如果你也在 怎样代写宏观经济学Macroeconomics 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。宏观经济学Macroeconomics对国家或地区经济整体行为的研究。它关注的是对整个经济事件的理解,如商品和服务的生产总量、失业水平和价格的一般行为。宏观经济学关注的是经济体的表现–经济产出、通货膨胀、利率和外汇兑换率以及国际收支的变化。减贫、社会公平和可持续增长只有在健全的货币和财政政策下才能实现。

宏观经济学Macroeconomics(来自希腊语前缀makro-,意思是 “大 “+经济学)是经济学的一个分支,处理整个经济体的表现、结构、行为和决策。例如,使用利率、税收和政府支出来调节经济的增长和稳定。这包括区域、国家和全球经济。根据经济学家Emi Nakamura和Jón Steinsson在2018年的评估,经济 “关于不同宏观经济政策的后果的证据仍然非常不完善,并受到严重批评。宏观经济学家研究的主题包括GDP(国内生产总值)、失业(包括失业率)、国民收入、价格指数、产出、消费、通货膨胀、储蓄、投资、能源、国际贸易和国际金融。

同学们在留学期间,都对各式各样的作业考试很是头疼,如果你无从下手,不如考虑my-assignmentexpert™!

my-assignmentexpert™提供最专业的一站式服务:Essay代写,Dissertation代写,Assignment代写,Paper代写,Proposal代写,Proposal代写,Literature Review代写,Online Course,Exam代考等等。my-assignmentexpert™专注为留学生提供Essay代写服务,拥有各个专业的博硕教师团队帮您代写,免费修改及辅导,保证成果完成的效率和质量。同时有多家检测平台帐号,包括Turnitin高级账户,检测论文不会留痕,写好后检测修改,放心可靠,经得起任何考验!

经济代写|宏观经济学代考Macroeconomics代写|Why Interest Rates Matter

Changes in real interest rates affect the standard of living of savers and borrowers. Many retirees, for example, rely on interest earnings from their stock of accumulated assets to provide much of their income, and thus benefit when real interest rates rise. In contrast, borrowers are made better off with low real interest rates. This point was dramatically illustrated during the 1970 s when homeowners who had long-term fixedrate mortgages benefited tremendously from several years of high and largely unanticipated inflation, which resulted in negative real interest rates (see Figure $19-6 \square$ ).

Interest rates also matter for the economy as a whole. As we will see in Chapter $21 \square$, real interest rates are an important determinant of the level of investment by firms. Changes in real interest rates lead to changes in the cost of borrowing and thus to changes in firms’ investment plans. Such changes in the level of desired investment have important consequences for the level of economic activity. We will see in Chapters 27므 and 28므 how the Bank of Canada influences interest rates as part of its objective of controlling inflation.

Interest Rates and “Credit Flows”

A loan represents a flow of credit between lenders and borrowers, with the interest rate representing the price of this credit. Credit is essential to the healthy functioning of a modern economy. Most firms require credit at some point-to finance the construction of a factory, to purchase inventories of intermediate inputs, or to continue paying their workers in a regular fashion even though their revenues may arrive at irregular intervals. Most households also require credit at various times-to finance the purchase of a home or car or to finance a child’s university education.

Banks play a crucial role in the economy by intermediating between those households and firms that have available funds and those households and firms that require funds. In other words, banks play a key role in “making the credit market” -in channelling the funds from those who have them to those who need them.

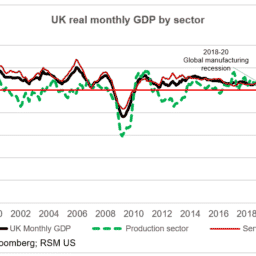

During normal times, these credit markets function very smoothly and most of us notice little about them. While there are fluctuations in the price of credit (the interest rate), they tend to be relatively modest. In the fall of 2008, however, credit markets in the United States, Canada, and most other countries were thrown into turmoil by the sudden collapse of several large financial institutions, mainly in the United States and Europe. As a result, many banks became reluctant to lend to any but the safest borrowers, mostly out of fear that the borrowers would go bankrupt before they could repay the loan. The flows of credit slowed sharply and market interest rates spiked upward, reflecting the greater risk premium required by lenders. The reduction in the flow of credit was soon felt by firms who needed credit in order to finance material or labour inputs, and the effect was a reduction in production and employment. This financial crisis, by interrupting the vital flows of credit, was an important cause of the recession that enveloped the global economy in late 2008 and through 2009. We will discuss banking and the flow of credit in more detail in Chapter 26ㅁ․

经济代写|宏观经济学代考Macroeconomics代写|The Exchange Rate

If you are going on a holiday to France, you will need euros to pay for your purchases. Many of the larger banks, as well as any foreignexchange office, will make the necessary exchange of currencies for you; they will sell you euros in return for your Canadian dollars. If you get 0.66 euros for each dollar that you give up, the two currencies are trading at a rate of 1 dollar $=0.66$ euros or, expressed another way, 1 euro $=1.52$ dollars. This was, in fact, the actual rate of exchange between the Canadian dollar and the euro in June of 2018.

As our example shows, the exchange rate can be defined either as dollars per euro or euros per dollar. In this book we adopt the convention of defining the exchange rate $₫$ between the Canadian dollar and any foreign currency as the number of Canadian dollars required to purchase one unit of foreign currency.

The exchange rate is the number of Canadian dollars required to purchase one unit of foreign currency. ${ }^2$

The term foreign exchange ${ }^D$ refers to foreign currencies or claims on foreign currencies, such as bank deposits, cheques, and promissory notes, that are payable in foreign money. The foreign-exchange market $\mathfrak{D}$ is the market in which currencies are traded-at a price expressed by the exchange rate.

Depreciation and Appreciation

A rise in the exchange rate means that it takes more Canadian dollars to purchase one unit of foreign currency-this is a depreciation $\triangle$ of the Canadian dollar. Conversely, a fall in the exchange rate means that it takes fewer Canadian dollars to purchase one unit of foreign currencythis is an appreciation $₫$ of the dollar.

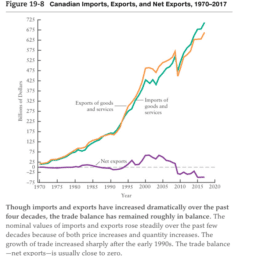

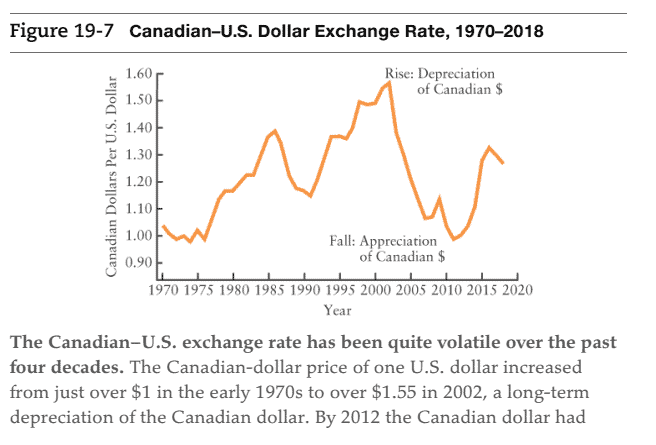

Figure 19-7! ! shows the path of the Canadian-U.S. exchange rate since 1970. Since more than 75 percent of Canada’s trade is with the United States, this is the exchange rate most often discussed and analyzed in Canada. In countries with trade more evenly spread across several trading partners, more attention is paid to what is called a trade-weighted exchange rate-this is a weighted-average exchange rate between the home country and its trading partners, where the weights reflect each partner’s share in the home country’s total trade. In Canada, the path of such a trade-weighted exchange rate is virtually identical to the Canadian-U.S. exchange rate shown in Figure 19-7另, reflecting the very large proportion of total Canadian trade with the United States.

宏观经济学代写

经济代写|宏观经济学代考MACROECONOMICS代写|WHY INTEREST RATES MATTER

实际利率的变化影响储户和借款人的生活水平。例如,许多退休人员依靠积㽧资产存量的利息收入来提供大部分收入,因此在实际利率上升时受 益。相比之下,借款人的实际利率较低。这一点在 20 世纪 70 年代得到了戏剧性的说明,当时拥有长期固定利率抵押贷款的房主从几年的高通胀和 很大程度上末预料到的通货膨胀中获益非浅,这导致实际利率为负seeFigure $\$ 19-6 \square \$$.

利率对整个经济也很重要。正如我们将在本章中看到的 $21 \square \mathrm{~ , 实 际 利 率 是 企 业 投 资 水 平 的 重 要 决 定 因 素 。 实 际 利 率 的 变 化 导 致 借 贷 成 本 的 变 化 , ~}$ 从而导致公司投资计划的变化。预期投资水平的这种变化对经济活动水平具有重要影响。我们将在第 27 章和第 28 章中看到加拿大银行如何影响利 率作为其控制通货膨胀目标的一部分。

利率和“信贷流动”

贷款代表贷方和借款人之间的信贷流动,利率代表该信贷的价格。信用对于现代经济的健康运行至关重要。大多数公司在某些时候需要信贷-一为 工厂建设提供资金,购买中间投入品存货,或者继续定期支付工人工资,即使他们的收入可能不定期出现。大多数家庭在不同时期也需要信贷为购买房屋或汽车提供资金,或者为孩子的大学教育提供资金。

银行在拥有可用资金的家庭和公司与需要资金的家庭和公司之间充当中介,在经济中发挥着至关重要的作用。换句话说,银行在“创造信贷市场” 方面发挥着关键作用一一将资金从拥有资金的人引导至需要资金的人。

在正常时期,这些信贷市场运作非常顺利,我们大多数人都很少注意到它们。虽然信贷价格存在波动theinterestrate,他们往往比较谦虚。然 而,在 2008 年秋季,美国、加拿大和大多数其他国家的信贷市场因数家主要位于美国和欧洲的大型金融机构的突然倒闭而陷入动荡。因此,除了 最安全的借款人之外,许多银行不愿向任何人提供贷款,主要是因为担心借款人会在偿还贷款之前破产。信贷流动急剧放缓,市场利率㪎升,反 映出贷方要求的风险溢价更高。需要信贷来为物质或劳动力投入提供资金的公司很快就会感受到信贷流量的减少,其影响是生产和就业的减少。 这场金融危机中断了至关重要的信贷流动,

经济代写|宏观经济学代考MACROECONOMICS代写|THE EXCHANGE RATE

如果您要去法国度假,您将需要欧元来支付您的购买费用。许多较大的银行以及任何外汇兑换处都会为您进行必要的货币兑换;他们会卖给你欧 元换取你的加元。如果您放弃的每一美元获得 0.66 欧元,则这两种货币的汇率为 1 美元 $=0.66$ 欧元,或者换句话说, 1 欧元 $=1.52$ 美元。事实 上,这是 2018 年 6 月加元和欧元之间的实际汇率。

正如我们的示例所示,汇率可以定义为美元兑欧元或欧元兑美元。在本书中,我们采用定义汇率的惯例加元与任何外币之间的差值,即购买一单 位外币所需的加元数。

汇率是购买一单位外币所需的加元数。 ${ }^2$

外汇术语 ${ }^D$ 指外币或外币债权,如银行存款、支票、本票等,可用外币支付的。外汇市场 $\mathfrak{D}$ 是货币交易的市场一一以汇率表示的价格。

Depreciation and Appreciation

汇率上升意味着购买一单位外币需要更多的加元 – 这是贬值 $\triangle$ 的加元。相反,汇率下降意味着购买一单位外币所需的加元减少,这就是升值的 美元。

图19-7!!显示了自 1970 年以来加美汇率的走势。由于加拿大 $75 \%$ 以上的贸易是与美国进行的,因此这是加拿大最常讨论和分析的汇率。在贸易 更均匀分布于多个贸易伙伴的国家,更多关注所谓的贸易加权汇率一一这是母国与其贸易伙伴之间的加权平均汇率,其中权重反映每个伙伴的在母 国贸易总额中的份额。在加拿大,这种贸易加权汇率的路径实际上与图 19-7 所示的加美汇率相同,反映了加拿大与美国贸易总额的很大比例。

经济代写|宏观经济学代考Macroeconomics代写 请认准exambang™. exambang™为您的留学生涯保驾护航。

微观经济学代写

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。my-assignmentexpert™ 为您的留学生涯保驾护航 在数学Mathematics作业代写方面已经树立了自己的口碑, 保证靠谱, 高质且原创的数学Mathematics代写服务。我们的专家在图论代写Graph Theory代写方面经验极为丰富,各种图论代写Graph Theory相关的作业也就用不着 说。

线性代数代写

线性代数是数学的一个分支,涉及线性方程,如:线性图,如:以及它们在向量空间和通过矩阵的表示。线性代数是几乎所有数学领域的核心。

博弈论代写

现代博弈论始于约翰-冯-诺伊曼(John von Neumann)提出的两人零和博弈中的混合策略均衡的观点及其证明。冯-诺依曼的原始证明使用了关于连续映射到紧凑凸集的布劳威尔定点定理,这成为博弈论和数学经济学的标准方法。在他的论文之后,1944年,他与奥斯卡-莫根斯特恩(Oskar Morgenstern)共同撰写了《游戏和经济行为理论》一书,该书考虑了几个参与者的合作游戏。这本书的第二版提供了预期效用的公理理论,使数理统计学家和经济学家能够处理不确定性下的决策。

微积分代写

微积分,最初被称为无穷小微积分或 “无穷小的微积分”,是对连续变化的数学研究,就像几何学是对形状的研究,而代数是对算术运算的概括研究一样。

它有两个主要分支,微分和积分;微分涉及瞬时变化率和曲线的斜率,而积分涉及数量的累积,以及曲线下或曲线之间的面积。这两个分支通过微积分的基本定理相互联系,它们利用了无限序列和无限级数收敛到一个明确定义的极限的基本概念 。

计量经济学代写

什么是计量经济学?

计量经济学是统计学和数学模型的定量应用,使用数据来发展理论或测试经济学中的现有假设,并根据历史数据预测未来趋势。它对现实世界的数据进行统计试验,然后将结果与被测试的理论进行比较和对比。

根据你是对测试现有理论感兴趣,还是对利用现有数据在这些观察的基础上提出新的假设感兴趣,计量经济学可以细分为两大类:理论和应用。那些经常从事这种实践的人通常被称为计量经济学家。

Matlab代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。