如果你也在 怎样代写微观经济学Microeconomics 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。微观经济学Microeconomics是从局部到整体的分析;宏观经济学从整体到局部进行分析。

微观经济学Microeconomics和宏观经济学是密切相关的。整个经济中发生的事情是基于个人决策的,但个人决策是在经济中做出的,只能在宏观背景下理解。例如,企业是否决定扩大生产能力将取决于所有者对其产品需求的预期。这些预期是由宏观经济条件决定的。因为微观经济学关注的是个人,而宏观经济学关注的是整个经济,所以传统上微观经济学和宏观经济学是分开教授的,尽管它们是相互关联的。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

我们在经济Economy代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的经济Economy代写服务。我们的专家在微观经济学Microeconomics代写方面经验极为丰富,各种微观经济学Microeconomics相关的作业也就用不着 说。

经济代写|微观经济学代考Microeconomics代写|Varieties of Trade Restrictions

The policies countries can use to restrict trade include tariffs and quotas, voluntary restraint agreements, embargoes, regulatory trade restrictions, and nationalistic appeals. I’ll consider each in turn and also review the geometric analysis of each.

Tariffs and Quotas

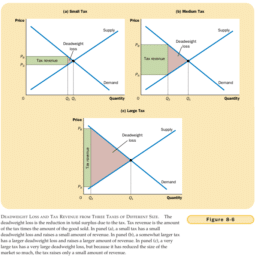

A tariff is a tax that governments place on internationally traded goods-generally imports. (Tariffs are also called customs duties.) Tariffs are the most-used and mostfamiliar type of trade restriction. Tariffs operate in the same way a tax does: They make imported goods relatively more expensive than they otherwise would have been, and thereby encourage the consumption of domestically produced goods. On average, U.S. tariffs raise the price of imported goods by less than 3 percent. Figure 10-3(a) presents average tariff rates for industrial goods for a number of countries and Figure 10-3(b) shows the tariff rates imposed by the United States since 1920.

Probably the most infamous tariff in U.S. history is the Smoot-Hawley Tariff of 1930, which raised tariffs on imported goods to an average of 60 percent. It was passed at the height of the Great Depression in the United States in the hope of protecting American jobs. It didn’t work. Other countries responded with similar tariffs. Partly as a result of these trade wars, international trade plummeted from $\$ 60$ billion in 1928 to $\$ 25$ billion in 1938, unemployment worsened, and the international depression deepened. These effects of the tariff convinced many, if not most, economists that free trade is preferable to trade restrictions.

The dismal failure of the Smoot-Hawley Tariff was the main reason the General Agreement on Tariffs and Trade (GATT), a regular international conference to reduce trade barriers, was established in 1947 immediately following World War II. In 1995 GATT was replaced by the World Trade Organization (WTO), an organization whose functions are generally the same as GATT’s were-to promote free and fair trade among countries. Unlike GATT, the WTO is a permanent organization with an enforcement system (albeit weak). Since its formation, rounds of negotiations have resulted in a decline in worldwide tariffs.

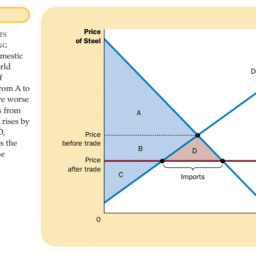

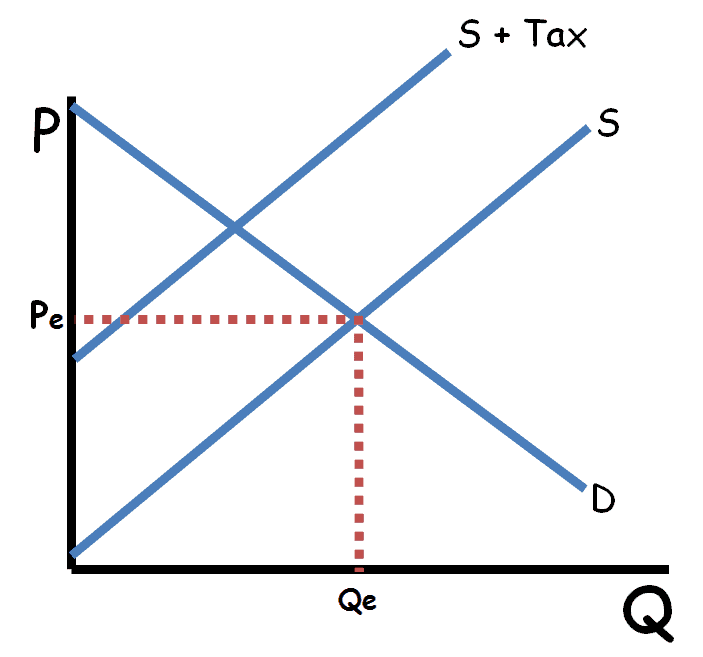

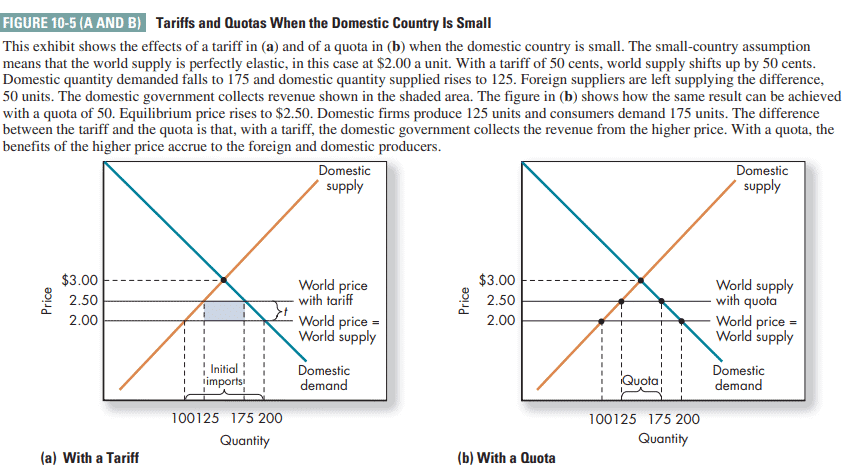

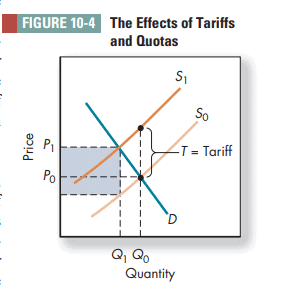

A quota is a quantity limit placed on imports. They have the same effect on equilibrium price and quantity as the quantity restrictions discussed in Chapter 5 , and their effect in limiting trade is similar to the effect of a tariff. Both increase price and reduce quantity. Tariffs, like all taxes on suppliers, shift the supply curve up by the amount of the tax, as Figure 10-4 shows. A tariff, $T$, raises equilibrium price from $P_0$ to $P_1$ by an amount that is less than the tariff, and equilibrium quantity declines from $Q_0$ to $Q_1$. With a quota, $Q_1$, the equilibrium price also rises to $P_1$.

There is, however, a difference between tariffs and quotas. In the case of the tariff, the government collects tariff revenue represented by the shaded region. In the case of a quota, the government collects no revenue. The benefit of the increase in price goes to the importer as additional corporate revenue. So which of the two do you think import companies favor? The quota, of course-it means more profits as long as your company is the one to receive the rights to fill those quotas. In fact, once quotas are instituted, firms compete intensely to get them.

经济代写|微观经济学代考Microeconomics代写|Voluntary Restraint Agreements

Imposing new tariffs and quotas is specifically ruled out by the WTO, but foreign countries know that WTO rules are voluntary and that, if a domestic industry brought sufficient political pressure on its government, the WTO rules would be forgotten. To avoid the imposition of new tariffs on their goods, countries often voluntarily restrict their exports. That’s why Japan has, at times, agreed informally to limit the number of cars it exports to the United States.

The effect of such voluntary restraint agreements is similar to the effect of quotas: They directly limit the quantity of imports, increasing the price of the good and helping domestic producers. For example, when the United States encouraged Japan to impose “voluntary” quotas on exports of its cars to the United States, Toyota benefited from the quotas because it could price its limited supply of cars higher than it could if it sent in a large number of cars, so profit per car would be high. Since they faced less competition, U.S. car companies also benefited. They could increase their prices because Toyota had done so. As Chinese car companies develop in the next decade, we can expect similar pushes for Chinese voluntary restraints.

Embargoes

An embargo is a total restriction on the import or export of a good. Embargoes are usually established for international political reasons rather than for primarily economic reasons.

An example was the U.S. embargo of trade with Iraq prior to the U.S. invasion in 2001. The U.S. government hoped that the embargo would so severely affect Iraq’s economy that Saddam Hussein would lose political power. It did make life difficult for Iraqis, but it did not bring about the downfall of the Hussein government. The United States has imposed embargoes on Cuba, Iran, and Libya.

Regulatory Trade Restrictions

Tariffs, quotas, and embargoes are the primary direct methods to restrict international trade. There are also indirect methods that restrict trade in not-so-obvious ways; these are called regulatory trade restrictions (government-imposed procedural rules that limit imports). One type of regulatory trade restriction has to do with protecting the health and safety of a country’s residents. For example, a country might restrict imports of all vegetables grown where certain pesticides are used, knowing full well that all other countries use those pesticides. The effect of such a regulation would be to halt the import of vegetables. Another example involves building codes. U.S. building codes require that plywood have fewer than, say, three flaws per sheet. Canadian building codes require that plywood have fewer than, say, five flaws per sheet. The different building codes are a nontariff barrier that makes trade in building materials between the United States and Canada difficult.

A second type of regulatory restriction involves making import and customs procedures so intricate and time-consuming that importers simply give up. For example, at one time France required all imported electronics to be individually inspected in Toulouse. Since Toulouse is a provincial city, far from any port and outside the normal route for imports after they enter France, the inspection process took months.

Some regulatory restrictions are imposed for legitimate reasons; others are designed simply to make importing more difficult and hence protect domestic producers from international competition. It’s often hard to tell the difference. A good example of this difficulty began in 1988, when the EU disallowed all imports of meat from animals that had been fed growth-inducing hormones. As the box “Hormones and Economics” details, the debate continues.

微观经济学代写

经济代写|微观经济学代考Microeconomics代写|Varieties of Trade Restrictions

各国可以用来限制贸易的政策包括关税和配额、自愿限制协议、禁运、监管贸易限制和民族主义呼吁。我将依次考虑每种方法,并回顾每种方法的几何分析。

关税和配额

关税是政府对国际贸易商品——通常是进口商品——征收的一种税。(关税也被称为关税。)关税是最常用和最熟悉的贸易限制类型。关税的运作方式与税收相同:它们使进口商品相对更贵,从而鼓励对国内生产商品的消费。平均而言,美国关税使进口商品的价格上涨不到3%。图10-3(a)显示了一些国家工业产品的平均关税税率,图10-3(b)显示了美国自1920年以来征收的关税税率。

美国历史上最臭名昭著的关税可能是1930年的斯穆特-霍利关税,该关税将进口商品的关税提高到平均60%。它是在美国经济大萧条最严重的时候通过的,目的是保护美国的就业机会。但没有成功。其他国家也以类似的关税作为回应。部分由于这些贸易战,国际贸易从1928年的600亿美元暴跌至1938年的250亿美元,失业率恶化,国际经济萧条加深。关税的这些影响使许多(如果不是大多数的话)经济学家相信,自由贸易比贸易限制更可取。

《斯穆特-霍利关税法》的惨淡失败是关税与贸易总协定(GATT)——一个旨在减少贸易壁垒的定期国际会议——于1947年在第二次世界大战后成立的主要原因。1995年,关贸总协定被世界贸易组织(WTO)取代,该组织的职能与关贸总协定大致相同,即促进各国之间的自由和公平贸易。与关贸总协定不同,世贸组织是一个常设组织,有一个执行体系(尽管很弱)。自成立以来,经过多轮谈判,全球关税水平有所下降。

配额是对进口商品的数量限制。它们对均衡价格和均衡数量的影响与第5章中讨论的数量限制相同,它们在限制贸易方面的作用类似于关税的作用。既提高价格又减少数量。关税和所有针对供应商的税一样,会使供给曲线上移,使之上移,如图10-4所示。关税$T$将均衡价格从$P_0$提高到$P_1$的幅度小于关税$T$,并且均衡数量从$Q_0$下降到$Q_1$。当配额为$Q_1$时,均衡价格也上升到$P_1$。

然而,关税和配额之间是有区别的。以关税为例,政府征收的关税收入由阴影区域表示。在配额的情况下,政府不收取任何收入。价格上涨的好处作为额外的公司收入归进口商所有。那么你认为进口公司更青睐哪一个呢?当然,配额意味着更多的利润,只要你的公司有权完成这些配额。事实上,配额一旦制定,企业就会为获得配额而激烈竞争。

经济代写|微观经济学代考Microeconomics代写|Voluntary Restraint Agreements

征收新的关税和配额是世贸组织明确排除的,但外国知道世贸组织的规则是自愿的,如果一个国内产业对其政府施加了足够的政治压力,世贸组织的规则就会被遗忘。为了避免对其商品征收新关税,各国往往自愿限制其出口。这就是为什么日本有时会非正式地同意限制向美国出口的汽车数量。

这种自愿限制协议的效果与配额的效果相似:它们直接限制进口数量,提高商品价格,帮助国内生产商。例如,当美国鼓励日本对其向美国出口的汽车实行“自愿”配额时,丰田从配额中受益,因为它可以将其有限的汽车供应定价高于大量出口时的价格,因此每辆车的利润将很高。由于面临的竞争较少,美国汽车公司也从中受益。他们可以提高价格,因为丰田已经这么做了。随着中国汽车企业在未来10年的发展,我们可以预期,中国将推出类似的自愿限制措施。

禁运

禁运是对某种商品进出口的全面限制。禁运通常是出于国际政治原因而不是主要出于经济原因。

一个例子是美国在2001年入侵伊拉克之前对伊拉克实施的贸易禁运。美国政府希望禁运会严重影响伊拉克的经济,使萨达姆·侯赛因失去政治权力。它确实使伊拉克人的生活变得困难,但它并没有导致侯赛因政府的垮台。美国对古巴、伊朗和利比亚实施禁运。

监管贸易限制

关税、配额和禁运是限制国际贸易的主要直接手段。还有以不太明显的方式限制贸易的间接方法;这些被称为监管贸易限制(政府强加的限制进口的程序性规则)。监管贸易限制的一种类型与保护一国居民的健康和安全有关。例如,一个国家可能会限制在使用某些农药的地方种植的所有蔬菜的进口,因为它完全知道所有其他国家都在使用这些农药。这一规定的效果将是停止蔬菜进口。另一个例子涉及建筑规范。美国建筑法规要求胶合板每片缺陷少于3个。加拿大建筑法规要求胶合板每片缺陷少于5个。不同的建筑规范是一种非关税壁垒,使美国和加拿大之间的建筑材料贸易变得困难。

第二种类型的监管限制涉及使进口和海关程序如此复杂和耗时,以至于进口商干脆放弃。例如,法国曾经要求在图卢兹对所有进口电子产品进行单独检查。由于图卢兹是一个省级城市,远离任何港口,并且在进口商品进入法国后不在正常路线上,因此检查过程需要数月时间。

有些监管限制是出于正当理由实施的;还有一些只是为了增加进口难度,从而保护国内生产商免受国际竞争的影响。通常很难分辨出其中的区别。这种困难的一个很好的例子始于1988年,当时欧盟禁止进口所有饲喂了促生长激素的动物肉。正如“荷尔蒙与经济学”一栏详述的那样,争论仍在继续。

经济代写|微观经济学代考Microeconomics代写 请认准exambang™. exambang™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。