如果你也在 怎样代写金融计量经济学Financial Econometrics 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。金融计量经济学Financial Econometrics是使用统计方法来发展理论或检验经济学或金融学的现有假设。计量经济学依靠的是回归模型和无效假设检验等技术。计量经济学也可用于尝试预测未来的经济或金融趋势。

金融计量经济学Financial Econometrics的一个基本工具是多元线性回归模型。计量经济学理论使用统计理论和数理统计来评估和发展计量经济学方法。计量经济学家试图找到具有理想统计特性的估计器,包括无偏性、效率和一致性。应用计量经济学使用理论计量经济学和现实世界的数据来评估经济理论,开发计量经济学模型,分析经济历史和预测。

金融计量经济学Financial Econometrics 免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。 最高质量的金融计量经济学Financial Econometrics作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此金融计量经济学Financial Econometrics作业代写的价格不固定。通常在专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

我们在经济Economy代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的经济Economy代写服务。我们的专家在微观经济学Microeconomics代写方面经验极为丰富,各种微观经济学Microeconomics相关的作业也就用不着 说。

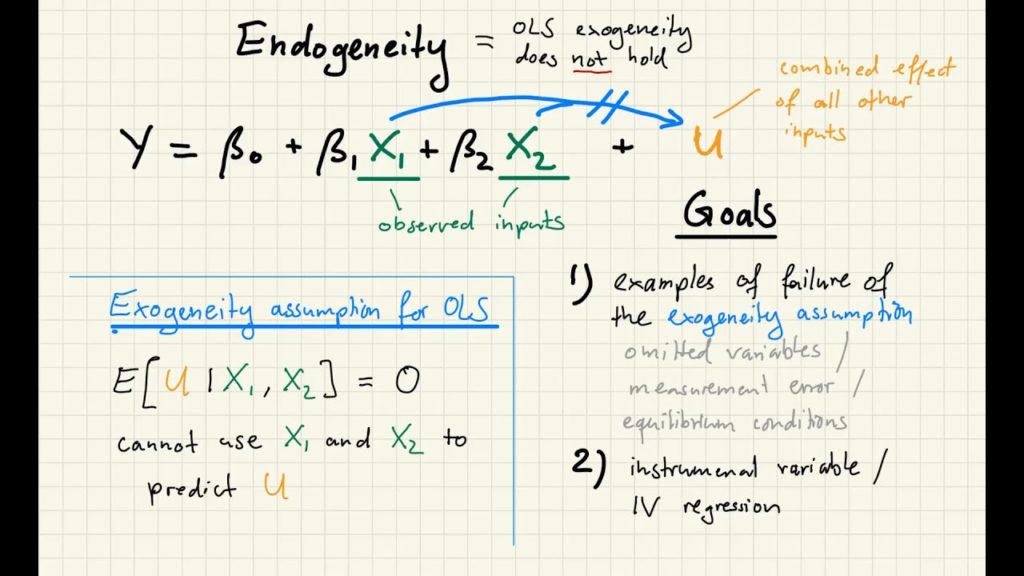

经济代写|计量经济学代写Introduction to Econometrics代考|Endogeneity Concerns

The point of working with the commodity component of the terms of trade rather than with the standard terms of trade measure, the point of taking average export weights, instead of time-varying weight, in the construction of the country-specific commodity price indices, the preference for selecting small economies and finally the choice of the econometric strategies all result to some extent from the need to address endogeneity concerns. We now present the four sources of endogeneity that must be addressed in these analyses.

Commodity Terms of Trade

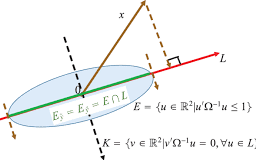

The identification of terms of trade shocks in explaining real exchange rate fluctuations is not an easy task, as terms of trade are generally not exogenous to the domestic economy. However, there is a component of the terms of trade that is largely considered to be exogenous to small economics. Indeed, commodity prices are set on international markets and commodity terms of trade can reasonably be considered as exogenous, that is $\mathrm{CToT}_t \perp \varepsilon_t$. In their review of natural experiments in macroeconomics Fuchs-Schuendeln and Hassan (2016), note that commodity price variations are viewed as quasi-natural experiments for small economies. This assumption of commodity prices’ exogeneity explains the development of the commodity currency literature and the construction of commodity terms of trade databases as the one of Gruss and Kebhaj (2019).

Terms of Trade Endogeneity

Although commodity prices can be viewed as exogenous, this is generally not the case of country-specific commodity terms of trade. Indeed, commodity terms of trade reflect fluctuations in commodity prices but also variations in the mix/weight of commodity exports. This mix is partially endogenous and can reflect new export and development policies, which are determined at the domestic level.

As a consequence, and to ensure that endogenous supply responses to price changes do not affect the analysis, it is a common practice to build the commodity price indices by taking commodity fixed weights, computed as average commodity weights in total commodity weights over a few years.

What is a “few years” is not consensual (three years, the full sample, mid-window average, etc.), but this choice has potentially substantial consequences. Indeed, the mix of commodity exports is not stable over time, and this variability can sometimes be extreme. For example, the share of aluminum in Mozambique exports was below $10 \%$ before 2001 and more than 50 in 2001 . By taking the average weight of aluminum over say 20 years, we would largely overestimate the weight of aluminum in commodity exports before 2001 and largely underestimate it as from 2001. An alternative solution to the weight endogeneity problem consists in selecting the first main exported commodity (say oil in Saudi Arabia and copper in Chile), but this approach remains subject to large changes as the one discussed above for Mozambique and aluminum.

经济代写|计量经济学代写Introduction to Econometrics代考|Market Power

One underlying assumption of the commodity currency literature is that fluctuations of the commodity price indices are exogenously affecting the real exchange rates, in other words, CToT ${ }_t$ is independent of $\varepsilon_t$. This is reasonable as long countries be small enough, compared to the globalized commodity markets. Gruss and Kebhaj (2019) showed that “the world export market share of individual countries is larger than 40\% in only a few food commodities: palm oil (Malaysia), soybeans (US), corn (US), olive oil (Spain), and soybeans oil (Argentina).” For minerals, the world market shares of Chile, Niger, and Australia for copper, uranium, and coal, exceed $20 \%, 30 \%$, and $20 \%$, respectively.

To test the market power of these countries, Gruss and Kebhaj (2019) tested the hypothesis that GDP Granger causes the commodity terms of trade for different group of countries over 1970-2014. They do not reject the null of Granger noncausality and confirm that commodity terms of trade can be taken as exogenous from the perspective of individual countries. This might come as a surprise as the market shares of $20 \%$ and more, mentioned above, are quite substantial but two caveat apply here. First, the market shares focus on total exports and not on total production. Second, substitution across similar commodity products mitigate the market power that large commodity exporters have, “even within the specific markets that they appear to dominate.” (Chen and Rogoff 2003).

Still, some (few) studies challenge this view. First, Chen and Lee (2018) studied the impact of market shares on the strength of commodity currencies and found “that as a country’s market power increases, RER reacts less to a given COMP change.” Second, Clements and Fry (2008) considered the case where a group of commodity-exporting countries have combined market power and found that “spillovers from commodities to currencies contributed less than $1 \%$ to the volatility of the currency returns, while spillovers from currencies to commodities generally contributed between 2 and 5.2\% to the commodities.” They concluded that this spillover reflected the endogeneity of commodity prices induced by market power. Neutralizing countries with a potential market power should be included in robustness analyses of commodity currency papers.

计量经济学代写

经济代写|计量经济学代写Introduction to Econometrics代考|Endogeneity Concerns

使用贸易条件的商品组成部分而不是使用标准贸易条件措施,在构建特定国家商品价格指数时采用平均出口权重而不是随时间变化的权重,偏爱选择小型经济体以及最后选择计量经济战略,这些都在某种程度上是由于需要处理内生性问题。我们现在提出在这些分析中必须解决的四个内生性来源。

商品贸易条件

确定贸易条件冲击来解释实际汇率波动并非易事,因为贸易条件通常与国内经济无关。然而,贸易条件的一个组成部分在很大程度上被认为是小型经济体的外生因素。事实上,商品价格是由国际市场决定的,商品贸易条件可以合理地认为是外生的,即$\ mathm {CToT}_t \perp \varepsilon_t$。在对宏观经济学自然实验的回顾中,Fuchs-Schuendeln和Hassan(2016)指出,商品价格变化被视为小型经济体的准自然实验。这种商品价格的外生性假设解释了商品货币文献的发展和商品贸易条件数据库的构建,如Gruss和Kebhaj(2019)。

贸易条件内生性

虽然商品价格可被视为外生因素,但具体国家的商品贸易条件通常并非如此。的确,商品贸易条件反映了商品价格的波动,但也反映了商品出口组合/比重的变化。这种混合部分是内生的,可以反映在国内一级确定的新的出口和发展政策。

因此,为了确保内生供给对价格变化的反应不影响分析,通常的做法是通过采用商品固定权重来构建商品价格指数,以几年来总商品权重中的平均商品权重计算。

什么是“几年”并不是双方同意的(三年,完整样本,中间窗口平均值等),但这种选择具有潜在的实质性后果。事实上,大宗商品出口的组合并不会随着时间的推移而稳定,而且这种变化有时可能是极端的。例如,2001年以前,铝在莫桑比克出口中所占的份额低于10%,2001年则超过50%。通过计算20年来铝的平均重量,我们会大大高估2001年以前铝在商品出口中的比重,而大大低估2001年以后的比重。重量内生性问题的另一种解决办法是选择第一种主要出口商品(例如沙特阿拉伯的石油和智利的铜),但这种方法仍然可能发生重大变化,就像上文讨论的莫桑比克和铝一样。

经济代写|计量经济学代写Introduction to Econometrics代考|Market Power

商品货币文献的一个基本假设是,商品价格指数的波动是外生影响实际汇率的,换句话说,CToT ${}_t$独立于$\varepsilon_t$。与全球化的大宗商品市场相比,只要国家足够小,这是合理的。Gruss和Kebhaj(2019)表明,“只有少数食品商品的世界出口市场份额大于40%:棕榈油(马来西亚)、大豆(美国)、玉米(美国)、橄榄油(西班牙)和大豆油(阿根廷)。”在矿产方面,智利、尼日尔和澳大利亚的铜、铀和煤的世界市场份额分别超过20%、30%和20%。

为了检验这些国家的市场力量,Gruss和Kebhaj(2019)检验了1970-2014年不同国家集团的GDP格兰杰导致商品贸易条件的假设。他们没有否定格兰杰非因果性的无效性,并确认从单个国家的角度来看,商品贸易条件可以被视为外生的。这可能会让人感到惊讶,因为上文提到的20%以上的市场份额是相当可观的,但这里有两点需要注意。首先,市场份额关注的是总出口,而不是总产量。其次,类似商品之间的替代削弱了大型大宗商品出口国的市场支配力,“即使是在它们似乎占据主导地位的特定市场内”。(Chen and Rogoff 2003)。

然而,一些(少数)研究对这一观点提出了质疑。首先,Chen和Lee(2018)研究了市场份额对商品货币强弱的影响,发现“随着一个国家市场力量的增加,RER对给定COMP变化的反应较小。”其次,Clements和Fry(2008)考虑了一组商品出口国联合市场力量的情况,发现“从商品到货币的溢出效应对货币回报波动的贡献不到1%,而从货币到商品的溢出效应对商品的贡献通常在2%到5.2%之间。”他们的结论是,这种溢出反映了市场力量导致的商品价格内生性。在大宗商品货币论文的稳健性分析中,应包括具有潜在市场力量的中立国家。

经济代写|计量经济学代考ECONOMETRICS代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。