低的外国钢铁竞争。关税提高了进口钢铁的价格,使美国钢铁对国内买家更具竞争力。正如预期的那样,进口钢材价格上涨了15%以上,达到每吨230美元左右,进口量有所下降。关税伤害的不仅仅是外国生产商。关税增加了进口产品对国内消费者的成本。以钢铁为例,汽车制造商等制造企业面临着更高的生产成本。钢铁成本的增加降低了这些行业的产量,增加了美国消费者购买各种商品的成本。

经济代写|微观经济学代考Microeconomics代写|Third-Party-Payer Markets

作为本章的最后一个例子,让我们考虑一下第三方支付市场。在第三方支付市场中,接受商品的人不同于为商品付款的人。医疗保健市场就是一个例子,许多个人都有保险。他们通常支付医疗保健服务的共同费用,HMO或其他保险公司支付剩余的费用。医疗保险和医疗补助都是第三方支付者。图5-6显示了在存在第三方支付市场和小额共同支付的情况下,供给/需求模型的情况。在正常情况下,当个体需求者为商品付费时,均衡量是需求量等于供给量的地方——在这种情况下,均衡价格为25美元,均衡量为10美元。

在第三方支付系统下,选择购买多少的人不必支付全部费用。由于消费者面临的共同支付费用要低得多,因此需求量要大得多。在这个共付5美元的例子中,消费者需要18美元。给定一条向上倾斜的供给曲线,卖方要求更高的价格,在这种情况下,为提供该数量的每单位提供$ $ 45$。假设共同支付是为每个单位,消费者支付该价格的$ $ 5$,总自付成本为$ $ $ 90$($ $ 5$乘以18)。第三方付款人支付剩余的$ $40 $,费用为$ $ 720$($ $40乘以18$)$。总支出为810美元。相比之下,如果消费者必须支付全部价格,则总支出仅为250美元(25乘以10)。请注意,在第三方支付系统中,用大的阴影矩形表示的总支出远远高于用小的深色矩形表示的消费者付费的总支出。

第三方支付系统描述了当今美国的大部分医疗保健系统。通常情况下,一个有健康保险的人会为一次诊所就诊支付固定的共同费用,而不管所提供的程序和检查如何。在这种支付制度下,受保人几乎没有动力去限制医生提供的治疗。医生向保险公司收费,保险公司付钱。在过去的几十年里,医疗费用的上涨可以部分归因于第三方支付系统。

第三方支付系统如何影响选择的一个经典例子是,一名70岁的男子在医院花了数周时间从腹部出血手术中恢复过来。由联邦医疗保险(Medicare)支付的医药费接近27.5万美元,而且病人恢复得没有预期的那么快。医生最终发现病人的病情没有好转,因为不合适的假牙使他无法正常进食。医生命令医院的牙医帮他修复假牙,但病人拒绝接受治疗。为什么?病人解释说:“75美元是一大笔钱。”这个75美元的手术不在医疗保险范围内。

经济代写|微观经济学代考Microeconomics代写 请认准exambang™. exambang™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。