如果你也在 怎样代写计算金融Computational finance这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。计算金融Computational finance是应用计算机科学的一个分支,处理金融中的实际利益问题。一些略有不同的定义是研究目前用于金融的数据和算法以及实现金融模型或系统的计算机程序的数学。

计算金融Computational finance强调实用的数字方法,而不是数学证明,并侧重于直接应用于经济分析的技术。它是数学金融学和数字方法之间的一个跨学科领域。两个主要领域是金融证券公允价值的有效和准确计算以及随机时间序列的建模。计算金融作为一门学科的诞生可以追溯到20世纪50年代初的哈里-马科维茨。马科维茨将投资组合的选择问题设想为均值-方差优化的一个练习。这需要比当时更多的计算机能力,所以他致力于研究有用的近似解决方案的算法。

my-assignmentexpert™ 计算金融Computational finance作业代写,免费提交作业要求, 满意后付款,成绩80\%以下全额退款,安全省心无顾虑。专业硕 博写手团队,所有订单可靠准时,保证 100% 原创。my-assignmentexpert™, 最高质量的计算金融Computational finance作业代写,服务覆盖北美、欧洲、澳洲等 国家。 在代写价格方面,考虑到同学们的经济条件,在保障代写质量的前提下,我们为客户提供最合理的价格。 由于统计Statistics作业种类很多,同时其中的大部分作业在字数上都没有具体要求,因此计算金融Computational finance作业代写的价格不固定。通常在经济学专家查看完作业要求之后会给出报价。作业难度和截止日期对价格也有很大的影响。

想知道您作业确定的价格吗? 免费下单以相关学科的专家能了解具体的要求之后在1-3个小时就提出价格。专家的 报价比上列的价格能便宜好几倍。

my-assignmentexpert™ 为您的留学生涯保驾护航 在计算金融project作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的计算金融project代写服务。我们的专家在计算金融Computational finance代写方面经验极为丰富,各种计算金融Computational finance相关的作业也就用不着 说。

我们提供的计算金融Computational finance及其相关学科的代写,服务范围广, 其中包括但不限于:

金融代写|计算金融project代写Computational finance代考|American-Style Options

American-style options can be exercised by the holder at any given time up to and including maturity time $T$. This is in contrast to European-style options that were considered up to now and can only be exercised at $T$. Clearly, the holder of an American-style option is faced with the decision as to when it is optimal to exercise.

American options are extensively traded in practice. The fair value of any given American option is always greater than or equal to that of its European counterpart. Under the Black-Scholes framework, it can be shown that for an American call it is actually optimal to exercise at maturity and, consequently, its fair value equals that of a European call. As it turns out, however, this is an exceptional case. In general, the fair values of American options cannot be expressed in (semi-)closed analytical form. Accordingly, they are valued through numerical approximation.

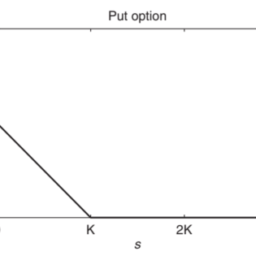

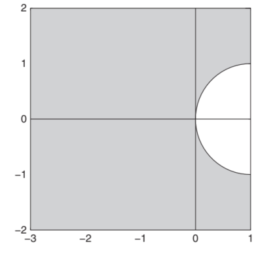

We consider here the example of an American put. This option gives the holder the right to sell the underlying asset for strike price $K$ at any given time up to and including maturity time $T$. A (semi-)closed analytical formula for the fair value of the American put is unknown. Let $u(s, t)$ denote this fair value at time $\tau=T-t$ if at that time the asset price equals $s$.

It is conceivable that, for any given $t$, there exists a value $s^{}(t)$ such that if $s}(t)$ it is optimal to exercise an American put and if

$s>s^{}(t)$ it is optimal to keep the option. Indeed, it can be proved that a function $s^{}:[0, T] \rightarrow[0, K]$ with this property exists. Its graph is called the early exercise boundary or optimal exercise boundary or free boundary. For this boundary a (semi-)closed analytical formula is also unknown. At the early exercise boundary, the option value function $u$ suffers from a lack of smoothness: it is once, but not twice, continuously differentiable there.

Let $\phi(s)=\max (K-s, 0)$ be the familiar payoff for a put option and write

$$

\mathcal{A} u(s, t)=\frac{1}{2} \sigma^{2} s^{2} \frac{\partial^{2} u}{\partial s^{2}}(s, t)+r s \frac{\partial u}{\partial s}(s, t)-r u(s, t)

$$

金融代写|计算金融PROJECT代写COMPUTATIONAL FINANCE代考|LCP Solution Methods

Solution methods for LCPs have been widely studied in the literature. We discuss here three approximation approaches that are often used for the application under consideration. Each of these successively generates for $n=1,2, \ldots, N$ approximations $\widehat{U}{n}$ to the vectors $U{n}$ defined by (11.4).

The explicit payoff method for (11.4) is the most basic approach and yields

$(I-\theta \Delta t A) \bar{U}{n}=(I+(1-\theta) \Delta t A) \widehat{U}{n-1}+\Delta t g$, $$ \widehat{U}{n}=\max \left{\bar{U}{n}, U_{0}\right} . $$ Here $\widehat{U}{0}=U{0}$ and the maximum of two vectors is to be understood componentwise. Method (11.5) can be viewed as first performing a time step by ignoring the American constraint, and next applying this constraint explicitly. The computational cost per time step is essen- tially the same as that in the case of the European counterpart of the option, which is very favourable. The obtained accuracy with the explicit payoff method is often relatively low, however. The Ikonen-Toivanen $(I T)$ splitting method for (11.4) is a more advanced approach and yields $$ (I-\theta \Delta t A) \bar{U}{n}=(I+(1-\theta) \Delta t A) \widehat{U}{n-1}+\Delta t g+\Delta t \widehat{\lambda}{n-1} \text {, (11.6a) } $$ $$ \left{\widehat{U}{n}-\bar{U}{n}-\Delta t\left(\widehat{\lambda}{n}-\widehat{\lambda}{n-1}\right)=0,\right. $$ $\widehat{U}{n} \geq U_{0}, \quad \widehat{\lambda}{n} \geq 0, \quad\left(\widehat{U}{n}-U_{0}\right)^{\mathrm{T}} \widehat{\lambda}_{n}=0$, componentwise. Method (11.5) can be viewed as first performing a time step by ignoring the American constraint, and next applying this constraint explicitly. The computational cost per time step is essentially the same as that in the case of the European counterpart of the option, which is very favourable. The obtained accuracy with the explicit payoff method is often relatively low, however.

The Ikonen-Toivanen (IT) splitting method for (11.4) is a more advanced approach and yields

with $\widehat{\lambda}{0}=0$. The vector $\widehat{U}{n}$ together with the auxiliary vector $\widehat{\lambda}{n}$ are computed in two stages. In the first stage an intermediate approximation $\bar{U}{n}$ is defined by the system of linear equations (11.6a). In the second stage, $\bar{U}{n}$ and $\widehat{\lambda}{n-1}$ are updated to $\widehat{U}{n}$ and $\widehat{\lambda}{n}$ by (11.6b). It is readily verified that these updates are given by the simple, explicit formulas

$$

\begin{aligned}

&\widehat{U}{n}=\max \left{\bar{U}{n}-\Delta t \widehat{\lambda}{n-1}, U{0}\right} \

&\widehat{\lambda}{n}=\max \left{0, \widehat{\lambda}{n-1}+\left(U_{0}-\bar{U}_{n}\right) / \Delta t\right}

\end{aligned}

$$

金融代写|计算金融PROJECT代写COMPUTATIONAL FINANCE代考|Numerical Study

We consider an American put option with

$$

K=100, T=0.5, r=0.02, \sigma=0.25 .

$$

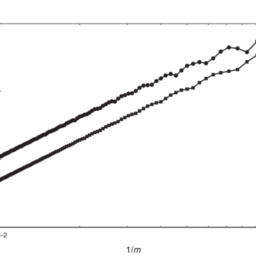

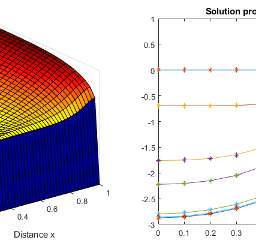

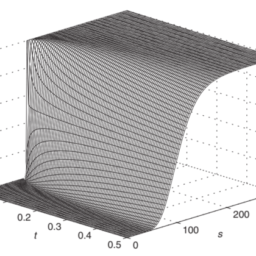

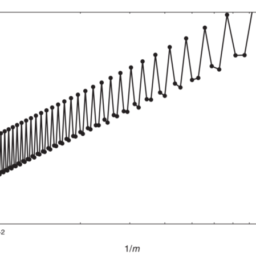

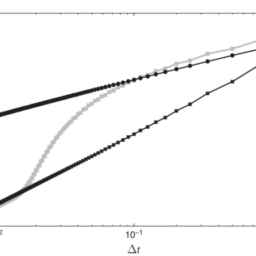

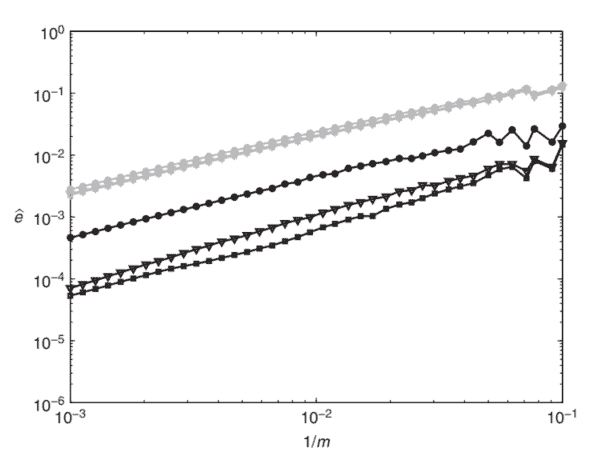

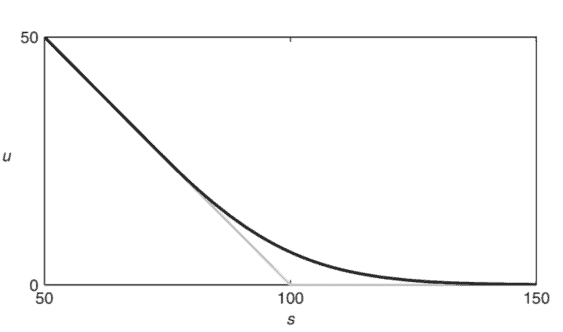

Figure $11.1$ shows the numerically approximated graph of the option value function (dark curve) together with the graph of the payoff function (light curve) on $\left[\frac{1}{2} K, \frac{3}{2} K\right]$ for $t=T$. Clearly, the option value is always greater than or equal to the corresponding payoff value. At the point $s=s^{}(T)$ on the left of $K$ where the two graphs meet, their derivatives with respect to $s$ are equal. This is known as smooth pasting. Figure $11.2$ displays the numerically approximated early exercise boundary. It is directly obtained by verifying whether or not $\widehat{U}{n, i}=U{0, i}$ holds. Notice that the function $s^{}$ which defines the early exercise boundary varies strongly near $t=0$, that is, when actual time is close to maturity. We mention that $s^{*}(T) \approx 73.4$.

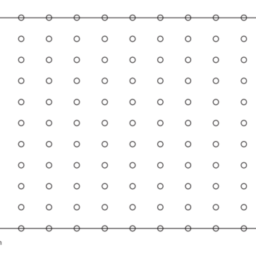

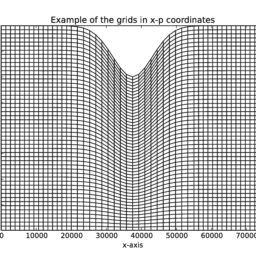

For the experiments, as in foregoing chapters, the spatial domain is truncated to $(0,3 K)$ and semidiscretization is performed on the nonuniform grid from Example 4.2.1 with second-order central formulas for convection and diffusion, using formula B for convection. Cell averaging is applied to smooth the initial data at the strike. The only change with respect to the semidiscretization for the European put option case is a different Dirichlet boundary condition at $s=0$, see (11.2). The matrix $A$ thus remains the same, whereas the vector $g(t)$ changes slightly and becomes independent of $t$.

计算金融代写

金融代写|计算金融PROJECT代写COMPUTATIONAL FINANCE代考|AMERICAN-STYLE OPTIONS

持有人可以在任何给定时间行使美式期权,包括到期时间吨. 这与迄今为止考虑的欧式期权形成鲜明对比,欧式期权只能在吨. 显然,美式期权的持有人面临着何时最佳行权的决定。

美式期权在实践中被广泛交易。任何给定的美式期权的公允价值总是大于或等于其欧洲期权的公允价值。在 Black-Scholes 框架下,可以证明对于美式看涨期权,在到期时行使实际上是最优的,因此,其公允价值等于欧式看涨期权的公允价值。然而,事实证明,这是一个例外情况。一般来说,美式期权的公允价值不能以s和米一世−封闭的分析形式。因此,它们是通过数值近似来评估的。

我们在这里考虑美式看跌期权的例子。该期权赋予持有人以行使价出售标的资产的权利ķ在任何给定时间直至并包括到期时间吨. 一种s和米一世−美式看跌期权公允价值的封闭式分析公式未知。让在(s,吨)表示当时的公允价值τ=吨−吨如果当时资产价格等于s.

可以想象,对于任何给定的吨, 存在一个值 $t$, there exists a value $s^{}(t)$ such that if $s}(t)$ it is optimal to exercise an American put and if $s>s^{}(t)$ it is optimal to keep the option. Indeed, it can be proved that a function $s^{}:[0, T] \rightarrow[0, K]$ with this property exists. Its graph is called the early exercise boundary or optimal exercise boundary or free boundary. For this boundary a (semi-)closed analytical formula is also unknown. At the early exercise boundary, the option value function $u$ 缺乏平滑度:它在那里连续可微分一次,但不是两次。

让φ(s)=最大限度(ķ−s,0)成为看跌期权的熟悉回报并写下

一种在(s,吨)=12σ2s2∂2在∂s2(s,吨)+rs∂在∂s(s,吨)−r在(s,吨)

金融代写|计算金融PROJECT代写COMPUTATIONAL FINANCE代考|LCP SOLUTION METHODS

LCP 的求解方法已在文献中得到广泛研究。我们在这里讨论三种近似方法,这些方法经常用于所考虑的应用程序。这些中的每一个都连续生成n=1,2,…,ñ近似值 $\widehat{U} {n}吨这吨H和在和C吨这rsU {n}$ 定义为11.4.

显式支付方法11.4是最基本的方法并产生

$(I-\theta \Delta t A) \bar{U}{n}=(I+(1-\theta) \Delta t A) \widehat{U}{n-1}+\Delta t g$, $$ \widehat{U}{n}=\max \left{\bar{U}{n}, U_{0}\right} . $$ Here $\widehat{U}{0}=U{0}$ and the maximum of two vectors is to be understood componentwise. Method (11.5) can be viewed as first performing a time step by ignoring the American constraint, and next applying this constraint explicitly. The computational cost per time step is essen- tially the same as that in the case of the European counterpart of the option, which is very favourable. The obtained accuracy with the explicit payoff method is often relatively low, however. The Ikonen-Toivanen $(I T)$ splitting method for (11.4) is a more advanced approach and yields $$ (I-\theta \Delta t A) \bar{U}{n}=(I+(1-\theta) \Delta t A) \widehat{U}{n-1}+\Delta t g+\Delta t \widehat{\lambda}{n-1} \text {, (11.6a) } $$ $$ \left{\widehat{U}{n}-\bar{U}{n}-\Delta t\left(\widehat{\lambda}{n}-\widehat{\lambda}{n-1}\right)=0,\right. $$ $\widehat{U}{n} \geq U_{0}, \quad \widehat{\lambda}{n} \geq 0, \quad\left(\widehat{U}{n}-U_{0}\right)^{\mathrm{T}} \widehat{\lambda}_{n}=0$,,按分量计算。方法11.5可以被视为首先通过忽略美国约束执行时间步,然后显式应用此约束。每个时间步的计算成本与欧洲期权对应的情况基本相同,这是非常有利的。然而,使用显式支付方法获得的准确度通常相对较低。

Ikonen-Toivanen一世吨拆分方法为11.4是一种更高级的方法,并且产生$\widehat{\lambda}{0}=0$. The vector $\widehat{U}{n}$ together with the auxiliary vector $\widehat{\lambda}{n}$ are computed in two stages. In the first stage an intermediate approximation $\bar{U}{n}$ is defined by the system of linear equations (11.6a). In the second stage, $\bar{U}{n}$ and $\widehat{\lambda}{n-1}$ are updated to $\widehat{U}{n}$ and $\widehat{\lambda}{n}$ by (11.6b). It is readily verified that these updates are given by the simple, explicit formulas

$$

\begin{aligned}

&\widehat{U}{n}=\max \left{\bar{U}{n}-\Delta t \widehat{\lambda}{n-1}, U{0}\right} \

&\widehat{\lambda}{n}=\max \left{0, \widehat{\lambda}{n-1}+\left(U_{0}-\bar{U}_{n}\right) / \Delta t\right}

\end{aligned}

$$

金融代写|计算金融PROJECT代写COMPUTATIONAL FINANCE代考|NUMERICAL STUDY

我们考虑一个美式看跌期权

$$

K=100, T=0.5, r=0.02, \sigma=0.25 .

$$

Figure $11.1$ shows the numerically approximated graph of the option value function (dark curve) together with the graph of the payoff function (light curve) on $\left[\frac{1}{2} K, \frac{3}{2} K\right]$ for $t=T$. Clearly, the option value is always greater than or equal to the corresponding payoff value. At the point $s=s^{}(T)$ on the left of $K$ where the two graphs meet, their derivatives with respect to $s$ are equal. This is known as smooth pasting. Figure $11.2$ displays the numerically approximated early exercise boundary. It is directly obtained by verifying whether or not $\widehat{U}{n, i}=U{0, i}$ holds. Notice that the function $s^{}$ which defines the early exercise boundary varies strongly near $t=0$, that is, when actual time is close to maturity. We mention that $s^{*}(T) \approx 73.4$.约 73.4 美元。

对于实验,如前几章所述,空间域被截断为(0,3ķ)对示例 4.2.1 中的非均匀网格进行半离散化,对流和扩散使用二阶中心公式,对流使用公式 B。应用单元平均来平滑罢工时的初始数据。欧式看跌期权半离散化的唯一变化是不同的狄利克雷边界条件s=0, 看11.2. 矩阵一种因此保持不变,而向量G(吨)略有变化并独立于吨.

金融代写|计算金融project代写Computational finance代考 请认准UprivateTA™. UprivateTA™为您的留学生涯保驾护航。

电磁学代考

物理代考服务:

物理Physics考试代考、留学生物理online exam代考、电磁学代考、热力学代考、相对论代考、电动力学代考、电磁学代考、分析力学代考、澳洲物理代考、北美物理考试代考、美国留学生物理final exam代考、加拿大物理midterm代考、澳洲物理online exam代考、英国物理online quiz代考等。

光学代考

光学(Optics),是物理学的分支,主要是研究光的现象、性质与应用,包括光与物质之间的相互作用、光学仪器的制作。光学通常研究红外线、紫外线及可见光的物理行为。因为光是电磁波,其它形式的电磁辐射,例如X射线、微波、电磁辐射及无线电波等等也具有类似光的特性。

大多数常见的光学现象都可以用经典电动力学理论来说明。但是,通常这全套理论很难实际应用,必需先假定简单模型。几何光学的模型最为容易使用。

相对论代考

上至高压线,下至发电机,只要用到电的地方就有相对论效应存在!相对论是关于时空和引力的理论,主要由爱因斯坦创立,相对论的提出给物理学带来了革命性的变化,被誉为现代物理性最伟大的基础理论。

流体力学代考

流体力学是力学的一个分支。 主要研究在各种力的作用下流体本身的状态,以及流体和固体壁面、流体和流体之间、流体与其他运动形态之间的相互作用的力学分支。

随机过程代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其取值随着偶然因素的影响而改变。 例如,某商店在从时间t0到时间tK这段时间内接待顾客的人数,就是依赖于时间t的一组随机变量,即随机过程

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。